Banking: Page 69

-

Customer satisfaction with card apps declines

"When it comes to delivering that level of personalization through high-touch digital channels, most banks and credit card providers are missing the mark," J.D. Power said in a new consumer survey report.

By Tatiana Walk-Morris • June 7, 2022 -

Lawsuits over Zelle pile up

Bank of America and Wells Fargo have both been sued recently by consumers who allege they were defrauded by scam artists using Zelle payments.

By Lynne Marek • June 6, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Global Payments taps former BofA exec as next CFO

Josh Whipple, a former investment banker, is taking the top finance job as the company gears up for more acquisitions to capitalize on a drop in valuations.

By Maura Webber Sadovi • June 3, 2022 -

Amex isn't afraid of inflation

American Express CEO Steve Squeri is bullish on his cardholders' financial health and the broader economic situation, saying Thursday he expects inflation to moderate in 2023.

By Caitlin Mullen • June 3, 2022 -

Economic pressures stress payment fintechs

PayPal, Klarna and Bolt have chopped their workforces in the face of mushrooming macro-economic pressures, suggesting a potential fintech shakeout in the offing.

By Lynne Marek • June 2, 2022 -

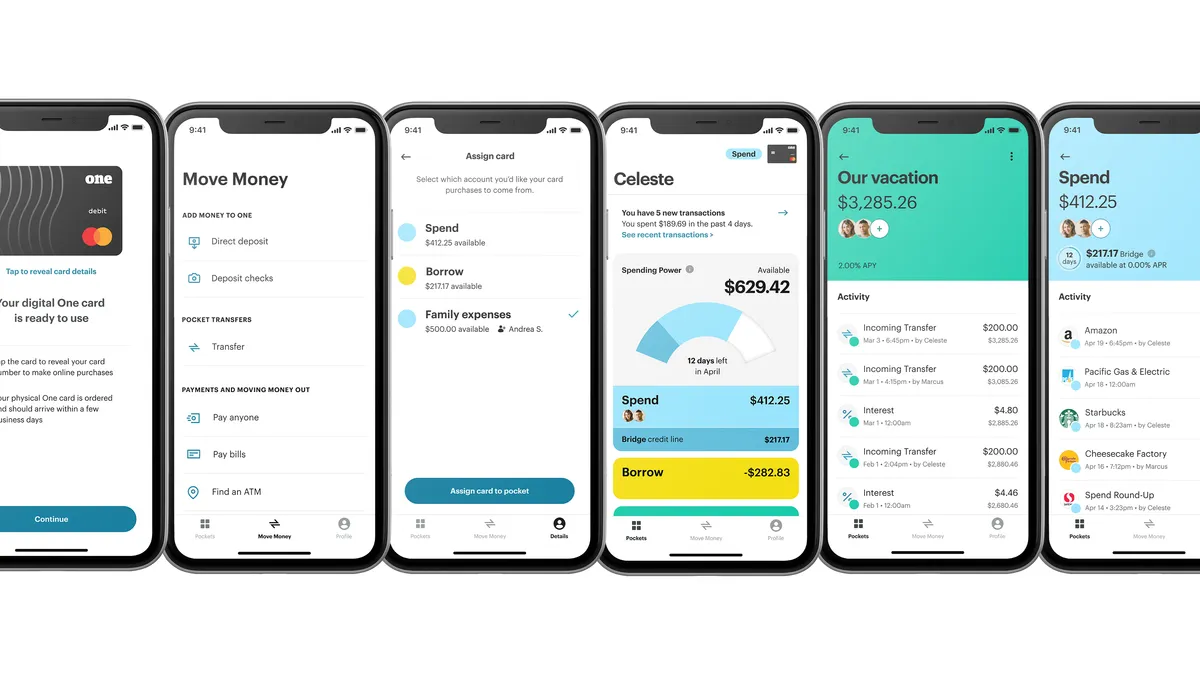

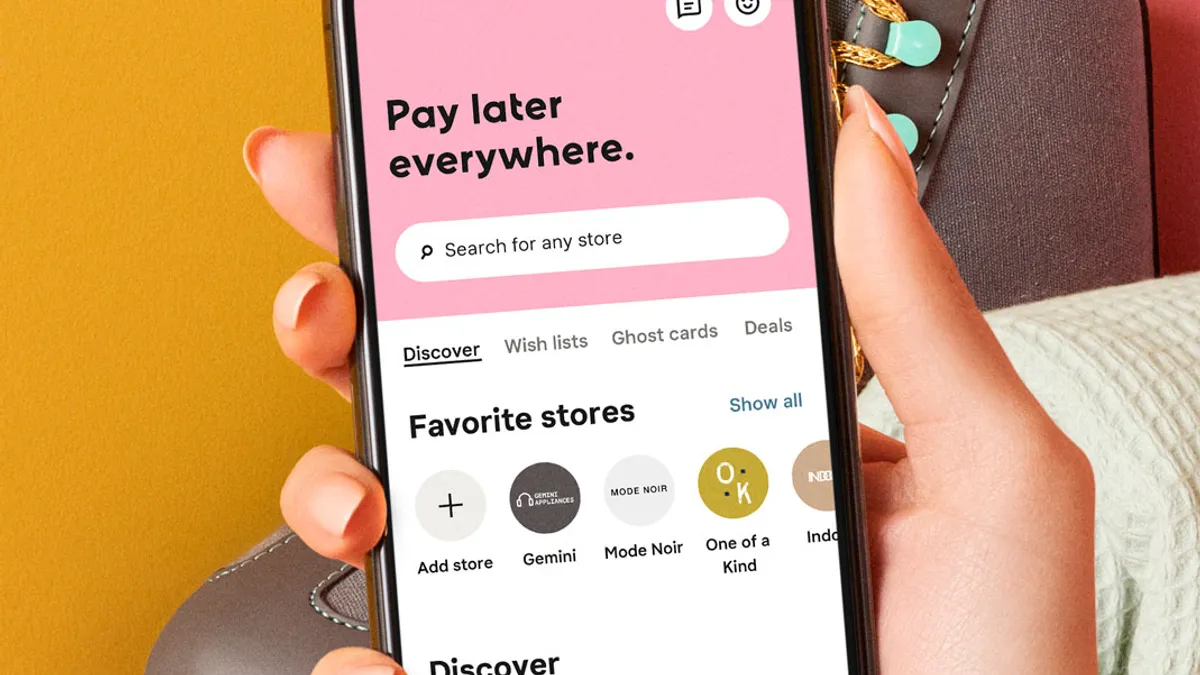

Klarna taps Marqeta for card

The partnership comes as buy now-pay later providers seek to expand their customer bases amid market volatility and regulatory pressure.

By Tatiana Walk-Morris • June 2, 2022 -

NMI aims to equip banks with modern payments tech

As banks try to fend off competition from fintechs in merchant acquiring and processing, payments gateway NMI aims to capitalize by offering to bolster their services.

By Caitlin Mullen • June 1, 2022 -

Opinion

Visa's CEO braces for legislation

Visa CEO Al Kelly said Sen. Dick Durbin is contemplating new legislation that would impose more pricing restrictions on the card industry. Kelly didn't elaborate and Durbin has been mum.

By Lynne Marek • May 31, 2022 -

Cross-border payments change as they rise: report

