Technology: Page 57

-

Green Dot juggles customer changes

The banking-as-a-service company posted profits in the final quarter of last year even as it recovered from the loss of clients.

By Lynne Marek • Feb. 24, 2023 -

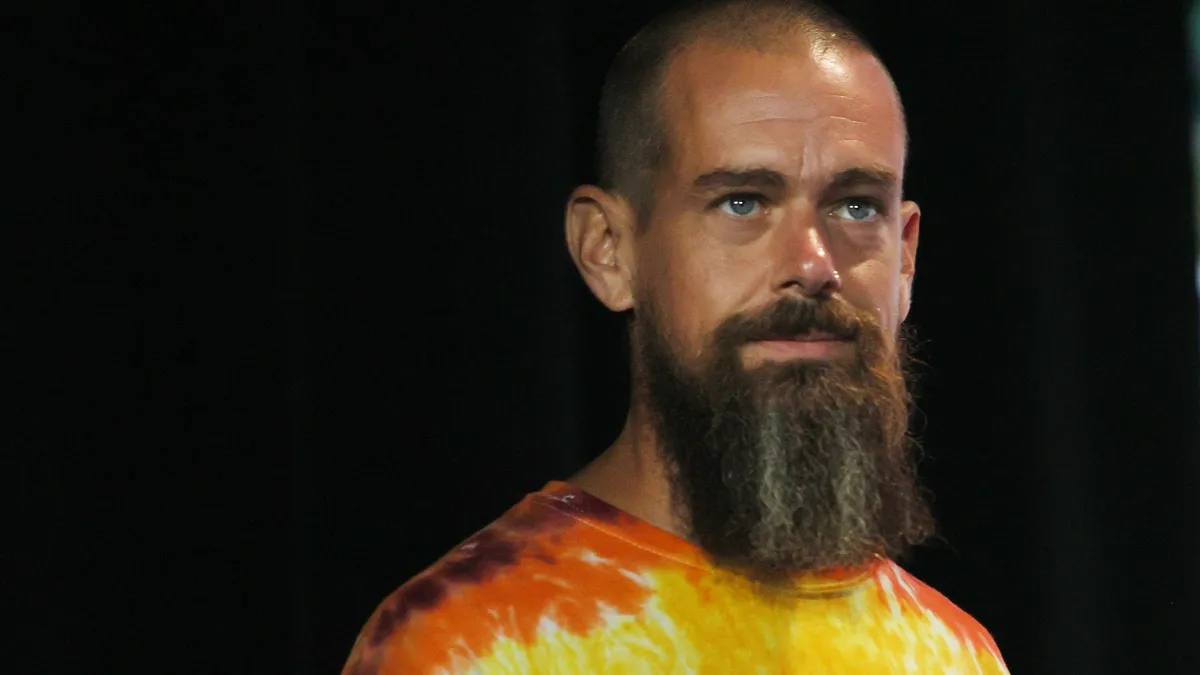

Block boosts Ahuja’s responsibilities

Pledging to be more efficient with a revamp of the company’s leadership structure, Block has combined the CFO and COO roles under Amrita Ahuja.

By Caitlin Mullen • Feb. 24, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

GoDaddy launches payable domain service

GoDaddy now offers its business owner clients a digital payment tool that is customizable to their company branding.

By Tatiana Walk-Morris • Feb. 24, 2023 -

FedNow aims to avoid Zelle-type fraud

As the Federal Reserve prepares for a mid-year launch of its instant payments system, FedNow, it’s zeroing in on anti-fraud tools to protect users.

By Lynne Marek • Feb. 23, 2023 -

Same-day, B2B payments fuel ACH growth

Last year’s same-day ACH limit increase helped nearly double that category’s total payment compared to 2021, Nacha said.

By Tatiana Walk-Morris • Feb. 23, 2023 -

Discover launches tech website

The card company joined the Linux Foundation and Fintech Open Source Foundation as part of a broader investment into its developer ecosphere.

