Retail: Page 51

-

Fed majority votes to finalize debit rule

In a 6-1 vote, the Federal Reserve finalized a debit card processing rule that underscores a requirement that multiple card networks be available for routing transactions, including online.

By Lynne Marek • Oct. 4, 2022 -

Fiserv adds data service for large merchants

The payments processor’s new Carat point-of-sale offering aims to help big businesses optimize transaction data.

By Caitlin Mullen • Oct. 4, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Durbin maps path for card bill

Sen. Dick Durbin and his Republican ally, Sen. Roger Marshall, seek to attach their credit card competition legislation to a defense spending bill.

By Lynne Marek • Oct. 3, 2022 -

Grocery, restaurant spending climbs: Mastercard

“Consumers are shifting their spending in the face of higher prices and a reinvigorated appreciation for experiences,” Mastercard said in a new report.

By Tatiana Walk-Morris • Oct. 3, 2022 -

Fintechs gain ground in merchant acquiring

New businesses are far more likely to opt for integrated software vendors over legacy providers, McKinsey discovered.

By Caitlin Mullen • Oct. 3, 2022 -

Affirm targets offline growth

The buy now-pay later provider’s chief financial officer said this week its Debit+ card is a key part of Affirm’s strategy to push further into brick-and-mortar sales.

By Caitlin Mullen • Sept. 30, 2022 -

Retrieved from Star Concessions website.

Retrieved from Star Concessions website.

Convenience store turns to Just Walk Out tech

Grab & Fly is the latest airport convenience store to use Amazon’s Just Walk Out technology, following a Hudson Nonstop store at Chicago Midway International Airport that debuted last summer.

By Brett Dworski • Sept. 30, 2022 -

Q&A

CEOs Sound Off: Forecasting holiday payment trends

CEOs of payments-related companies shared their thoughts on what consumers and merchants want when it comes to checkout and payments this holiday season.

By Caitlin Mullen • Sept. 29, 2022 -

Consumers tap BNPL for larger purchases

Marqeta's report, which showed U.S. buy now-pay later use has climbed since last year, also points to consumers acquiring more credit cards.

By Tatiana Walk-Morris • Sept. 29, 2022 -

BNPL firms encounter growing pains

As buy now-pay later providers face a shifting economic environment and regulatory scrutiny, they’re likely pursuing transformation, a Guidehouse consultant said.

By Caitlin Mullen • Sept. 28, 2022 -

Shopify adds mobile POS hardware

Pushing further into brick-and-mortar shopping, the commerce company faces competition from other point-of-sale providers as the volume of POS transactions is expected to rise.

By Tatiana Walk-Morris • Sept. 27, 2022 -

Deep Dive

Will biometrics be the future of payments?

The use of biometrics to authenticate payments is poised to bring more security and speed to transactions, but some say broad adoption on the part of consumers and merchants is still far from reach.

By Caitlin Mullen • Sept. 26, 2022 -

Klarna seeks to shed more workers

In acknowledging the pursuit of further downsizing, a Klarna spokesperson cited changes being made by company executive Camilla Giesecke assuming COO duties.

