Technology: Page 13

-

Stablecoins may push aside payments

Digital assets have the power to “disintermediate” the financial system by bypassing traditional payment rails, according to a Deloitte report.

By Patrick Cooley • June 25, 2025 -

Klarna, Google join forces

The Swedish buy now, pay later business integrated its payments tool into the search giant’s digital wallet, making its services more widely available.

By Patrick Cooley • June 24, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Fiserv launches new stablecoin

The payments processor wants to be an early mover as banks, the U.S. government and other payments players press for stablecoin adoption.

By Justin Bachman • June 23, 2025 -

Tensec raises $12M to boost growth

Meanwhile, other cross-border payment firms have raised millions in recent weeks to bolster their international expansion.

By Tatiana Walk-Morris • June 20, 2025 -

Opinion

Don’t make Americans pay to pass financial data

“Pausing or gutting Rule 1033 wouldn’t just stall innovation,” writes one industry executive who has international perspective. “It would send a message that the system works best when it’s closed.”

By Jamie Twiss • June 20, 2025 -

Ramp raises $200M

The maker of software to oversee corporate spending and procurement is now valued at $16 billion with its latest capital raise.

By Justin Bachman • June 17, 2025 -

Cantaloupe scooped up for $848M

The self-checkout kiosk company was purchased by 365 Retail Markets, a firm focused on self-service technology and backed by private equity firm Providence Equity Partners.

By Lynne Marek • June 17, 2025 -

Column

Credit card bill crusade persists

Sens. Dick Durbin and Roger Marshall may have lost their latest bid to win a congressional vote on the Credit Card Competition Act, via stablecoin legislation, but proponents are undeterred.

By Lynne Marek • June 16, 2025 -

CFPB, consumer groups clash over BNPL

The battle over buy now, pay later — whether it’s helpful or hurtful to users — persists even after the Consumer Financial Protection Bureau last month withdrew its rule regulating such services.

By Patrick Cooley • June 16, 2025 -

Deep Dive

Open banking to survive Trump, fintechs say

Consumers and financial services firms will pursue their mutual interests in sharing personal data, despite a move by the Consumer Financial Protection Bureau to extinguish the trend, industry experts contend.

By Justin Bachman • June 16, 2025 -

NY legislature backs bill to protect cash

The state’s two chambers voted in favor of a bill that requires New York retailers to accept cash, following a trend set by other states and cities.

By Lynne Marek • June 13, 2025 -

Tapcheck embeds EWA in payroll

Recent integrations with HR management platforms position the Texas earned wage access startup for growth.

By Justin Bachman • June 13, 2025 -

Adyen opts for build over buy

The Dutch payments processor eschews acquisitions in favor of building its own systems to drive growth, including in the U.S. market.

By Lynne Marek • June 12, 2025 -

Payoneer CFO sees stablecoin hurdles

The “last mile” infrastructure for stablecoin payment rails carries some challenges for the industry to resolve, Payoneer’s Bea Ordonez says.

By Grace Noto • June 12, 2025 -

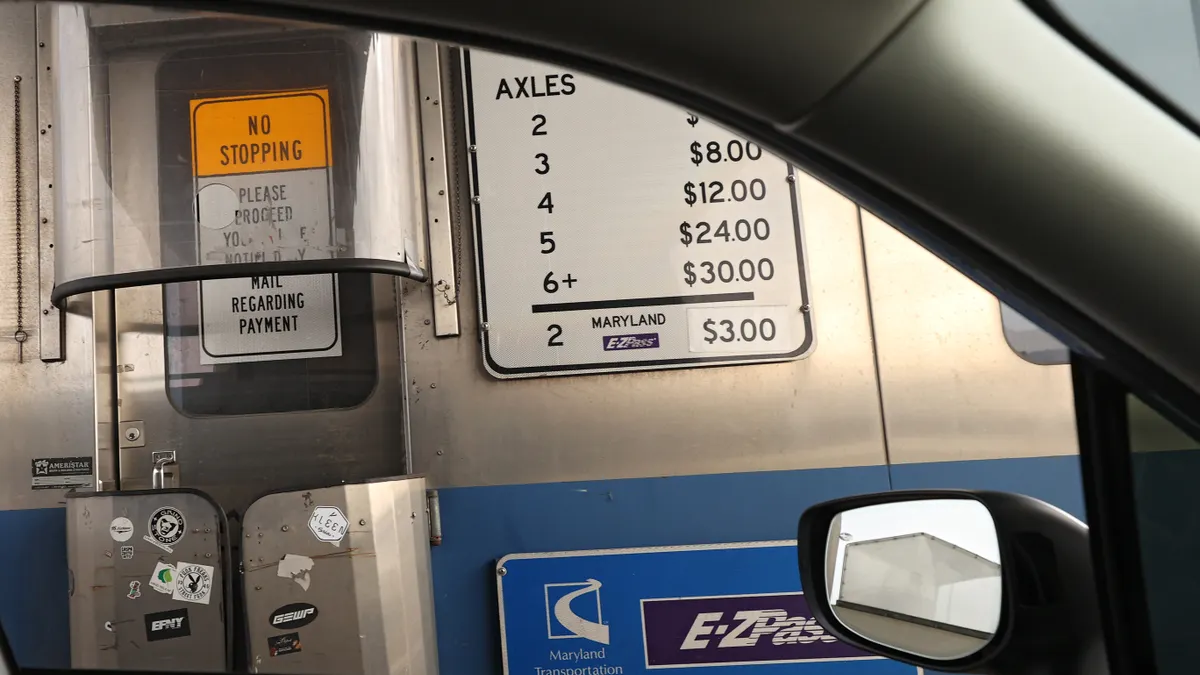

Drivers seek digital payment options

Digital payments are on the rise, but toll road payments are lagging behind.

