Technology: Page 66

-

Palm pay hits more Whole Foods stores

The grocery chain added Amazon One technology, which lets users pay with their palm prints, to a newly opened store in Austin, Texas, this week and plans to bring it to six other area locations in the coming weeks.

By Catherine Douglas Moran • April 21, 2022 -

Payment players seek to expand credit pool

Driven by the financial inclusion movement and a desire to grow the pool of consumers eligible for credit products, well-established credit reporting bureaus and new fintechs are addressing the issue of access to credit and allowing more consumers to become creditworthy.

By Caitlin Mullen • April 21, 2022 -

Explore the Trendline➔

Explore the Trendline➔

NatalyaBurova via Getty Images

NatalyaBurova via Getty Images Trendline

TrendlineEmbedded payment tools make inroads

Business customers demanding integrated tools is likely to keep driving a trend toward more embedded payments tools.

By Payments Dive staff -

Mastercard picks new startup program members

The initiative aims to support fintech startups during and after their time with Mastercard by introducing the small business owners to other entrepreneurs and potential partners in the payments realm.

By Tatiana Walk-Morris • April 21, 2022 -

Deep Dive

2022's restaurant payment tech push includes QR codes, kiosks

From QR codes to advanced mobile apps and robots, restaurants are planning to adopt more technology within their operations — including payments — in the year ahead.

By Julie Littman • April 20, 2022 -

NovoPayment lands $19M, spearheads US growth

Miami-based NovoPayment, the banking-as-a-service provider of digital payments and other services, is collecting capital for an expansion move in the U.S., just as its key business territory in Latin America is heating up as a destination for international fintech expansion.

By Lynne Marek • April 20, 2022 -

Robinhood's acquisition of crypto firm puts UK, Europe in its sights

The purchase of Ziglu, which is in the good graces of the Financial Conduct Authority, marks the second attempt by the stock-trading app to broach the U.K. market. Terms of the deal were not disclosed Tuesday.

By Dan Ennis • April 19, 2022 -

Opinion

Retail has a checkout problem...and speed alone won't solve it

The speed of one-click checkout isn't the answer to every cart abandonment problem, says one payments tech executive. There are other factors for retailers to consider when determining whether the checkout experience is convenient for the customer.

By Yvan Boisjoli • April 19, 2022 -

Mastercard, Interos partner on risk management tools

Mastercard's new partnership with the software provider is the latest in a string of added ties to fintechs aimed at expanding its payments and risk assessment tool offering.

By Tatiana Walk-Morris • April 14, 2022 -

Retrieved from Stripe's Stephen Imm on October 26, 2021

Retrieved from Stripe's Stephen Imm on October 26, 2021

Payments players caught in venture capital squeeze

The flow of venture capital to startups ebbed in the first quarter for the biggest quarterly decline since 2012. Payments players, which have been big beneficiaries of such investments, are beginning to feel the pinch.

By Lynne Marek • April 12, 2022 -

SEC issues guidance on crypto-asset accounting, disclosure

As theft of crypto-assets rises, the Securities and Exchange Commission is pushing companies to publicly report on the potential costs of such crimes and efforts to curb hacking risks.

By Jim Tyson • April 12, 2022 -

Stripe sees growth slowing this year after pandemic e-commerce boon

Despite opportunities to sell to the creator economy and meet demand for embedded tools, the company said it won't grow as much this year as last year, citing "one-time behavioral adjustments" in 2021. The super-unicorn still expects to expand based on "explosive growth in fintech."

By Jonathan Berr • April 12, 2022 -

Amex takes on banks in bid for new generation of clients

With the launch of its new checking service, American Express aims to expand its relationship with cardmembers — and not miss out on attracting consumers drawn to debit cards.

By Caitlin Mullen • April 11, 2022 -

CBDC will take years to develop, Yellen says

Despite new technologies, payments often take too long, the treasury secretary said in her first remarks on digital assets since a March executive order on the topic. Regardless of where assets are stored, regulation should be "tech neutral," she said.

By Dan Ennis • April 8, 2022 -

FDIC: Banks should alert agency of their crypto-related pursuits

The regulator said it supports safe and sound innovations, but is concerned that the risks associated with crypto assets and crypto-related activities are not well understood.

