Technology: Page 65

-

FIS knocks Fiserv out of No. 2 merchant acquirer spot

In a competitive field of merchant acquirers, FIS bested Fiserv last year as JPMorgan Chase held its lead, according to a ranking from The Nilson Report.

By Caitlin Mullen • May 18, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB carves out new competition angle for oversight

A former CFPB enforcement director told an audience of payments professionals this week that they'd best be prepared for the agency to expand its oversight by way of its markets authority.

By Lynne Marek • May 18, 2022 -

Explore the Trendline➔

Explore the Trendline➔

NatalyaBurova via Getty Images

NatalyaBurova via Getty Images Trendline

TrendlineEmbedded payment tools make inroads

Business customers demanding integrated tools is likely to keep driving a trend toward more embedded payments tools.

By Payments Dive staff -

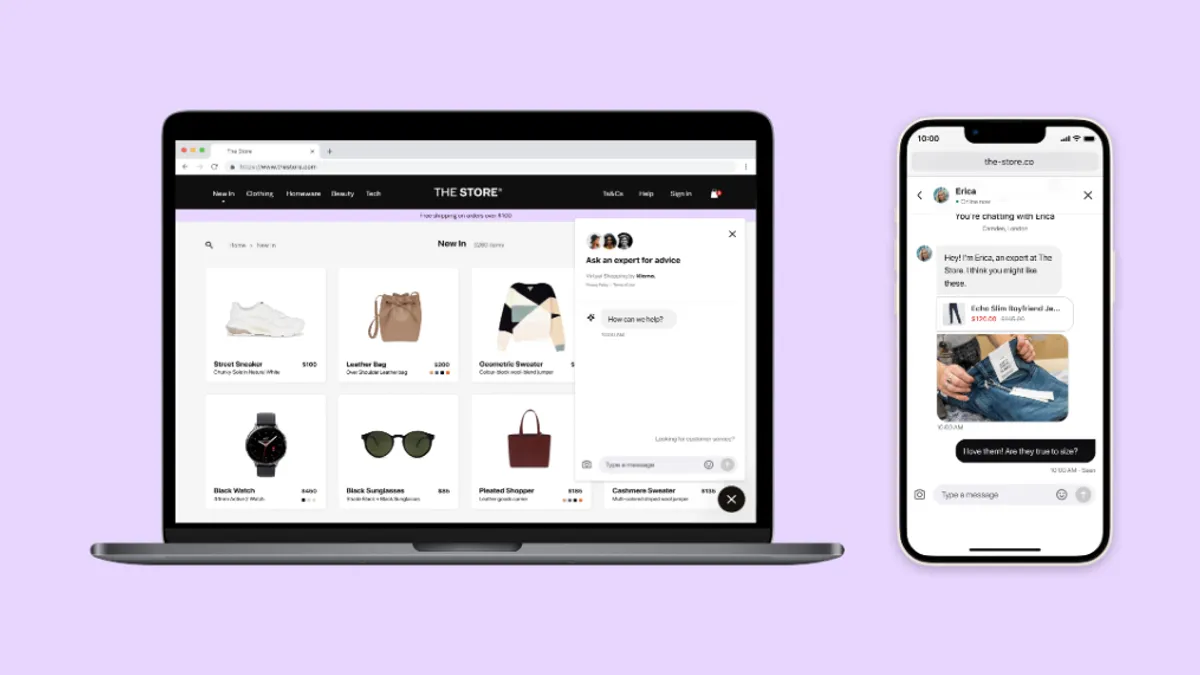

Klarna debuts virtual shopping tool

The platform is adding more services as the buy now-pay later industry faces more regulatory scrutiny.

By Tatiana Walk-Morris • May 17, 2022 -

Amex, Discover get top marks in direct banks survey

The No. 3 and No. 4 card companies, which also hold bank licenses, scored highly in customer satisfaction among online-only banks, J.D. Power found.

By Caitlin Mullen • May 16, 2022 -

Opinion

Are restaurant operators eating too many fees?

"I’ve been disappointed to see how the payments industry is constantly looking for ways to profit off of small businesses in sneaky ways," says Copper CEO Dickson Chu.

By Dickson Chu • May 16, 2022 -

Deserve taps Goldman for credit facility

With the $250 million credit facility from Goldman Sachs and other backers, the Palo Alto, California-based digital card startup aims to keep financing an expanding clientele.

By Caitlin Mullen • May 12, 2022 -

Jack Henry prowls for acquisitions

The payment technology provider aims to start making acquisitions again this year, the CEO said. While potential targets had been too expensive in recent years, the public market's swoon is creating more options now.

By Lynne Marek • May 12, 2022 -

World Bank forecast for cross-border payments rises

The international bank expects remittances to climb 3.7% to $802 billion this year. That's more than was previously expected and the increase is partly due to the upheaval in Ukraine, the World Bank said.

