Regulations & Policy: Page 10

-

Retrieved from Office of the Governor of the State of New York.

Retrieved from Office of the Governor of the State of New York.

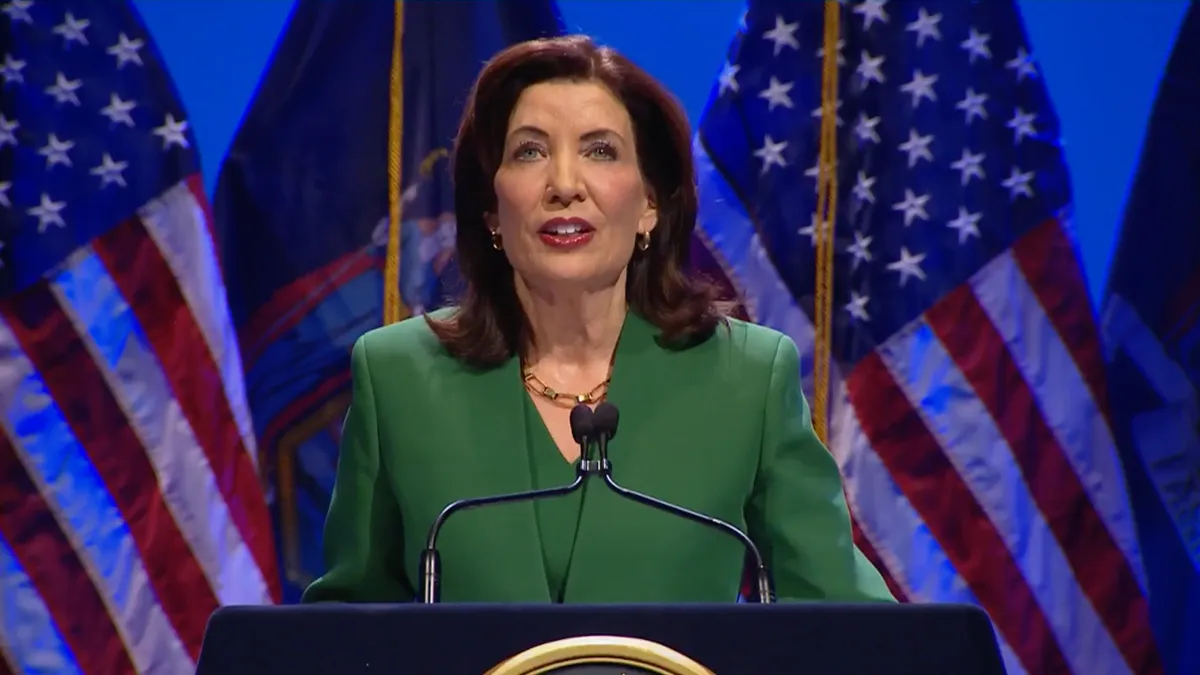

Fintech groups oppose state BNPL rules

Lobbying organizations argue that New York's rules treat buy now, pay later purchases too much like credit card transactions.

By Patrick Cooley • May 28, 2025 -

Credit card cap amendment stokes opposition

Industry trade groups for financial institutions have united to rail against legislation that could cap credit card interest rates.

By Lynne Marek • May 28, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

CFPB to yank ‘unlawful’ open banking rule

That move bends to bank groups that filed a lawsuit last year to block the Consumer Financial Protection Bureau rule aimed at making it easier for consumers to move their financial accounts.

By Justin Bachman • May 27, 2025 -

Cash use declines as cards rise: Atlanta Fed

Consumers keep using cash, but credit cards are king, the Federal Reserve Bank of Atlanta documented in its annual payment method survey.

