Retail: Page 48

-

Visa seeks to draw creators in

The card behemoth is partnering with other fintechs in an effort to sell creators embedded payment and financial tools.

By Lynne Marek • Oct. 14, 2022 -

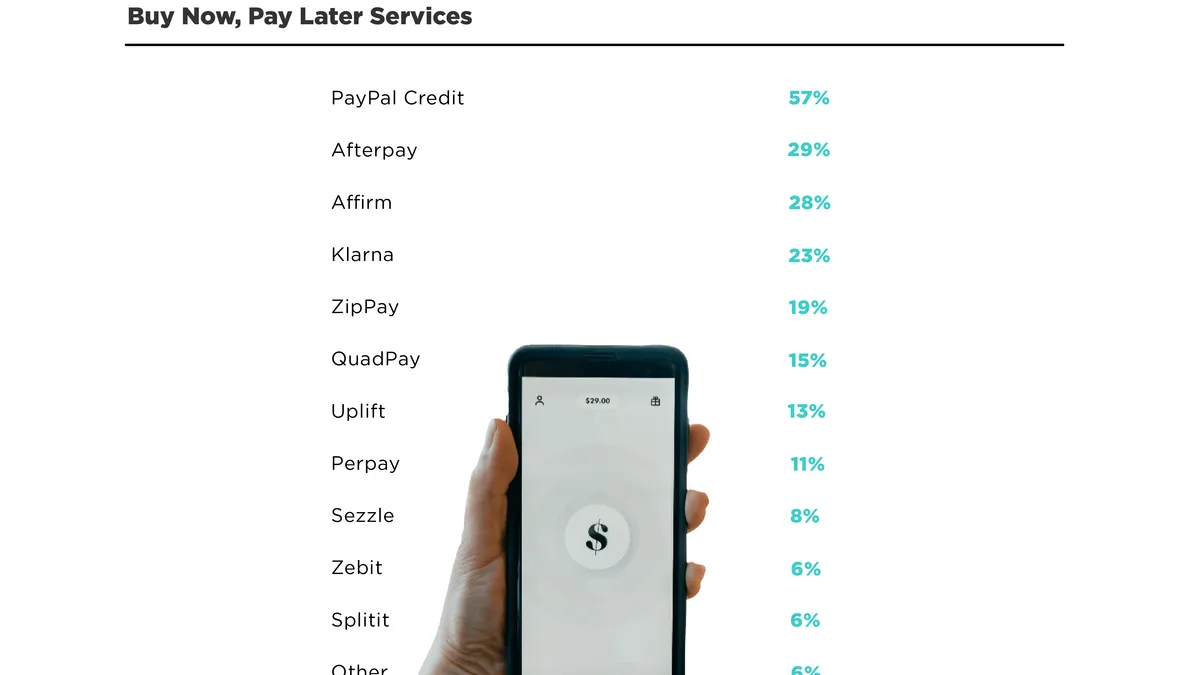

Affirm gains, Klarna slips in Q3

As buy now-pay later providers vie for holiday shoppers, Affirm's third-quarter market share increase showed it's gaining as Klarna's growth stalled.

By Caitlin Mullen • Oct. 14, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Nearly half of Gen Z, millennials to tap BNPL for holiday shopping

That buy now-pay later outlook emerged from a new Bluedot survey that also showed 43% of consumers are likely to open a new store credit card during the yearend shopping period.

By Tatiana Walk-Morris • Oct. 12, 2022 -

Hollister app lets teens shop, parents pay

The Abercrombie & Fitch Co. brand released the Share2Pay function based on company data about customer pain points.

By Dani James • Oct. 11, 2022 -

Payments deals gain momentum

Four billion-dollar payments acquisitions this year reflect industry dynamics that will drive more buyouts in coming months, analysts say.

By Lynne Marek • Oct. 11, 2022 -

Fiserv cuts deeper into workforce

Payment processing giant Fiserv pared more employees in recent weeks as the company seeks to boost profit margin growth amid economic turmoil.

By Caitlin Mullen • Oct. 11, 2022 -

Retrieved from Standard AI press release.

Retrieved from Standard AI press release.

Standard AI’s taps cameras with checkout-free tech

The checkout-free company is looking to help its convenience store customers make more informed decisions on how to run their operations, CEO Jordan Fisher said.

