Technology: Page 70

-

Small businesses count on digital payments to drive growth

Most micro and small businesses surveyed by Visa said they expect new digital payment methods to help their enterprises grow this year, with almost a quarter saying they plan to accept digital currencies like Bitcoin this year.

By Caitlin Mullen • Jan. 13, 2022 -

Powell says Fed paper on CBDC is weeks away

The oft-delayed digital currency white paper is coming "within weeks," Powell said Tuesday, but is "an exercise in asking questions and seeking input ... rather than taking a lot of positions."

By Dan Ennis • Jan. 13, 2022 -

Explore the Trendline➔

Explore the Trendline➔

NatalyaBurova via Getty Images

NatalyaBurova via Getty Images Trendline

TrendlineEmbedded payment tools make inroads

Business customers demanding integrated tools is likely to keep driving a trend toward more embedded payments tools.

By Payments Dive staff -

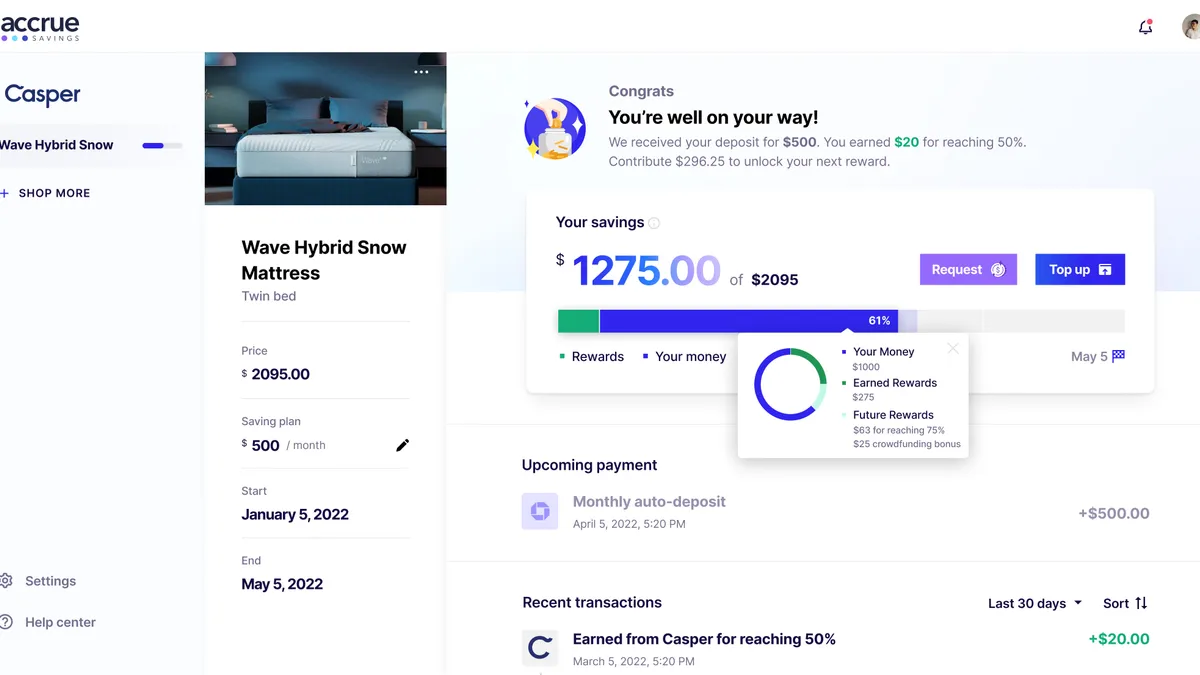

Save-now, buy-later startup raises $25M

Amid the buy now-pay later buzz, fintech Accrue Savings is going a different route. CEO Michael Hershfield said Accrue is on a mission to encourage consumers to save.

By Caitlin Mullen • Jan. 13, 2022 -

Is there an expiration date on Visa's main growth engine?

One analyst thinks so. Mizuho Securities Analyst Dan Dolev, who has been covering Visa for about three years, downgraded his rating on the largest U.S. card network company because he expects time is running out on consumers converting from cash to cards.

By Lynne Marek • Jan. 11, 2022 -

Payments firms see slam dunk opportunity with sports venues

Digital payments players are charging into the sports and events space, bringing new technologies to arenas they say can improve the fan experience and unlock a trove of data.

