Retail: Page 24

-

Digital wallets to overtake debit cards in stores: report

Having already dominated e-commerce transactions, digital wallets are projected to overtake at least one traditional form of payment in stores, according a Thursday report by Worldpay.

By James Pothen • March 22, 2024 -

Column

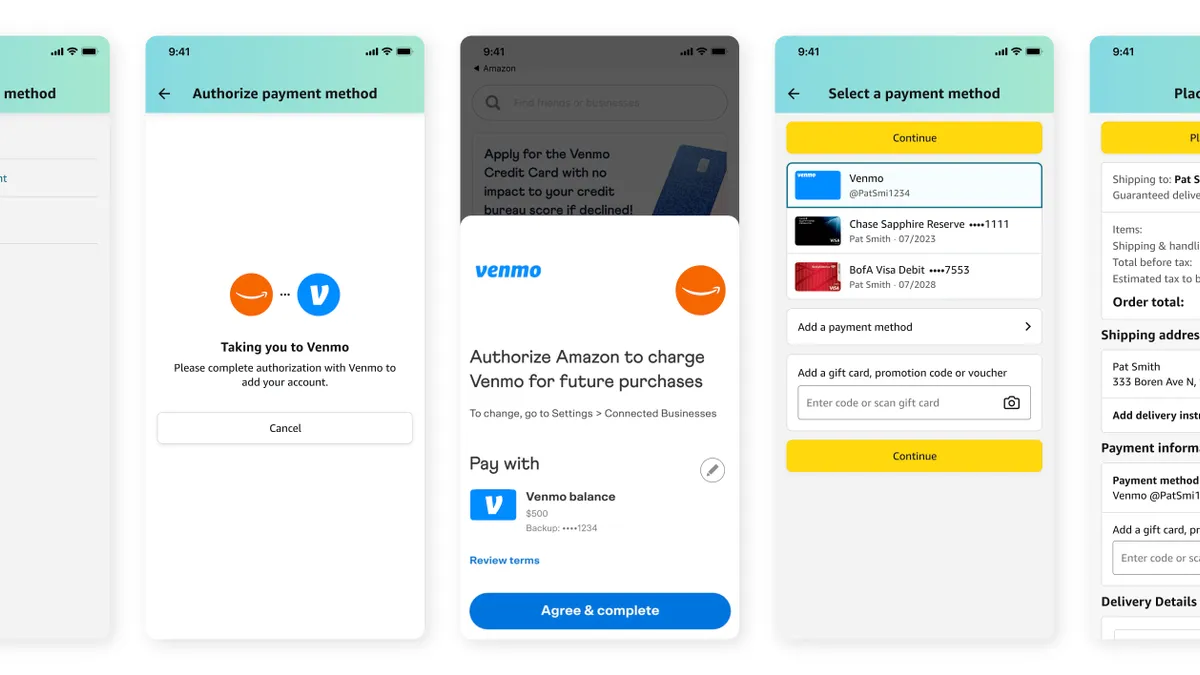

PayPal’s new CEO takes the Venmo challenge

PayPal has been striving for more than a decade to better connect Venmo to merchants and make it pay off. Now, a new CEO has inherited the challenge.

By Lynne Marek • March 21, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Meta’s payment plays may pay off this year: report

A partnership between tech giants Meta and Amazon “could represent the tipping point of transforming social media into a transaction platform,” Mizuho Securities analysts said in a report this week.

By James Pothen • March 20, 2024 -

Fed banks analyze consumer use of card promos

New research from the Philadelphia and Boston Feds finds that consumers are cycling through low APR credit card offers.

By Tatiana Walk-Morris • March 20, 2024 -

Ballooning credit card balances loom over retail sales

The level of debt may surpass the all-time record this year, even when adjusted for inflation, some analysts say.

By Daphne Howland • March 19, 2024 -

Nuvei forms committee to evaluate ‘strategic alternatives’

The Canadian payments company confirmed it’s in talks about a potential transaction with a third party, noting the committee will explore possibilities.

By Lynne Marek • March 18, 2024 -

Afterpay extends reach beyond apparel

The Block-owned buy now, pay later provider said its expansion is a response to younger consumers looking for new tools to manage inflation.