By Matt Ashare • Feb. 23, 2023 -

Paymentus hands interim CFO severance benefits

The company called the severance benefits’ approval a formality. But one expert said it is likely a retention strategy designed to encourage the interim CFO to “stick around.”

By Maura Webber Sadovi • Feb. 16, 2023 -

Toast acquires drive-thru tech company

Adding Delphi Display Systems’ technology helps Toast more broadly serve its quick-service restaurant customers, the company’s executives said.

By Caitlin Mullen • Feb. 16, 2023 -

Branch draws Uber, others into fold

After landing Uber as a client, the worker payment services company has recently attracted other logistics and delivery clients with help from that big name.

By Caitlin Mullen • Feb. 16, 2023 -

Payments firms gear up for new ISO standard

The Clearing House and other payments players, including Swift, are readying for the March rollout of a international payments standard.

By Lynne Marek • Feb. 15, 2023 -

Coen stores add Grabango checkout technology

As the frictionless locations go into service, Grabango’s CEO Will Glaser sees the technology gaining traction in coming years.

By Jessica Loder • Feb. 15, 2023 -

SpotOn aims to unseat restaurant rivals

The restaurant payments and software company is battling Toast and Square and taking on legacy payments companies such as NCR and Oracle.

By Caitlin Mullen • Feb. 14, 2023 -

P97, Visa partner on payment security

The agreement aims to reduce friction for connected-car payments and enhance mobile payment acceptance at 60,000 convenience stores.

By Jessica Loder • Feb. 13, 2023 -

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Global Payments sells gaming unit for $415M

Like the company’s $1 billion sale of its Netspend consumer unit, the divestiture reflects efforts to refine its portfolio, said Global Payments CEO Jeff Sloan.

By Caitlin Mullen • Feb. 10, 2023 -

Fiserv’s new HQ approved for state tax credits

The company is set to receive up to $7 million from the Wisconsin Economic Development Corporation for its new Milwaukee headquarters.

