Banking

-

Affirm delves into in-game payments

The buy now, pay later player is for the first time partnering with a company that provides in-game payment services to video game developers.

By Patrick Cooley • June 30, 2025 -

Payments firms switch up CFOs

ACI Worldwide, Bill and Corpay lured chief financial officers from other companies this month as the health of the U.S. economy wavers.

By Lynne Marek • June 30, 2025 -

Explore the Trendline➔

Explore the Trendline➔

tommy via Getty Images

tommy via Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Fintechs ask court to uphold open banking

Banks and the Consumer Financial Protection Board are misreading the law that enables open banking, the Financial Technology Association told a federal court.

By Justin Bachman • June 30, 2025 -

Visa, FIS boost value-added card services

The companies say they aim to strengthen tech tools available for smaller financial institutions in issuing cards.

By Tatiana Walk-Morris • June 30, 2025 -

Stablecoins may act as finance bridge

Stablecoins are like “another payment rail,” said Vince Tejada, who heads treasury and strategic finance at stablecoin infrastructure provider Bastion.

By Grace Noto • June 26, 2025 -

Payments firms pursue top talent

Companies developing digital wallets, cryptocurrency strategies and pay later tools are still seeking top talent despite economic turmoil, recruiters say.

By Lynne Marek • June 26, 2025 -

PayPal lines up Big Ten, Big 12 ties

The digital payments pioneer will handle the collegiate conferences’ payments to student athletes as it makes a bid for more student spending.

By Lynne Marek • June 26, 2025 -

Payments conferences yet to come in 2025

Artificial intelligence, FedNow and the ISO 20022 standards are expected to be hot topics at this year’s payments conferences.

By Shefali Kapadia • Updated June 26, 2025 -

FedNow delivers new risk management tools

Alongside those instant payment security features, the Federal Reserve increased the maximum payment that can be sent over the real-time system to $1 million.

By Tatiana Walk-Morris • June 26, 2025 -

Visa loses bid to toss DOJ debit lawsuit

A New York federal judge ruled Department of Justice allegations against the card network over an illegal monopoly in the debit card market are plausible at this stage of litigation.

By Justin Bachman • June 25, 2025 -

Stablecoins may push aside payments

Digital assets have the power to “disintermediate” the financial system by bypassing traditional payment rails, according to a Deloitte report.

By Patrick Cooley • June 25, 2025 -

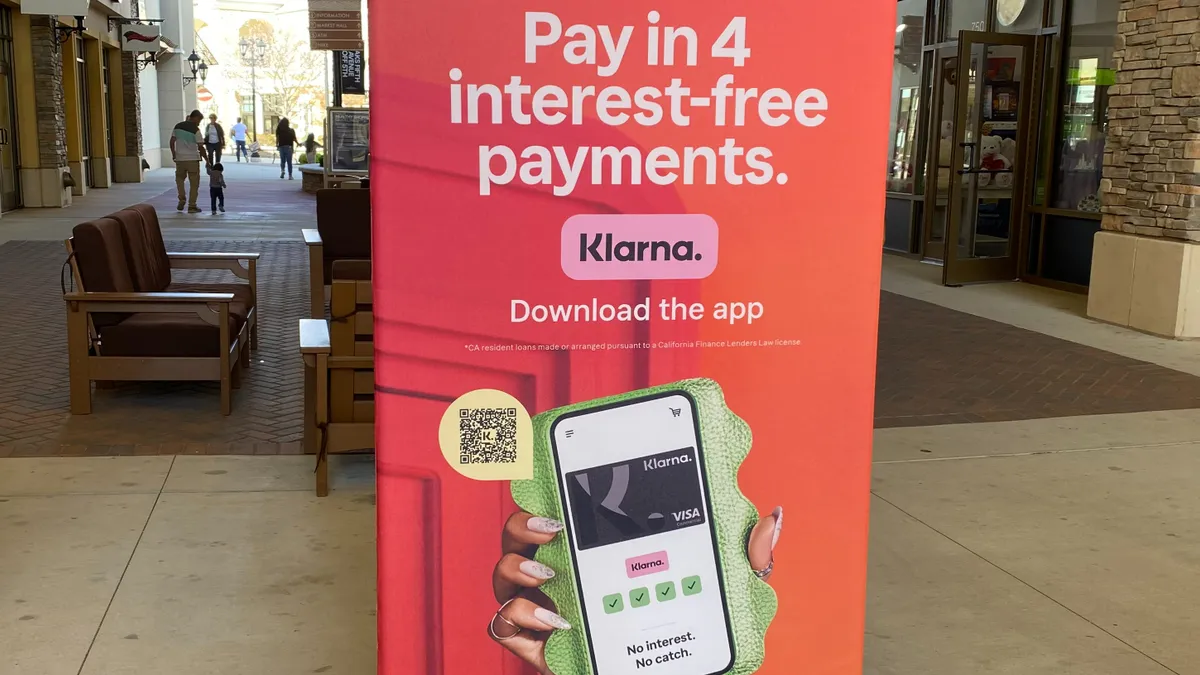

Klarna, Google join forces

The Swedish buy now, pay later business integrated its payments tool into the search giant’s digital wallet, making its services more widely available.

By Patrick Cooley • June 24, 2025 -

Court approves $197M ATM settlement

The class action agreement covers consumers and ATM operators who alleged that Visa and Mastercard restrained competition in the cash machine market.

