Technology: Page 56

-

Tilia C-suite gets overhaul

The payments startup has a new team of top executives to spearhead payments for gaming, social media and other next-generation marketplaces.

By Lynne Marek • March 14, 2023 -

Sponsored by PayiQ

Cloud-enabled processing with PayiQ: The key to automating merchant onboarding

In a world where merchants expect fast and easy payments, the time required for ISOs and ISVs to complete arduous technical onboarding processes can cost sales and damage reputations.

March 13, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Affirm courts Amazon for more business

Even as it angles for an increase, the buy now, pay later provider’s CFO acknowledged Thursday that its juggernaut e-commerce partner has other BNPL options.

By Caitlin Mullen • March 10, 2023 -

USDA picks 5 states for mobile SNAP payments pilot

Illinois, Louisiana, Massachusetts, Missouri and Oklahoma are working with the government agency to expand payment options for SNAP consumers.

By Catherine Douglas Moran • March 9, 2023 -

FedNow may draw in low-income users

The real-time payments system due later this year could have particular appeal to unbanked and underbanked Americans, Fed researchers say.

By Lynne Marek • March 9, 2023 -

Pagos aims to check merchants’ payments costs

With a recent venture capital infusion for the merchant software tools provider, Pagos is planning to add jobs, including engineers.

By Ryan Deffenbaugh • March 9, 2023 -

Brex offers ChatGPT-style tools

The announcement comes as interest in ChatGPT is rapidly gaining momentum, even as some worry about potential privacy and security risks.

By Alexei Alexis • March 8, 2023 -

Shift4 needles rival Toast

Toast and Shift4 are battling to win larger customers in the intensely competitive restaurant payments arena.

By Caitlin Mullen • March 8, 2023 -

Retrieved from Amazon press page.

Retrieved from Amazon press page.

Amazon Go to close 8 of its stores

The company will close the checkout-free stores next month as it struggles to get its physical retail footprint right.

By Brett Dworski • March 7, 2023 -

Affirm exits Australia

Less than two years after launching in Australia, the buy now, pay later company is shuttering its operations there.

By Caitlin Mullen • March 7, 2023 -

Banking technology provider Amount cut 25% of staff

The Chicago-based fintech, which was valued at $1 billion in 2021, recently initiated its second round of layoffs in less than a year.

By Anna Hrushka • March 6, 2023 -

PayPal leans on Venmo for growth

While the digital payments pioneer has kept its PayPal and Venmo operations separate, the parent company expects them to converge in about a year.

By Lynne Marek • March 6, 2023 -

Senators urge regulators to keep close eye on Zelle

Five Democrats blasted the platform for its use of murky language, such as “authorized” transactions, in fraud-related reimbursements of customers.

By Rajashree Chakravarty • March 6, 2023 -

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Jack Henry, ACI pounce on FedNow

The companies are gearing up to add U.S. real-time services for customers with the mid-year launch of the Federal Reserve instant payments system.

By Lynne Marek • March 3, 2023 -

Square raises prices

The price increases come as Block’s merchant business faces stiffer competition in the point-of-sale software market.

By Caitlin Mullen • March 2, 2023 -

Fiserv discloses 7% drop in workforce

As the company cut 3,000 employees, Fiserv’s employee termination costs nearly doubled to $187 million in 2022.

By Caitlin Mullen • March 2, 2023 -

Shift4 adds PayPal’s checkout tools

Shift4 will promote the digital payments giant’s checkout capabilities to merchants and receive a share of revenue for any PayPal checkout.

By Caitlin Mullen • March 1, 2023 -

Mastercard embraces nationalism

The card company isn’t shying away from countries in which the governments are taking a more insular approach to building their payments systems.

