Technology: Page 24

-

Stripe to buy stablecoin company Bridge for reported $1.1 billion

The CEOs for Stripe and Bridge confirmed the news on the social media platform X on Monday, but offered few details on the deal.

By Patrick Cooley • Oct. 21, 2024 -

Fiserv may grab competitive edge with new bank charter

The payments processor can undercut rivals on price because it won’t be paying bank fees, say industry consultants.

By Patrick Cooley • Oct. 21, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

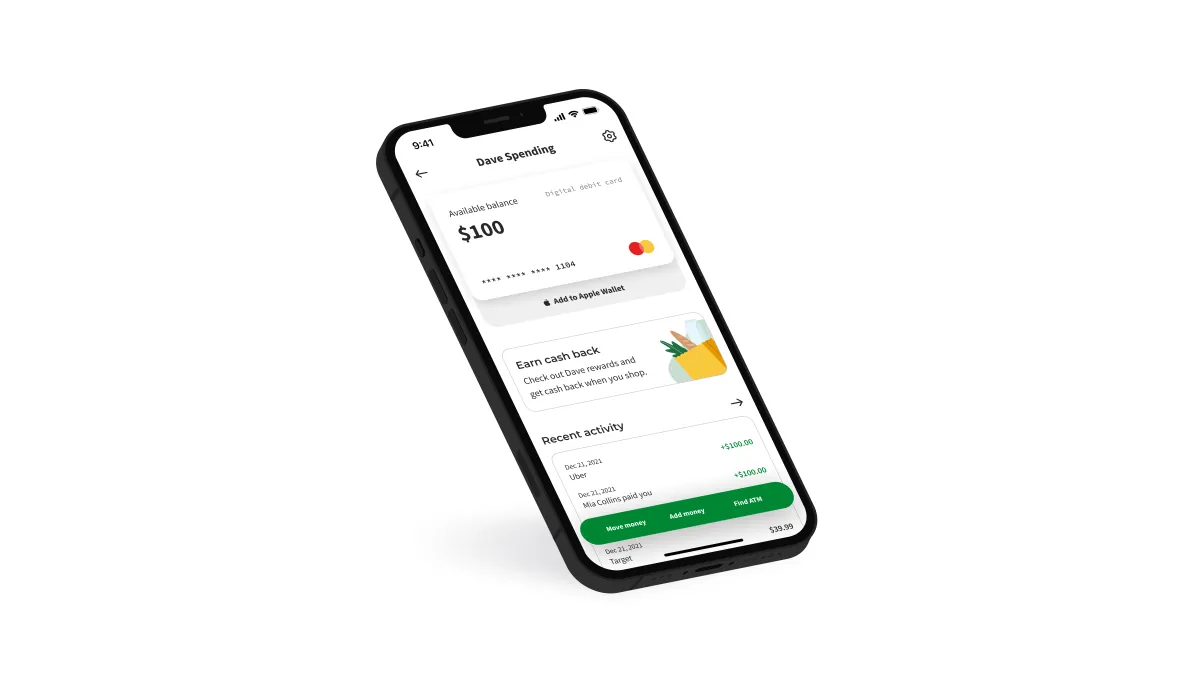

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Employees who lean on EWA face increased fees

Many employees who use earned wage access services are high-frequency customers who end up with higher overdraft costs, said a Center for Responsible Lending report.

By Tatiana Walk-Morris • Oct. 18, 2024 -

Apple, Klarna collaborate on BNPL

The tech giant has linked with the Swedish buy now, pay later provider to offer Apple Pay customers in the U.S. and U.K. another payment option.

By Patrick Cooley • Oct. 18, 2024 -

Visa taps AI analytics partner to add merchant services

The card network giant has signed a new multi-year agreement with the marketing research firm Analytic Partners to deliver advertising insights to merchant clients.

By Lynne Marek • Oct. 16, 2024 -

Payments players tap M&A to build tech stacks

The Fed’s recent interest rate cut could spur even more deal-making in the remaining months of the year and into 2025. Mastercard, Global Payments and Payoneer are among the companies that have bought businesses this year.

By Shefali Kapadia • Oct. 16, 2024 -

Payments investments rise worldwide

Although venture capital investment in young payments firms grew globally during the third quarter, compared with the same period last year, that wasn’t the case for U.S. firms.

By Lynne Marek • Oct. 15, 2024 -

Worldpay taps Aeropay for gaming payments assist

The two payments companies have teamed up to provide account-to-account payments for gaming merchants and their customers.

By Lynne Marek • Oct. 14, 2024 -

Treasury official calls for new regulatory framework

The department’s undersecretary for domestic finance, Nellie Liang, suggested state oversight of money transmitters was outdated in an era of electronic payments.