By Caitlin Mullen • Sept. 22, 2022 -

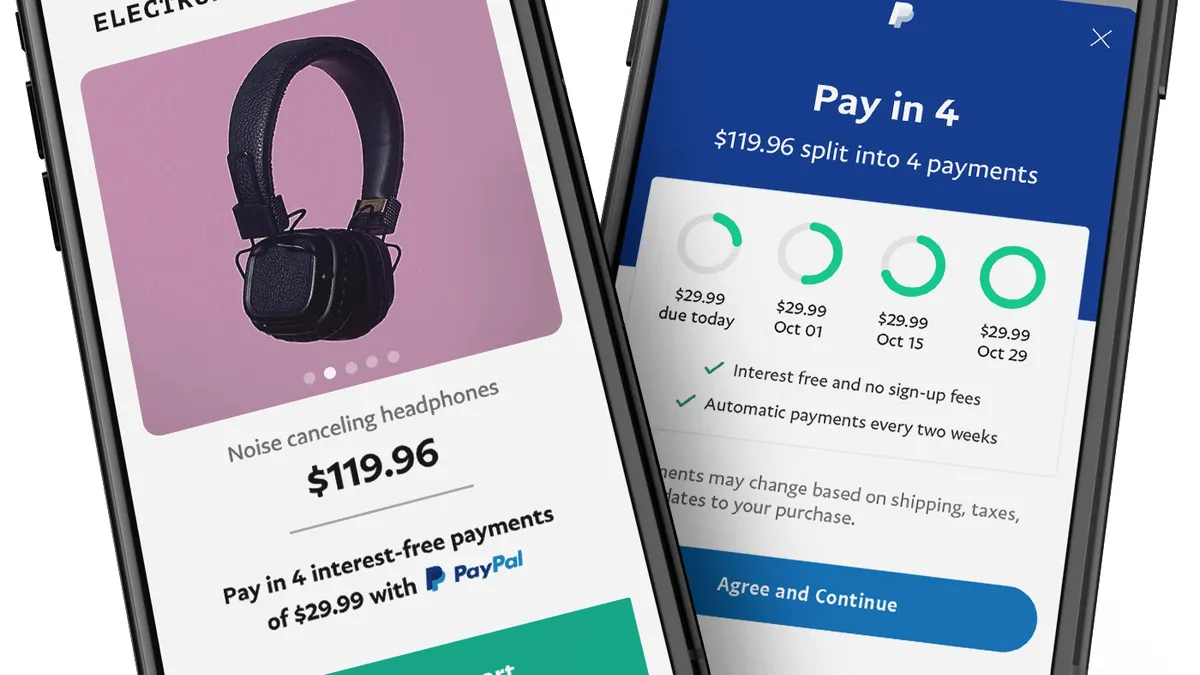

PayPal defends BNPL position

The payments firm is just as popular with younger shoppers as its buy now-pay later rivals, a PayPal executive said last week.

By Caitlin Mullen • Sept. 22, 2022 -

Republicans grill bank CEOs on merchant gun code

GOP lawmakers, during a wide-ranging hearing Wednesday, demanded the CEOs of the nation’s top banks share how they plan to respond to a new category code for gun and ammunition retailers.

By Anna Hrushka • Sept. 22, 2022 -

Opinion

QR code resurges for payments

“Businesses that have consigned QR technology to the tech graveyard would be wise to give it another look,” writes Mike Storiale, Synchrony’s VP of innovation development.

By Mike Storiale • Sept. 22, 2022 -

Extra costs biggest reason shoppers ditch online carts

With cart abandonment costing online retailers up to $136 billion annually, Coresight Research’s findings suggest they might want to focus on total purchase price more closely matching shopper expectations.

By Caitlin Mullen • Sept. 21, 2022 -

Visa eyes B2B, remittances for growth

Visa is eyeing certain portions of the B2B market for near-term growth, the company’s chief financial officer said during a conference last week. It’s also building out its network for remittances.

By Lynne Marek • Sept. 21, 2022 -

Profits slip for small businesses: survey

Three in 4 small business leaders are feeling squeezed by inflationary pressures, American Express discovered, and more than half expect don’t expect inflation to subside until summer 2023.

By Tatiana Walk-Morris • Sept. 21, 2022 -

House lawmakers add credit card competition bill

Members of Congress on Monday introduced the House companion to a Senate bill seeking to rein in the Visa-Mastercard credit network “duopoly.”

By Caitlin Mullen • Sept. 20, 2022 -

Instacart rolls out in-store tech enhancements

Frictionless checkout and a more efficient shopping journey are core focuses under the new services, which include a scan-and-pay mobile checkout program.

By Jeff Wells • Sept. 19, 2022 -

Square adds services in Spanish

The Block-owned merchant platform debuted its Spanish-language tools in an effort to serve a bigger share of Hispanic-owned businesses in the U.S.

By Tatiana Walk-Morris • Sept. 19, 2022 -

New PayPal CFO takes medical leave

PayPal SVP of Capital Markets Gabrielle Rabinovitch will step in for her second round as interim CFO as Blake Jorgensen departs for medical leave.

By Grace Noto • Sept. 16, 2022 -

BNPL players spar with CFPB

BNPL players under the microscope at the Consumer Financial Protection Bureau pushed back against the federal agency’s plan to increase regulation of the industry.

By Lynne Marek • Sept. 16, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB mulls rules for BNPL

The Consumer Financial Protection Bureau is weighing new rules and guidance for the fast-growing buy now-pay later industry after wrapping up a comprehensive report on it.

By Lynne Marek • Sept. 15, 2022