By Jonathan Berr • May 11, 2022 -

Yellen urges stricter stablecoin regulation amid TerraUSD crash

The coin, which relies on an algorithm rather than being backed by dollar reserves, plummeted to 23 cents Wednesday, according to CoinDesk.

By Robin Bradley • May 11, 2022 -

VizyPay carves out a niche catering to rural America

Austin Mac Nab, the CEO and cofounder of Waukee, Iowa-based payments processing firm VizyPay, said the company aims to disrupt the payments landscape by catering to small town businesses.

By Caitlin Mullen • May 11, 2022 -

Self-checkout tech maker Mashgin raises $62.5M

The technology company, which currently partners with convenience stores, cafeterias, hospitals and sports arenas, said it will use the investment to build out its team, quicken expansion and scale globally.

By Catherine Douglas Moran , Sam Silverstein • May 10, 2022 -

EMVCo invites input on new contactless standard

The firm controlled by the card companies has drafted a new contactless technology standard and it's seeking public comment on the specifications. Their plan is to implement a change by yearend.

By Lynne Marek • May 10, 2022 -

Stripe-Plaid squabble erupts

When digital payments company Stripe launched a new service this week, it caught fintech Plaid, one of its customers and partners, by surprise, and not in a good way. Plaid's CEO expressed his displeasure in what has become a Twitter drama.

By Lynne Marek • May 6, 2022 -

Fiserv, Affirm partner on BNPL

Brookfield, Wisconsin-based Fiserv is adding a new buy now-pay later player to its roster. The company said Wednesday that San Francisco-based Affirm will be the first BNPL option integrated into its Carat service, which is directed at larger enterprises.

By Caitlin Mullen • May 5, 2022 -

Toast checks into hotels

Restaurant software company Toast on Tuesday announced its move into the hotel market with Toast for Hotel Restaurants, which it says will provide tools to streamline operations, increase revenue and process room charges directly from its suite of features.

By Alicia Kelso • May 3, 2022 -

Opinion

FTA pushes for remittance fee reform

"We urge Director Rohit Chopra to update the CFPB’s outdated remittance rule and take on the high cost of international payments," the Financial Technology Association says in this op-ed piece.

By Penny Lee • May 2, 2022 -

Sponsored by Modern Treasury

Getting companies to market faster with compliant money movement

Companies don't have time to wait weeks to get a compliance program up to speed; instead they need to effectively manage risk and compliance from day one.

By Matt Marcus • May 2, 2022 -

US payments firms notch venture round record

First-quarter data from research firm CB Insights showed U.S. payments startups saw a 61% spike in funding rounds from the previous quarter, but a 23% drop in total funding.

By Caitlin Mullen • April 29, 2022 -

Fidelity debuts 401(k) bitcoin option

Fidelity Investments said it is seeing growing interest in digital assets from plan sponsors. The offering will be widely available to employers mid-year.

By Kate Tornone • April 28, 2022 -

PayPal cuts back growth plans, again

The digital payments pioneer reduced its revenue growth targets for the second time this year when it reported first-quarter earnings Wednesday. CEO Dan Schulman took responsibility for not delivering, blaming macroeconomic factors affecting the company.

By Lynne Marek • April 28, 2022 -

Clover revenue growth boosts Fiserv earnings

During a Wednesday presentation on first quarter earnings, Brookfield, Wisconsin-based payments company Fiserv said global revenue for its Clover operating system for small and medium-sized businesses grew 39%.

By Caitlin Mullen • April 28, 2022 -

Checkout startup Bolt sued by fashion brand group

Checkout startup Bolt Financial is being sued by Authentic Brands Group, which owns the rights to a pack of brands from Forever 21 to Nautica to Spyder. ABG alleges Bolt's software services led to technology failures and lost sales, but Bolt denies the claims.

By Caitlin Mullen • April 27, 2022 -

US plays catch-up on real-time payments

Other countries, including China and India, are reaping much bigger rewards than the U.S. from their business and consumer adoption of real-time payment systems, according to a new study.

By Lynne Marek • April 26, 2022 -

Crypto bank Anchorage ordered to revamp AML program

The Office of the Comptroller of the Currency said the bank — the first crypto firm to receive a national trust bank charter in January 2021 — must overhaul its anti-money laundering program after failing to implement internal controls for customer due diligence and procedures for monitoring suspicious activity.

By Anna Hrushka • April 25, 2022 -

PayPal CEO's compensation surges

The pay package for Dan Schulman jumped last year to $32 million even as the digital payment company delivered disappointing results for the fourth quarter and cut its revenue growth outlook for this year.

By Lynne Marek • April 22, 2022