By Lynne Marek • Oct. 11, 2024 -

Stripe partners with Nvidia, Pepsi and Rivian

The payments software provider announced a slew of new partnerships on Wednesday, also with Amazon and AMC Networks.

By Patrick Cooley • Oct. 11, 2024 -

Automated-checkout company Grabango shuts down

The tech company was unable to secure the funding needed to continue operating, a spokesperson said.

By Brett Dworski , Jeff Wells • Oct. 11, 2024 -

Toast increases processing fees, adds surcharge feature

The digital restaurant payments provider raised processing fees for some restaurant clients. Separately, it’s aiding clients in adding surcharges on their customers’ orders.

By Patrick Cooley • Oct. 9, 2024 -

Global Payments embarks on ‘transition’ year

The payments processor expects to undertake possible divestitures, beginning this year, as part of an effort to jump-start revenue in subsequent years.

By Lynne Marek • Oct. 9, 2024 -

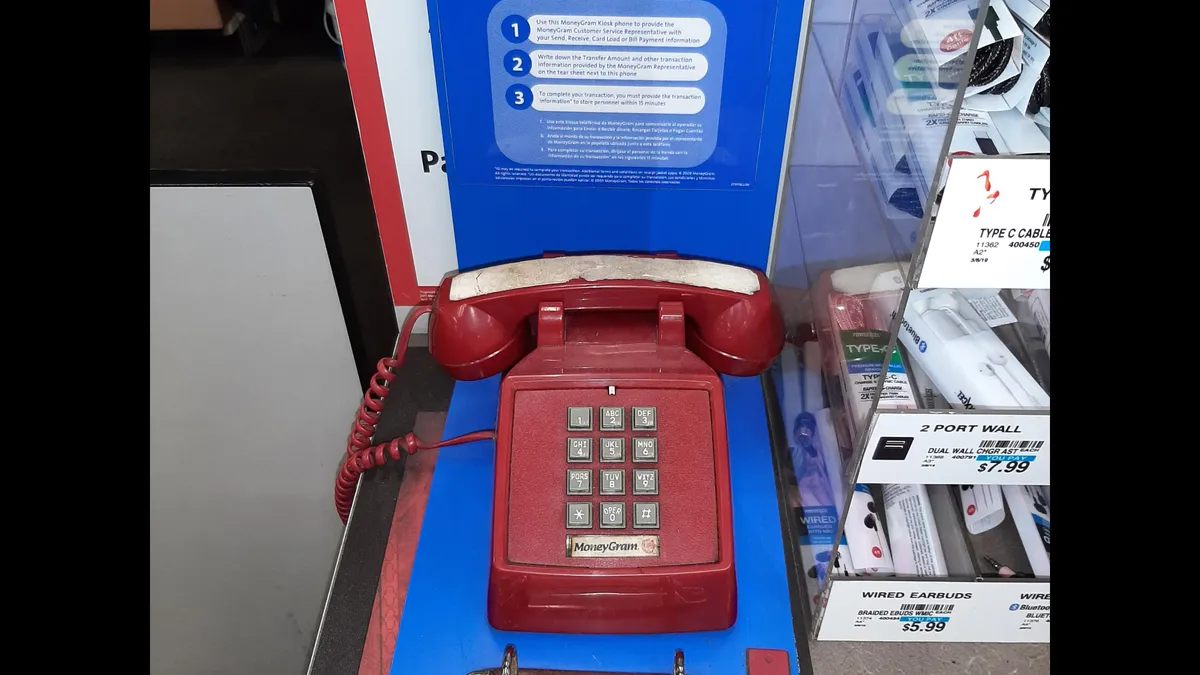

MoneyGram attack exposed sensitive customer data

The attack led to a days-long outage in September. The money transfer firm hasn’t described the nature of the incident or said how many people have been impacted.

By Matt Kapko • Oct. 9, 2024 -

Opinion

Healthcare’s paper check disease

“The persistence of paper checks for patient refunds is not just an inconvenience — it's a symptom of a larger problem that threatens the very sustainability of healthcare organizations,” one software firm CFO writes in this opinion piece.

By Seton Marshall • Oct. 8, 2024 -

Fiserv teams with Canadian company on open banking

Fiserv has allowed Zūm Rails to use its embedded finance system to bring open banking and instant payments to Fiserv’s U.S. business customers.

By Patrick Cooley • Oct. 7, 2024 -

Real-time payments to make uneven progress, report predicts

The number of banks receiving real-time payments will outpace the number of those sending payments through at least 2028, according to a new survey by the U.S. Faster Payments Council.

