Technology: Page 27

-

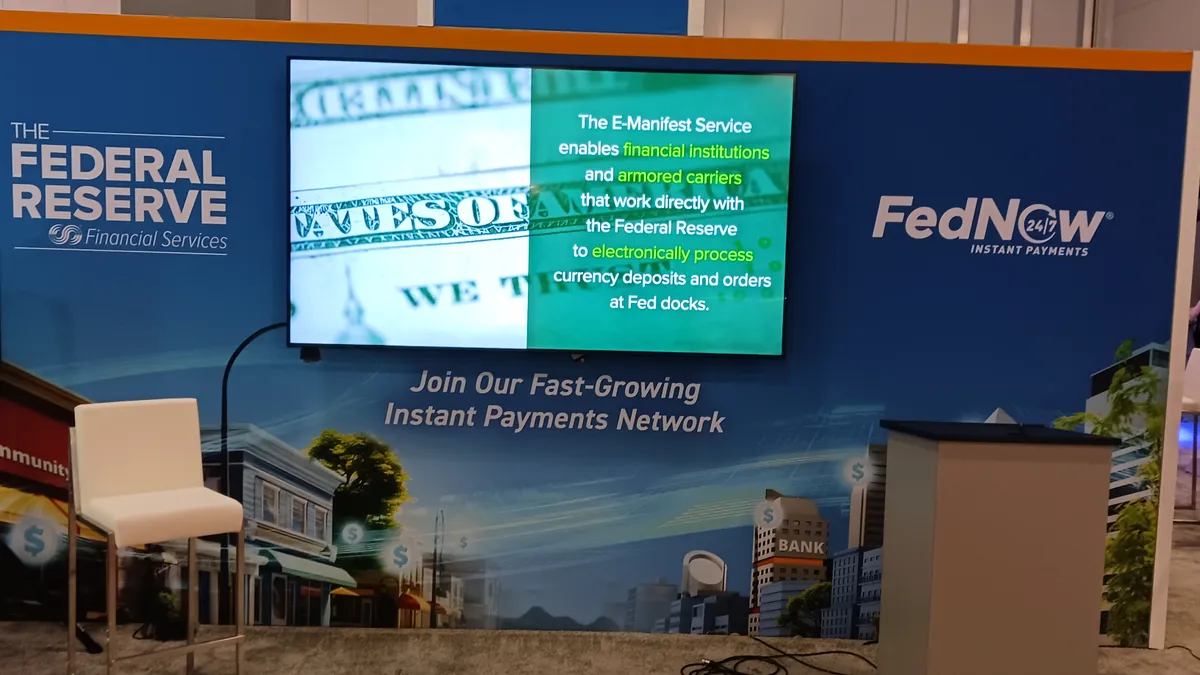

FedNow to add more fraud tools, Fed official says

The Federal Reserve is still seeking to allay financial institutions' concerns that faster payments allowed by the new instant payments system could lead to faster fraud.

By Lynne Marek • Aug. 16, 2024 -

JPMorgan, Zelle may have upper hand if litigation ensues

If the banks that own Zelle’s parent battle the Consumer Financial Protection Bureau in court, they may find some federal judges open to their arguments, lawyers specializing in the area said.

By Patrick Cooley • Aug. 15, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Fintechs ramp up lobbying over earned wage access, crypto

Chime, PayPal and Block, for example, spent more on lobbying in the first half of 2024 than for the same span last year, OpenSecrets reported.

By Suman Bhattacharyya • Aug. 15, 2024 -

Opinion

Why the CFPB’s recent EWA rule is wrong

The Consumer Financial Protection Bureau’s earned wage access rule “could outright deny EWA to the wage earners who need it the most,” writes a trade group CEO.

By Brian Tate • Aug. 14, 2024 -

How embedded payments are changing the way we pay

As payments technology advances, more companies are embedding the payments process in websites and apps. Here’s a primer on how this trend is advancing and changing the payments arena.

By Patrick Cooley • Aug. 13, 2024 -

Q&A

Employers react to CFPB’s new stance on EWA

Employers are responding quickly to the Consumer Financial Protection Bureau’s rule noting earned wage access services may constitute lending, says a Chime executive.

