Technology: Page 58

-

Stripe CFO exiting to handle ‘family matters’

Dhivya Suryadevara will leave the digital payments startup in April, as Stripe executives weigh taking the company public.

By Elizabeth Flood • Feb. 6, 2023 -

Merchants frustrated with fees, tech issues

Inflation-weary business owners are less satisfied with their merchant service providers this year, a J.D. Power survey showed.

By Caitlin Mullen • Feb. 3, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Standard AI to acquire Skip Checkout

The deal would create the first company to combine self-checkout and AI-powered autonomous checkout for retailers, according to the announcement.

By Brett Dworski • Feb. 2, 2023 -

Checkout.com changes up leadership

The company promoted Céline Dufétel to president and elevated Nirupam Sinha to CFO as it pursues U.S. expansion and battles Stripe.

By Elizabeth Flood • Feb. 2, 2023 -

FIS sheds 2,600 employees: report

Amid a strategic review of operations, the payments processor and fintech giant has dismissed 2,600 workers, Bloomberg reported.

By Caitlin Mullen • Feb. 2, 2023 -

Is Affirm out as Amazon’s sole BNPL provider?

An exclusivity provision between the two companies has lapsed as the buy now, pay later arena becomes more competitive.

By Caitlin Mullen • Feb. 2, 2023 -

Euronet’s Dandelion takes on cross-border rivals

The international network that grew out of Ria parent Euronet is extending its cross-border money movement pitch to banks and businesses.

By Lynne Marek • Feb. 2, 2023 -

Zip pauses acquisitions

The Australia-based buy now, pay later provider’s acquisitive days “are behind us, for now,” said CEO Larry Diamond.

By Caitlin Mullen • Feb. 1, 2023 -

PayPal to cut 7% of its workforce

The digital payments pioneer said it’s cutting 2,000 employees as the company seeks to adapt to a new, more competitive environment.

By Lynne Marek • Jan. 31, 2023 -

Jack Henry earnings grab spotlight

Customer appetite for Jack Henry's services is likely to attract analysts' attention in the upcoming earnings report.

By Caitlin Mullen • Jan. 31, 2023 -

Marqeta’s new CEO targets embedded finance

Simon Khalaf, who takes the top job Tuesday, is counting on new embedded offerings to help expand the company’s services for corporate clients.

By Lynne Marek • Jan. 31, 2023 -

Marqeta to buy Power Finance

The virtual card company said it would pay $275 million to buy the New York fintech that allows companies to manage their credit card programs.

By Lynne Marek • Jan. 30, 2023 -

Deep Dive

Crypto may yet upend payments

Nearly 2,000 crypto workers have been laid off in 2023, but the value of Bitcoin climbed enough in January for Goldman Sachs to take note.

By Gabrielle Saulsbery • Jan. 30, 2023 -

FIS sees another director resign

A second director resigned this month from the mega payment processor’s board as it undertakes a comprehensive review of its operations.

By Lynne Marek • Jan. 26, 2023 -

Warren calls for more regulation of crypto

The Democratic senator called SEC Chair Gary Gensler “the right leader to get the job done,” but said regulators need to do more to bolster their scrutiny of the industry.

By Anna Hrushka • Jan. 26, 2023 -

Visa stands by crypto

At the card giant’s annual meeting Tuesday, CEO Al Kelly showed no signs of backing off crypto. He also suggested Visa’s management team may change after he exits as CEO.

