Retail: Page 25

-

Retrieved from BP.

Retrieved from BP.

BP to upgrade mobile app, POS system

The c-store and fuel giant will overhaul its BPme platform as it looks to create an enhanced purchasing experience, a spokesperson said.

By Brett Dworski • March 6, 2024 -

CFPB imposes $8 credit card late fee rate

The Consumer Financial Protection Bureau finalized a rule that sets a “threshold” of $8 for late fees that can be imposed by large credit card issuers, and eliminates automatic inflation increases.

By Lynne Marek • March 5, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Caitlin Mullen/Payments Dive, data from Fiserv

Caitlin Mullen/Payments Dive, data from Fiserv

Fiserv lines up FedNow clients

The mega processor has signed up 200 banks for FedNow, but now its clients are in search of use cases.

By Lynne Marek • March 5, 2024 -

Cash App enforcement action expected this year

Federal regulators reviewing whistleblower allegations related to Block’s Cash App may act on the complaints this year, predicted an attorney for the complainants.

By Lynne Marek • March 4, 2024 -

Mastercard, Fiserv execs take sides on debit regulation

A Mastercard executive painted Regulation II as potentially harmful to consumers, while Fiserv’s CEO said it was an appropriate update due to the rise of online transactions.

By Caitlin Mullen • March 4, 2024 -

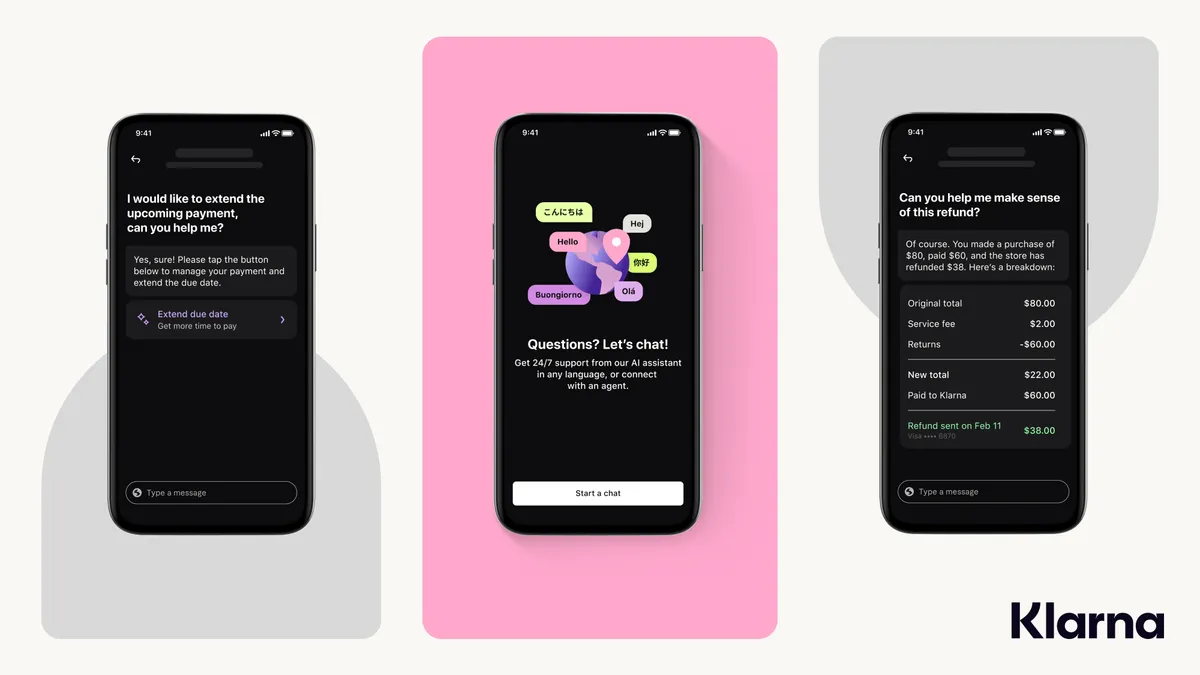

Klarna news may confirm workers’ worst fears: AI replacement

FOBO or “fear of becoming obsolete” has long plagued workers concerned about AI replacing their jobs.