By Caitlin Mullen • Jan. 10, 2022 -

Crypto, privacy lead legislative priorities for payment trade group

The Electronic Transactions Association said legislative moves related to those issues will be among the most important it's tracking this year at the state and federal government levels.

By Jonathan Berr • Jan. 7, 2022 -

Retrieved from Ono Kosuki from Pexels.

Retrieved from Ono Kosuki from Pexels.

ATMs headed the way of the payphone

As cash use declines, ATMs are disappearing. The U.S. count for such automated tellers peaked in 2019 and is headed down, according to data from the research firm Euromonitor International.

By Lynne Marek • Jan. 7, 2022 -

Payments deals pile up in 2021

More than $50 billion in acquisitions were announced last year by companies in the payments arena. That wasn't a record, but it still ranked among one of the industry's busiest years for deal-making.

By Lynne Marek • Jan. 5, 2022 -

stock.adobe.com./Antonioguillem

Opinion

OpinionPayments are becoming invisible. Here's why that's a good thing.

"The next great evolution will see payments fully disappear into simplified, holistic commerce platforms," according to a U.S. Bank payments executive. That new era "will be here faster than you think."

By Shailesh Kotwal • Jan. 4, 2022 -

7 payments trends for 2022 as innovation climbs

From cross-border services to BNPL to cybersecurity tools, there will be no shortage of innovation and competition in the payments industry as businesses and their regulators shape new digital tools in the wake of the COVID-19 pandemic.

By Jonathan Berr , Caitlin Mullen , Lynne Marek • Jan. 4, 2022 -

Green Dot, PayPal helped recover $400M in stolen relief funds

Criminals have swindled nearly $100 billion through fraudulent applications since the start of the pandemic in the U.S., the agency said. Some payment companies aided in the effort to recover the money, CNBC reported.

By Robin Bradley • Dec. 30, 2021 -

Payments firms raised record sums in 2021

It was a banner year for payments startups in 2021, as they raked in nearly $32 billion in investments, according to research firm CB Insights. This year could be even hotter.

By Caitlin Mullen • Dec. 28, 2021 -

Mastercard buys AI firm Dynamic Yield from McDonald's

Combining Mastercard's payment expertise and Dynamic Yield's AI capabilities could help McDonald's strengthen its digital ordering strategy, as the fast-food chain pivots toward outsourcing its technology. The card company may benefit from further scaling the Yield AI business across other industries.