By Tatiana Walk-Morris • May 22, 2025 -

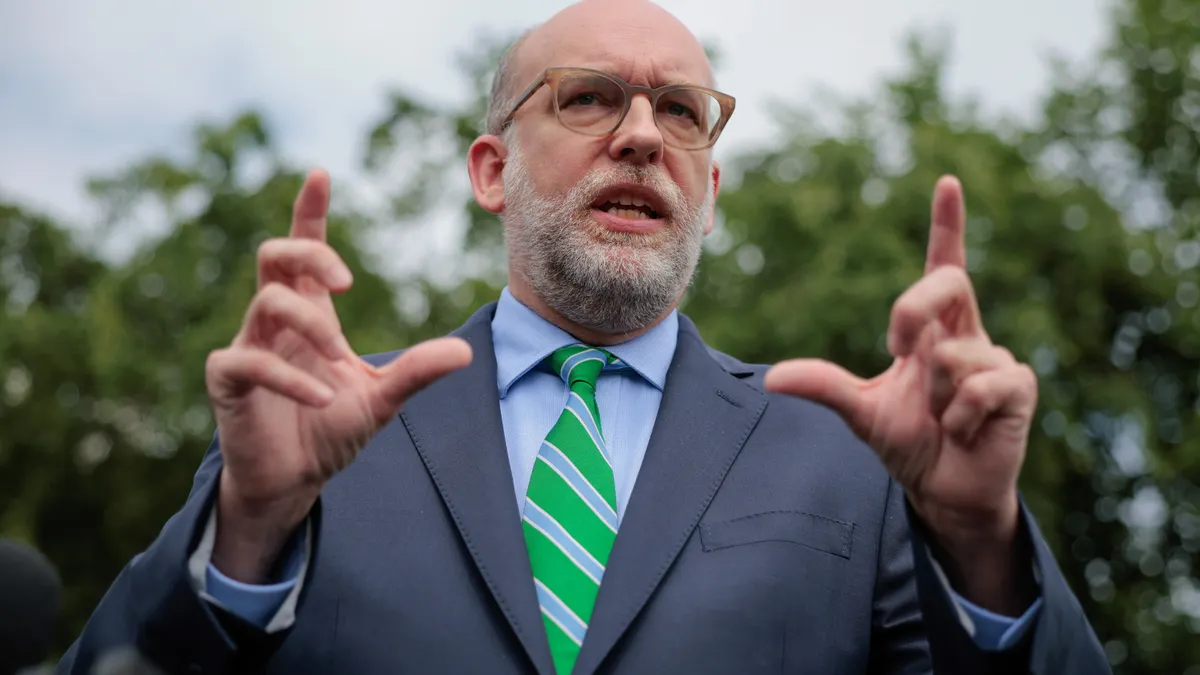

Durbin, Marshall push credit card amendment

Sens. Roger Marshall and Dick Durbin aim to add their Credit Card Competition Act legislation to the GENIUS stablecoin bill advancing in Congress.

By Lynne Marek • May 21, 2025 -

Hack could cost Coinbase up to $400M

The crypto exchange is offering a $20 million reward for information leading to the hackers’ arrest. Coinbase terminated customer support agents who leaked customer data.

By Gabrielle Saulsbery • May 19, 2025 -

Capital One closes Discover deal

Completion of the combination results in the richest banking deal of the past six years and creates the nation’s largest credit card issuer.

By Dan Ennis • May 19, 2025 -

CFPB slashes Wise penalty

The U.S. unit of fintech Wise must pay the bureau $45,000 and roughly $450,000 in redress to affected customers – a far cry from the $2.5 million penalty issued in January.

By Rajashree Chakravarty • May 18, 2025 -

Opinion

Let’s scrap paper checks

If the federal government can ditch paper checks, so can the private sector, one industry CEO contends.

By Chase Gilbert • May 16, 2025 -

FTA to defend open banking in court

The Financial Technology Association will seek to protect a Consumer Financial Protection Bureau open banking rule after receiving a federal judge’s permission to intervene.

By Justin Bachman • May 15, 2025 -

Banks struggle to talk about fraud

Financial institutions battling an increase in fraud, particularly push-payment scams, have been stymied in sharing information that might help them better protect customers.

By Lynne Marek • May 15, 2025 -

Credit card delinquencies rise: NY Fed

Meanwhile, U.S. credit card balances declined and credit card aggregate limits inched up from the prior quarter, the New York Fed said.

By Tatiana Walk-Morris • May 15, 2025 -

Warren prods DOJ to block Capital One-Discover deal

The senator urged the Justice Department’s new antitrust czar, who's expressed concern over the creation of too-big-to-fail firms, to take action.

