Technology: Page 15

-

Google drops lawsuit against CFPB

The tech giant ended its court battle as the federal agency halted supervision of the company’s payments arm.

By Justin Bachman • May 13, 2025 -

Stablecoin bill falters in Senate

Democrats demanded fixes to the GENIUS Act – designed to create a framework for bringing stablecoins into the U.S. financial system – and raised concerns about Trump’s ties with crypto ventures.

By Rajashree Chakravarty • May 12, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Q&A

Marqeta chief focuses on revenue diversity, execution

Interim CEO Mike Milotich wants to boost the processor’s non-Block revenue and expand its embedded finance offerings via a new mobile app for customers.

By Justin Bachman • May 12, 2025 -

Cash App profits disappoint

Block reported just 10% growth in first-quarter gross profit for Cash App, even after it added Afterpay to Cash App debit cards.

By Patrick Cooley • May 12, 2025 -

Expensify predicts brand boom from Brad Pitt F1 film

The travel-and-expense manager is the top sponsor of Pitt’s fictional race team and says it expects a wave of new leads from Apple’s summer drama.

By Justin Bachman • May 9, 2025 -

Opinion

Banks must accelerate ISO 20022 prep

“While larger banks have made considerable progress in preparing for this transition, smaller regional banks and credit unions are largely lagging,” writes one IT executive.

By Robert Turner • May 9, 2025 -

unsplashed.com/Simon Kadula

AvidXchange swallowed in $2B deal

The accounts payable software firm agreed to be taken private in an acquisition by investment company TPG and card processor Corpay.

By Lynne Marek • May 8, 2025 -

Apple faces new payments lawsuit

A basketball training company is suing the tech titan, which it claims unfairly collected money from potentially more than 100,000 app developers.

By Justin Bachman • May 7, 2025 -

The image by Massimo Catarinella is licensed under CC BY-SA 2.0

The image by Massimo Catarinella is licensed under CC BY-SA 2.0

Indiana passes EWA law

The state follows others, including Nevada and Wisconsin, in instituting licensing requirements for earned wage access providers.

By Tatiana Walk-Morris • May 7, 2025 -

Visa pursues stablecoins for cross-border payments

The biggest U.S. card network is setting up partnerships and innovating behind the scenes to develop stablecoins for cross-border uses.

By Lynne Marek • May 6, 2025 -

Zelle service glitch tied to Fiserv resolved

The P2P payments experienced technical troubles Friday as Fiserv cited an "internal issue" that disrupted its service.

By Justin Bachman • Updated May 5, 2025 -

Apple violated app payments injunction, judge rules

The tech giant schemed to limit competition and protect its payment revenues from app developers despite the court’s 2021 order, a federal judge said.

By Justin Bachman • May 2, 2025 -

Green Dot, Crypto.com partner for banking services

Crypto.com has collaborated with other mainstream financial firms like Visa and FIS to offer its digital currency customers more services.

By Tatiana Walk-Morris • May 2, 2025 -

Visa sees economic uncertainty starting to curb travel spending

As consumers brace for the potential impacts of Trump’s tariffs, they’re cutting back on hotel stays and airline travel, Visa executives said.