By Emma Liem Beckett • Dec. 21, 2021 -

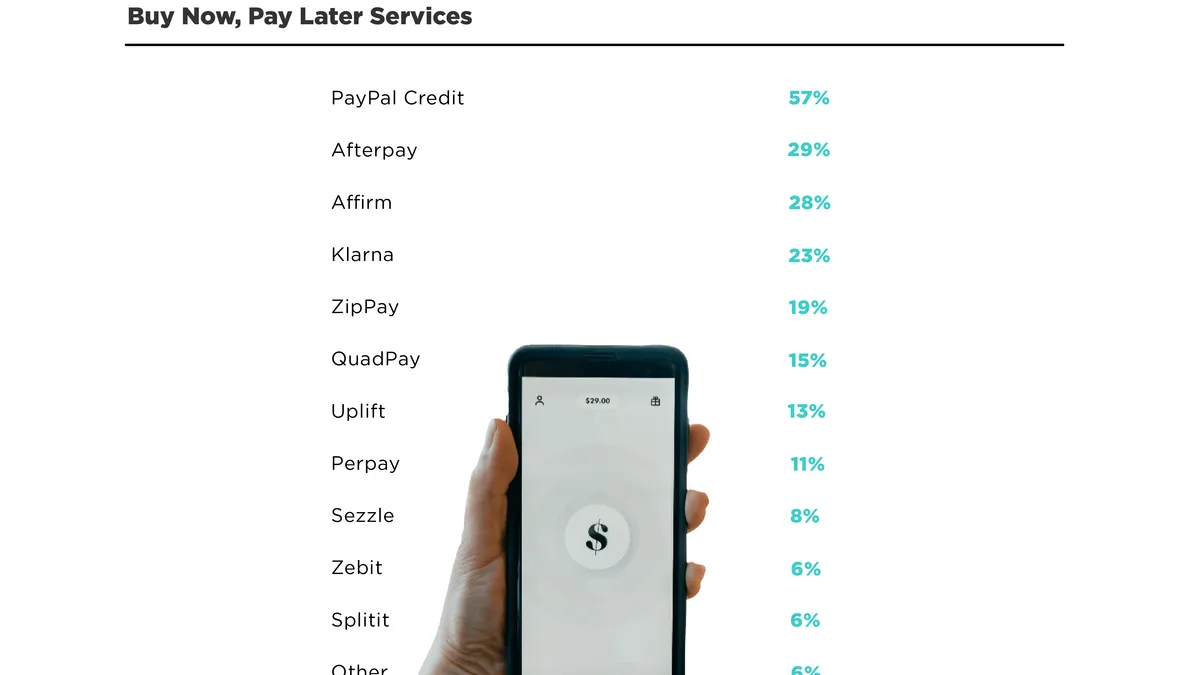

BNPL growth prompts change from credit bureaus

Paying in installments has become wildly popular, but many of these plans aren't reflected on consumers' credit reports. Credit agencies say adaptations are coming.

By Caitlin Mullen • Dec. 20, 2021 -

Community banks form payments network to compete with Zelle: report

Community bank innovation consortium Alloy Labs Alliance will manage the network in partnership with Payrailz, a digital payments company, Forbes reported.

By Anna Hrushka • Dec. 20, 2021 -

Bankers group presses CFPB to expand tech probe

Independent Community Bankers of America is urging the Consumer Financial Protection Bureau to sweep data aggregators into its inquiry into the practices of payment tech companies.

By Jonathan Berr • Dec. 20, 2021 -

Payhawk plans 2022 New York office opening

The Sofia-based company raised more than $130 million this year, arming it to take on U.S. rivals in providing business clients with payments management tools.

By Ted Jackson • Dec. 17, 2021 -

Feds increase scrutiny of buy now-pay later

The Consumer Financial Protection Bureau is concerned about consumers taking on too much debt, and about BNPL providers evading laws. As a result, it's demanding information from five of the biggest players in the emerging industry.

By Lynne Marek , Jonathan Berr , Caitlin Mullen • Dec. 16, 2021 -

Klarna extends BNPL to all online retailers

After acquiring the Dutch marketing software company Piggy, the Swedish buy now-pay later company is folding automatic couponing and price drop notifications into its offering and expanding the reach of its services.

By Tatiana Walk-Morris • Dec. 15, 2021 -

Gen Zers relied on buy now-pay later for holiday shopping. It's time to pay up.

Look up #Klarna, #Afterpay or #Affirm on the social media site TikTok. Beneath some of those BNPL provider hashtags are videos of teens dancing and lip syncing to viral sounds, with the balances they owe in the background.

By Maria Monteros • Dec. 15, 2021 -

Retrieved from Flickr/frankieleon.

Retrieved from Flickr/frankieleon.

Card industry faces $400B in fraud losses over next decade, Nilson says

Fraud-fighting efforts kept card industry losses at bay last year, according to Nilson Report, but the research firm says don’t expect the same when this year wraps up. "The decline in the dollar amount of fraud losses in 2020 will not be repeated in 2021," the report said.

By Caitlin Mullen • Dec. 14, 2021 -

Corcentric to grow through SPAC

Payments technology company Corcentric aims to grow, including internationally, by way of a merger with a special purpose acquisition company that will raise capital and take the business public.

By Lynne Marek • Dec. 13, 2021 -

alamy.com/Westend61 GmbH

Sponsored by Cybersource

Sponsored by CybersourceThree payments "resolutions" that no company can afford to skip

Learn the three payments "resolutions" that every company must make to ensure their customers never face a moment of friction at the check-out screen.

Dec. 13, 2021 -

Crypto execs urge regulation tailored to risks

They told lawmakers at a Wednesday hearing on Capitol Hill that nothing short of U.S. leadership in the field of digital assets is at stake.

By Dan Ennis • Dec. 10, 2021 -

Fintech firms lock arms for new standard

Digital finance company Plaid is leading a group of fintechs, data security companies and compliance firms in developing a new standard to protect confidential consumer data from hackers.

By Jonathan Berr • Dec. 9, 2021