Retail: Page 49

-

Toast surpasses $100B in annualized payments

The payments company that caters to restaurants reached that quarterly record after significant expansion this year.

By Jonathan Berr • Nov. 15, 2022 -

Fortis acquires Payment Logistics

The founder of Payment Logistics will remain at the firm overseeing its employees in California.

By Tatiana Walk-Morris • Nov. 15, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Musk pushes Twitter toward payments

“Give them some amount of money, like ten bucks or something, that they can send anywhere in the system,” said Twitter’s new owner, Elon Musk. “We need money transfer licenses for that, which we’ve applied for.”

By Anna Hrushka • Nov. 11, 2022 -

Green Dot CEO taps new team

The payment services company’s recently appointed CEO brought on his own team this week, naming a new CFO, COO and chief revenue officer.

By Lynne Marek • Nov. 11, 2022 -

Opinion

Preparing for the CBDC era

Central bank digital currencies would allow for faster cross-border payments that would “help boost trade within the region and with the rest of the world,” an Equinix executive writes.

By Lance Homer • Nov. 9, 2022 -

Affirm curbs hiring amid economic uncertainty

The buy now-pay later company is pulling back on adding talent in some areas, but plunging ahead in others and seeking out talent in lower-cost regions.

By Jonathan Berr • Nov. 9, 2022 -

FIS targets $500M in cost cuts

The digital payments company is aiming to cut costs by streamlining operations, reducing capital expenditures and pulling back on vendor contracts.

By Jonathan Berr • Nov. 9, 2022 -

Tracker

How active shooters pay for guns

Payment methods used by active shooters to acquire guns are becoming part of the U.S. dialogue about such incidents. A Payments Dive series tracking those details seeks to inform the discussion.

By Payments Dive staff • Updated Dec. 13, 2022 -

Block pledges to curb spending

The digital payments company plans to slow the pace of hiring in 2023 as executives aim to rein in expenses.

By Caitlin Mullen • Nov. 4, 2022 -

PayPal girds for slowdown, leans on Apple, Amazon

The digital payment pioneer is counting on its ties to Apple and Amazon as it prepares for an economic slowdown already showing up in e-commerce.

By Lynne Marek • Nov. 4, 2022 -

Musk aims Twitter at payments

Twitter’s new billionaire owner plans to make the company into a payments player, but industry pros say social media platforms aren’t cut out for that game.

By Lynne Marek • Nov. 3, 2022 -

Stripe chops workforce for ‘leaner times’

The payments company will cut about 1,140 jobs as it reins in expenses in the face of deteriorating economic conditions after growing too fast.

By Lynne Marek • Nov. 3, 2022 -

Amazon offers merchants cash advances

Sellers on the company’s online marketplace can access from $500 to $10 million in cash advances, with repayment based on a fixed percentage of their gross merchandise sales.

By Tatiana Walk-Morris • Nov. 2, 2022 -

MoneyGram dives deeper into crypto

The money transfer company said it’s adding a new crypto feature to its mobile app, expanding on an attempt to appeal to a younger client set.

By Tatiana Walk-Morris • Nov. 2, 2022 -

6 payments takeaways from big consulting firms

Recent reports from Ernst & Young, Forrester Research and McKinsey examined forces at play in the payments industry, from “swipe” fee frustration to open banking and cross-border payments trends.

By Caitlin Mullen , Lynne Marek , Jonathan Berr • Nov. 2, 2022 -

Honeywell jumps into mobile payments battle

The tech conglomerate will couple new payments software with its mobile computers to process transactions anywhere, taking on a pack of rivals already in the market.

By Lynne Marek • Nov. 1, 2022 -

Deluxe aims to add crypto

The company better known for paper checks is preparing for increased consumer use of digital assets, with plans to add options for accepting crypto next year.

By Lynne Marek • Oct. 31, 2022 -

Mastercard profit rises on consumer spending

The company also credited cross-border travel, digital-first deals with banks and co-branding alliances for its performance during the quarter.

By Jonathan Berr • Oct. 28, 2022 -

Shoppers turn to installment payments for holidays: report

Shoppers aim to stretch their budgets by trying installment payment plans and seeking discounts from retailers, according to a new report.

