Retail: Page 50

-

CFPB seeks to jettison ‘junk data’ in credit reports

Companies must have policies and procedures to detect and remove inconsistencies and “obvious impossibilities” in credit data, the CFPB said.

By Anna Hrushka • Oct. 24, 2022 -

Opinion

BNPL for business is a high stakes proposition

“As BNPL providers, especially in the business realm where more money is being spent, fintechs are going to need much more sophisticated, secure, reliable authentication methods,” writes Flexbase CEO Zaid Rahman.

By Zaid Rahman • Oct. 24, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Ammo to launch its own online payments processing

The Scottsdale, Arizona company said that bringing the payments aspect of transactions in-house, as opposed to using third parties, will allow it to reduce costs.

By Jonathan Berr • Oct. 21, 2022 -

Earnings preview: Payments companies confront 3Q challenges

Macroeconomic headwinds, consumer health and cost management are set to be topics of conversation during payments companies' quarterly earnings calls.

By Caitlin Mullen • Oct. 20, 2022 -

Advanced checkout tech surges at c-stores

From self-checkout machines to checkout-free stores, the options for processing payments are expanding at retail venues. Here’s how retailers find the best fit.

By Jessica Loder • Oct. 19, 2022 -

CFPB sues Global Payments unit

The Consumer Financial Protection Bureau sued Active Network, a unit of Global Payments, saying the company used “dark patterns” to unlawfully extract $300 million from consumers.

By Lynne Marek • Oct. 19, 2022 -

Analysts on lookout for Fiserv job cut costs

With the company set to report third-quarter results next week, ongoing employee cuts have put severance expense under the microscope.

By Caitlin Mullen • Oct. 18, 2022 -

PayPal launches cash-back rewards program

The digital payments pioneer is trying to rope in customers with rewards via a new loyalty program, just in time for the holiday shopping season.

By Tatiana Walk-Morris • Oct. 18, 2022 -

PayPal brings Zettle terminal to US

After launching the new terminal in Europe last year, PayPal is offering the point-of-sale equipment now for small businesses in the U.S.

By Tatiana Walk-Morris • Oct. 17, 2022 -

Visa seeks to draw creators in

The card behemoth is partnering with other fintechs in an effort to sell creators embedded payment and financial tools.

