Technology: Page 14

-

Payments sector called “indisputable winner”

Providers of payments services generated about a third of the $378 billion in global fintech revenue last year, according to a new report. The sector is poised for more growth with AI innovation.

By Gabrielle Saulsbery • June 6, 2025 -

MoneyGram CEO targets digital remake

Anthony Soohoo is tackling a digital transformation of the legacy cross-border payments company, leaning on experience at Walmart and Apple.

By Lynne Marek • June 4, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Why BNPL appeals to salons

The buy now, pay later option attracts more customers and leads to bigger spending, asserts a payments software executive.

By Patrick Cooley • June 4, 2025 -

CFPB seeks to end open banking case

The Consumer Financial Protection Bureau and its former court foes are now in agreement: an open banking rule shouldn't be considered lawful.

By Lynne Marek • June 2, 2025 -

Conduit, Palla raise cross-border capital

The startups, which both offer cross-border payments, each closed on major capital-raising efforts this week.

By Tatiana Walk-Morris and Lynne Marek • May 30, 2025 -

Q&A

Pushpay targets church payment niche

The company caters to churches and other nonprofits, smoothing the channels to take in donations in various forms, including cryptocurrencies.

By Patrick Cooley • May 30, 2025 -

Maryland passes EWA law

The state’s governor allowed an earned wage access bill to become law, over the objections of some consumer groups, including AARP.

By Lynne Marek • May 29, 2025 -

PayPal’s venture arm taps new leader

The digital payments company has promoted Ian Cox Moya, who rejoined the company in 2022, to head the unit that invests in startups.

By Tatiana Walk-Morris • May 29, 2025 -

Retrieved from Office of the Governor of the State of New York.

Retrieved from Office of the Governor of the State of New York.

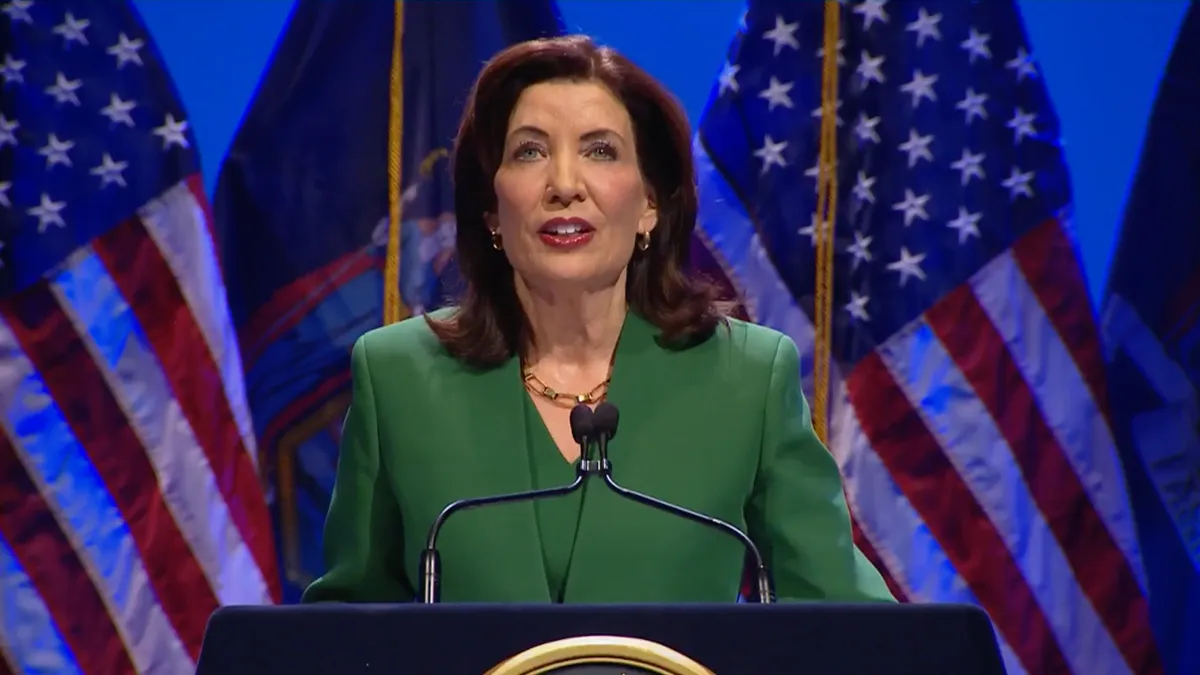

Fintech groups oppose state BNPL rules

Lobbying organizations argue that New York's rules treat buy now, pay later purchases too much like credit card transactions.