By Justin Bachman • June 24, 2025 -

CFPB medical debt rule weighed

With additional briefs in hand, a federal judge will consider a Consumer Financial Protection Bureau rule that bars medical debt on consumer credit reports.

By Justin Bachman • June 23, 2025 -

Senate official blocks CFPB defunding in Trump’s megabill

Measures to defund the Consumer Financial Protection Bureau and to reduce salaries at the Federal Reserve are outside the limits of Senate reconciliation procedures, the chamber’s parliamentarian ruled Thursday.

By Gabrielle Saulsbery • June 23, 2025 -

Shift4 buys Smartpay for $180M

The payments services provider bought the distribution network business to keep building its presence in Australia and New Zealand.

By Lynne Marek • June 23, 2025 -

Opinion

Don’t make Americans pay to pass financial data

“Pausing or gutting Rule 1033 wouldn’t just stall innovation,” writes one industry executive who has international perspective. “It would send a message that the system works best when it’s closed.”

By Jamie Twiss • June 20, 2025 -

JPMorgan, Amex flash new cards

Both companies teased premium card refreshes in the past two weeks, reflecting the race for high-end card holders.

By Patrick Cooley • June 20, 2025 -

Amex, Fiserv cite inflation benefit

“Modest” price increases benefit card and payment companies as long as the economy doesn’t trip into a recession, executives say.

By Patrick Cooley • June 17, 2025 -

Federal Reserve targets fraud

Federal agencies took aim at payments fraud Monday, proposing more collaboration, including with states, to combat the rising problem, especially with respect to paper checks.

By Lynne Marek • June 17, 2025 -

Column

Credit card bill crusade persists

Sens. Dick Durbin and Roger Marshall may have lost their latest bid to win a congressional vote on the Credit Card Competition Act, via stablecoin legislation, but proponents are undeterred.

By Lynne Marek • June 16, 2025 -

CFPB, consumer groups clash over BNPL

The battle over buy now, pay later — whether it’s helpful or hurtful to users — persists even after the Consumer Financial Protection Bureau last month withdrew its rule regulating such services.

By Patrick Cooley • June 16, 2025 -

Deep Dive

Open banking to survive Trump, fintechs say

Consumers and financial services firms will pursue their mutual interests in sharing personal data, despite a move by the Consumer Financial Protection Bureau to extinguish the trend, industry experts contend.

By Justin Bachman • June 16, 2025 -

Adyen opts for build over buy

The Dutch payments processor eschews acquisitions in favor of building its own systems to drive growth, including in the U.S. market.

By Lynne Marek • June 12, 2025 -

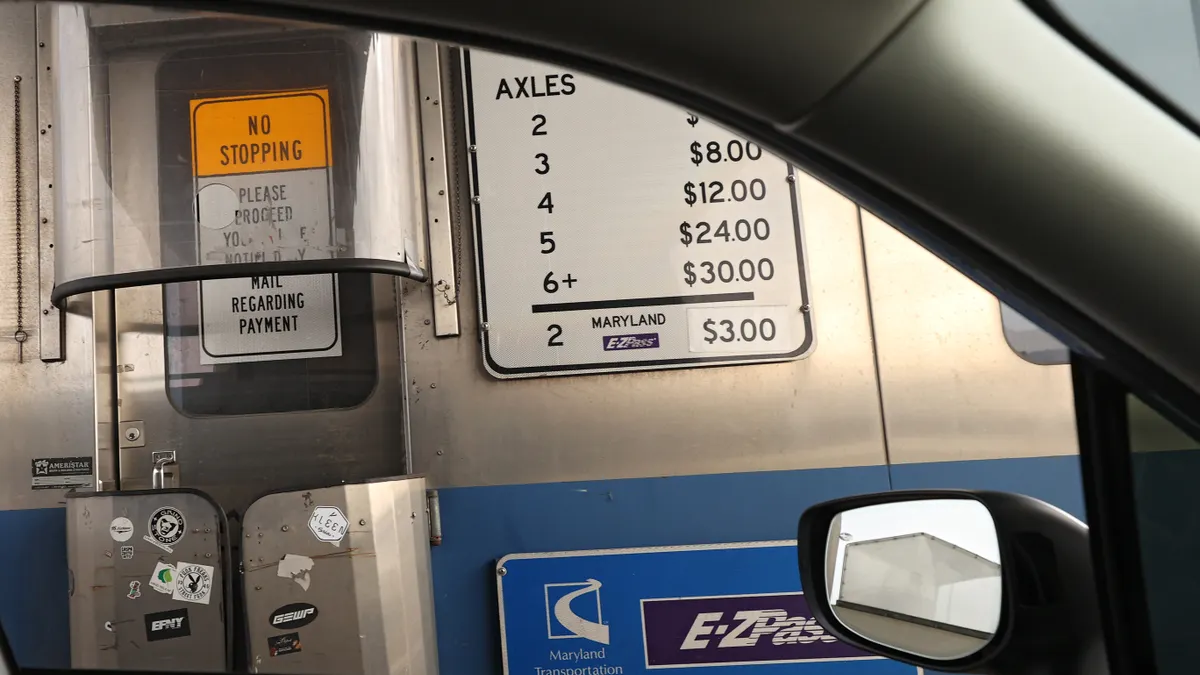

Drivers seek digital payment options

Digital payments are on the rise, but toll road payments are lagging behind.

By Tatiana Walk-Morris • June 12, 2025