Deep Dive

Industry insights from our journalists

-

Open banking to survive Trump, fintechs say

Consumers and financial services firms will pursue their mutual interests in sharing personal data, despite a move by the Consumer Financial Protection Bureau to extinguish the trend, industry experts contend.

Justin Bachman • June 16, 2025 -

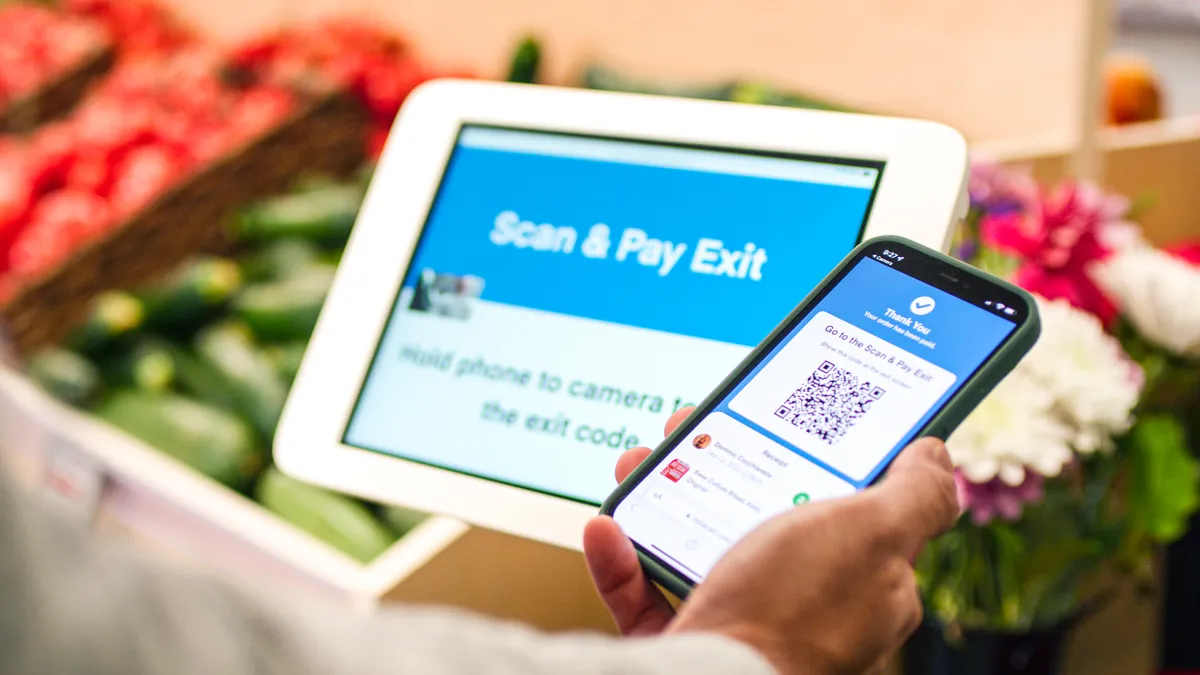

Checkout-free payments may yet rise

Rapidly advancing artificial intelligence could let cashierless payment companies succeed where Grabango failed, industry insiders and observers say.

Patrick Cooley • June 9, 2025 -

Fintechs may gain at banks’ expense in Trump era

The Trump administration may usher in policies that buttress the aspirations of new entrant payments players and increase competition for banks.

Lynne Marek • Jan. 28, 2025 -

Payments plays gather momentum in 2025: 6 industry trends to watch

Deregulation, artificial intelligence and stablecoin use are among the industry forces that will drive more digital payments use and innovation this year.

Lynne Marek and Patrick Cooley • Jan. 9, 2025 -

PayPal CEO pushes beyond payments

After a year as CEO of the digital payments pioneer, Alex Chriss is spearheading an expanded role in commerce for the company.

Lynne Marek • Nov. 20, 2024 -

Real-time lessons for FedNow from Brazil, India

The fledgling U.S. instant payments system can learn from real-time systems that have flourished in Brazil and India using QR codes and broad missions, say industry professionals.

Christiana Sciaudone • May 21, 2024 -

Why more tech in stores shouldn’t mean fewer workers

Stores can automate more tasks than ever, including pricing, inventory management and checkout. But for theft prevention, customer service and brand engagement, they need humans.

Daphne Howland • April 11, 2024 -

Fiserv has ambitious goals for Clover. Can it meet them?

To achieve growth targets, Clover will need to fend off competition from rivals, especially Square, and make headway in new verticals and geographic regions, analysts and consultants said.