By Tatiana Walk-Morris • March 18, 2024 -

Q&A

FreedomPay doubles down on gateway focus

The company, which provides point-of-sale payments and other technology services to merchants, isn’t interested in handling acquiring, said President Chris Kronenthal.

By Caitlin Mullen • March 18, 2024 -

Retrieved from Business Wire on March 14, 2024

Retrieved from Business Wire on March 14, 2024

Fiserv searches for ‘tuck-in type’ deals

Despite a focus on smaller acquisition options, the processor doesn’t feel confined to a particular price range, CFO Bob Hau suggested Thursday.

By Caitlin Mullen • March 15, 2024 -

Opinion

Fintech founder backs Google, Apple

“It’s easy for giant app companies to pick fights with Apple and Google, but when billionaire companies fight about who gets richer, it’s usually the little guy that loses,” writes CashEx’s CEO.

By Kingsley Ezeani • March 15, 2024 -

Q&A

ACI CEO weighs in on FedNow, cross-border payments

The federal real-time payments system may spool up slowly, but it could ultimately transform U.S. cross-border payments, ACI Worldwide's CEO predicted.

By Lynne Marek • March 14, 2024 -

Visa teams with SAP’s Taulia on embedded payments

The card network giant wants to simplify payment processes for chief financial officers, accounts payable staff and procurement professionals, via the new tie.

By Tatiana Walk-Morris • March 14, 2024 -

Klarna’s IPO prospects grab spotlight

The BNPL provider’s CEO has suggested the company could IPO “quite soon,” but fintech investors expect the market will first want to see a stronger track record of profitability.

By Caitlin Mullen • March 13, 2024 -

PayPal, Mastercard add C-suite hires

Payments firms are loading up on new C-suite hires this year as some in the industry build out new management teams.

By Lynne Marek • March 13, 2024 -

Stripe reports payments volume increase

The digital payments company processed $1 trillion in total payments volume last year, according to its annual letter released Wednesday.

By James Pothen • March 13, 2024 -

PayPal may axe straggler business units

On the fringes of the digital payment pioneer’s two main businesses are some in a third category that could be jettisoned this year, CEO Alex Chriss said last week.

By Lynne Marek • March 12, 2024 -

Affirm CFO swears off auto lending, for now

The buy now, pay later company seeks to be involved in more consumer spending opportunities, but finance chief Michael Linford all but ruled out auto lending.

By Caitlin Mullen • March 12, 2024 -

Hertz taps Stripe for digital payments

The digital payments company will power website and app-based reservations for the car rental business, along with providing a point-of-sale system.

By James Pothen • March 12, 2024 -

Visa spends ‘billions’ battling cybersecurity threats

“We are all in an arms race to protect this ecosystem, to protect the network,” Visa CEO Ryan McInerney said at an investor conference last week.

By Lynne Marek • March 11, 2024 -

JPMorgan to launch biometric checkout next year

The bank’s payments unit plans to engage in more pilots this year before rolling out the checkout service broadly next year, said Prashant Sharma, JPMorgan’s executive director of biometrics and identity solutions.

By Caitlin Mullen • March 11, 2024 -

IHG approves slew of hotel digital tipping solutions

The hotel group announced that it had newly approved several payment vendors to expand the company’s digital tipping capabilities.

By Noelle Mateer • March 11, 2024 -

Biden, Republicans clash over card fees

President Biden and Republican lawmakers sparred Thursday over credit card late fees, as some House members also challenged the Federal Reserve’s proposed cap on debit card fees.

By Lynne Marek • March 8, 2024 -

Capital One angles to push Discover upmarket

With its acquisition of the card network, Capital One seeks to elevate Discover’s brand while also working to expand its acceptance abroad.

By Caitlin Mullen • March 7, 2024 -

PayPal CEO prioritizes bettering branded services

Alex Chriss aims to use the company’s faster-growing unbranded Braintree business to give a boost to the legacy PayPal brand.

By Lynne Marek • March 7, 2024 -

Huck’s adds touchless payments for fleets

The convenience retailer is the latest to add this capability as it seeks to win over more business from corporate accounts and professional drivers.

By Jessica Loder • March 6, 2024