Banking: Page 68

-

Retrieved from Novi on May 27, 2020

Retrieved from Novi on May 27, 2020

Meta to shutter Novi digital currency project Sept. 1

The company’s website tells users how to withdraw funds and access transaction data that they’ll lose access to once the Novi pilot ends. Meta, however, said it plans to use Novi’s technology in future projects.

By Dan Ennis • July 5, 2022 -

Congress takes on 'bro culture' in fintech

A congressional task force this week heard from fintech founders and venture capitalists about persistent inequities in funding for female- and minority-founded startups.

By Lynne Marek • July 1, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Retrieved from Outside spokesperson Daniel Gerardi on March 29, 2022

Retrieved from Outside spokesperson Daniel Gerardi on March 29, 2022 Opinion

OpinionFrom a payments CEO: 5 discriminatory behaviors that need to go

“Until the industry addresses this blatant lack of advocacy for women in leadership, it will continue to foster a culture where women can’t thrive,” says Stax CEO Suneera Madhani.

By Suneera Madhani • June 30, 2022 -

PayPal hit with Venmo fraud lawsuit

Yet another lawsuit related to alleged fraud on a peer-to-peer payment app targets digital payments company PayPal.

By Caitlin Mullen • June 30, 2022 -

CFPB strikes at debt collector fees

In the federal agency's crusade against “junk fees," debt collectors’ fees for certain payments are now in its sights.

By Jonathan Berr • June 30, 2022 -

FTC sues Walmart over money transfer services

The federal agency said Tuesday that the big retailer allowed money transfer fraud that “fleeced customers out of hundreds of millions of dollars.”

By Lynne Marek • June 29, 2022 -

Fintech Amount cuts about 18% of workforce

The Chicago-based banking technology provider, valued at $1 billion last year, said this week it had pared 108 workers in what the company called “proactive adjustments.”

By Caitlin Mullen • June 28, 2022 -

PayPal launches small business credit card

The digital payments company is targeting small business owners as they seek credit financing and loans.

By Tatiana Walk-Morris • June 28, 2022 -

Brex's move has fellow fintechs ready to pounce

Brex cutting small business customers — the handling of which prompted a mea culpa from the co-founder — may provide opportunity for B2B fintechs like Ramp or Divvy. But big banks still dominate the space.

By Caitlin Mullen • June 27, 2022 -

Alviere sets sights on Europe, Latam expansion

Embedded payments player Alviere has raised money from Silicon Valley Bank to support expansion in Europe and Latin America, following the hiring of a pack of new executives.

By Tatiana Walk-Morris • June 24, 2022 -

PayPal changes up its pricing

In a move that could increase or decrease charges for merchants, the company said it aims to better distinguish between personal and commercial payments on its system.

By Lynne Marek • June 24, 2022 -

CFPB takes aim at card late fees

The Consumer Financial Protection Bureau seems to think credit card late fees are out of control. Now, it plans to do something about it.

By Lynne Marek • June 23, 2022 -

Mastercard expands sonic branding with 'Priceless' album

The multi-artist album, a first-time marketing move by the card company, features original songs that incorporate Mastercard’s brand sound.

By Chris Kelly • June 22, 2022 -

Mastercard shareholders reject ghost guns proposal

A shareholder who is also a state official and candidate for Congress urged the card giant’s board to issue a report related to untraceable guns, but the proposal didn’t win enough support to pass at the company’s annual meeting.

By Caitlin Mullen • June 22, 2022 -

Discover eyes benefits of downturn

As smaller fintechs grapple with restructuring challenges, the card company expects there will be more opportunities for it in hiring talent and acquiring businesses.

By Caitlin Mullen • June 21, 2022 -

Opinion

Card fees: the price hike nobody is talking about

"The Visa-Mastercard duopoly controls about 80% of the market share, allowing them to raise fees indiscriminately and with no formidable opposition," contends Doug Kantor, general counsel for the National Association of Convenience Stores.

By Doug Kantor • June 17, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB urges standardization in BNPL credit reporting

The agency isn’t pleased about the three big credit reporting bureaus taking different approaches to tracking consumer data for buy now-pay later financing.

By Lynne Marek • Updated June 17, 2022 -

Samsung debuts a new digital wallet with crypto

The new wallet will store IDs, cards and crypto, giving the South Korean company more leverage to compete with digital payment apps from tech giants Apple and Google.