By Lynne Marek • Jan. 26, 2023 -

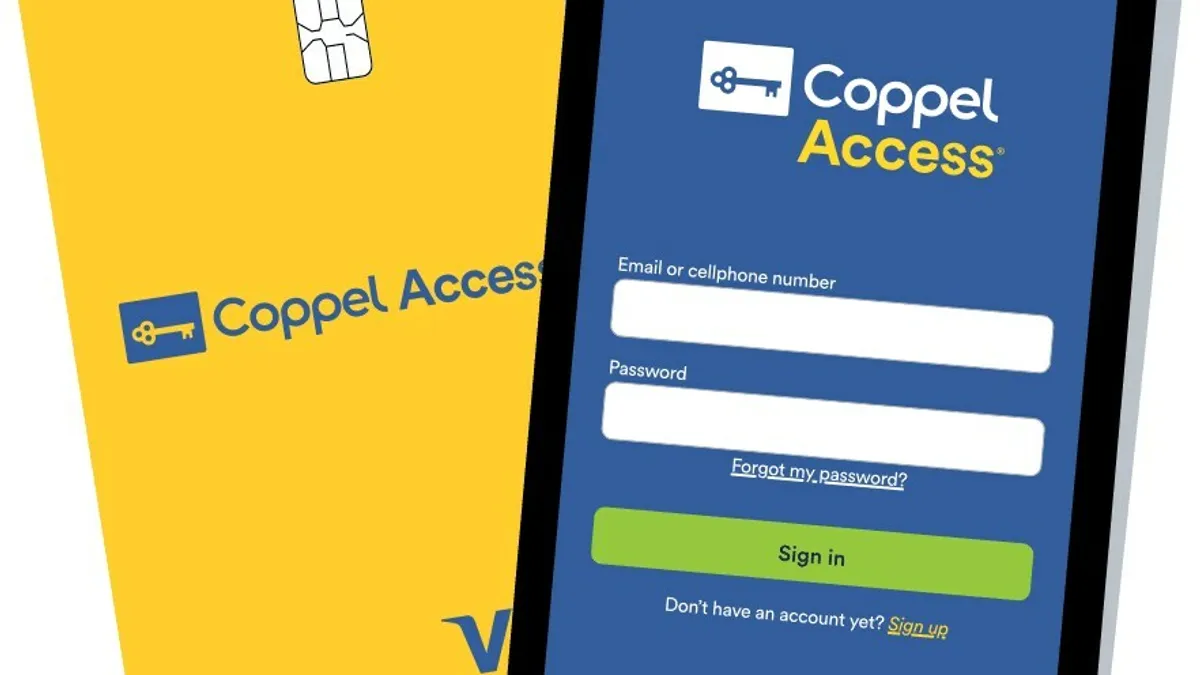

Retailer targets Mexican Americans for digital wallet

The largest department store in Mexico is carving out a niche in offering digital and physical debit cards, as well as remittance services, to people sending payments over the border.

By Gabrielle Saulsbery • Jan. 25, 2023 -

Opinion

Why the Arizona AG opinion on EWA matters

“The Arizona decision is in line with decades of decisions across the country that have found that non-recourse products are not loans,” the Payactiv authors write in this opinion piece.

By Aaron Marienthal and Molly Jones • Jan. 24, 2023 -

Bluefin, Visa pursue network tokenization

Bluefin is entering a partnership with card network giant Visa as worldwide payment fraud is predicted to rise in the coming years.

By Tatiana Walk-Morris • Jan. 24, 2023 -

Stripe, Amazon ‘deepening’ their tie

Stripe has become “a strategic payments partner” in the U.S., Europe, and Canada for mega retailer Amazon under a renewed agreement.

By Lynne Marek • Jan. 24, 2023 -

Big banks to launch digital wallet operated by Zelle parent: report

The wallet, which is expected to launch in the second half of the year, aims to compete with PayPal and Apple, sources told The Wall Street Journal. But serious competition may take a while, an analyst said.

By Anna Hrushka • Jan. 24, 2023 -

Gemini cut another 10% of staff: report

The crypto exchange has been affected by Genesis' bankruptcy and the FTX contagion.

By Gabrielle Saulsbery • Jan. 24, 2023 -

Paymentus to accept payments via Green Dot Network

Paymentus is tapping Green Dot’s network to extend the number of locations where it accepts cash bill payments from consumers.

By Tatiana Walk-Morris • Jan. 23, 2023 -

International coalition pursues cross-border payments improvements

In a new report, a group of international organizations give a broad overview of routes for improving international payments systems.

By Lynne Marek • Jan. 23, 2023 -

Earnings preview: Payments companies face up to 4Q

How economic stress challenged payments companies in the final months of 2022 will be closely watched in upcoming earnings reports.

By Caitlin Mullen • Jan. 23, 2023