By Patrick Cooley • May 28, 2025 -

Global Payments to sell payroll unit for $1.1B

The payments processor agreed to sell the division to software company Acrisure as it focuses on selling merchant services.

By Lynne Marek • May 28, 2025 -

Credit card cap amendment stokes opposition

Industry trade groups for financial institutions have united to rail against legislation that could cap credit card interest rates.

By Lynne Marek • May 28, 2025 -

Executive Shuffle: Fiserv, Temenos, Medius

Recent executive appointments demonstrate the importance software and financial services firms are placing on product strategy.

By Justin Bachman • May 27, 2025 -

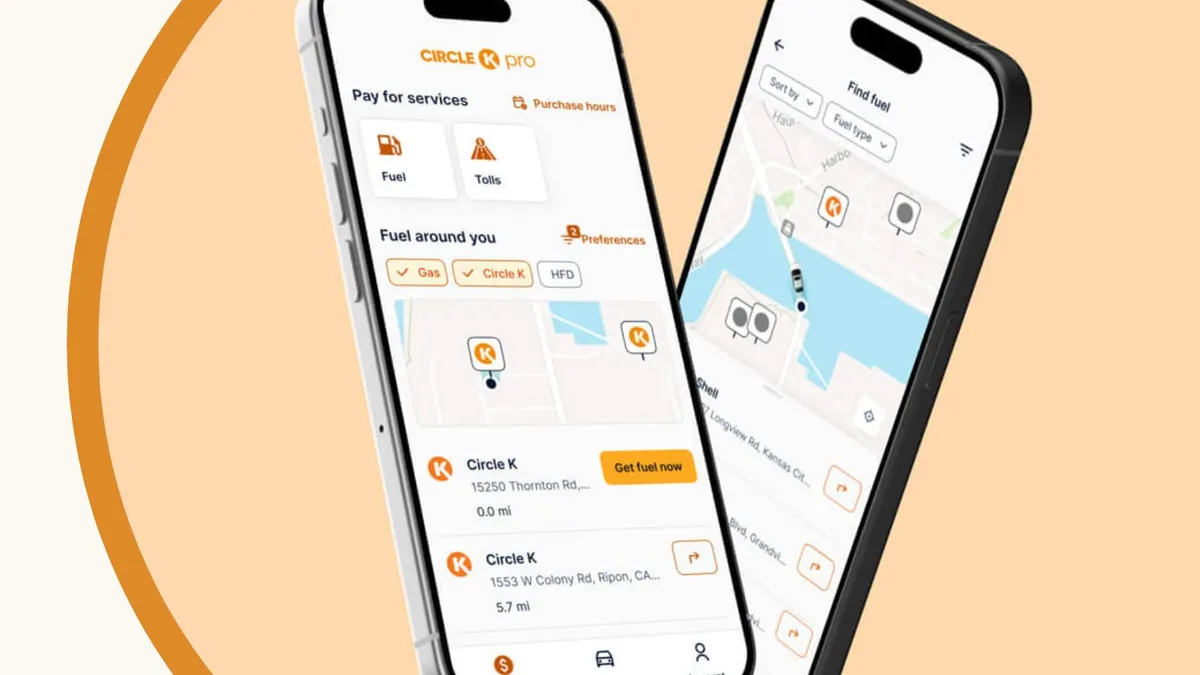

Retrieved from Circle K.

Retrieved from Circle K.

Circle K launches fleet payment mobile app

The program, developed alongside Car IQ, is designed to help drivers avoid credit card skimmers at the pump.

By Brett Dworski • May 22, 2025 -

Klarna touts merchant growth

The buy now, pay later provider surpassed 100 million users globally this year, but also reported widening consumer credit losses for the first quarter.

By Tatiana Walk-Morris and Lynne Marek • May 20, 2025 -

Q&A

Paymentus keeps the lights on

Utilities and auto loans may not be exciting, but nondiscretionary payments is a profitable business largely unaffected by downturns, CEO Dushyant Sharma says.

By Justin Bachman • May 20, 2025 -

Hack could cost Coinbase up to $400M

The crypto exchange is offering a $20 million reward for information leading to the hackers’ arrest. Coinbase terminated customer support agents who leaked customer data.

By Gabrielle Saulsbery • May 19, 2025 -

Why Mastercard invested in Corpay

The $300 million infusion in a cross-border partner creates a complementary tie, the network’s CFO said. It also comes as headwinds rise on that front.