Caitlin Mullen • April 1, 2024 -

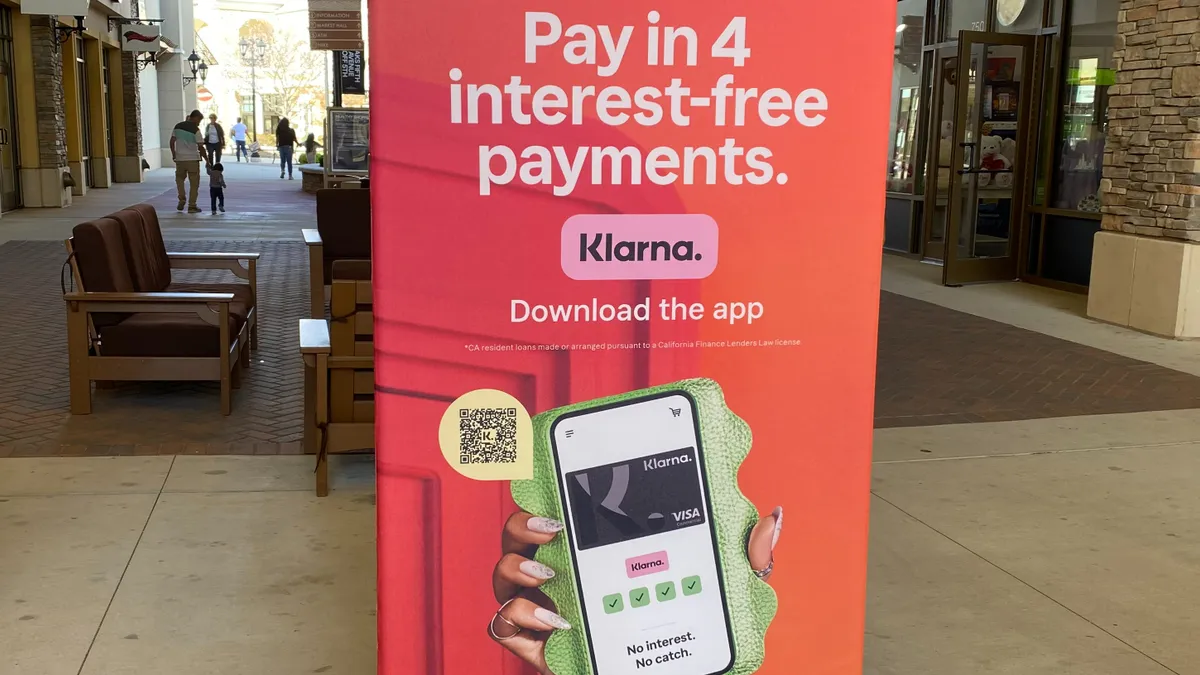

Will BNPL pass the test?

The buy now, pay later trend faces a starkly different environment than the one in which it gained traction. Regulation looms, the economy has worsened and investors are demanding profits. It’s all a test of BNPL’s long-term footing.

Caitlin Mullen • June 27, 2023 -

Payments fraud climbs as banks reach for joint response

Financial institutions and payments players are seeking to coalesce around new efforts to battle skyrocketing payments fraud.

Lynne Marek • May 25, 2023 -

EWS readies Paze to help banks take on digital wallet market

Even with the backing of the nation’s largest banks, the platform, set for a June launch, will have adoption and security hurdles to overcome to grab a slice of the digital wallet market, industry experts say.

Anna Hrushka • April 3, 2023 -

Crypto may yet upend payments

Nearly 2,000 crypto workers have been laid off in 2023, but the value of Bitcoin climbed enough in January for Goldman Sachs to take note.

Gabrielle Saulsbery • Jan. 30, 2023 -

6 payments trends to watch in 2023

FedNow, embedded payments, deal-making, cybersecurity and more mature BNPL will be dominant themes, among others, in the industry this year.

Lynne Marek and Caitlin Mullen • Jan. 10, 2023 -

Investors press FIS, Fiserv for divestitures

The big processors mushroomed in 2019 acquisitions, with promises that scale would pay off, but shareholders now urge them to consider divestitures.

Lynne Marek and Caitlin Mullen • Dec. 22, 2022 -

Will biometrics be the future of payments?

The use of biometrics to authenticate payments is poised to bring more security and speed to transactions, but some say broad adoption on the part of consumers and merchants is still far from reach.

Caitlin Mullen • Sept. 26, 2022 -

FedNow chases real-time payments front-runners

The Federal Reserve plans to unleash a U.S. real-time payments system next year in the form of FedNow, but it’s an open question as to whether, or how, consumers and businesses will adopt instant payments.

Lynne Marek • July 14, 2022 -

BNPL players’ losses grow as costs soar

At buy now-pay later providers, expenses have been rising faster than revenue as consumer demand increases, so losses are mounting amid BNPL mania.

Jonathan Berr • May 3, 2022 -

2022's restaurant payment tech push includes QR codes, kiosks

From QR codes to advanced mobile apps and robots, restaurants are planning to adopt more technology within their operations — including payments — in the year ahead.

Julie Littman • April 20, 2022 -

How does Gen Z feel about credit cards? It's complicated.

Each generation has approached credit differently; Gen Z is no exception. As they turn toward credit cards, industry analysts say these consumers are likely to keep card companies on their toes.

Caitlin Mullen • March 16, 2022 -

US banks brace for stricter sanctions against Russia

The Russian banks the U.S. targeted Tuesday account for only 5% of the country's total bank assets. But penalties aimed at larger banks of greater systemic importance may be in the offing.

Robin Bradley • Feb. 25, 2022 -

Payment Choice Act wins bipartisan backing

New Jersey Democrat Rep. Payne is trying to preserve cash as a form of payment and collecting support across the aisle, even as the possibility of a U.S. digital dollar gains traction.

Lynne Marek • Nov. 23, 2021 -

Crypto creeps into the checkout line

Payments firms are betting on crypto's growth as an asset class to fuel crypto adoption at checkout.

Suman Bhattacharyya • Nov. 10, 2021 -

Early wage payments draw scrutiny

Companies that offer earned wage access, aka on-demand pay, have proliferated in the U.S. Now, legislators and regulators are targeting the industry for more oversight.

Lynne Marek • Updated Nov. 4, 2021 -

Anti-fraud niche in payments thrives as e-commerce climbs

Major payments players and fledgling upstarts alike are developing new tools to fight increasing fraud threats to their businesses.

Mercedes Cardona • Aug. 23, 2021 -

Retrieved from TheAndrasBarta, Pixabay on May 25, 2021

Retrieved from TheAndrasBarta, Pixabay on May 25, 2021

Fintechs attack cross-border business payments as banks and legacy players rush to innovate

Nonbank fintechs are gaining ground, mainly with small company customers, but target larger ones for cross-border business, even as competition gives way to symbiotic 'coopetition' with larger bank incumbents.

Suman Bhattacharyya • May 25, 2021