Technology: Page 26

-

Visa to upgrade pay-by-bank service in UK next year

The card network plans to make the account-to-account service available to consumers for paying bills, like rent, but eventually for other uses too, such as digital streaming.

By Patrick Cooley , Lynne Marek • Sept. 6, 2024 -

Grabango CEO pushes for more partnerships

The Berkleley, California-based company is looking to expand by building ties with established retailers, CEO Will Glaser said.

By Patrick Cooley • Sept. 5, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Opinion

CFPB’s EWA rule may undo progress

“The CFPB’s plan to reclassify EWA as a loan could accidentally backfire on the agency by driving people right back to the payday lending industry,” writes one tech trade group professional.

By Adam Kovacevich • Sept. 5, 2024 -

Academics question digital wallet security

Due to lax authentication practices, a thief or hacker can easily add a stolen credit card to their own digital wallet, the study concluded.

By Patrick Cooley • Sept. 4, 2024 -

CFPB slammed with EWA commentary

The Consumer Financial Protection Bureau asked for public feedback on its earned wage access rule proposal and it got an earful.

By Lynne Marek • Sept. 4, 2024 -

Viral JPMorgan Chase glitch is ‘fraud, plain and simple,’ bank says

Some customers deposited bad checks and immediately withdrew funds before the checks bounced in a glitch that went viral on TikTok. Now, some users have holds on their accounts.

By Gabrielle Saulsbery • Sept. 4, 2024 -

Paysafe taps FIS alum for CFO amid growth pivot

The iGaming payments platform is looking to expand on its “robust” performance in the first half of the year with the appointment of new financial leadership.

By Grace Noto • Sept. 4, 2024 -

Maryland gets tough on BNPL

Two buy now, pay later companies pivoted in offering their services in the state because it insists they must be licensed to provide loans.

By Patrick Cooley • Sept. 3, 2024 -

PayPal offers guest checkout service to Fiserv clients

The two firms are working together again as other payment giants collaborate on checkout enhancements.

By Tatiana Walk-Morris • Sept. 3, 2024 -

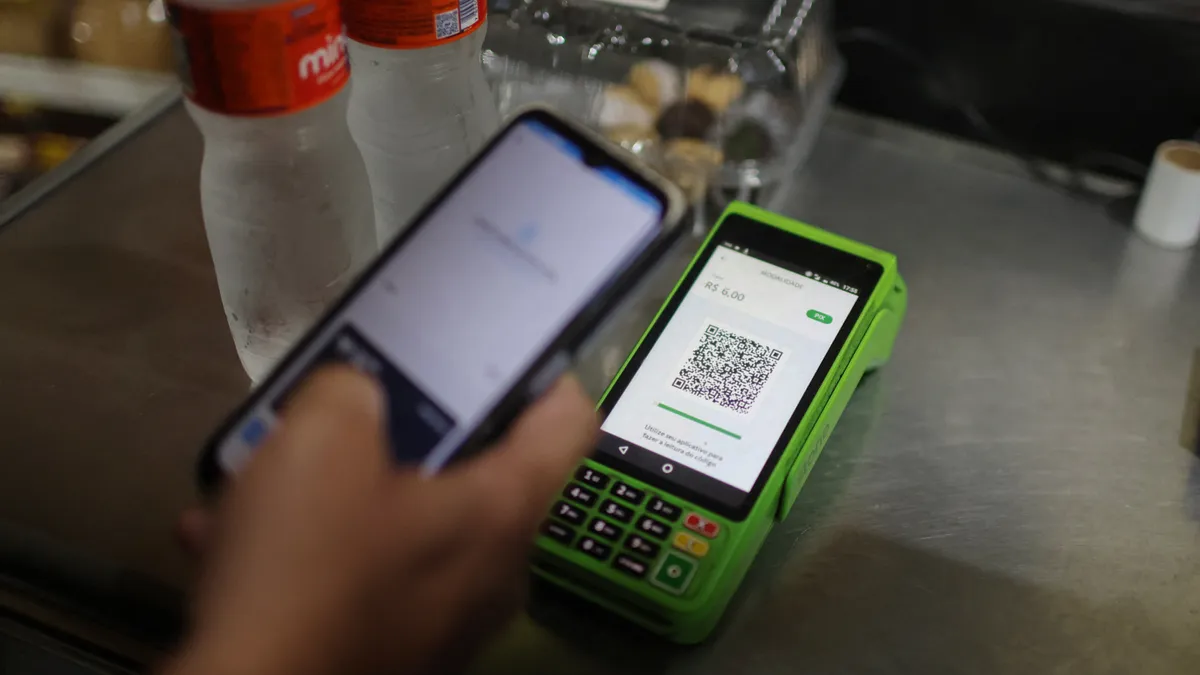

PayPal joins group investing $15M in Brazilian startup

The digital payments pioneer expects the fintech to capitalize on the rise of buy now, pay later services in Brazil.