By Lynne Marek • Oct. 14, 2022 -

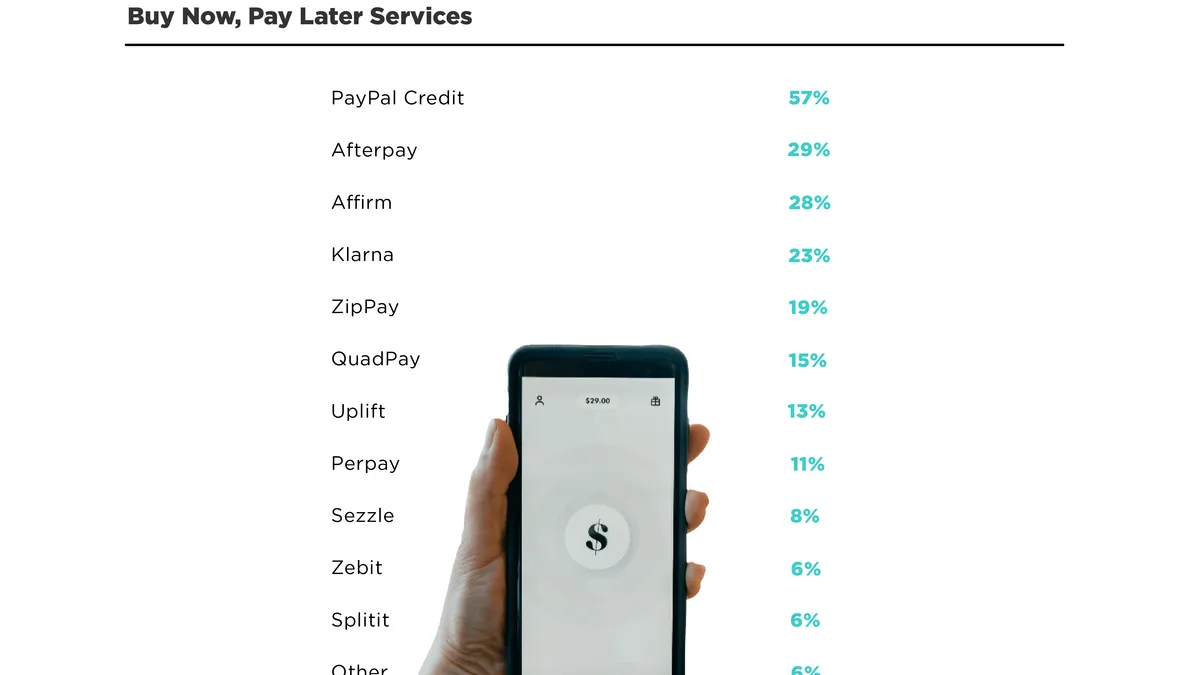

Affirm gains, Klarna slips in Q3

As buy now-pay later providers vie for holiday shoppers, Affirm's third-quarter market share increase showed it's gaining as Klarna's growth stalled.

By Caitlin Mullen • Oct. 14, 2022 -

Nearly half of Gen Z, millennials to tap BNPL for holiday shopping

That buy now-pay later outlook emerged from a new Bluedot survey that also showed 43% of consumers are likely to open a new store credit card during the yearend shopping period.

By Tatiana Walk-Morris • Oct. 12, 2022 -

Hollister app lets teens shop, parents pay

The Abercrombie & Fitch Co. brand released the Share2Pay function based on company data about customer pain points.

By Dani James • Oct. 11, 2022 -

Payments deals gain momentum

Four billion-dollar payments acquisitions this year reflect industry dynamics that will drive more buyouts in coming months, analysts say.

By Lynne Marek • Oct. 11, 2022 -

Fiserv cuts deeper into workforce

Payment processing giant Fiserv pared more employees in recent weeks as the company seeks to boost profit margin growth amid economic turmoil.

By Caitlin Mullen • Oct. 11, 2022 -

Retrieved from Standard AI press release.

Retrieved from Standard AI press release.

Standard AI’s taps cameras with checkout-free tech

The checkout-free company is looking to help its convenience store customers make more informed decisions on how to run their operations, CEO Jordan Fisher said.

By Brett Dworski • Oct. 7, 2022 -

Big-name BNPL providers remain scarce in stores: report

As spending shifts back to stores, retailers are side-stepping big-name buy now-pay later providers, such as Affirm and Afterpay, in favor of offering their own in-store options, a recent survey revealed.

By Caitlin Mullen • Oct. 7, 2022 -

EMVCo rolls out new payment standard

The international standard-setting organization finalized a new specification for contactless and mobile payments, but adoption of the new approach by merchants may be slow-going.

By Lynne Marek • Oct. 6, 2022 -

Visa flags rising in-person fraud

The card behemoth said it’s observing an increase in in-person fraud now that U.S. consumers are returning to their pre-pandemic shopping habits.

By Lynne Marek • Oct. 6, 2022 -

Retrieved from Hudson press release.

Retrieved from Hudson press release.

Checkout-free technology spreads at airports

New frictionless convenience stores are coming to airports in Los Angeles and Dallas, continuing a trend that has gained steam since last summer.

By Brett Dworski • Oct. 6, 2022 -

PayPal acting CFO’s pay package hints at staying power

The $2.5 million in equity grants PayPal is handing its interim chief financial officer are part of the kind of package typically given to long-term CFOs, executive search experts said.

By Maura Webber Sadovi • Oct. 5, 2022 -

Consumers prefer cashback rewards: Bank of America

Consumers base credit card choices mainly on incentives offered, with a preference for cash back over points, a Bank of America survey found.

By Tatiana Walk-Morris • Oct. 5, 2022 -

Afterpay adds monthly BNPL option

The Block-owned buy now-pay later provider is growing beyond its “pay in 4” plans by adding a financing option for pricier purchases.

By Caitlin Mullen • Oct. 5, 2022 -

FTC issues warning on BNPL claims

As buy now-pay later popularity has mushroomed, the companies offering the financing have attracted the attention of another regulator.

By Caitlin Mullen • Oct. 5, 2022 -

Legislation needed to fill crypto oversight gaps, FSOC says

The federal panel said more oversight of stablecoins and crypto spot markets for tokens is needed. It also recommended rules that would help prevent regulatory arbitrage in the sector.

By Anna Hrushka • Oct. 4, 2022