By Lynne Marek • May 19, 2025 -

Amex offers virtual card to small businesses

The company has long provided the service to corporate clients, but this month started letting small business owners pay suppliers who accept Amex without a physical card.

By Patrick Cooley • May 19, 2025 -

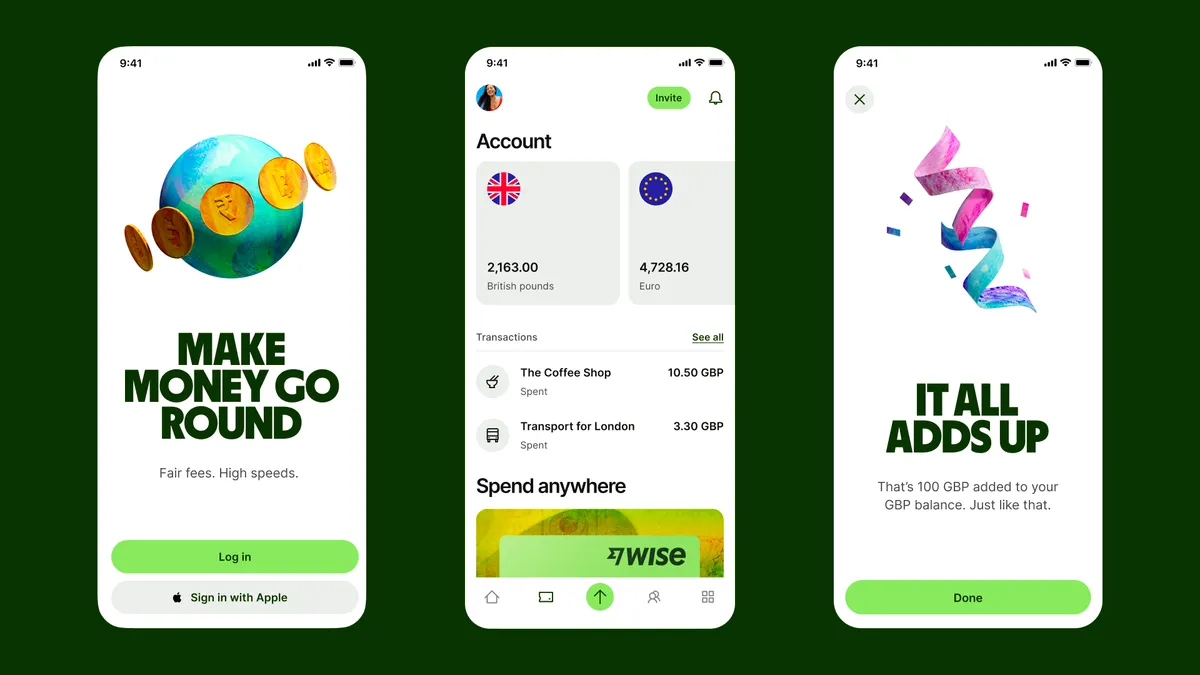

CFPB slashes Wise penalty

The U.S. unit of fintech Wise must pay the bureau $45,000 and roughly $450,000 in redress to affected customers – a far cry from the $2.5 million penalty issued in January.

By Rajashree Chakravarty • May 18, 2025 -

Toast targets entertainment venues

The digital processor signed a Dallas-based chain of driving ranges as a customer in the first quarter, and has made a push to add movie theaters, bowling alleys and arcades.

By Patrick Cooley • May 16, 2025 -

Banks struggle to talk about fraud

Financial institutions battling an increase in fraud, particularly push-payment scams, have been stymied in sharing information that might help them better protect customers.

By Lynne Marek • May 15, 2025 -

Businesses grapple with payments fraud

Companies are struggling to keep up with fraudsters’ growing technological prowess, particularly in business email compromises.

By David McCann • May 14, 2025 -

Q&A

JPMorgan Chase taps payments tech head

The bank’s payments arm named Sri Shivananda to head up its technology operations this year. Now, he’s overseeing decisions on stablecoins, real-time transactions and other advances.

By Lynne Marek • May 14, 2025 -

BNPL users struggle with payments

Nearly half of U.S. adults who have used buy now, pay later services experienced financial difficulties, such as overspending or missing a bill payment, according to a recent survey.

By Patrick Cooley • May 13, 2025 -

Google drops lawsuit against CFPB

The tech giant ended its court battle as the federal agency halted supervision of the company’s payments arm.

By Justin Bachman • May 13, 2025