Regulations & Policy: Page 12

-

House votes to kill CFPB big tech payments rule

The measure revoking the bureau’s oversight of large technology payments players, such as Google and Block, passed on a straight party-line vote.

By Justin Bachman • April 10, 2025 -

PayPal’s Xoom, Tencent partner on cross-border payments

The deal provides another avenue for customers seeking to send remittances to Chinese consumers.

By Tatiana Walk-Morris • April 10, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Rain raises $75M in equity funding

With a fresh capital infusion, the earned wage access provider aims to launch more savings and credit products this year.

By Tatiana Walk-Morris • April 9, 2025 -

Fiserv acquires Australian payment facilitator Pinch

The move comes after the Milwaukee-based payments processor said it would expand its Clover point-of-sale service in Australia.

By Patrick Cooley • April 9, 2025 -

Fiserv says US trade war could harm demand

The company’s point-of-sale devices are manufactured overseas, and therefore subject to across-the-board import taxes.

By Patrick Cooley • April 8, 2025 -

DailyPay sues New York Attorney General

The earned wage access provider lodged a lawsuit against the state after it was notified of alleged lending violations.

By Lynne Marek • April 8, 2025 -

Do growing fintechs need more federal regulation?

State regulators say they’re updating their rules and are best-suited to oversee licensed money transmitters — and a new U.S. payments charter isn’t needed.

By Justin Bachman • April 8, 2025 -

Stripe seeks Georgia special banking charter

If approved, the charter would give Stripe the ability to process credit card transactions without a bank partner.

By Patrick Cooley • April 7, 2025 -

US businesses cling to paper checks

Large and small businesses alike are still using the 20th-century form of payment extensively, even as the federal government presses ahead with digital alternatives.

By Lynne Marek • April 7, 2025 -

Cap One-Discover deal detractors assail reported DOJ approval

Capital One’s $35 billion purchase faces two remaining federal approvals — and plenty of critics who expect consumers will face higher costs.

By Justin Bachman • April 6, 2025 -

Durbin rounds up CCCA support

The Democrat from Illinois asked retail and restaurant industry representatives this week to help build support for the Credit Card Competition Act, but it has yet to be introduced this year.

By Lynne Marek • April 4, 2025 -

Debit cards top Fed’s fraud troubles list: survey

Card and check fraud continue to plague financial institutions, a new survey from the Federal Reserve Financial Services shows.

By Tatiana Walk-Morris • April 4, 2025 -

Fed raises alarm on synthetic identity fraud

The use of generative AI and fraudulently obtained accounts to execute synthetic identity fraud is on the rise, a Federal Reserve official said in a podcast interview.

By Tatiana Walk-Morris • April 3, 2025 -

Amex opposes shareholder proposals

A conservative legal group wants American Express to consider eliminating diversity goals to determine financial incentives for executives. A spokesperson for the card issuer says it no longer uses those goals in evaluating executive performance.

By Patrick Cooley • April 2, 2025 -

House plans vote to kill CFPB payments rule

The chamber’s measure revoking bureau oversight of large tech payments players has passed the Senate and would next head to an approving Trump.

By Justin Bachman • Updated April 2, 2025 -

EWS drops Zelle standalone app

Zelle users will need to turn to their online banking portals starting today in light of Early Warning Services proceeding as planned with the shutdown of its Zelle app this month.

By Patrick Cooley • April 1, 2025 -

Affirm COO: Walmart deal was “uneconomic”

Walmart makes up a relatively small portion of Affirm’s business that the buy now, pay later company can make up elsewhere, Chief Operating Officer Michael Linford said.

By Patrick Cooley • March 31, 2025 -

CFPB plans to spike BNPL rule

The buy now, pay later industry sued to block the consumer-friendly rule, arguing that the services are not the same as those offered via credit cards.

By Justin Bachman • March 31, 2025 -

Mercury raises $300M

The payments startup, which has backing from Marathon Management Partners and Andreessen Horowitz, aims to use the funds to expand its clientele and increase its profitability.