By Caroline Colvin • March 1, 2024 -

Q&A

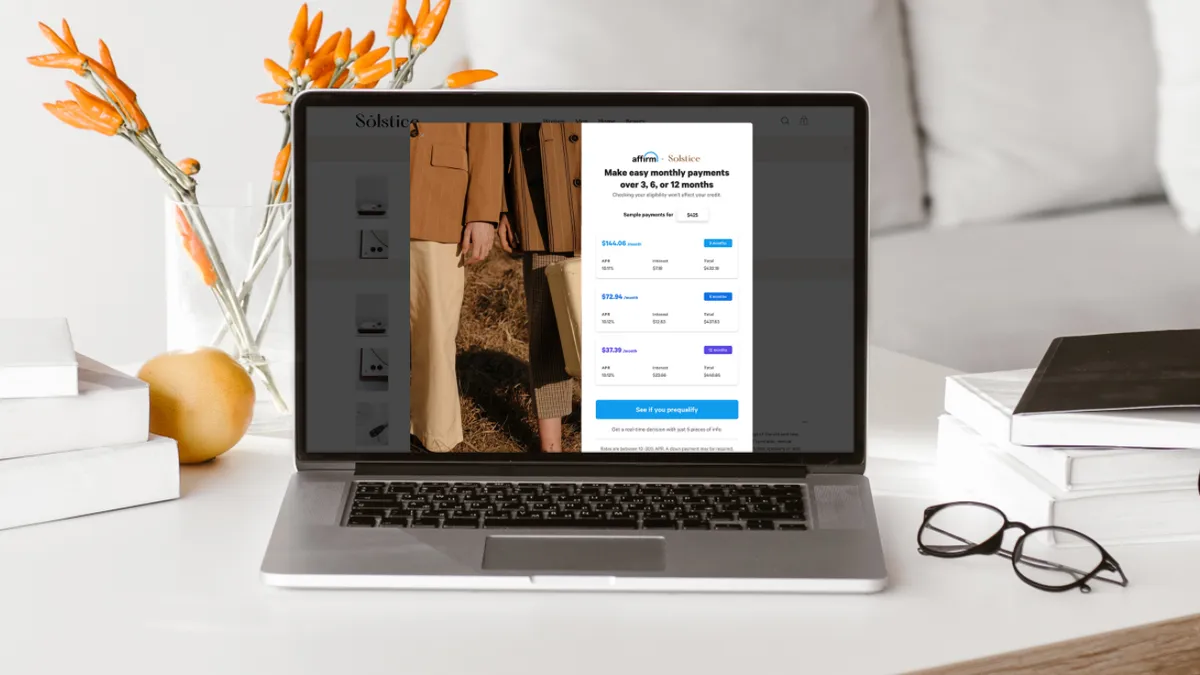

Affirm preps for UK launch

Beyond expansion to the U.K., the BNPL provider may seek to plant a flag where its large partners such as Amazon and Shopify have a presence, said Affirm’s Chief Revenue Officer Wayne Pommen.

By Caitlin Mullen • March 1, 2024 -

Fiserv ponders M&A

CEO Frank Bisignano declined to comment Wednesday on a potential acquisition of Shift4, but would like to see Fiserv make more purchases that further its digital capabilities.

By Caitlin Mullen • Feb. 29, 2024 -

App features bolster Zip’s US revenue growth

Gamified repayment and variable first installments were two features that CEO Cynthia Scott said contributed to the BNPL company’s U.S. revenue growth.

By James Pothen • Feb. 28, 2024 -

Amazon expands smart carts pilot

The tech giant’s smart shopping carts, designed to speed up the checkout process, are now available for use in a California Whole Foods store.

By James Pothen • Feb. 27, 2024 -

Self-checkout promises ultimate convenience. Is it doing its job?

The process can make for faster, easier experiences, but it needs regular attention and helpful associates to thrive, consultants said.

By Bryan Wassel • Feb. 26, 2024 -

Congress members lob dueling gun code bills

Democratic and Republican Congress members took opposing stances this month in introducing bills on the use of a new gun merchant category code.

By Caitlin Mullen • Feb. 26, 2024 -

Cash-strapped consumers turn to BNPL: Fed survey

Consumers facing financial hardships turned to buy now, pay later services more last year than stable consumers, according to survey results from the Philadelphia Federal Reserve Bank.

By Tatiana Walk-Morris • Feb. 23, 2024 -

Affirm sheds workers

The buy now, pay later provider has cut about 6% of its employees, joining other payments companies that have trimmed workforces this year.

By Caitlin Mullen • Feb. 22, 2024 -

Mastercard to be dinged by Discover deal

While both Mastercard and Visa will be impacted by Discover Financial Services’ plan to be acquired by card issuer Capital One, the former is likely to bear the brunt of the blow.

By Lynne Marek • Feb. 21, 2024 -

Cross-border payments remain focus for Fed

Tools that “automate processes, reduce costs and promote effective safeguards across jurisdictions” may help improve cross-border payments, a Federal Reserve official said last week.

By Lynne Marek • Feb. 20, 2024 -

PayPal invests in AI startup Rasa

The investment is the first that the digital payments pioneer is making from its new artificial intelligence venture fund.

By Tatiana Walk-Morris • Feb. 20, 2024 -

Toast to cut 550 employees

The company’s CEO acknowledged during an earnings call that “we grew our team too quickly in some areas,” while reporting a presence in 106,000 locations as of the end of 2023.

By Lynne Marek • Feb. 16, 2024 -

Global Payments may pare operations

While there has been industry speculation about the company making an acquisition, CEO Cameron Bready was more ready to talk “pruning” this week.

By Lynne Marek • Feb. 15, 2024 -

BNPL popularity rises among ‘financially fragile’ consumers

About 60% of that group has used BNPL five or more times in the past year, compared to just over 20% of financially stable consumers, the New York Fed said.

By Caitlin Mullen • Feb. 15, 2024 -

Apple extends prepaid debit card reach

Adding a virtual card number feature “is about giving options to consumers when retailers do not support Apple Pay,” Creative Strategies President Carolina Milanesi said.

By James Pothen • Feb. 15, 2024 -

Q&A

Adyen eyes growth in North America

Davi Strazza, North America president at Adyen, pointed to the Dutch processor’s single technology platform as setting it apart in a crowded field of payments players.

By Caitlin Mullen • Feb. 14, 2024 -

Bitcoin Depot expands footprint by 400 ATMs

The bitcoin ATM operator is adding to its fleet as it sees “a lot of demand,” according to COO Scott Buchanan.

By James Pothen • Feb. 14, 2024 -

PayPal’s Rabinovitch takes Worldpay CFO seat

Worldpay will lean on PayPal alum Gabrielle Rabinovitch’s finance chops to help it navigate life as an independent company after a recent rocky history for the business.

By Grace Noto • Feb. 13, 2024 -

Card networks to implement gun code in California: report

Visa, Mastercard and American Express are moving forward with use of a new gun merchant category code for credit card purchases in California, according to CBS News.

By Caitlin Mullen • Feb. 12, 2024