By Lynne Marek • Oct. 7, 2024 -

Fiserv nets special banking charter in Georgia

The payments processor is only the second company to win the special bank charter since Georgia made it available.

By Patrick Cooley • Oct. 4, 2024 -

Mastercard to buy Minna Technologies

The card network will acquire the Swedish business in a bid to provide consumers with a centralized hub for managing their subscriptions.

By Tatiana Walk-Morris • Oct. 2, 2024 -

P2P payments tools lack transparency, consumer group says

Zelle, the popular peer-to-peer payment service, and rivals should be more upfront with consumers about the ability to ask for money back, Consumer Reports says.

By Patrick Cooley • Oct. 2, 2024 -

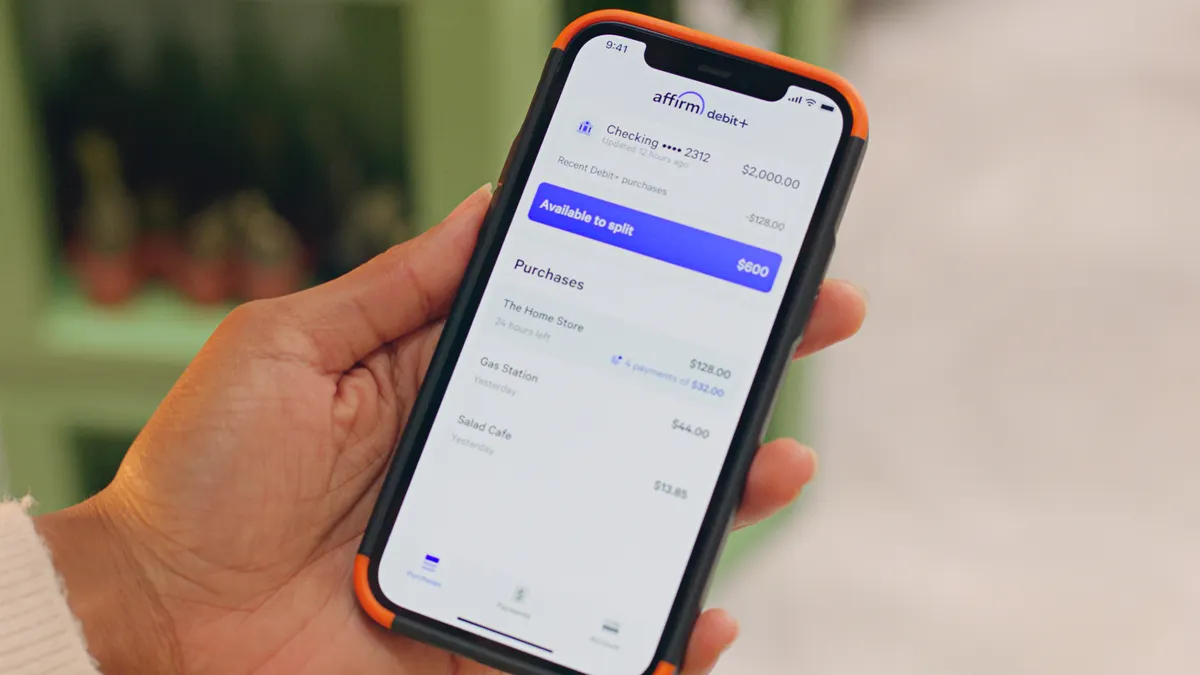

Affirm may offer discounts after Fed interest rate cut

The Federal Reserve’s interest rate reduction may give the company leeway to offer more consumers 0% interest or a lower APR, Affirm CFO Michael Linford said this week.

By Patrick Cooley • Oct. 1, 2024 -

Visa to buy cybersecurity firm Featurespace

The cybersecurity acquisition is the latest move in a race by card networks to meet their clients’ needs in keeping up with fraud threats.

By Lynne Marek • Sept. 26, 2024 -

Retrieved from Lynne Marek on March 04, 2022

Retrieved from Lynne Marek on March 04, 2022

Moneygram faces backlog after outage

The international wire transfer company has restarted some services after a cyberattack, but is battling to fulfill transactions after taking its systems offline for much of the week.

By Lynne Marek • Sept. 26, 2024 -

How Visa stymied big tech rivals

The U.S. lawsuit paints a picture of the dominant card network using lures and threats to stifle competition from competitors Apple, PayPal and others.

By Lynne Marek • Sept. 25, 2024 -

Q&A

Sezzle evolves alongside BNPL industry

The company now offers more products but also faces more regulatory pressure, Sezzle CEO Charlie Youakim told Payments Dive.

By Patrick Cooley • Sept. 25, 2024