Technology: Page 53

-

Block boosts compliance spending to $160M

Square parent Block is increasing compliance spending on personnel and software this year.

By Caitlin Mullen • May 5, 2023 -

Shift4 snags Focus POS for $45M

The acquisition gives Shift4 ownership of a business with ties to 10,000 restaurant merchants.

By Caitlin Mullen • May 4, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Jack Henry preps clients for FedNow

The financial technology provider is encouraging clients to be prepared to receive payments through FedNow.

By Caitlin Mullen • May 3, 2023 -

Andreessen Horowitz partners spy payments play

Gaming, cannabis and telehealth are some of the “high-risk” niches that would benefit from more vertical-specific payments software, two partners for the firm contend.

By Lynne Marek • May 3, 2023 -

Finix takes aim at processor incumbents

Now certified as a processor, Finix seeks to take on legacy and fintech rivals.

By Caitlin Mullen • May 3, 2023 -

FDIC proposes higher insurance coverage for payroll accounts

Under the agency’s targeted coverage scenario, accounts used for payment purposes — specifically, business payment accounts — would merit higher deposit insurance coverage.

By Anna Hrushka • May 2, 2023 -

CSI targets $1B in annual revenue

The company that provides community banks with payments, fintech and other services is gunning for growth with new private equity capital.

By Lynne Marek • May 2, 2023 -

Fiserv arms vendors with text payment tool

Payment processor Fiserv this week began broadly offering a new tool that lets merchants text customers for payment.

By Caitlin Mullen • May 2, 2023 -

Walmart, Kroger eye instant payments

The giant retailers eagerly await instant payment system possibilities, especially as an alternative to card payments, according to industry professionals who heard their representatives speak recently.

By Lynne Marek • May 1, 2023 -

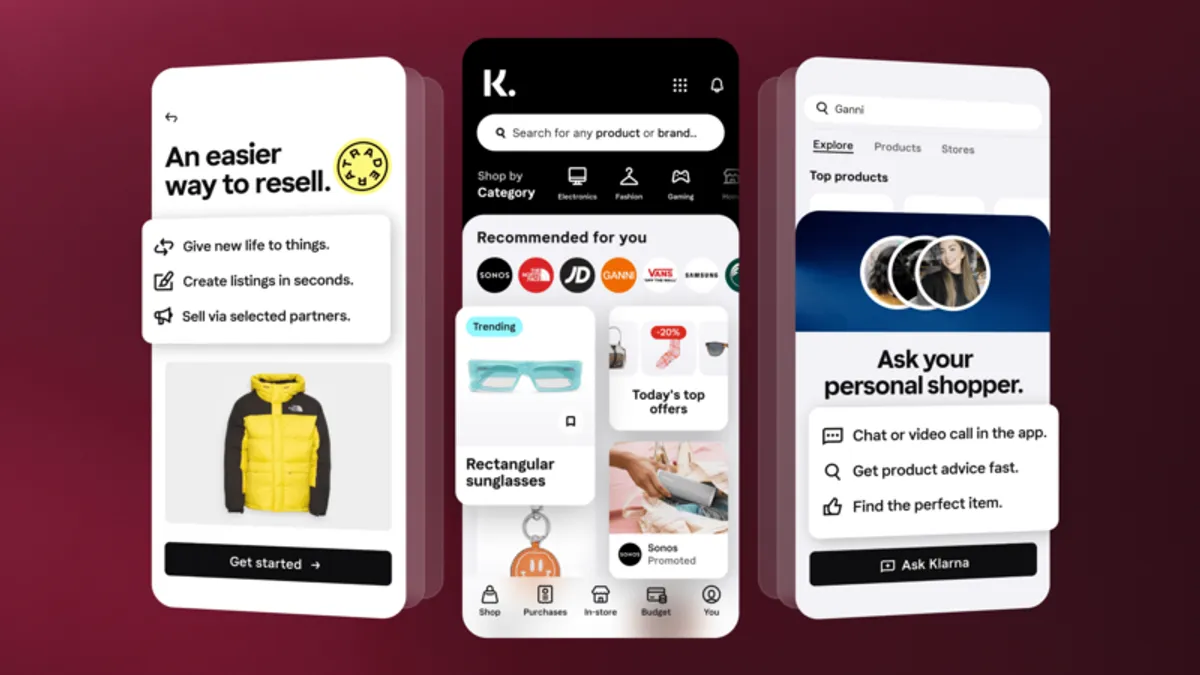

Klarna overhauls mobile app

The buy now, pay later company has rolled out an AI-powered shopping feed, along with tools for creators, a personal shopping assistant and new resell capabilities.