By Caitlin Mullen • Feb. 10, 2023 -

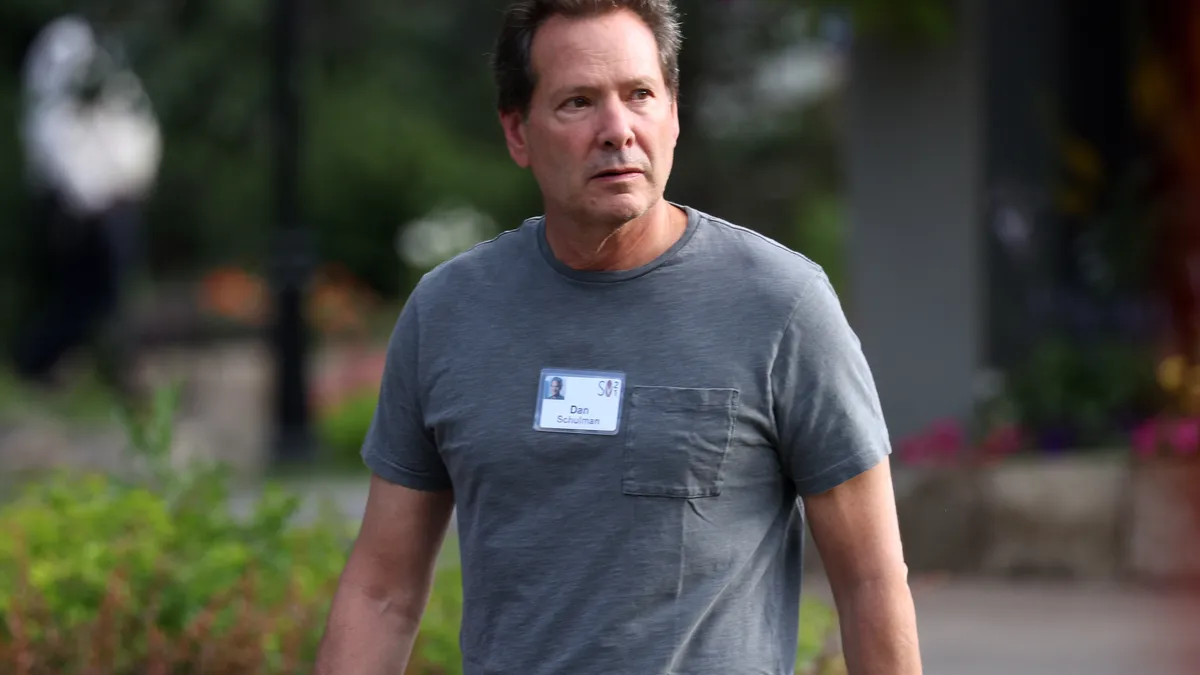

PayPal CEO will retire at the end of 2023

Dan Schulman said he plans to exit then, but will be flexible in the timing. He called 2023 a potentially “transformational year” for the digital payments company.

By Lynne Marek • Feb. 9, 2023 -

Ingenico aims to make acquirers more competitive

Ingenico is adding an in-store payments software service, and hinted that a large U.S.-based merchant acquirer will start using it soon.

By Caitlin Mullen • Feb. 9, 2023 -

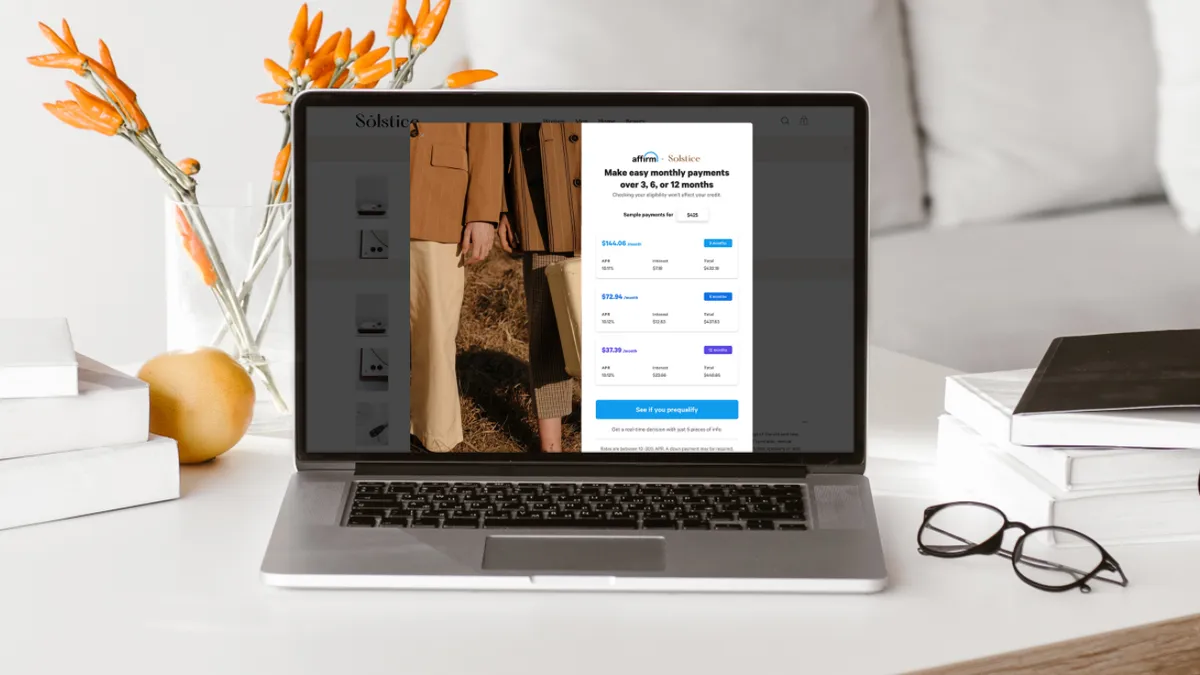

Affirm cuts 500 employees

The buy now, pay later provider is eliminating jobs after its loss for the fourth quarter of last year ballooned over the same period in 2021.

By Lynne Marek • Feb. 9, 2023 -

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Jack Henry touts FedNow launch

In July, the company expects to become the first payments processor to launch the Federal Reserve’s new real-time service.