By Tatiana Walk Morris • Oct. 27, 2022 -

Fiserv sheds Korea unit, plans move to Milwaukee

After selling off three business units and taking other actions to “tighten spending” in the third quarter, Fiserv CFO Bob Hau expects cost improvement for the fourth quarter.

By Caitlin Mullen • Updated Oct. 28, 2022 -

Visa eyes 2023 growth, sidesteps threats for now

“Should there be a recession, or a geopolitical shock that impacts our business...we will, of course, adjust our spending plans,” Visa’s CFO said.

By Lynne Marek • Oct. 27, 2022 -

Ukraine raises fraud concerns, Stripe exec says

The war in Ukraine raised the stakes for payment fraud detection, as bad actors devise more complex ways of evading oversight.

By Suman Bhattacharyya • Oct. 26, 2022 -

Synchrony delivers mixed results

While the financial services company’s third-quarter income rose over the year-earlier period, net earnings sagged. Synchrony also increased credit loss provisions.

By Jonathan Berr • Oct. 26, 2022 -

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Discover tightens underwriting

Count the card company among those that added to credit loss provisions in the third quarter as economic conditions soured.

By Caitlin Mullen • Oct. 26, 2022 -

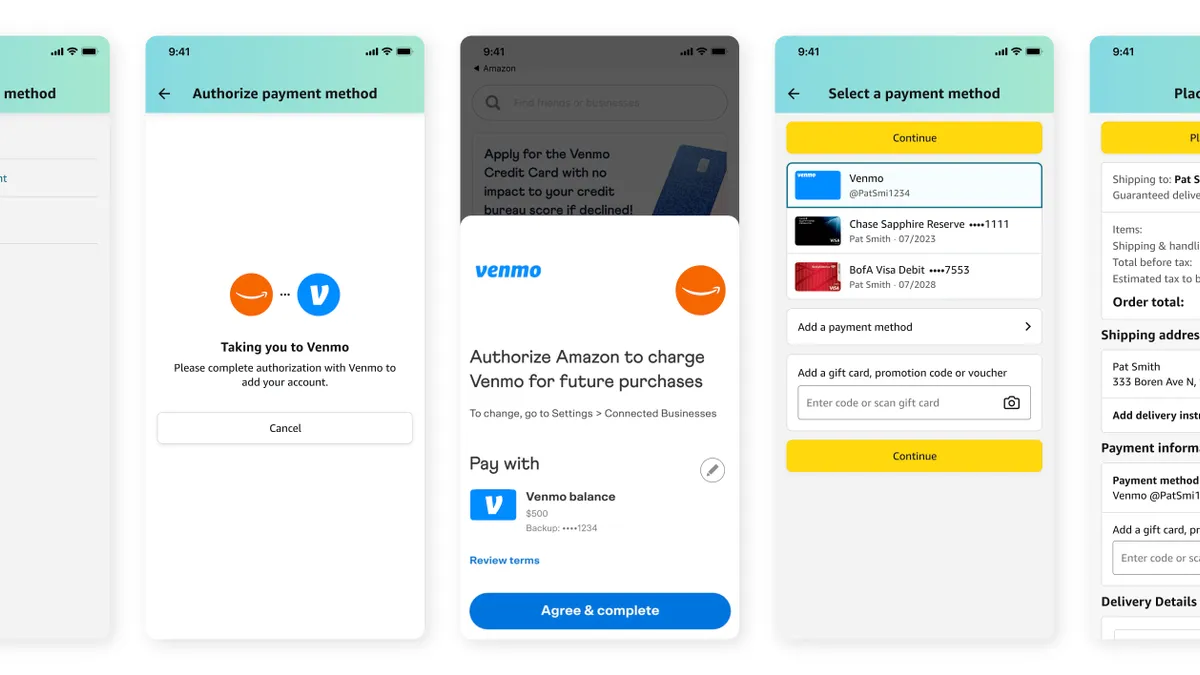

Amazon rolls out Venmo payment option

The e-commerce giant’s new payment method was first teased in an announcement from Venmo owner PayPal last year.

By Dani James • Oct. 25, 2022