By Tatiana Walk-Morris • June 16, 2022 -

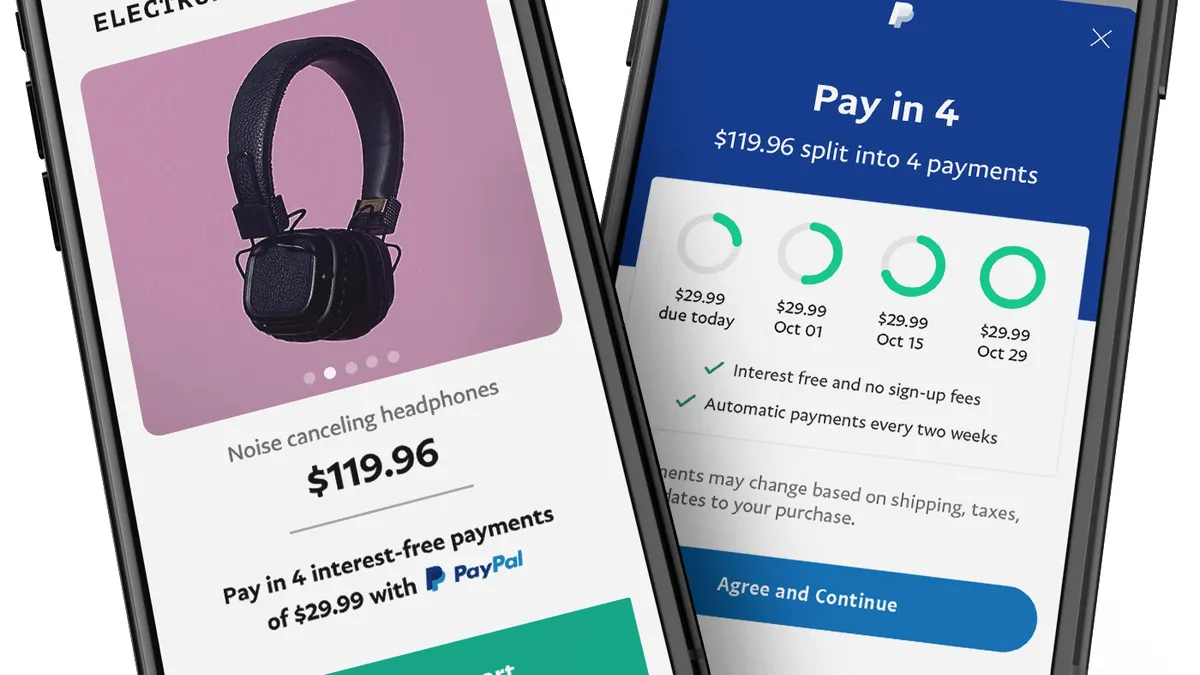

PayPal expands BNPL payment options

PayPal is making a bigger move into buy now-pay later financing as competitors in that arena multiply. It will now offer a new monthly payment plan targeted at bigger purchases.

By Lynne Marek • June 15, 2022 -

Payments startups still gaining value, for now

Payments companies “led the pack in valuation increases” and had the biggest average increase in valuation, according to S&P Global Market Intelligence.

By Jonathan Berr • June 14, 2022 -

Payrailz gains traction in battle with big rivals

The six-year-old company said it expanded its client base by a third in the first quarter and will double last year’s count to 150 by the end of this year.

By Lynne Marek • June 14, 2022 -

Column

Don't count crypto out just yet

Cryptocurrency skeptics were undoubtedly delighted by TerraUSD’s collapse last month, but there are plenty of signs already this month that the crypto era is far from over. Maybe it’s just beginning.

By Lynne Marek • June 10, 2022 -

Visa sees long runway with cash-to-card transition

For Visa, plenty of opportunity remains in cash-to-card digitization, offsetting any slowdown in consumer spending, CFO Vasant Prabhu said this week.

By Caitlin Mullen • June 9, 2022 -

Green Dot pays Republic Bank $13M to settle suit over failed acquisition

The payout comes atop a $5 million termination fee Republic received in January after Green Dot pulled out of a proposed $165 million purchase of the bank's tax refund processing unit.

By Dan Ennis • June 8, 2022 -

Foundation opines on crypto bill

The Stellar Development Foundation provided its take on this week’s bipartisan Senate bill to create a regulatory framework for cryptocurrencies.

By Robin Bradley • June 7, 2022