By Dan Ennis • May 14, 2025 -

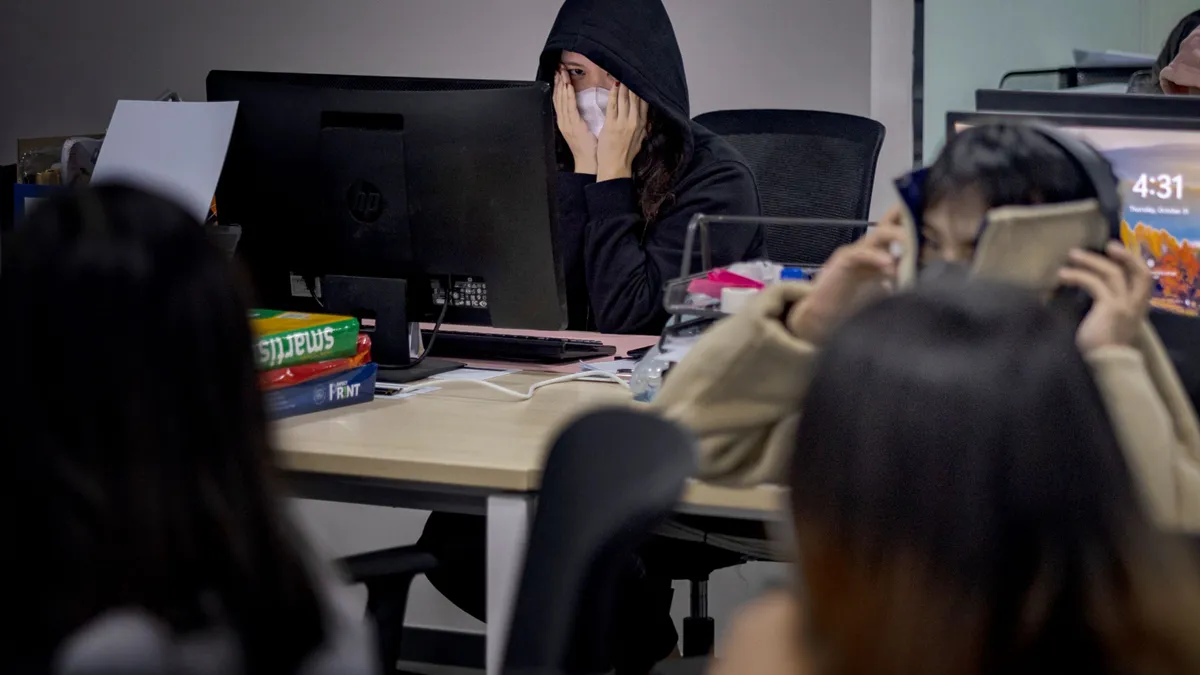

Businesses grapple with payments fraud

Companies are struggling to keep up with fraudsters’ growing technological prowess, particularly in business email compromises.

By David McCann • May 14, 2025 -

BNPL users struggle with payments

Nearly half of U.S. adults who have used buy now, pay later services experienced financial difficulties, such as overspending or missing a bill payment, according to a recent survey.

By Patrick Cooley • May 13, 2025 -

Nevada bill would charter new payment banks

The new banks would connect directly to real-time payment rails like FedNow and ACH to potentially lower retailers’ transaction costs.

By Justin Bachman • May 13, 2025 -

Google drops lawsuit against CFPB

The tech giant ended its court battle as the federal agency halted supervision of the company’s payments arm.

By Justin Bachman • May 13, 2025 -

CFPB rescinds 67 pieces of guidance

The rescissions are not final and will allow the bureau to evaluate whether each of the items was statutorily prescribed, CFPB Acting Director Russ Vought said.

By Gabrielle Saulsbery • May 13, 2025 -

Stablecoin bill falters in Senate

Democrats demanded fixes to the GENIUS Act – designed to create a framework for bringing stablecoins into the U.S. financial system – and raised concerns about Trump’s ties with crypto ventures.

By Rajashree Chakravarty • May 12, 2025 -

Opinion

Banks must accelerate ISO 20022 prep

“While larger banks have made considerable progress in preparing for this transition, smaller regional banks and credit unions are largely lagging,” writes one IT executive.

By Robert Turner • May 9, 2025 -

Mastercard faces cross-border headwinds

The credit card network reported a first-quarter slowdown in the growth of international travel, a potential warning sign amid economic uncertainty.

By Patrick Cooley • May 8, 2025 -

The image by Massimo Catarinella is licensed under CC BY-SA 2.0

The image by Massimo Catarinella is licensed under CC BY-SA 2.0

Indiana passes EWA law

The state follows others, including Nevada and Wisconsin, in instituting licensing requirements for earned wage access providers.

By Tatiana Walk-Morris • May 7, 2025 -

CFPB spurns BNPL rule

The Consumer Financial Protection Bureau won’t prioritize enforcement actions related to buy now, pay later payments, the agency said in a notice.

By Lynne Marek , Patrick Cooley • May 7, 2025 -

Fiserv names Michael Lyons CEO

The company disclosed the promotion minutes after the U.S. Senate voted to confirm outgoing CEO Frank Bisignano as commissioner of the Social Security Administration.

By Patrick Cooley • May 6, 2025 -

Visa pursues stablecoins for cross-border payments

The biggest U.S. card network is setting up partnerships and innovating behind the scenes to develop stablecoins for cross-border uses.

By Lynne Marek • May 6, 2025