Technology: Page 29

-

Crypto firm Abra settles with 25 states for operating without a license

Abra agreed to repay customers some $82 million in crypto. CEO Bill Barhydt said all but $2 million, yet to be claimed, has been repaid.

By Gabrielle Saulsbery • June 27, 2024 -

Amex banks on spending at high-end restaurants

Analysts say American Express wants to cash in on the restaurant industry’s success and give customers admission to hard-to-access premium experiences.

By Patrick Cooley • June 26, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Bank of America zeroes in on banking app innovation

The team behind the bank’s CashPro app aims to stay a step ahead of rivals, including with payment approval features.

By Caitlin Mullen • June 26, 2024 -

Q&A

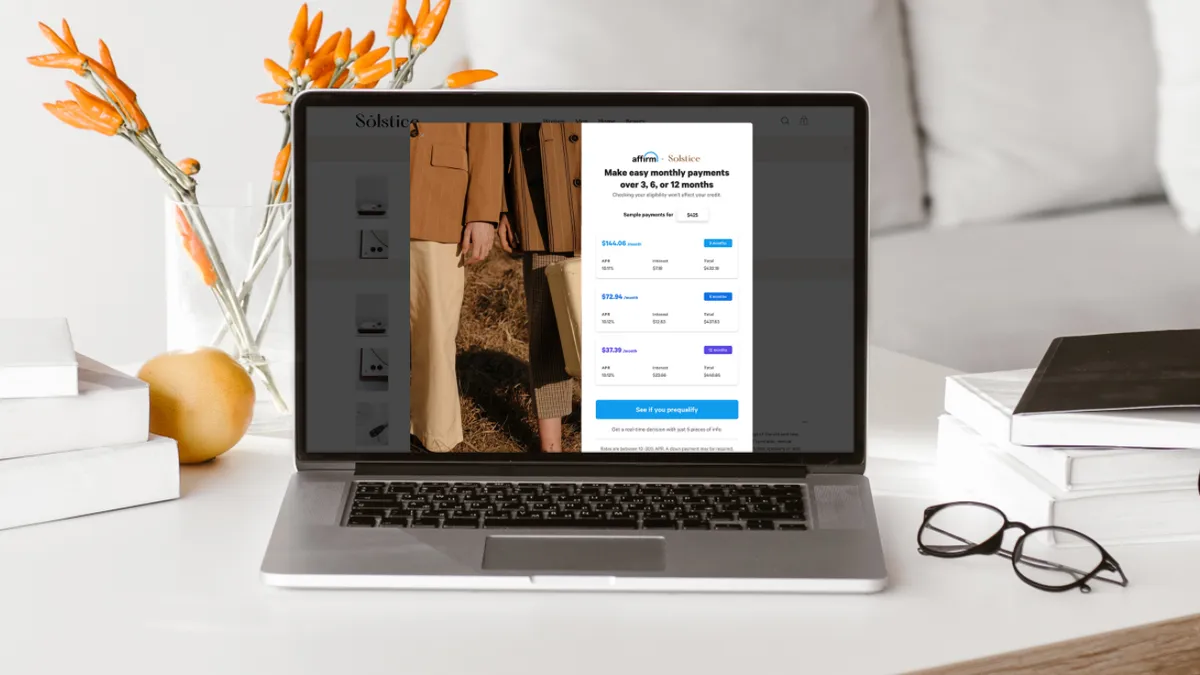

BNPL to shift toward larger-ticket expenses: CEO

The short-term financing option, which already costs more than cards for merchants, will eventually retreat from daily purchases, Priority Technology CEO Tom Priore predicted.

By James Pothen • June 25, 2024 -

Affirm may see payment volume bump from Apple Pay: Mizuho report

The partnership is estimated to represent a $12 billion opportunity for buy now, pay later provider Affirm, according to an analyst note last week.

By James Pothen • June 24, 2024 -

Sponsored by PayNearMe

An optimal payment experience is the new essential for billers

Businesses that rely on recurring billing with legacy payment processes may be missing a crucial opportunity to generate return business.

