Technology: Page 28

-

Revolut faces more fraud claims than other UK banks: report

The fintech investigates each fraud claim independently of other cases, and takes such claims “incredibly seriously,” a spokesperson for the company said.

By Gabrielle Saulsbery • July 25, 2024 -

Zelle, big banks challenge senators on scam reimbursements

Forcing banks to reimburse authorized payments could encourage bad behavior and would not deter scammers, bank executives said in a Senate hearing.

By Patrick Cooley • July 25, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Fiserv to leverage artificial intelligence to help merchants

The payments behemoth says its data team will use AI to mine transactions on its products to help merchants and financial institutions profit.

By Patrick Cooley • July 24, 2024 -

FTC demands pricing input from Mastercard, others

The Federal Trade Commission demanded information from eight companies, including the card network, to better understand how consumer data is being used in the pricing of products and services.

By Lynne Marek • July 23, 2024 -

Visa, Mastercard say CrowdStrike didn’t impact networks

Still, cardholders may have been affected, particularly in Europe, as some bank card issuers were hit by the cybersecurity company’s update snafu.

By Lynne Marek • July 22, 2024 -

JPMorgan Chase invests in B2B payments startup Slope

The big bank’s payments unit and Y Combinator were among investors providing $65 million in financing for the business-to-business upstart this month.

By Lynne Marek • July 19, 2024 -

6 viewpoints from the CFPB’s director that may affect payments

“We are looking a lot at the convergence of payments and commerce and the extent to which a very big player could use that to shatter that wall between banking and commerce,” the agency’s director, Rohit Chopra, said this month.

By Suman Bhattacharyya • July 19, 2024 -

Stripe leads the way to Q2 fundraising recovery

Payment startups, particularly Stripe, benefitted from a revival of venture capital flows during the second quarter.

By Lynne Marek • July 17, 2024 -

Fiserv’s RNC visibility carries possible benefits, perils

Publicity for the Republican National Convention, at a venue bearing Fiserv’s name, may raise the company’s profile, but also risks associating the payments player with polarizing partisan rhetoric.

By Patrick Cooley • July 17, 2024 -

FedNow zooms past RTP participation in inaugural year

The Federal Reserve’s nascent instant payments system has collected hundreds of bank participants across the country in its first year of operations, although a few major banks are holdouts.

By Lynne Marek • July 16, 2024 -

Bolt advances strategy under new CEO

Justin Grooms, who was promoted to the checkout software firm’s CEO post this year, is taking its strategy to the next level with merchant clients.

