Technology: Page 71

-

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Global Payments kicks off $28B growth agenda

The Atlanta payments processor aims to drive $28 billion into acquisitions and other investments that will scale its business over the next four years.

By Lynne Marek • Sept. 9, 2021 -

Mastercard to buy CipherTrace crypto security company

Mastercard is buying the six-year-old company to better serve its customers' needs in understanding digital asset risks, thwarting fraud and complying with regulations.

By Lynne Marek • Sept. 9, 2021 -

Explore the Trendline➔

Explore the Trendline➔

1401461124 via Getty Images

1401461124 via Getty Images Trendline

TrendlineTop 5 stories from Payments Dive

The digital evolution of payments is roiling the industry, forcing companies to rethink pricing schemes and revamp corporate strategies. Embedded payments, earned wage access, real-time systems and other innovations will transform the business.

By Payments Dive staff -

PayPal agrees to buy Paidy for $2.7B

The digital payments titan said it's buying the Japanese company to expand its "capabilities, distribution and relevance" in the third-largest e-commerce market in the world.

By Lynne Marek • Sept. 8, 2021 -

NovoPayment sets sights on US market

NovoPayment expects to land its first venture investment soon, just as it's extending its Latin American-focused financial services software business into the U.S.

By Lynne Marek • Sept. 8, 2021 -

JPMorgan to buy majority stake in Volkswagen's payments business

"One of the fastest-growing platforms is the connected car marketplace, whereby the car acts like a wallet for purchasing goods, services or subscriptions," a JPMorgan executive said.

By Anna Hrushka • Sept. 8, 2021 -

Mastercard to buy European open-banking company Aiia

The Mastercard acquisition will allow the big card company to cross-sell digital banking and payment services between its U.S. and European markets.

By Lynne Marek • Sept. 7, 2021 -

Amazon takes Visa battle to Australia

The online retail behemoth extended a surcharge to include Visa credit card transactions in Australia, and added an incentive nudging consumers there to ditch the cards.

By Lynne Marek • Sept. 3, 2021 -

Fed finds businesses eager for faster payments

The Federal Reserve said Tuesday that a survey of businesses last year revealed a majority are eager to make use of faster payments, with many ready to do so now. The Fed doesn't plan to launch its real-time system until 2023.

By Lynne Marek • Sept. 1, 2021 -

Competition for SMB payments clients heats up acquisitions

Some companies are buying up businesses that will help them cater to small and mid-sized clients, while others are getting out of the increasingly competitive arena.

By Lynne Marek • Aug. 31, 2021 -

Bank regulators issue guidance on partnering with fintechs

Community banks should evaluate fintechs' business experience and financial condition, information security and regulatory compliance, among other things, regulators said Friday.