By Tatiana Walk-Morris • March 28, 2025 -

Swipe fee foes find legislative support in almost a dozen states

The battle to curb interchange fees has migrated from Illinois across the nation, with bills in 11 states seeing robust lobbying.

By Justin Bachman • March 28, 2025 -

CFPB nixes filing in case tied to Electronic Funds Transfer Act

The bureau’s brief was withdrawn because it “advances an interpretation of the law that has never been embraced by any federal court prior.”

By Gabrielle Saulsbery • March 27, 2025 -

Utah governor signs EWA law

The state joins a pack of others that have passed industry-friendly laws seeking to oversee earned wage access providers and their services.

By Lynne Marek • March 27, 2025 -

Republicans air CFPB grievances, jockey for agency change

Kentucky Republican Rep. Andy Barr called the bureau an “Orwellian predator” at a House subcommittee hearing where several lawmakers proposed reforms.

By Caitlin Mullen • March 26, 2025 -

CFPB predicts late fee lawsuit settlement

The agency’s new leadership believes it can settle a 2024 lawsuit banks and business groups filed over an $8 cap on credit card late fees.

By Justin Bachman • March 26, 2025 -

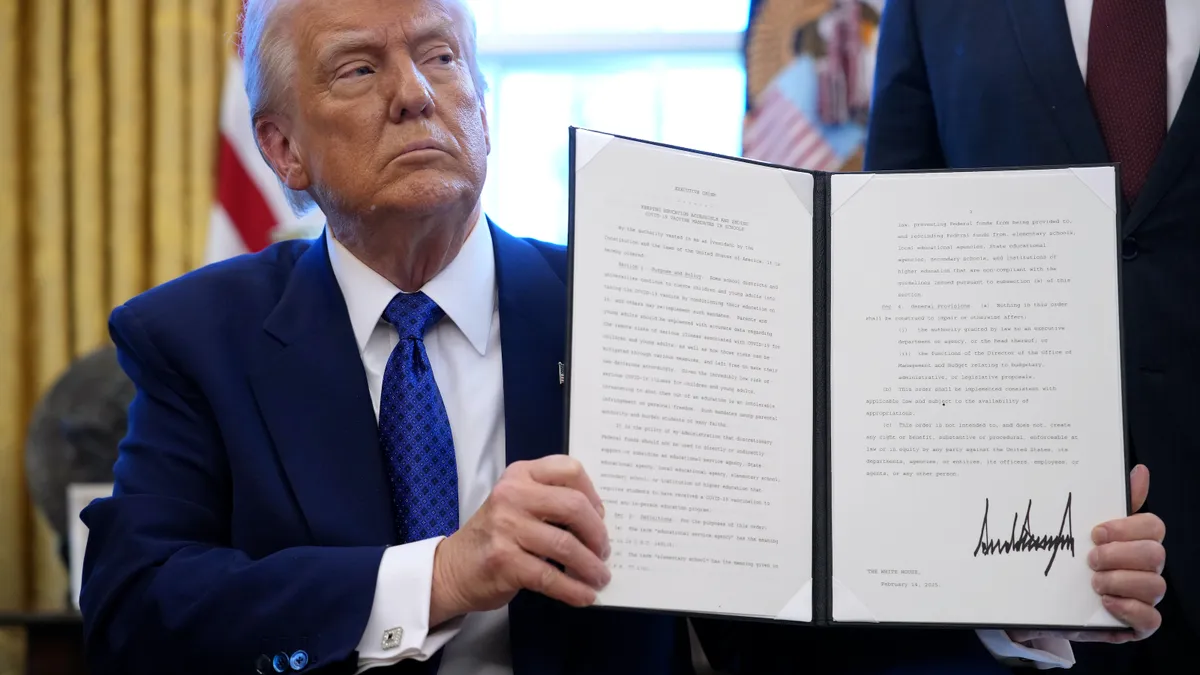

Trump calls on federal gov’t to banish paper checks

The White House issued an executive order calling on the federal government to cease using paper checks by September, except in certain circumstances.

By Lynne Marek • March 26, 2025