By Lynne Marek • July 15, 2024 -

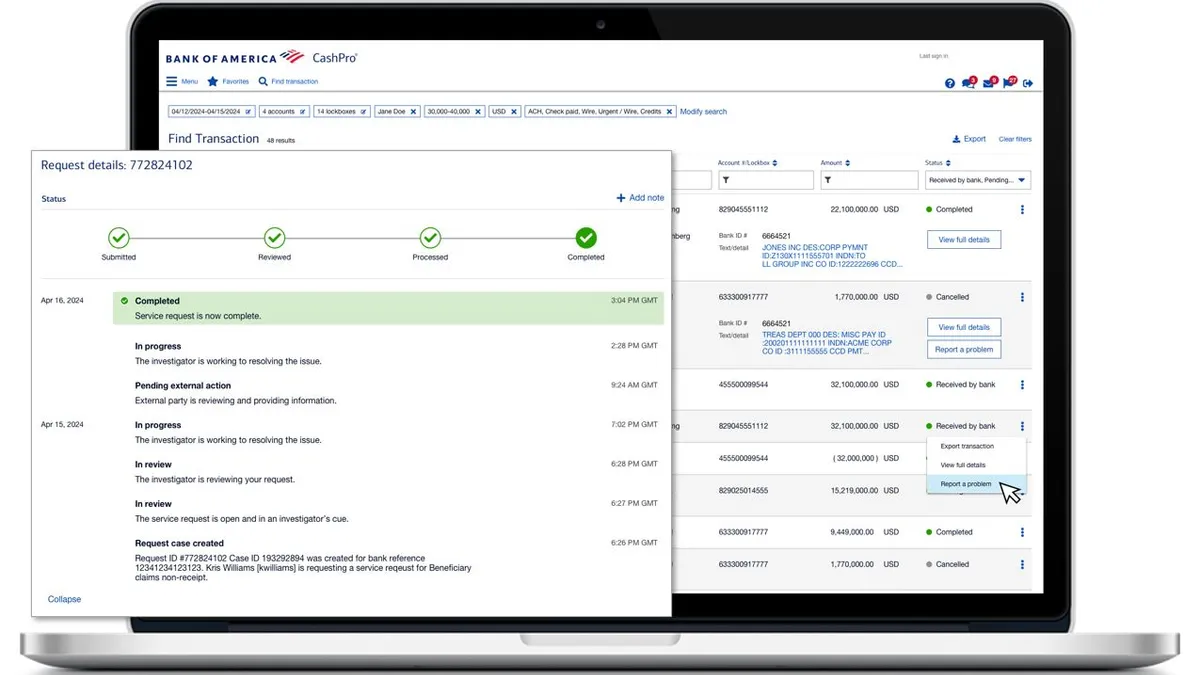

BofA tackles digital payments pain points

The bank’s latest platform update is designed to better address transaction-related inquiries — one of the top reasons business customers call and email for help.

By Maura Webber Sadovi • July 15, 2024 -

Banks should proactively tackle instant payments fraud: BNY

Use of data-sharing protocols among banks could warn customers before they send money, said Carl Slabicki, a BNY executive.

By Suman Bhattcharyya • July 12, 2024 -

Self checkout boasts ‘record’ year: report

The U.S. is the world’s largest self-checkout market, driven in part by supermarket chains and convenience stores, even as some retailers pull back on the tech.

By Tatiana Walk-Morris • July 12, 2024 -

Crypto theft doubles to $1.38B

The May theft of over $300 million worth of bitcoin from Japanese cryptocurrency exchange DMM Bitcoin is the largest digital currency heist so far this year.

By Alexei Alexis • July 11, 2024 -

Q&A

Versapay plunges ahead with new C-suite team

The business-to-business accounts receivable player is weighing its strategic options as CEO Carey O’Connor Kolaja lines up her new management team.

By Lynne Marek • July 11, 2024 -

The Clearing House’s RTP network logs Q2 records

The real-time payments system has been growing its roster of banks and credit unions, as it newly competes with the Federal Reserve’s FedNow service.

By Tatiana Walk-Morris • July 11, 2024 -

Payroc preps for more acquisitions, envisions potential IPO

Fresh off its biggest acquisition ever, Payroc is pressing ahead with more acquisitions and preparations for a possible initial public offering.

By Lynne Marek • July 10, 2024 -

Target to stop accepting personal checks

The retailer’s customers will still have six payment options after the change takes effect in about a week.

By Nate Delesline III • July 10, 2024 -

Congress members egg on US payments system expansion

A bipartisan group is nudging the Federal Reserve to explain why it can’t speed up a plan to extend the operational availability of the U.S. payments system.

By Lynne Marek • July 8, 2024 -

NCR Voyix terminates staff across several units

The tech company, whose tools are used by numerous stores, cut employees in its sales, engineering, professional services, data and product management teams last week.

By Brett Dworski • July 3, 2024 -

Payments industry to use AI to detect fraud, improve efficiency

Research from the investment bank Jefferies suggests generative artificial intelligence could be used in the payments industry to improve fraud detection and make transactions happen faster.

By Patrick Cooley • July 2, 2024 -

Chuck morphs into a new Alloy Labs-backed effort

Community banks partnered with Alloy Labs and Payrailz a few years ago on a project called Chuck, in a bid to rival Zelle, but that effort has been subsumed by a stealthy successor.

By Lynne Marek • June 27, 2024 -

Crypto firm Abra settles with 25 states for operating without a license

Abra agreed to repay customers some $82 million in crypto. CEO Bill Barhydt said all but $2 million, yet to be claimed, has been repaid.

By Gabrielle Saulsbery • June 27, 2024 -

Amex banks on spending at high-end restaurants

Analysts say American Express wants to cash in on the restaurant industry’s success and give customers admission to hard-to-access premium experiences.

By Patrick Cooley • June 26, 2024