Retail: Page 52

-

Amex, Discover see lasting credit changes

The chief financial officers at American Express and Discover each said this week that pre-pandemic credit metrics for delinquencies and charge-offs won’t soon return.

By Caitlin Mullen • Sept. 15, 2022 -

Visa raises concerns on new gun code

Visa cautioned the public about perceiving a new merchant code for gun-sellers as a means to interfere with any lawful sales. And the NRA said it’s seeking to water down implementation of the new code.

By Lynne Marek • Sept. 14, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

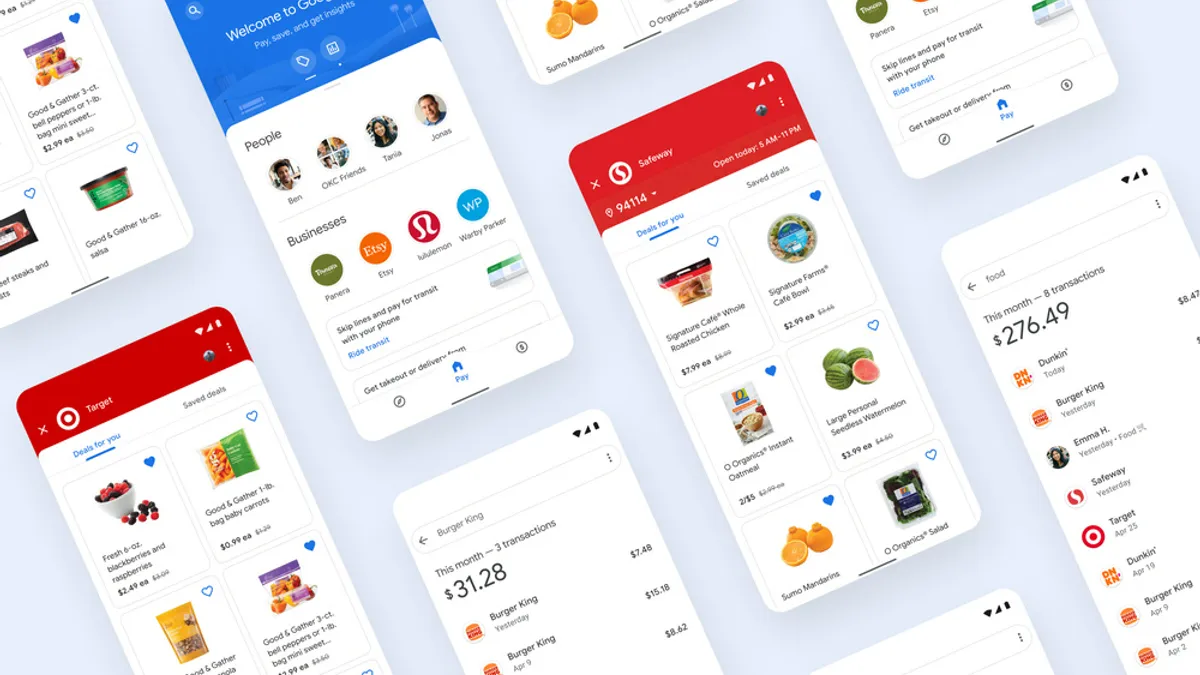

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Fiserv CEO downplays margin pressure

CEO Frank Bisignano said expenses related to “synergy work” have tapered off, with benefits becoming visible in the second half of the year.

By Caitlin Mullen • Sept. 14, 2022 -

Holiday spending to rise 7.1%: Mastercard

The big credit card company forecast an increase in spending by consumers for the yearend U.S. holiday shopping season.

By Tatiana Walk-Morris • Sept. 13, 2022 -

Zelle counters scam talk with growth rates

The instant payments brand is highlighting a double-digit growth rate for its peer-to-peer payments tool and downplaying scams on its system.

By Lynne Marek • Sept. 12, 2022 -

Visa to adopt new coding for gun merchants

Card network juggernaut Visa said it will adhere to a new standard for identifying independent gun shops with a unique merchant code after an international body adopted the new approach last week.

By Caitlin Mullen and Lynne Marek • Sept. 12, 2022 -

Bolt drops Wyre purchase

The checkout startup had planned to purchase the cryptocurrency payments firm for $1.5 billion. That was before the collapse of crypto values recently.

By Caitlin Mullen • Sept. 12, 2022 -

JPMorgan buys payments firm Renovite

The biggest U.S. bank is buying the payments company as competition in the checkout and card processing ecosystem mounts.

By Lynne Marek • Sept. 12, 2022 -

Gun merchant code approved for card purchases

An international standards body approved a new merchant code that will apply to gun sellers for transactions using credit card networks like Visa and Mastercard.

By Caitlin Mullen • Updated Sept. 9, 2022 -

Google invests in new cohort of Black entrepreneurs

The tech behemoth invested another $5 million in Black entrepreneurs, including some that have founded firms in the payments arena.

By Tatiana Walk-Morris • Sept. 9, 2022 -

Mesh Payments raises $60M

The payments company hopes to gain more business-to-business payments market share as the demand for expense management services rises.

By Tatiana Walk-Morris • Sept. 8, 2022 -

Lawmakers push card companies to back gun-merchant code

Democratic Congress members, in letters to the CEOs of Visa, Mastercard and American Express, pressed the companies to support creating a merchant code for gun sellers.

By Caitlin Mullen • Sept. 7, 2022 -

Retrieved from Flickr/frankieleon.

Retrieved from Flickr/frankieleon. Opinion

OpinionConsumers need credit card reform

“It's not just merchants at the mercy of the oligopoly,” writes Ed Mierzwinski, a senior director at the Public Interest Research Group. “Consumers all pay more at the store and more at the pump.”

