Retail: Page 23

-

Opinion

CFPB’s new late fee cap charts ‘a better way,’ says Sunbit CEO

“The credit card industry should take a page from innovators, instead of relying on yesterday’s fee models,” argues the CEO of the payment tools provider.

By Arad Levertov • April 16, 2024 -

Q&A

Gen Z clings to new payment tools

Gen Zers will abandon a transaction in one out of two cases if their preferred payment method isn’t available, says an EY payments specialist, citing the firm’s survey results.

By Lynne Marek • April 12, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

BNPL users grapple with financial stress: survey

BNPL users, who are having problems with overspending and missed payments, are tapping buy now, pay later services to spread out their cash flow.

By Tatiana Walk-Morris • April 12, 2024 -

Deep Dive

Why more tech in stores shouldn’t mean fewer workers

Stores can automate more tasks than ever, including pricing, inventory management and checkout. But for theft prevention, customer service and brand engagement, they need humans.

By Daphne Howland • April 11, 2024 -

Mastercard appoints three C-suite execs

As part of the leadership changes and a corporate realignment, a long-time executive is also leaving the card network company.

By Tatiana Walk-Morris • April 11, 2024 -

PayPal’s new CEO lands $42M pay package

The bulk of that compensation stems from a major stock grant handed to Alex Chriss when he took the digital payments company’s top post last year.

By Lynne Marek • April 10, 2024 -

Capital One’s Discover bid tops biggest Q1 tech-related deals

The proposed Capital One-Discover merger made the list because of fintech issues that are at stake in the $35.3 billion deal.

By Alexei Alexis • April 10, 2024 -

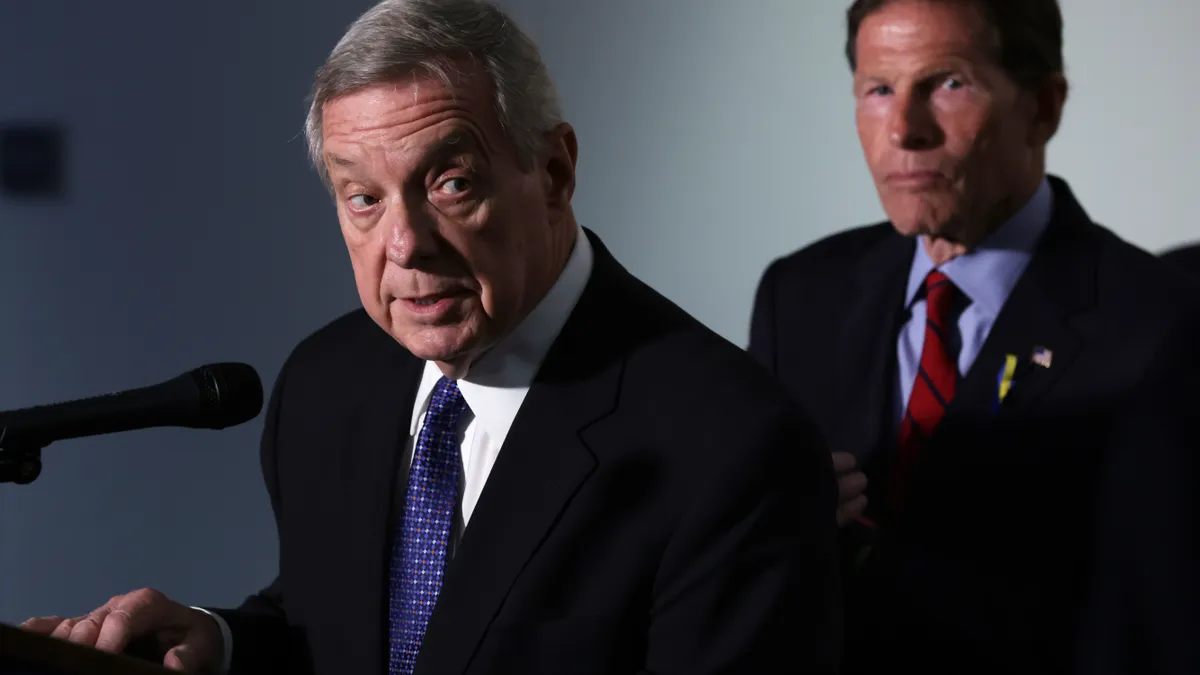

Visa, Mastercard CEOs throw hearing off track

Senate Judiciary Committee Chairman Dick Durbin postponed a plan to call credit card chieftains on the capitol carpet at a Tuesday hearing, but he’s still aiming to get them to Washington.

