Regulations & Policy: Page 11

-

Warren, Waters urge Fed to reconsider Capital One-Discover

The Democratic lawmakers blasted the central bank’s “analysis, or lack thereof,” arguing the Fed “parroted assertions made by Capital One.”

By Dan Ennis • May 6, 2025 -

Caitlin Mullen/Payments Dive, data from Fiserv

Caitlin Mullen/Payments Dive, data from Fiserv

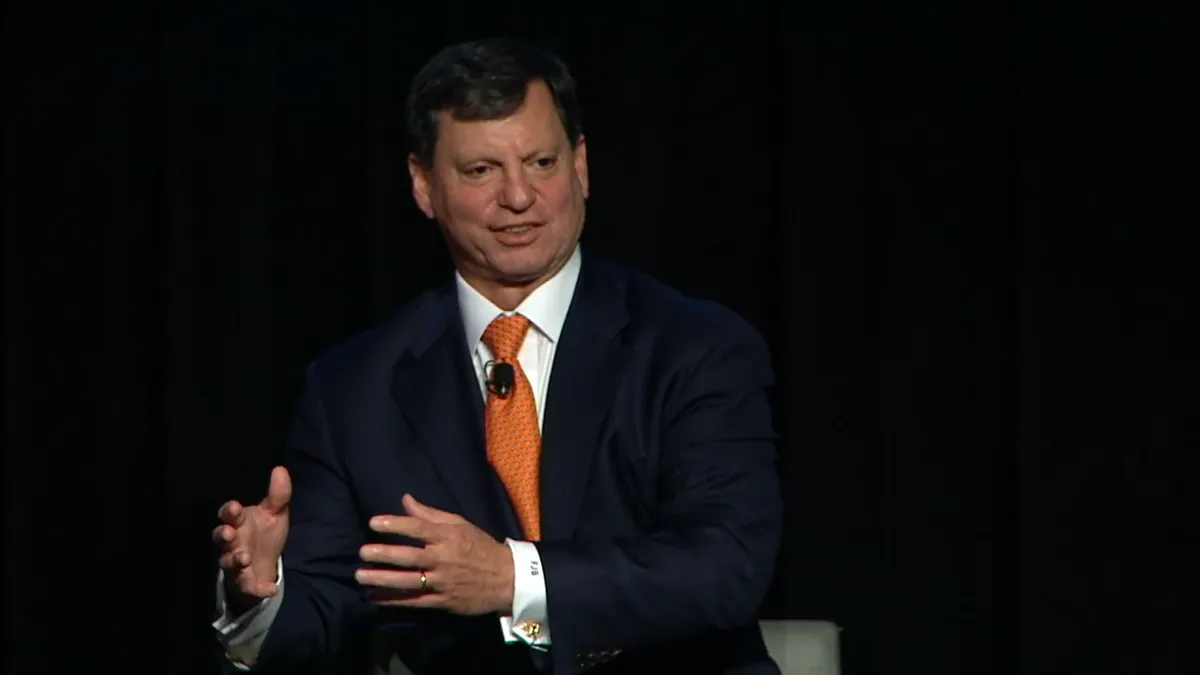

Senate to vote on Fiserv CEO for SSA post

The Senate Finance Committee chair urged colleagues to support Frank Bisignano to become head of the Social Security Administration when they vote on his nomination this week.

By Patrick Cooley • May 5, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Column

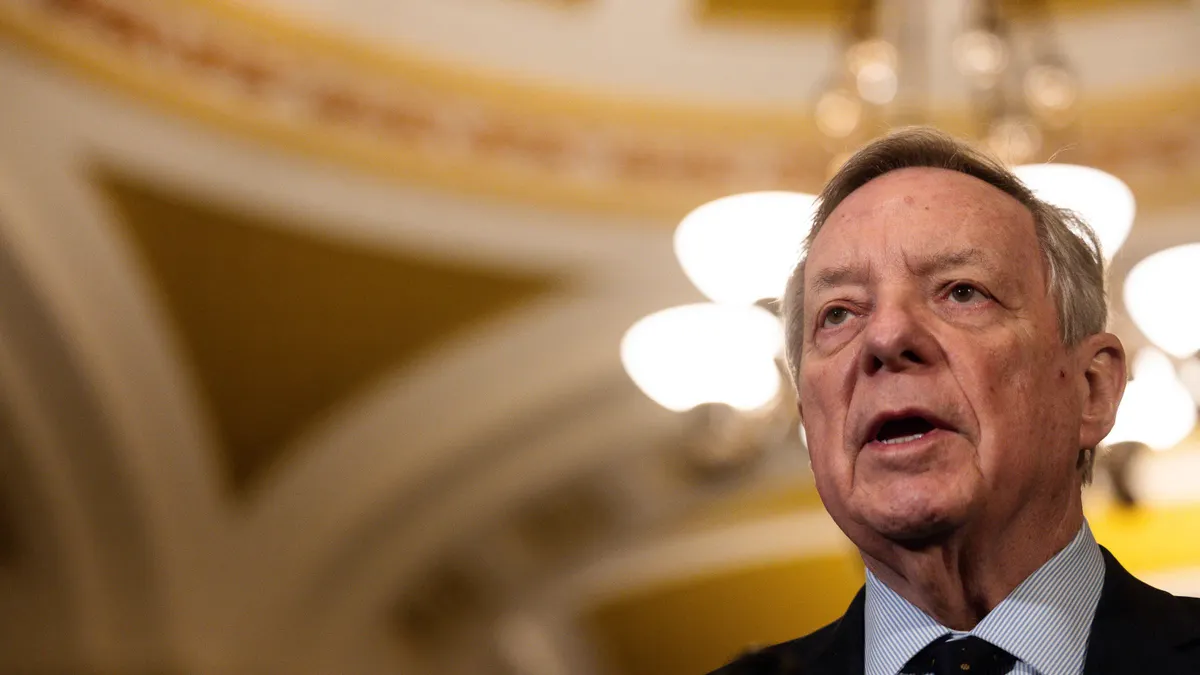

Durbin to keep pushing card bill

The retiring Senate Democrat plans to reintroduce the Credit Card Competition Act proposal despite plans to wrap his four-decade congressional career.

