Technology: Page 52

-

Consumers use cash to forget, study shows

New research suggests consumers’ payment method choice can depend on what they’re buying, especially if it’s a guilty-pleasure purchase.

By Caitlin Mullen • May 30, 2023 -

Consumers, businesses gravitate to faster, mobile payments

As electronic payment options become available, consumers and businesses in the U.S. are using them more often, but keeping a wary eye on fraud.

By Lynne Marek • May 26, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Debit network players gear up for July

Card network operators Visa, Mastercard and Fiserv are bracing for change in light of the Federal Reserve’s debit routing rule clarification.

By Caitlin Mullen • May 26, 2023 -

Deep Dive

Payments fraud climbs as banks reach for joint response

Financial institutions and payments players are seeking to coalesce around new efforts to battle skyrocketing payments fraud.

By Lynne Marek • May 25, 2023 -

Levchin downplays Apple threat

Affirm’s CEO said PayPal, Klarna and Afterpay are more likely to face pressure from Apple’s buy now, pay later move.

By Caitlin Mullen • May 25, 2023 -

Opinion

Give EWA a chance

“It is unclear why critics want to place EWA in the credit silo and call for heavy-handed regulations to restrict access to EWA products,” argues the CEO of the Innovative Payments Association.

By Brian Tate • May 24, 2023 -

Cash App pursues older, affluent customers

The Block business is seeking older, higher-income users as it pursues diversified growth, CEO Jack Dorsey said.

By Caitlin Mullen • May 24, 2023 -

Legislators spar over stablecoin proposals

Lawmakers agree stablecoin legislation is needed to ensure the U.S. establishes itself as a leader in the space.

By Caitlin Mullen • May 22, 2023 -

NY Fed teams with Singapore on CBDC study

The two central banks tested digital ledger technology for payments across multiple currencies in less than 30 seconds.

By Lynne Marek • May 22, 2023 -

Worldpay spin-off hands FIS mixed bag

The payments processing and technology company will keep a stake in the Worldpay unit, but take on higher-interest-rate debt.

By Lynne Marek • May 18, 2023 -

ACI boots chief technology officer

ACI Worldwide has fired its chief technology officer just as it’s gearing up for the FedNow real-time payments system.