Consumers and businesses are more frequently using digital means to send payments around the world, according to Mastercard's second annual report on cross-border payments.

By Tatiana Walk-Morris • May 31, 2022 -

JPMorgan hires exec from PayPal to head fintech partnerships

Peggy Mangot joined the bank this month to lead a team responsible for designing and developing fintech partnership strategy at JPMorgan Chase's commercial bank.

By Anna Hrushka • May 27, 2022 -

CBDC, stablecoins, commercial bank money can coexist, Brainard says

The Federal Reserve vice chair, at a House Financial Services Committee hearing Thursday, also called for stricter regulation in the stablecoin space.

By Robin Bradley • May 27, 2022 -

Chip shortage drives up card costs

Russia's invasion of Ukraine is affecting card chip prices because Ukraine is home to two companies that produce half of the world’s neon supply, a key ingredient in chips.

By Jonathan Berr • May 26, 2022 -

Weave teams with Sunbit for healthcare BNPL

With Sunbit, Weave can now add BNPL to its other services that help small businesses collect customers’ payments, including text to pay, digital wallets, wireless terminals and credit-card on file.

By Joseph Burns • May 26, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB recasts innovation office to emphasize competition

The bureau walked back its no-action letter and sandbox policies in favor of "incubation events" meant to troubleshoot barriers to innovation and help customers switch providers more easily.

By Dan Ennis • May 26, 2022 -

CBDC poses threat to banks, trade groups tell Fed

A U.S. digital dollar would take $720 billion in deposits out of banks even if the central bank were to cap accounts at $5,000 per "end user," the American Bankers Association wrote in a letter.

By Robin Bradley • May 25, 2022 -

Lower-income app users seek savings options

Low- and moderate-income households in the U.S. say they want savings products in their digital payment apps, a survey by the nonprofit Commonwealth revealed.

By Caitlin Mullen • May 25, 2022 -

Big tech pushes passwordless for payments

Google, Microsoft and Apple this month began a big, new push in their campaign for a passwordless standard that's aimed at improving digital identity verification, including for payments.