By Anna Hrushka • Aug. 30, 2021 -

Retrieved from Pexels on August 09, 2021

Retrieved from Pexels on August 09, 2021

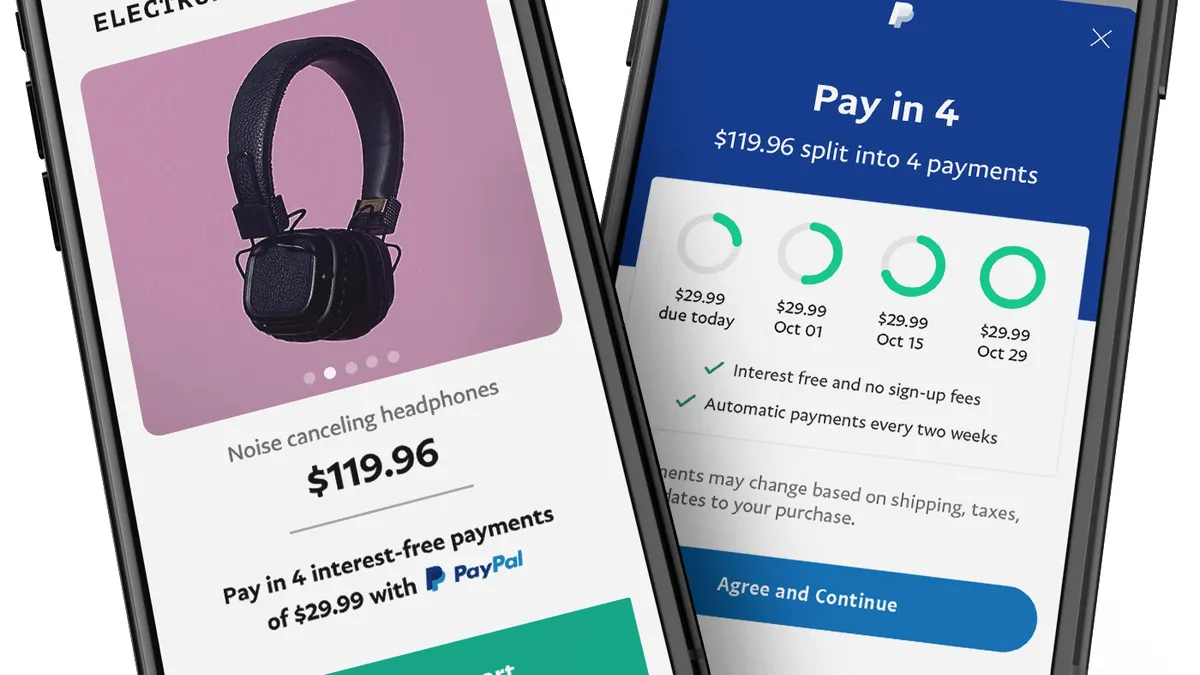

Amazon taps Affirm for installment financing

As Amazon explores payment options for its worldwide shoppers, it's turning to Affirm to test installment financing.

By Lynne Marek • Aug. 30, 2021 -

InComm Payments, Doxo to offer cash bill payments in stores

The partnership will stretch services for cash payment of bills to some 60,000 retail locations nationwide.

By Tatiana Walk-Morris • Aug. 27, 2021 -

Permission granted by Casey Kozieja, outside spokesperson for the company ([email protected])

Permission granted by Casey Kozieja, outside spokesperson for the company ([email protected])

Crypto ATMs multiply despite challenges to the currency

The biggest crypto kiosk companies are expanding as the value of bitcoin recovers and more merchants seek a piece of the action.

By Lynne Marek • Aug. 26, 2021 -

Klarna tallies 20M US customers

The buy now-pay later company has doubled its American customer base in just over a year.

By Tatiana Walk-Morris • Aug. 25, 2021 -

Fiserv strikes up a bevy of new partnerships

Fiserv has new ties to MovoCash, Selecta Group and Venmo that will allow it to keep expanding its digital payment services.

By Lynne Marek • Aug. 24, 2021 -

Deep Dive

Anti-fraud niche in payments thrives as e-commerce climbs

Major payments players and fledgling upstarts alike are developing new tools to fight increasing fraud threats to their businesses.

By Mercedes Cardona • Aug. 23, 2021 -

BitPay CFO: long-time crypto users incentivized to keep spending

Cryptocurrency is well on its way to “emerge as the next evolution to modern alternative payments,” Jagruti Solanki, CFO of Bitcoin and payment provider BitPay, said Friday.

By Jane Thier • Aug. 20, 2021 -

How Square's Afterpay purchase advances its small-business banking goals

Square is "going to turn to all their small-business users and they're going to say, 'We're helping you with accounts receivable and now we can help you with accounts payable,'" says one analyst.

By Anna Hrushka • Aug. 18, 2021 -

Senators raise privacy concerns about Amazon One

Senators Amy Klobuchar, Bill Cassidy and Jon Ossoff questioned the security of customer data and noted the palm payment tool technology raises additional anti-competitive concerns.

By Tatiana Walk-Morris and Cara Salpini • Aug. 18, 2021 -

PayPal drops BNPL late fees worldwide

The payments giant will soon get rid of the late fees on buy now-pay later transactions in the U.S., the United Kingdom and France, catching those regions up with other parts of the world where it didn't have them.

By Lynne Marek • Aug. 18, 2021 -

Walmart looks for a cryptocurrency strategy leader

The retailer follows Amazon in seeking a subject matter expert for a field that is still largely unproven.

By Ben Unglesbee • Aug. 17, 2021 -

Payments called 'dominant driver' for fintech investment: KPMG

The rise of venture capital and private equity investment in fintechs is likely to lead to more mergers and acquisitions in the arena too, a KPMG report said.

By Jim Tyson • Aug. 17, 2021 -

Paypal, Venmo get into grocery stores

PayPal and Venmo have arrived in-store at their first grocery outlet, Giant Eagle, allowing that operator to accept their digital payment options at cash registers.

By Sam Silverstein • Aug. 13, 2021 -

BlackBerry teams with Car IQ for in-vehicle payments

The companies are working together to create car payment systems with a “digital fingerprint” that securely connects a driver to a banking network.

By Wendy Cole • Aug. 13, 2021 -

Coinbase attracts big hedge fund clients

The company has attracted 10% of the top 100 hedge funds as customers, and it's ramping up marketing to increase the visibility of its products, the company's CFO said.

By Ted Knutson • Aug. 12, 2021