By Tatiana Walk-Morris • June 12, 2025 -

Visa, Mastercard race to agentic AI commerce

The top U.S. card networks are speeding to develop payments services that will enable bot-based buying, with digital rival PayPal also making a play.

By Lynne Marek • June 11, 2025 -

Affirm boasts 2 million debit cards

The number of such cards the buy now, pay later provider has now made available is an increase of about 600,000 cards since January.

By Patrick Cooley • June 11, 2025 -

Sezzle sues Shopify in BNPL battle

The buy now, pay later provider says Shopify violated antitrust laws when it sought to dominate BNPL transactions on its merchants’ platform.

By Justin Bachman • June 11, 2025 -

Q&A

FTA CEO says open banking central to fintechs’ work

The leader of the Financial Technology Association sees a federal court battle over the Consumer Financial Protection Bureau rule as critical to innovation.

By Justin Bachman • June 10, 2025 -

Opinion

GENIUS Act is just the beginning

“The bill tackles the fundamental question that has paralyzed our industry: what exactly is a stablecoin, and who gets to regulate it?” writes one Tulane University professor.

By Ryan Peters • June 10, 2025 -

Fiserv CEO embraces stablecoins

The processor is developing an infrastructure that would let its merchant customers make use of the digital assets, Mike Lyons said.

By Patrick Cooley • June 10, 2025 -

Deep Dive

Checkout-free payments may yet rise

Rapidly advancing artificial intelligence could let cashierless payment companies succeed where Grabango failed, industry insiders and observers say.

By Patrick Cooley • June 9, 2025 -

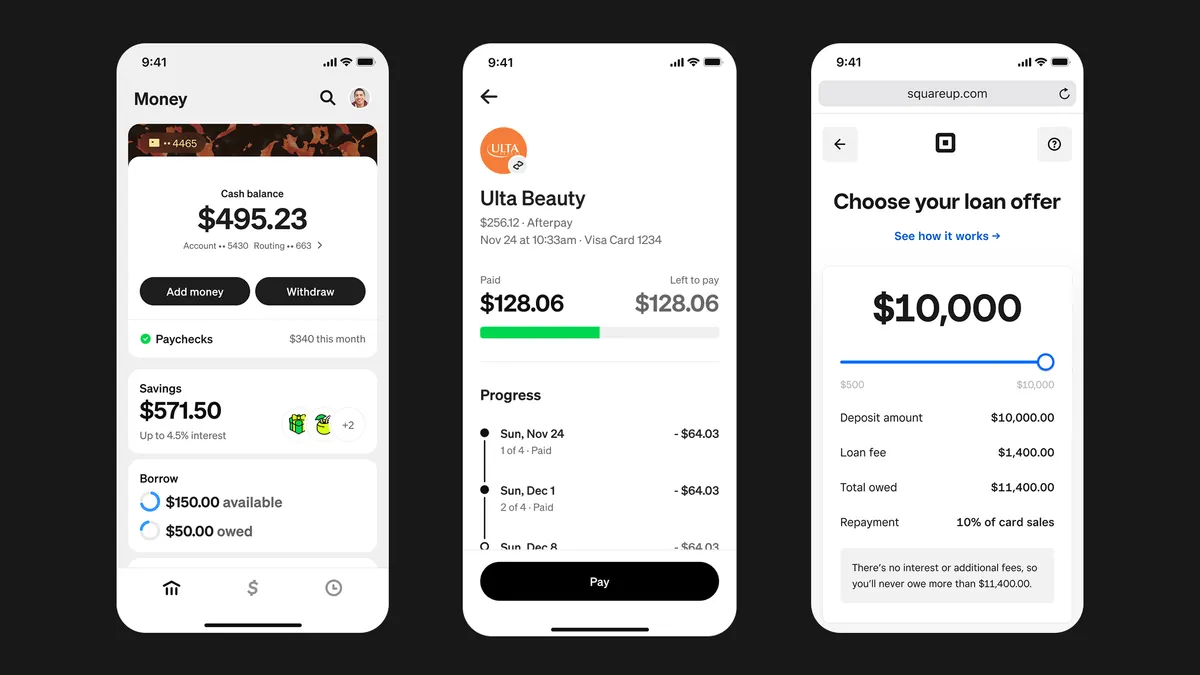

Sponsored by Block, Inc

Block has found the key to unlocking credit for millions of Americans – don’t use credit scores

How near real-time data can build a more inclusive financial system.

By Owen Jennings Head of Business at Block, Inc. • June 9, 2025 -

Opinion

Don’t Turn Back the Clock on earned wage access

The Consumer Financial Protection Bureau “should settle this issue once and for all by issuing an expanded (EWA) advisory opinion,” writes a trade group leader.

By Brian Tate • June 6, 2025 -

Payments sector called “indisputable winner”

Providers of payments services generated about a third of the $378 billion in global fintech revenue last year, according to a new report. The sector is poised for more growth with AI innovation.

By Gabrielle Saulsbery • June 6, 2025