By Brett Dworski • Oct. 7, 2022 -

Big-name BNPL providers remain scarce in stores: report

As spending shifts back to stores, retailers are side-stepping big-name buy now-pay later providers, such as Affirm and Afterpay, in favor of offering their own in-store options, a recent survey revealed.

By Caitlin Mullen • Oct. 7, 2022 -

EMVCo rolls out new payment standard

The international standard-setting organization finalized a new specification for contactless and mobile payments, but adoption of the new approach by merchants may be slow-going.

By Lynne Marek • Oct. 6, 2022 -

Visa flags rising in-person fraud

The card behemoth said it’s observing an increase in in-person fraud now that U.S. consumers are returning to their pre-pandemic shopping habits.

By Lynne Marek • Oct. 6, 2022 -

Retrieved from Hudson press release.

Retrieved from Hudson press release.

Checkout-free technology spreads at airports

New frictionless convenience stores are coming to airports in Los Angeles and Dallas, continuing a trend that has gained steam since last summer.

By Brett Dworski • Oct. 6, 2022 -

PayPal acting CFO’s pay package hints at staying power

The $2.5 million in equity grants PayPal is handing its interim chief financial officer are part of the kind of package typically given to long-term CFOs, executive search experts said.

By Maura Webber Sadovi • Oct. 5, 2022 -

Consumers prefer cashback rewards: Bank of America

Consumers base credit card choices mainly on incentives offered, with a preference for cash back over points, a Bank of America survey found.

By Tatiana Walk-Morris • Oct. 5, 2022 -

Afterpay adds monthly BNPL option

The Block-owned buy now-pay later provider is growing beyond its “pay in 4” plans by adding a financing option for pricier purchases.

By Caitlin Mullen • Oct. 5, 2022 -

FTC issues warning on BNPL claims

As buy now-pay later popularity has mushroomed, the companies offering the financing have attracted the attention of another regulator.

By Caitlin Mullen • Oct. 5, 2022 -

Legislation needed to fill crypto oversight gaps, FSOC says

The federal panel said more oversight of stablecoins and crypto spot markets for tokens is needed. It also recommended rules that would help prevent regulatory arbitrage in the sector.

By Anna Hrushka • Oct. 4, 2022 -

Fed majority votes to finalize debit rule

In a 6-1 vote, the Federal Reserve finalized a debit card processing rule that underscores a requirement that multiple card networks be available for routing transactions, including online.

By Lynne Marek • Oct. 4, 2022 -

Fiserv adds data service for large merchants

The payments processor’s new Carat point-of-sale offering aims to help big businesses optimize transaction data.

By Caitlin Mullen • Oct. 4, 2022 -

Durbin maps path for card bill

Sen. Dick Durbin and his Republican ally, Sen. Roger Marshall, seek to attach their credit card competition legislation to a defense spending bill.

By Lynne Marek • Oct. 3, 2022 -

Grocery, restaurant spending climbs: Mastercard

“Consumers are shifting their spending in the face of higher prices and a reinvigorated appreciation for experiences,” Mastercard said in a new report.

By Tatiana Walk-Morris • Oct. 3, 2022 -

Fintechs gain ground in merchant acquiring

New businesses are far more likely to opt for integrated software vendors over legacy providers, McKinsey discovered.

By Caitlin Mullen • Oct. 3, 2022 -

Affirm targets offline growth

The buy now-pay later provider’s chief financial officer said this week its Debit+ card is a key part of Affirm’s strategy to push further into brick-and-mortar sales.

By Caitlin Mullen • Sept. 30, 2022 -

Retrieved from Star Concessions website.

Retrieved from Star Concessions website.

Convenience store turns to Just Walk Out tech

Grab & Fly is the latest airport convenience store to use Amazon’s Just Walk Out technology, following a Hudson Nonstop store at Chicago Midway International Airport that debuted last summer.

By Brett Dworski • Sept. 30, 2022 -

Q&A

CEOs Sound Off: Forecasting holiday payment trends

CEOs of payments-related companies shared their thoughts on what consumers and merchants want when it comes to checkout and payments this holiday season.

By Caitlin Mullen • Sept. 29, 2022 -

Consumers tap BNPL for larger purchases

Marqeta's report, which showed U.S. buy now-pay later use has climbed since last year, also points to consumers acquiring more credit cards.

By Tatiana Walk-Morris • Sept. 29, 2022