By Lynne Marek • April 9, 2024 -

Fiserv CEO compensation rose last year to $28M

Compensation for Fiserv CEO Frank Bisignano climbed 57% over 2022, as the value of stock awarded to him surged and he received a $3 million cash bonus.

By Lynne Marek • April 8, 2024 -

Amazon debuts app for palm payment

The Amazon One app can be used to enter various locations, identify individuals, pay for items and access loyalty rewards.

By Xanayra Marin-Lopez • April 7, 2024 -

Whole Foods to pull Amazon’s Just Walk Out technology from stores

The specialty grocer, which operates the checkout tech at just two stores, will follow the same path as Amazon Fresh stores in the U.S., a spokesperson confirmed Friday.

By Peyton Bigora • April 5, 2024 -

Photo by Bia Santana from Pexels.

Fiserv to let Brazilians use Pix in US

The payments processing giant is providing support to extend the Brazilian instant payments system to merchants and consumers around the world.

By Lynne Marek • April 4, 2024 -

PayPal pursues pricing power

The digital payments pioneer aims to increase pricing for its services to boost profitable growth under a new management team.

By Lynne Marek • April 3, 2024 -

Credit card complaints jumped 38% last year: CFPB

The Consumer Financial Protection Bureau received 70,000 card-related complaints from consumers last year, according to a report last week.

By James Pothen • April 3, 2024 -

Amazon to drop ‘just walk out’ at some grocery stores

The e-commerce giant will replace the grab-and-go tech with its smart shopping carts in its Amazon Fresh grocery stores, a tech media outlet reported.

By James Pothen • April 2, 2024 -

Nuvei goes private in stock sale to Advent

The sale of the Canadian payments processor’s stock to the private equity firm will hand some investors a $560 million windfall.

By Lynne Marek • April 2, 2024 -

How Amex is entangled in the Visa-Mastercard settlement

The settlement gives merchants the ability to surcharge for nearly all Visa and Mastercard credit card transactions, and puts pressure on American Express to allow the same.

By Lynne Marek • April 1, 2024 -

Deep Dive

Fiserv has ambitious goals for Clover. Can it meet them?

To achieve growth targets, Clover will need to fend off competition from rivals, especially Square, and make headway in new verticals and geographic regions, analysts and consultants said.

By Caitlin Mullen • April 1, 2024 -

Warren reiterates call for gun MCC guidance

The Massachusetts senator and 32 other Democrats stressed the need for federal guidance on the gun merchant category code as states diverge.

By Caitlin Mullen • March 29, 2024 -

CFPB warns remittance firms about false ads

The agency told international money transfer companies that “deceptive marketing” may run afoul of federal law.

By Tatiana Walk-Morris • March 29, 2024 -

Discover CEO to exit for Ally

Michael G. Rhodes, who took the top post at Discover this year, is leaving to become the next CEO of the bank Ally.

By Caitlin Mullen • March 27, 2024 -

Walmart can end Capital One card tie early, judge says

It won’t be easy for Walmart to find a new partner to replace Capital One, though, said Brian Riley, co-head of payments at Javelin Strategy & Research.

By Caitlin Mullen • March 27, 2024 -

NY Assembly bill counters governor on BNPL

A New York assemblymember has introduced a buy now, pay later bill, countering one introduced in the governor’s budget bill.

By Lynne Marek • March 27, 2024 -

Visa, Mastercard reach landmark credit card settlement

The two biggest U.S. card networks agreed to cap interchange fees for five years, among other terms, to settle merchant litigation that has lasted nearly two decades.

By Lynne Marek • March 26, 2024 -

How Visa handled ‘BidenCash’ card fraud incident

The card network giant identified 556,000 card accounts that were put at risk as a result of the cybercrime ring BidenCash’s release of data online in December.

By Tatiana Walk-Morris and Lynne Marek • March 25, 2024