June 24, 2024 -

PayPal fills CTO position with former Walmart exec

Former Walmart EVP Srini Venkatesan will replace Archie Deskus, who joined the payments firm in 2022.

By Roberto Torres • June 21, 2024 -

Faster payments catch on slowly: survey

About half of payments players surveyed recently by the U.S. Faster Payments Council said they have integrated faster payment technologies.

By Tatiana Walk-Morris • June 20, 2024 -

Affirm CFO doesn’t expect profits from its Apple tie soon

The company’s finance chief compared the rollout of its partnership with Apple to the launch of its own payment card, saying the company preferred a “very thoughtful and controlled” approach.

By James Pothen • June 18, 2024 -

Apple to drop its BNPL option in US

The tech giant said it will discontinue its buy now, pay later service and shift to offering consumers alternative payment options.

By Patrick Cooley , Lynne Marek • June 17, 2024 -

Shift4 acquires stake in German firm

Shift4 is on an acquisition spree after making a new investment in the point-of-sale supplier, and closing of a purchase announced earlier this year.

By Lynne Marek • June 17, 2024 -

Wise persists with reduced pricing approach

The fintech plans to continue its strategy of reducing prices for its customers, which is reflected in its forecast, interim CFO Kingsley Kemish said.

By Grace Noto • June 17, 2024 -

Sponsored by Adyen

5 key steps to creating and executing on an embedded finance roadmap

By offering financial services tools and features, SaaS platforms can become stickier and more indispensable to SMBs.

June 17, 2024 -

Brex moves to single-CEO model

Pedro Franceschi will become sole chief executive, while co-founder Henrique Dubugras will move to board chair as the company aims to go public in 2025.

By Dan Ennis • June 14, 2024 -

Startup offers ‘credit-building’ debit cards for Gen Z

Startup Fizz is marketing itself as a company helping college students build credit and manage daily spending.

By Patrick Cooley • June 13, 2024 -

Apple adds BNPL offerings from rivals

The tech giant will allow installment plans from Affirm, as well from certain debit and credit cards, onto Apple Pay alongside its own BNPL service.

By James Pothen • June 13, 2024 -

EBay to accept Venmo

A week after dropping American Express, the online auctioneer said it will now accept payments through Venmo, a digital tool popular among Gen Z and millennials.

By Patrick Cooley • June 12, 2024 -

Opinion

Fighting deepfakes via payments

“Since many of these deepfake software services accept credit cards, payments providers are on the front lines of detecting these companies,” writes one corporate compliance officer.

By Alan Primitivo • June 12, 2024 -

Cash use persists in US beyond pandemic

Consumers remained committed to cash use last year, even as the share of card payments rose and online payments increased, according to an annual Federal Reserve study.

By Lynne Marek • June 11, 2024 -

Sponsored by U.S. Bank

Evolving to embedded payments: 4 steps to move your company forward

Enabling embedded payments is a strategic evolution that occurs step by step.

June 10, 2024 -

Sponsored by Adyen

How machine learning protects merchants from digital payment fraud

Fraud is always a problem companies want to tackle. But in the current business environment, it has become an even greater priority.

June 10, 2024 -

Affirm adds new options in bid to battle cards

The buy now, pay later provider now offers two 30-day payment plans; one that allows for full payment and another that splits a purchase in two, in addition to its “pay in four” offering.

By James Pothen • June 7, 2024 -

Retrieved from Consumer Financial Protection Bureau.

Retrieved from Consumer Financial Protection Bureau.

CFPB finalizes open banking standard-setter rule

The bureau will consult public interest groups and app developers on open banking standards, and no single special interest can dominate the standards-making process.

By Gabrielle Saulsbery • June 7, 2024 -

Waystar envisions $20B healthcare payments market

The software provider offered its outlook as it seeks to take the company public and expand its business.

By Lynne Marek • June 6, 2024 -

New York races to pass BNPL bill

State lawmakers are negotiating three separate proposals related to the buy now, pay later industry ahead of the end of the legislative session on Thursday.

By James Pothen • June 6, 2024