By Justin Bachman • May 1, 2025 -

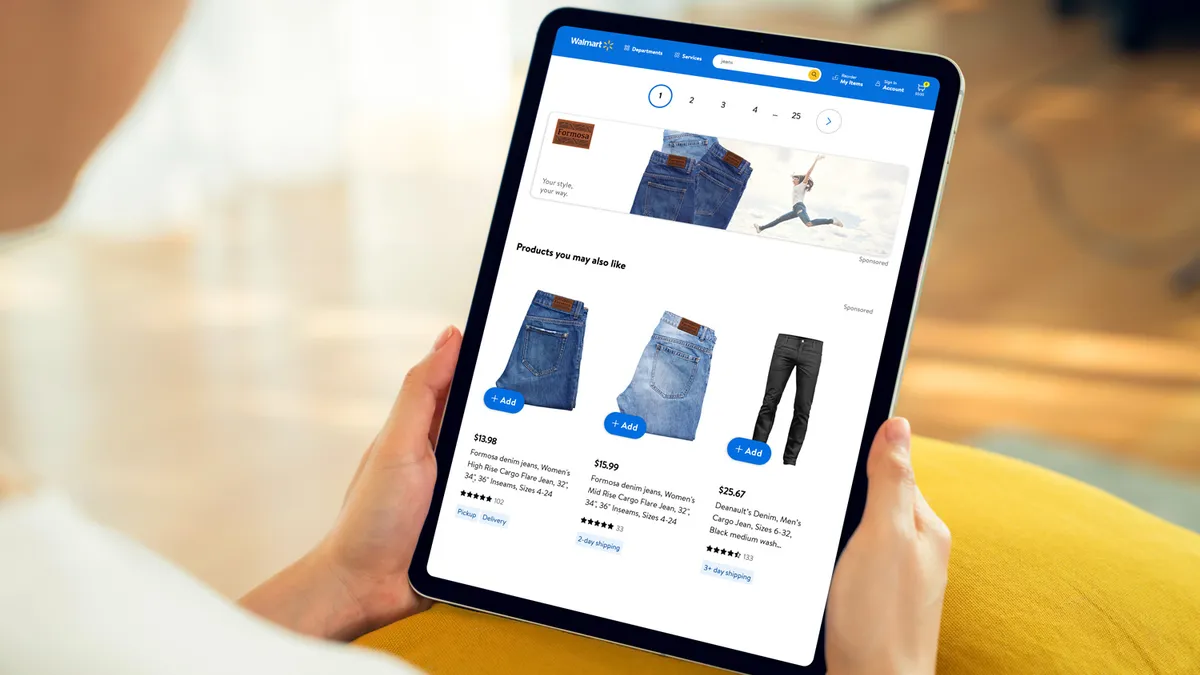

Walmart drives toward instant payments

The mega retailer is eager to use more real-time payments as it speeds up digital services for cost-conscious customers.

By Lynne Marek • May 1, 2025 -

Mastercard invests $300M in Corpay unit

The card network invested in the cross-border business of its corporate payments partner as the companies agreed to expand their partnership.

By Lynne Marek • April 30, 2025 -

Executive Shuffle: JPMorgan, Mastercard and PayZen

Payments and fintech companies are targeting growth, often by harnessing technology, with their recent executive appointments.

By Patrick Cooley • April 30, 2025 -

PayPal targets European branded service growth

The payments pioneer plans to expand its omnichannel payments strategy in Germany and the U.K., its biggest European markets.

By Justin Bachman • Updated May 1, 2025 -

Paze aims to pump up the volume with Fiserv

The digital wallet owned by seven banks has loaded 150 million customer cards onto the system. Now, it’s working with its processor ally to add more banks.

By Lynne Marek • April 29, 2025 -

Toast, Clover fight for restaurant customers

The fledgling fintechs have gobbled up a significant share of the U.S. restaurant point-of-sale market, but they’ll increasingly be battling industry heavyweights.

By Patrick Cooley • April 29, 2025 -

ATM provider Hyosung Americas issues security alert

The cash machine maker called for a software update, with locations in the Northeast and on the West Coast particularly at risk.

By Tatiana Walk-Morris • April 28, 2025 -

Fiserv ventures into high-end restaurants

The payment processing giant’s point-of-sale platform Clover will begin catering to upscale dining establishments next month.

By Patrick Cooley • April 28, 2025 -

Uber expands test with an exotic payment – cash

The company is testing more cities in which drivers will take cash, aiming to attract riders who don’t have credit or debit cards.

By Justin Bachman • April 28, 2025 -

PayPal pays up for talent

The digital payments pioneer delivered sizable pay packages last year after it hired new executives, including one landing $29.4 million in annual compensation.

By Lynne Marek • April 25, 2025 -

Fiserv to acquire Brazilian fintech Money Money

The processor’s purchase will benefit its Clover unit in its effort to provide financing to small businesses, the company said.

By Patrick Cooley • April 24, 2025