By Caitlin Mullen • Feb. 8, 2023 -

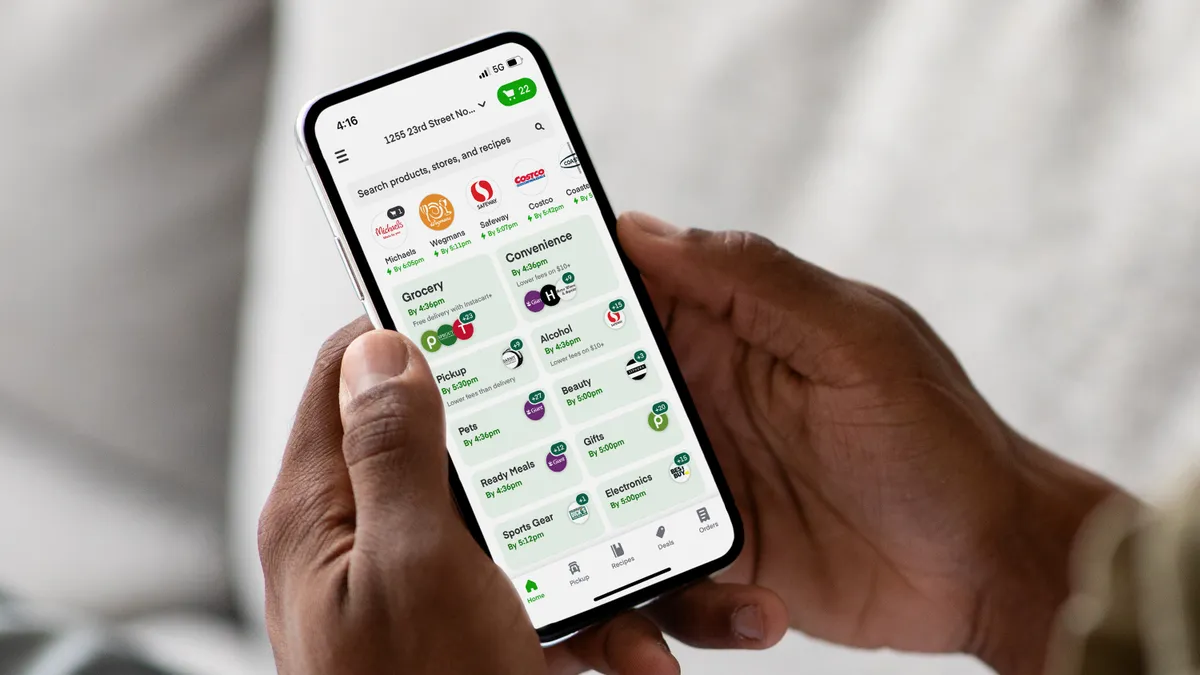

Instacart debuts Scan & Pay with NYC grocer

This marks the retail debut of the Instacart technology, which is part of the company’s suite of in-store solutions for retailers.

By Catherine Douglas Moran • Feb. 7, 2023 -

Google, Amex roll out anti-fraud tool

Amex is the latest card company to tap a Google virtual card service aimed at increasing the security of online payments.

By Lynne Marek • Feb. 7, 2023 -

Fiserv discloses acquisitions

Even as the payments and fintech giant cut employees and sold off business units, the company spent $1 billion on acquisitions last year.

By Caitlin Mullen • Feb. 7, 2023 -

Opinion

Eliminating costly false declines online

“False declines are especially problematic in an environment where demanding customers with high expectations are not afraid to take their business elsewhere,” writes an Experian executive.

By Chris Ryan • Feb. 6, 2023 -

Lightspeed bets on bigger customers

In pursuing profitable growth, point-of-sale software and payments provider Lightspeed Commerce is zeroing in on larger merchants as clients.

By Caitlin Mullen • Feb. 6, 2023 -

Stripe CFO exiting to handle ‘family matters’

Dhivya Suryadevara will leave the digital payments startup in April, as Stripe executives weigh taking the company public.

By Elizabeth Flood • Feb. 6, 2023