By Caitlin Mullen • May 18, 2023 -

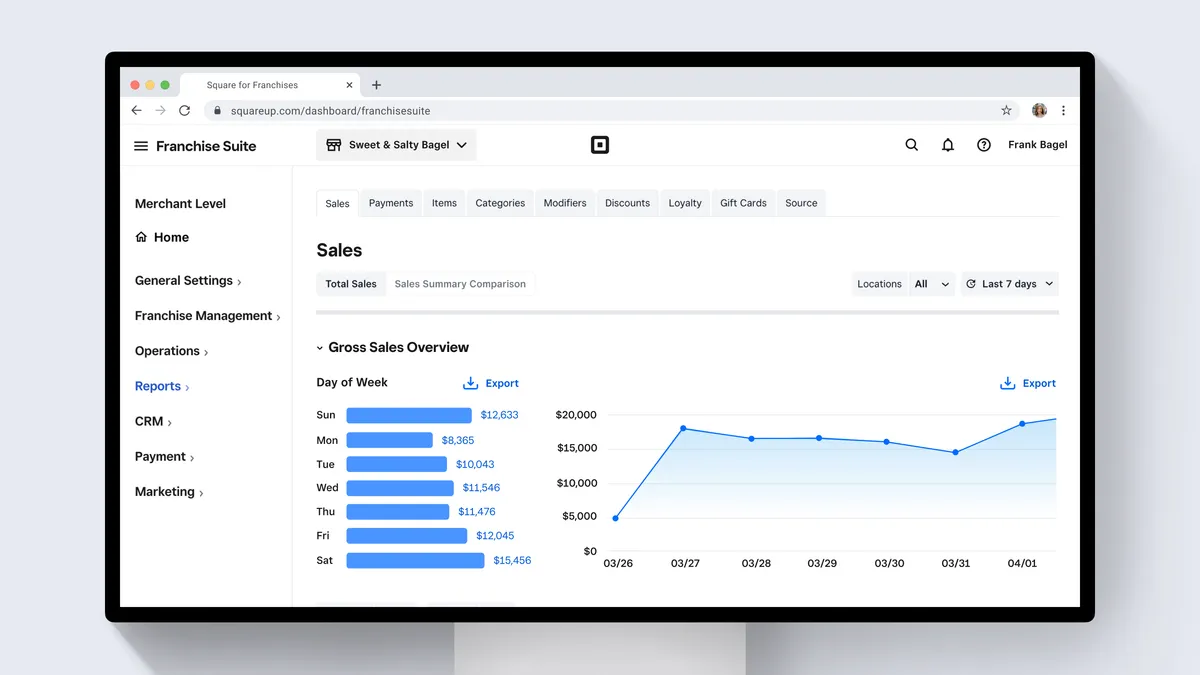

Square adds franchise platform

Block-owned Square said the tool lets restaurant franchisors monitor multiple units on one dashboard.

By Julie Littman • May 17, 2023 -

PayPal considers Xoom sale: report

The digital payments company is considering a sale of its Xoom cross-border business, The Information reported, citing an unnamed source.

By Lynne Marek • May 17, 2023 -

PayPal urged to accelerate CEO search

The digital payments pioneer faces pressure from investors to name CEO Dan Schulman’s successor sooner rather than later.

By Lynne Marek • May 16, 2023 -

Revolut CFO leaves digital bank for ‘personal reasons’

The company’s finance head is the latest to depart the troubled fintech as it fends off regulatory and financial concerns.

By Grace Noto • May 15, 2023 -

Catch chases in-store opportunity

Currently focused on e-commerce, Catch seeks to bring its ACH payment option into stores.

By Caitlin Mullen • May 15, 2023 -

Opinion

How to advance cross-border B2B payments

“Regional regulatory bodies must work together on common financial standards that support multilateral payment systems if we are to make progress,” writes one payments professional.

By Scott Frisby • May 15, 2023 -

Paysend charges into US market

From a new U.S. headquarters in Miami, the British cross-border payments company is pitching services to U.S. businesses and consumers.

By Lynne Marek • May 12, 2023 -

Everee takes on EWA providers

The payroll provider is angling to disrupt the earned wage access companies that have been making it easier for employers to offer workers on-demand pay.

By Lynne Marek • May 11, 2023 -

Convenience chain adds Amazon palm pay

Energy Mart is the second convenience store chain to install the palm-scanning technology that’s also being used in sports arenas and Amazon’s own brick-and-mortar retail locations.

By Jessica Loder • May 11, 2023 -

Marqeta to cut workforce by 15%

The card-issuing fintech plans to dismiss about 150 employees in an effort to become profitable. It aims to reduce annual costs by as much as $45 million.

By Lynne Marek • May 10, 2023 -

What does the buy now, pay later boom mean for food retailers?

As more shoppers turn to short-term loans to buy groceries, there may be a shift in how people think about paying for essential goods, experts say.

By Sam Silverstein • May 10, 2023 -

PayPal growth driven by Braintree

PayPal's Braintree unit is bolstering the company's growth, but that expansion isn't as profitable as building its legacy business.

By Lynne Marek • May 9, 2023 -

Green Dot braces for profit margin pressure

Green Dot expects profit margins to be squeezed in coming quarters after the exit of some clients last year.

By Caitlin Mullen • May 8, 2023 -

Shopify cuts 20% of workforce

The e-commerce platform’s cuts announced Thursday affect about 2,300 jobs, based on the company’s most recent headcount.

By Nate Delesline III • May 5, 2023