By Lynne Marek • March 1, 2023 -

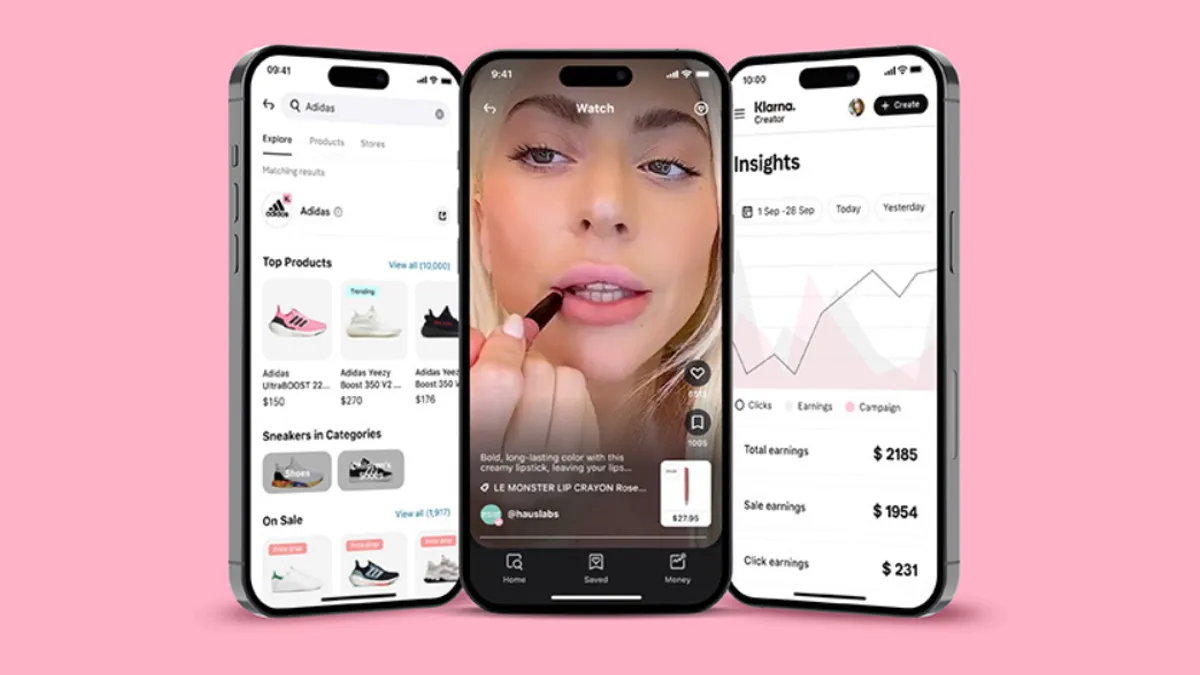

Klarna’s growth comes at a cost

The buy now, pay later pioneer kept up growth despite employee cuts last year. The credit loss rate edged up too.

By Lynne Marek • Feb. 28, 2023 -

Retrieved from Kaitlyn Fitzgerald, a spokesperson for Charlie Youakim on January 24, 2022

Retrieved from Kaitlyn Fitzgerald, a spokesperson for Charlie Youakim on January 24, 2022

Sezzle ekes out a profit

The buy now, pay later company has cut costs by winding down operations in some markets, renegotiating prices with merchants and tightening underwriting.

By Caitlin Mullen • Feb. 28, 2023 -

Remitly to shutter digital banking platform Passbook

The Seattle-based remittance fintech launched Passbook in 2020. The product, however, hasn’t garnered significant overlap with existing customers, Remitly CEO Matt Oppenheimer said.

By Anna Hrushka • Feb. 27, 2023 -

Paymentus bets on office return boost

New business bookings and onboarding of signed clients have both picked up steam as workers return to offices, said Paymentus CEO Dushyant Sharma.

By Caitlin Mullen • Feb. 27, 2023 -

Transparency key to crypto’s next phase: Circle CFO

USDC issuer Circle is moving to become a public company, its CFO said, even as regulatory attention on the space sharpens.

By Grace Noto • Feb. 24, 2023 -

Green Dot juggles customer changes

The banking-as-a-service company posted profits in the final quarter of last year even as it recovered from the loss of clients.

By Lynne Marek • Feb. 24, 2023 -

Block boosts Ahuja’s responsibilities

Pledging to be more efficient with a revamp of the company’s leadership structure, Block has combined the CFO and COO roles under Amrita Ahuja.

By Caitlin Mullen • Feb. 24, 2023