By Lynne Marek • Aug. 12, 2024 -

North American Bancard rebrands in bid to improve

The card payments service provider for merchants said it will now be known as North as part of an effort to evolve and appeal to businesses of all sizes.

By Lynne Marek • Aug. 12, 2024 -

Shift4 strives to become ‘SpaceX of payments’

Recent acquisitions and an expanded roster of clients that includes several sports teams are intended to help Shift4 dominate the payments space, the CEO said.

By Patrick Cooley • Aug. 9, 2024 -

Flywire acquires Invoiced for $55M

By way of the latest deal, the software company seeks to further expand its international payments services for its business-to-business clientele.

By Tatiana Walk-Morris • Aug. 9, 2024 -

JPMorgan fires up biometric payments processing

The biggest U.S. bank is piloting payments processing for biometric transactions, with plans to use it at the hamburger chain Whataburger, which lets customers pay with a face scan.

By Lynne Marek • Aug. 7, 2024 -

Toast aims to move beyond restaurants

The payments service provider is known for working with restaurants, but seeks to make headway with convenience stores, grocery stores and bottle shops.

By Patrick Cooley • Aug. 7, 2024 -

FIS starts to get its payments mojo back

Fidelity National Information Services is starting to recharge its card payments business in the wake of selling Worldpay, the company’s CEO said.

By Lynne Marek • Aug. 6, 2024 -

Apple services revenue rises with boost from payments

The company said it raised a record $24.2 billion from services in the most recent quarter, a 14% year-over-year increase.

By Patrick Cooley • Aug. 5, 2024 -

FedNow ‘could lower fees’ in future, analyst reports

The Federal Reserve instant payments system may cut fees after it attracts more financial institutions, or in the face of competition, a Wolfe Research analyst said, citing a FedNow official.

By Lynne Marek • Aug. 5, 2024 -

Outdated tech could slow instant payment adoption: survey

Financial institutions expect business clients to be a driver of instant payment revenue, but adopting the technology comes with hurdles, the results of a recent survey showed.

By Tatiana Walk-Morris • Aug. 2, 2024 -

Stripe, Fifth Third Bank to team on embedded services

The global digital payments company will team with the bank to offer embedded finance services to its clients.

By Patrick Cooley • Aug. 1, 2024 -

Mastercard refocuses on tech in int’l markets

The card network will incur a charge in the current quarter for a realignment that is boosting investments in newer technologies, including in Africa and Latin America.

By Lynne Marek • Aug. 1, 2024 -

Q&A

How artificial intelligence can improve payments fraud prevention

Generative AI could help spot fraudulent patterns in transaction data and reduce the cost of processing payments, says a McKinsey consultant.

By Patrick Cooley • July 31, 2024 -

Q&A

5 questions for Brex’s new compliance chief

When it comes to innovation, “if it's moving too quickly for customer protection to keep pace, it’s not happening,” said Sibongile Ngako, who recently joined the fintech as chief compliance officer.

By Caitlin Mullen • July 31, 2024 -

Amazon’s checkout tech is getting an AI upgrade

Just Walk Out is rolling out an advanced AI model that the company says will make its system more accurate and efficient and less costly to implement.

By Jeff Wells • July 31, 2024 -

PayPal CEO leans on big-name clients for growth

Alex Chriss, appointed to lead the digital payments business last year, noted the company is benefiting from ties to companies like Facebook parent Meta.

By Lynne Marek • July 30, 2024 -

Stripe buys software rival Lemon Squeezy

The San Francisco payments giant bought the 4-year-old Salt Lake City startup as it continues its global expansion.

By Patrick Cooley • July 30, 2024 -

Affirm says CFPB’s proposed BNPL rules will confuse customers

In commenting on the proposal, the BNPL provider said consumers would be better served by rules specific to BNPL transactions, as opposed to credit card regulations.

By Patrick Cooley • July 29, 2024 -

PayPal changes chairman, reduces board size

PayPal’s chairman of nine years left that post this week, and was replaced by one of the board’s newer members.

By Lynne Marek • July 26, 2024 -

Opinion

How to speed up FedNow adoption

“Interfaces need to be standardized to ensure a consistent and reliable payment experience for businesses and consumers,” writes one payments software executive.

By Ani Narayan • July 26, 2024