By Ed Mierzwinski • Sept. 2, 2022 -

Go slow on a CBDC, Nacha says

The biggest payment system in the U.S. recommends limited implementation of a central bank digital currency if the Federal Reserve pursues that digital dollar.

By Lynne Marek • Sept. 2, 2022 -

Credit card interest rates reach record

With the Federal Reserve pushing up interest rates to calm inflation, the average credit card interest rate is climbing, too, reaching a two-decade-plus record in August.

By Lynne Marek • Sept. 2, 2022 -

Fiserv buys LR2 Group

The global payments processor said it paid $26 million to acquire the independent sales organization, which had been a long-time partner.

By Caitlin Mullen • Sept. 1, 2022 -

Who’s afraid of FedNow? Not Visa

Visa's CFO on Wednesday brushed off any concerns about the threat of new competition from FedNow, or any other real-time payments system.

By Lynne Marek • Sept. 1, 2022 -

U.S. adults using mostly cash drops sharply

Affluence and age significantly affect whether people choose to use cash for purchases, according to the latest Gallup poll on cash use in the U.S.

By Debbie Carlson • Aug. 31, 2022 -

Card companies urged to code gun sellers

Calls from government officials urging Visa, Mastercard and American Express to support creating a merchant code for gun sellers are growing louder.

By Caitlin Mullen • Aug. 31, 2022 -

Digital wallets dig in

Continued adoption of digital wallets is likely to depend on the services that providers add, said Charlotte Principato, a financial services analyst for polling firm Morning Consult.

By Caitlin Mullen • Aug. 30, 2022 -

Affirm scans landscape for acquisitions

With plenty of cash on hand, Affirm CEO Max Levchin considers acquisitions as one of many routes for the buy now-pay later company to continue its growth.

By Lynne Marek • Aug. 26, 2022 -

Payoneer battles e-commerce slowdown

Payoneer is counting on global growth and new services to offset what CFO Michael Levine called e-commerce “softness.”

By Caitlin Mullen • Aug. 26, 2022 -

Big payments companies poke at CBDC

Mastercard, PayPal, Fiserv and Stripe gave the Federal Reserve feedback on a central bank digital currency, pointing out key requirements and cautioning about the outcome.

By Lynne Marek • Aug. 25, 2022 -

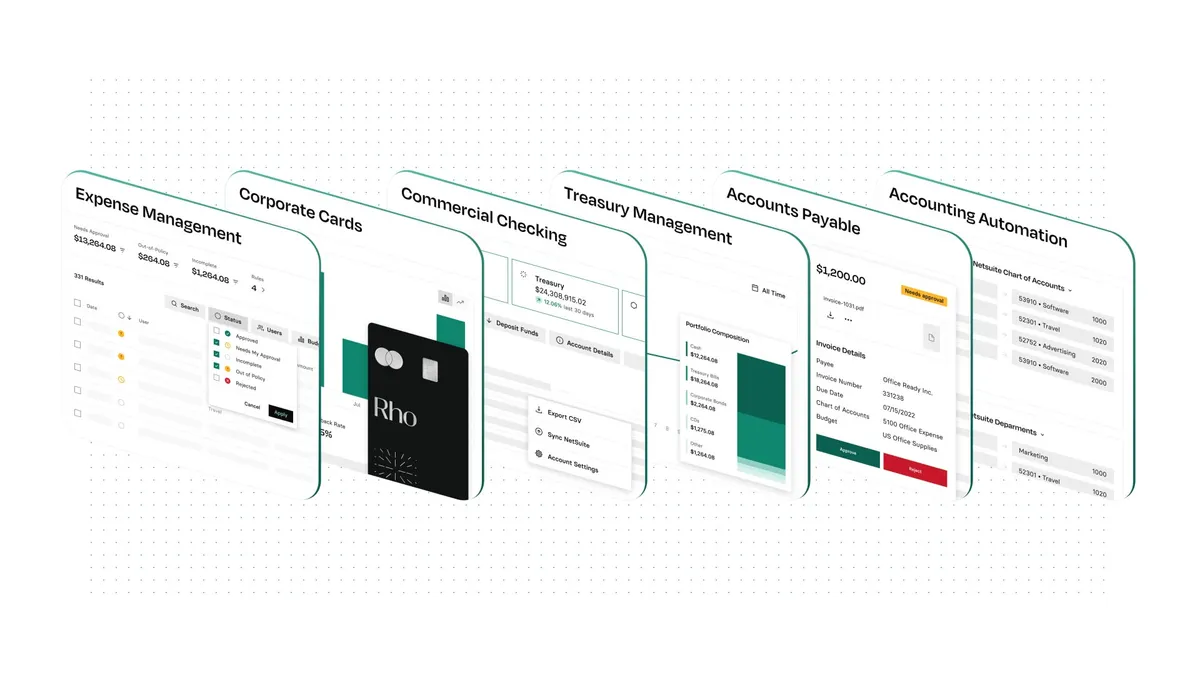

Rho woos clients in bid to fill Brex’s small-biz void

The business banking startup added an automated expense-management tool for its middle-market clients as the company angles to snatch its share of Brex's former clients.

By Suman Bhattacharyya • Aug. 25, 2022 -

Retrieved from Google on April 30, 2021

Retrieved from Google on April 30, 2021

Google Wallet seeps into six more countries

The tech giant extended its payment services to more nations as competition with Samsung Pay and Apple Pay intensifies.

By Tatiana Walk-Morris • Aug. 25, 2022