By Anna Hrushka • April 8, 2022 -

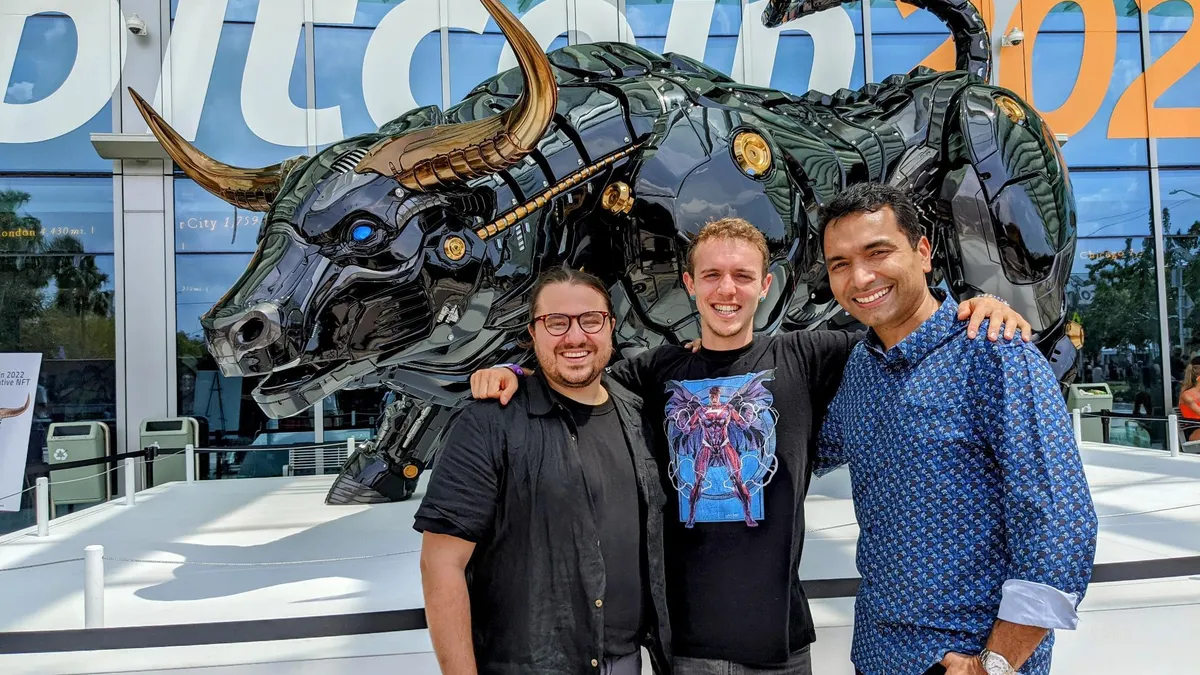

Bolt buys Wyre to get crypto in its wallet

With the $1.5 billion acquisition of cryptocurrency payments firm Wyre, Bolt aims to bring crypto front and center within its online checkout capabilities and digital wallet. Crypto "will be a major part of Bolt’s strategy going forward," said CEO Maju Kuruvilla.

By Caitlin Mullen • April 8, 2022 -

Amazon expands cashierless supermarket chain

The tech juggernaut opened its first full-size checkout free Fresh store on the East Coast last week in suburban Washington, D.C., bringing the chain total to 27 nationwide. That latest opening in Fairfax, Virginia, is the first of four in that suburban area that Amazon plans to open.

By Sam Silverstein • April 8, 2022 -

Crypto buyers see long-term investment value

As cryptocurrency adoption grows worldwide, many Americans are increasingly interested in it, according to several new surveys. However, many consumers acknowledge they still don’t fully understand cryptocurrencies.

By Tatiana Walk-Morris • April 6, 2022 -

Startup Fast abruptly shuts down

The one-click checkout startup announced Tuesday it’s shutting down, despite the CEO promising heady growth this year as recently as January. Fast will "permanently discontinue" its Fast Checkout service on April 15, the company said.

By Caitlin Mullen • April 6, 2022 -

Checkout startup Fast seeks buyer: report

In January, CEO Domm Holland said his company was fielding "incredible demand" from investors and planning big growth this year. Now, the San Francisco-based one-click checkout startup has reportedly hired Morgan Stanley to consider a sale and may lay off hundreds of employees, according to the publication The Information.

By Caitlin Mullen • April 5, 2022 -

Digital outages resolved, Amex says

An American Express spokesperson said Wednesday all systems were working once again, after some customers had encountered website and mobile app outages that persisted through the weekend.

By Caitlin Mullen • Updated April 6, 2022 -

Sen. Cruz seeks to restrict Fed role for CBDC

Sen. Ted Cruz's legislation, which follows a companion House bill introduced earlier this year, would prevent the Federal Reserve from issuing a central bank digital currency directly to consumers.

By Jonathan Berr • April 1, 2022 -

Cross River reaches $3B valuation, eyes global expansion

The banking-as-a-service company, has a sweet spot in payments. Cross River's clients include payments juggernaut Stripe, buy now-pay later provider Affirm and crypto exchange Coinbase.

By Anna Hrushka • March 31, 2022 -

Column

CEOs Sound Off: Confronting a lack of diversity in payments

Payments CEOs recognize the need to draw more women and people of color into the industry, and the need to promote them. To effect change, these CEOs are changing job descriptions, casting a wider net in recruiting and showcasing how they're different.

By Lynne Marek • March 31, 2022 -

Transit app incorporates Apple Pay, Google Pay for fares

An integration between public transportation app Transit and mobile ticketing provider Token Transit aims to make these mobile wallet payment methods available to more commuters across the U.S.

By Caitlin Mullen • March 30, 2022 -

Congress mulls a different digital dollar

While talk of a digital dollar has mainly focused on creation of a central bank digital currency through the Federal Reserve, a group of House Democrats on Monday proposed legislation that pivots in a different direction, creating an electronic dollar through a new program administered by the Treasury Department.

By Lynne Marek • March 29, 2022