By Lynne Marek • May 23, 2022 -

Fiserv shareholders approve severance curbs

A proposal to subject certain severance agreements to a shareholder vote — which the board was not in favor of — was approved during Fiserv’s annual meeting Wednesday.

By Caitlin Mullen • May 19, 2022 -

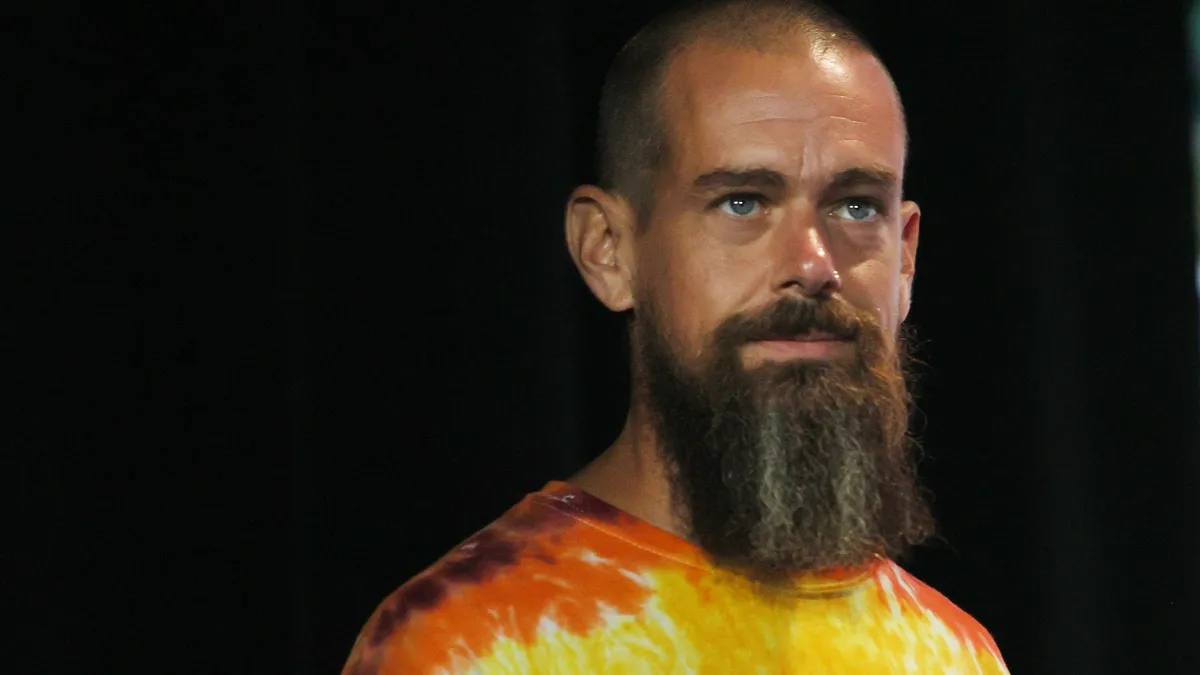

Block bets on bitcoin

“We are no longer just a payments company,” Block CEO Jack Dorsey said at the company’s investor day Wednesday.

By Caitlin Mullen • May 18, 2022 -

FIS knocks Fiserv out of No. 2 merchant acquirer spot

In a competitive field of merchant acquirers, FIS bested Fiserv last year as JPMorgan Chase held its lead, according to a ranking from The Nilson Report.

By Caitlin Mullen • May 18, 2022 -

Affluent consumers may drive $257B in spending

The wealthiest U.S. consumers are eager to open their wallets again, especially for travel, though there is one possible caveat, predicts Visa's chief economist.

By Lynne Marek • May 17, 2022 -

Amex, Discover get top marks in direct banks survey

The No. 3 and No. 4 card companies, which also hold bank licenses, scored highly in customer satisfaction among online-only banks, J.D. Power found.

By Caitlin Mullen • May 16, 2022 -

Three US cash trends persist, Fed report says

The COVID-19 pandemic led U.S. consumers to change up their payment habits, but three long-term cash trends have mainly persisted, according to a Federal Reserve Bank report issued this month.

By Lynne Marek • May 16, 2022 -

Jack Henry prowls for acquisitions

The payment technology provider aims to start making acquisitions again this year, the CEO said. While potential targets had been too expensive in recent years, the public market's swoon is creating more options now.

By Lynne Marek • May 12, 2022 -

Yellen urges stricter stablecoin regulation amid TerraUSD crash

The coin, which relies on an algorithm rather than being backed by dollar reserves, plummeted to 23 cents Wednesday, according to CoinDesk.

By Robin Bradley • May 11, 2022