By Aaron Baar • May 1, 2023 -

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Global Payments to replace CEO

CEO Jeff Sloan will step down June 1 and be replaced by the payment processor’s president and chief operating officer, Cameron Bready.

By Caitlin Mullen • May 1, 2023 -

Q&A

Will frictionless checkout ever take off in retail?

Standard AI CEO Jordan Fisher acknowledged that the technology has “been a really hard market to start growing,” but believes it will expand alongside other AI-driven innovations.

By Sam Silverstein • April 28, 2023 -

Mastercard ‘cannot afford to ignore’ AI, CEO says

The card network company is considering using artificial intelligence in more ways, including in customer service, CEO Michael Miebach said.

By Caitlin Mullen • April 28, 2023 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Payments increasingly in regulatory crosshairs, industry lawyers say

Attorneys and payments professionals called out recent areas of interest for regulators during the Electronic Transactions Association’s conference in Atlanta.

By Caitlin Mullen • April 27, 2023 -

Self-checkout now dominant grocery checkout format, report says

Self-checkout, which grocers have turned to as a way of lowering costs, accounted for 55% of transactions in 2022, according to shopper insights firm VideoMining.

By Peyton Bigora • April 27, 2023 -

Opinion

Swift executive calls for payments standardization

“As a standardized format, ISO 20022 creates a common language for international payments the world over,” writes an executive in support of industry collaboration.

By Stephen Lindsay • April 26, 2023 -

Former Amex execs raise $78M for early stage fintech fund

Women-led Vesey Ventures, which has already invested in five startups, aims to bridge the gap between companies in need of new technologies and those building them.

By Rajashree Chakravarty • April 26, 2023 -

Fiserv lines up bank clients for FedNow

The mega processor has a handful of bank customers in the Federal Reserve’s real-time payments pilot, and a pack signed up for services after the system’s July launch. It’s part of the company’s growth strategy.

By Lynne Marek • April 26, 2023 -

CFOs hunt for revenue-generating tech tools: Stripe

The financial service provider’s updated tools come as CFOs seek emerging technologies that can aid in key areas like revenue generation.

By Grace Noto • April 25, 2023 -

Enerbase pilots Amazon One at first convenience stores

The technology that allows a contactless payment using a customer’s palm is being tested at the first stand-alone convenience stores.

By Jessica Loder • April 25, 2023 -

DailyPay racks up bank clients

Santander Bank last week became the latest in a string of financial institutions partnering with DailyPay to provide companies with on-demand pay services.

By Lynne Marek • April 24, 2023 -

Fed study highlights growth in card, ACH payments

Card, ACH and check payment values climbed from 2018 to 2021, as cash was left behind, according to the Federal Reserve’s noncash payments study.

By Caitlin Mullen • April 24, 2023 -

Opinion

FedNow won’t bring ‘tidal wave’ of change

“Payments solutions reach scale when they provide better usability, affordability, and security,” write partners at a San Francisco venture capital firm.

By Kevin Jacques and Ben Malka • April 21, 2023 -

Same-day ACH payments soar

The dollar value of same-day ACH payments nearly doubled in the first quarter as the volume increased 20.7%, Nacha said this week in a quarterly update.

By Tatiana Walk-Morris • April 20, 2023 -

Fed to reduce cross-border payments program

The Federal Reserve plans to discontinue its cross-border ACH payments service to Europe and Canada later this year, Fed officials reiterated at a conference this week.

By Lynne Marek • April 20, 2023