By Lynne Marek • April 28, 2025 -

Illinois AG, Durbin defend state card fee law

They filed a second brief supporting a state law that excludes taxes and tips from card interchange fees.

By Justin Bachman • April 25, 2025 -

Fiserv to acquire Brazilian fintech Money Money

The processor’s purchase will benefit its Clover unit in its effort to provide financing to small businesses, the company said.

By Patrick Cooley • April 24, 2025 -

Adyen hit with cyberattack in Europe

Services were disrupted for about eight hours over two days by a distributed denial of service attack, the Dutch company said on its website.

By Patrick Cooley • April 23, 2025 -

Card holders rail about Uber in FTC lawsuit

Uber user complaints about recurring monthly charges, unclear enrollment and a frustrating cancellation process spur a Federal Trade Commission lawsuit.

By Justin Bachman • April 22, 2025 -

Instant payments could improve video games: KC Fed

Moving away from in-game currencies may make the gaming experience simpler for players and reduce costs for video game companies, Kansas City Fed specialists argue.

By Patrick Cooley • April 22, 2025 -

Q&A

Write off paper checks, ACI Worldwide CEO advises

Tom Warsop praised the Trump administration’s move to eliminate paper checks and suggested businesses should do the same.

By Lynne Marek • April 22, 2025 -

Fed, FDIC force more oversight of Discover

The Federal Reserve and the FDIC penalized the card network for overcharging merchants on interchange fees and said the company must pay $250 million in fines, make restitution to merchants, and change its practices as a condition to merging with Capital One.

By Patrick Cooley • April 21, 2025 -

Ramp reportedly angles for part of $700B US credit card program

The fintech is seeking to handle a piece of the SmartPay federal employee charge card program, assisted by its close ties to the Trump administration, the media outlet ProPublica reported.

By Justin Bachman • April 21, 2025 -

Retrieved from OCC.

Retrieved from OCC.

Capital One-Discover wins approvals

The Federal Reserve and the Office of the Comptroller of the Currency will allow a merger creating the largest U.S. credit card issuer.

By Dan Ennis • April 18, 2025 -

CFPB to ‘deprioritize’ payments oversight

An agency memo directs the agency’s staff to bring redress directly to affected consumers, “rather than imposing penalties on companies.”

By Gabrielle Saulsbery • April 18, 2025 -

Visa’s Pismo names new CEO

The Brazilian payments software business promoted new executives as it pursues growth under the auspices of its giant card network owner.

By Tatiana Walk-Morris • April 18, 2025 -

Pay-by-bank should offer perks: Deloitte

Banks must persuade merchants and consumers the payment method is an acceptable alternative to credit cards, the consulting firm suggested.

By Patrick Cooley • April 17, 2025 -

For medical debt, ‘care now, pay later’ models abound

As healthcare expenses grow, fintech startups look to boost the affordability — and profitability — of medical payments.

By Justin Bachman • April 16, 2025 -

Klarna partners with Fiserv’s Clover

A recently signed deal will bring Klarna’s installment loans to Clover checkout at merchants across the U.S.

By Patrick Cooley • April 16, 2025 -

Worldpay delivers payments industry insights in DC

Executives of the merchant services company visited Capitol Hill this month to connect with congressional staffers and share their views on payments.

By Lynne Marek • April 15, 2025 -

Credit card 90-day delinquencies rise to record: report

The percentage of U.S. credit card accounts past due for 90 days was the highest in 12 years during the fourth quarter, a Philadelphia Federal Reserve report said.

By Patrick Cooley • April 15, 2025 -

NY AG alleges two wage access providers made illegal loans

The state’s lawsuits against DailyPay and MoneyLion seek to wind down their earned wage access practices in New York.

By Justin Bachman • April 15, 2025 -

Republicans pressure Fed on debit card fees

Some House Financial Services Committee members are pressuring the Federal Reserve to reverse a proposal to lower the debit card fees that banks can charge.

By Lynne Marek • April 14, 2025 -

DOJ scales back crypto enforcement

The Justice Department will stop prosecuting “unwitting” regulatory violations and focus its efforts on going after those who victimize crypto investors or use crypto to support illicit activities.

By Gabrielle Saulsbery • April 11, 2025 -

Block agrees to pay $40M New York penalty

The payments technology company agreed to pay the fine under a consent order to settle allegations related to lax oversight of its Cash App payments tool.

By Lynne Marek • April 11, 2025 -

PayPal, Block and others face recession risk: analysts

As President Trump’s tariff war raises the specter of a U.S. recession, analysts cited certain payments players as potentially more vulnerable in an economic downturn.

By Lynne Marek • April 10, 2025 -

Shift4 CEO grilled by senators on Musk, SpaceX ties

The lawmakers questioned Jared Isaacman on whether he would remain independent of Musk if he is confirmed to lead NASA.

By Patrick Cooley • April 10, 2025