Technology: Page 23

-

Shift4 CEO bets on crypto and Trump

The payment processor’s CEO, Jared Isaacman, plans to plunge ahead with a recent crypto initiative, wagering that President-elect Trump will give a boost to the effort.

By Patrick Cooley • Nov. 14, 2024 -

Private sector merits ‘significant’ payments footprint, Waller says

The Federal Reserve must consider when to make up for private sector shortcomings in payments, while keeping its role limited, board member Christopher Waller said Tuesday.

By Tatiana Walk-Morris • Nov. 13, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Klarna files for IPO

The buy now, pay later company announced Tuesday it had filed confidentially with the Securities and Exchange Commission for an initial public offering.

By Patrick Cooley • Nov. 13, 2024 -

Young people fall prey to payments fraudsters

Debit and credit card users under 40 years old are more likely than older peers to experience fraud in making payments, a recent J.D. Power survey found.

By Patrick Cooley • Nov. 12, 2024 -

Will Shift4 scoop up Lightspeed?

The acquisitive payments company could be a good fit with the Canadian point-of-sale technology provider, analysts said Monday.

By Lynne Marek • Nov. 11, 2024 -

Q&A

Open banking to move toward FDX standard

Industry collaboration on open banking is likely to move forward, with or without the CFPB’s recent final 1033 rule, one Jack Henry executive said.