By Tatiana Walk-Morris • Aug. 30, 2024 -

Tracker

Earned wage access: Following states that have passed laws, or have legislation pending

States began passing laws friendly to the industry in 2023 and have continued to pursue them this year, even after the federal government weighed in with a stricter standard.

By Lynne Marek • Aug. 30, 2024 -

Affirm shuffles leadership, promoting CFO to COO

The BNPL provider plans to promote Michael Linford, the chief financial officer, to chief operating officer and tap a new CFO.

By Patrick Cooley • Aug. 29, 2024 -

Fed official questions faster cross-border payments ties

Federal Reserve Governor Christopher Waller suspects there could be more fraud and money-laundering if countries move too quickly to link their faster payments systems, he said at a conference.

By Lynne Marek • Aug. 29, 2024 -

Shoppers’ online fraud fears escalate

Four in five consumers are worried about identity theft or someone stealing their credit card numbers, according to a report this month from the credit monitoring agency Experian.

By Patrick Cooley • Aug. 28, 2024 -

MoneyGram, Adyen add chief technology officers

The payments companies are bolstering their tech leadership as big changes roil the industry and stoke competition.

By Lynne Marek • Aug. 28, 2024 -

Aeropay targets pay-by-bank evolution in US

The Chicago fintech has moved from servicing small merchants to handling cannabis payments, and now it’s catering to gaming clients.

By Lynne Marek • Aug. 26, 2024 -

Fed’s Waller eggs on payments research

Federal Reserve Governor Christopher Waller encouraged attendees at a summer research workshop to keep exploring payments systems, and innovations to overcome frictions in financial markets.

By Tatiana Walk-Morris and Lynne Marek • Aug. 23, 2024 -

U.S. Bank buys healthcare payments firm

The bank’s acquisition of Tempe, Arizona-based Salucro Healthcare allows its Elavon unit to dig deeper into healthcare payments and billing services.

By Lynne Marek • Aug. 22, 2024 -

Q&A

Marqeta isn’t a ‘single-trick pony,’ CEO says

The embedded finance firm’s partnerships with Varo Bank, Affirm, Visa and Zoho and its new office launch in Warsaw, Poland, underscore the expansion of the payment platform's market presence.

By Rajashree Chakravarty • Aug. 22, 2024 -

Stripe, Zip partner on BNPL processing

The buy now, pay later firm will partner with Stripe, adding another major payments player tie to a set of recent high-profile collaborations.

By Patrick Cooley • Aug. 21, 2024 -

Capital One, Citi plan to join FedNow in ‘near future’

The two big banks say they’ll soon connect to the Federal Reserve’s new instant payment system, even as other major banks remain on the sidelines.

By Lynne Marek • Aug. 20, 2024 -

BNPL providers won’t face penalties during transition to new CFPB rule

CFPB Director Rohit Chopra said in a blog post that the agency will not fine companies making a good faith effort to follow regulations treating buy now, pay later loans like credit card transactions. His remarks follow significant industry pushback.

By Patrick Cooley • Aug. 20, 2024 -

Adyen collects more US customers

The Dutch payments service provider is gaining traction in the U.S. market as it adds to its client roster, including big U.S. retail names such as Crate & Barrel.

By Patrick Cooley • Aug. 19, 2024 -

Mastercard to cut 1,000 employees in restructuring

The card network is shrinking its workforce as it restructures the company to focus more resources on some international markets.

By Lynne Marek • Aug. 19, 2024 -

UK fintech Revolut valued at $45B

The British fintech has completed a secondary share sale with new and existing investors to provide liquidity to employees.

By Gabrielle Saulsbery • Aug. 16, 2024