By Lynne Marek • Nov. 11, 2024 -

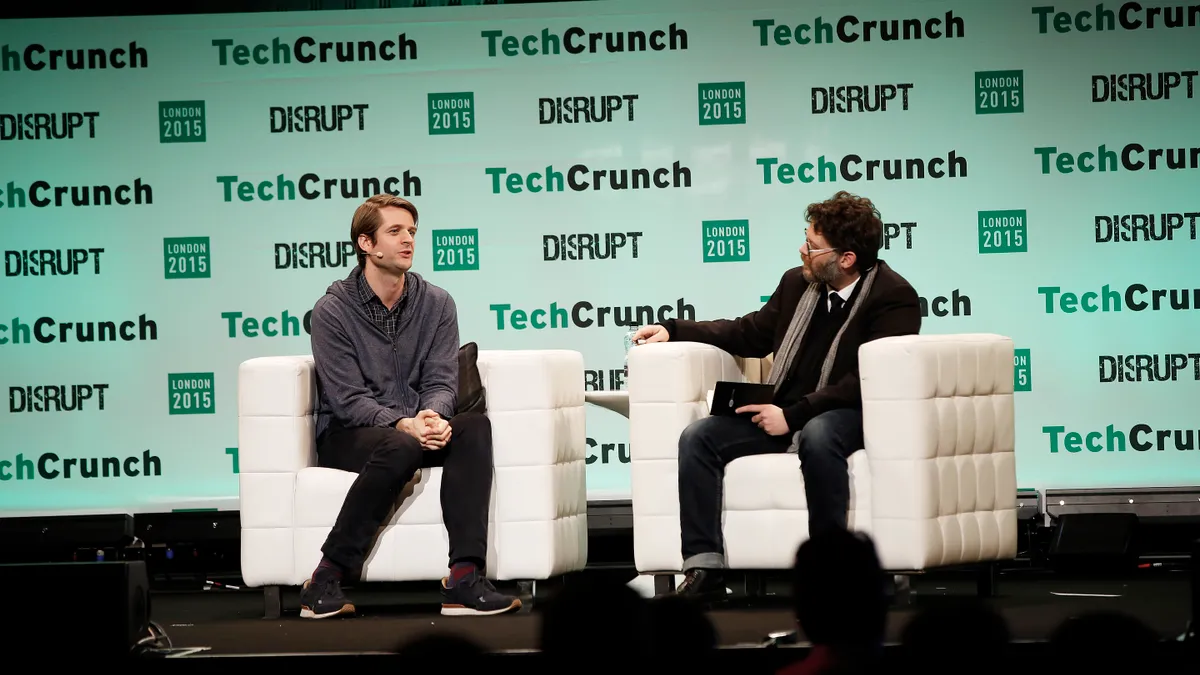

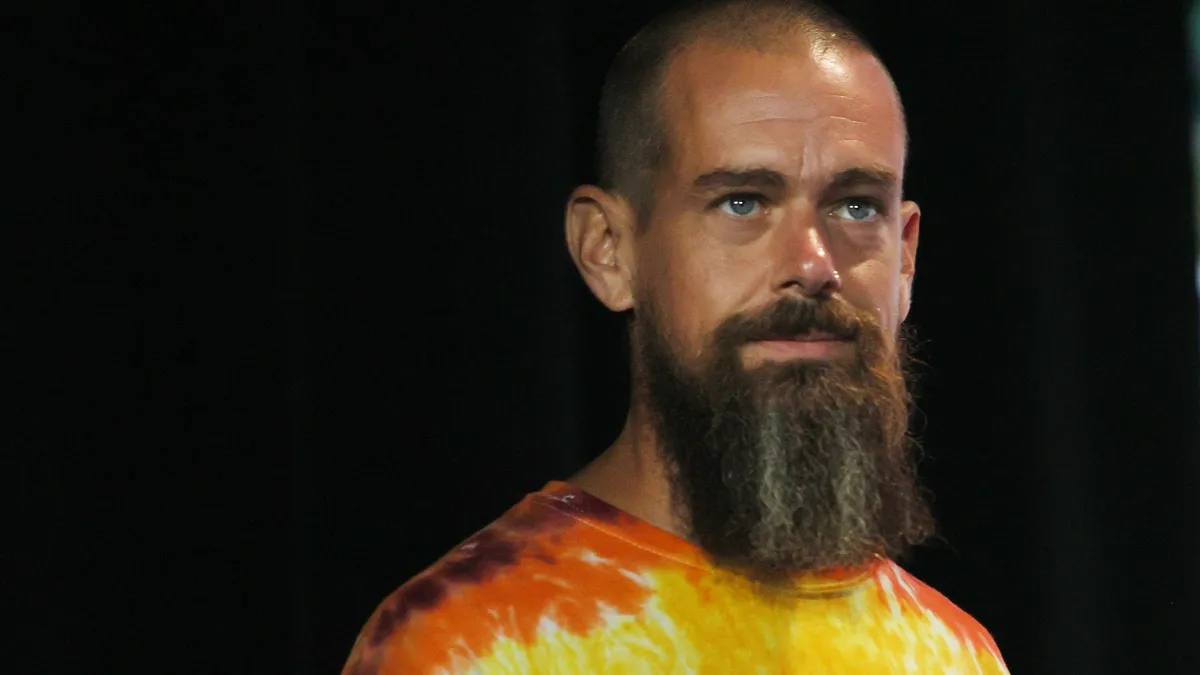

Afterpay to arrive on 24M Cash App cards

The digital payment company’s leader, Jack Dorsey, aims to create lending services that will appeal to millions of U.S. adults who haven’t had access to other forms of credit.

By Patrick Cooley • Nov. 8, 2024 -

How Trump’s administration may rework payments policies

The president-elect and his new administration will have the opportunity to revamp federal government approaches for everything from earned wage access to digital currencies to open banking.

By Lynne Marek and Patrick Cooley • Nov. 7, 2024 -

Paze gets new leader amid slow start

Early Warning Services, the bank-owned company that operates Paze, tapped a new leader last month for the digital wallet operation after slow progress in launching the new service.

By Patrick Cooley • Nov. 7, 2024 -

Q&A

Fiserv exec opens up on Walmart, DoorDash partnerships

Sunil Sachdev, Fiserv’s head of embedded finance, shed light on his company’s latest high-profile collaborations.

By Patrick Cooley • Nov. 6, 2024 -

Sheetz accepting crypto at all locations

After a limited trial run, customers can now use several popular digital currencies to buy items at all of the East Coast retailer’s 750-plus locations.

By Jessica Loder • Nov. 5, 2024 -

Fed aims to make instant payments the norm

“It's going to be up to us to move instant payments from being novel to being normal,” Federal Reserve Financial Services’ chief payments executive told attendees at a major industry conference.

By Lynne Marek and Patrick Cooley • Nov. 5, 2024 -

Mastercard gains edge in ancillary services

The card network is besting its larger rival Visa in the sale of cybersecurity and data services, at least according to one set of analysts who reviewed their recent results.

By Lynne Marek • Nov. 5, 2024 -

Stablecoins face obstacles to widespread adoption

The digital currencies could simplify cross-border payments, but consumers are wary of using them, payments and fintech executives say.

By Patrick Cooley • Nov. 4, 2024 -

Paytronix acquired by Access Group

The deal will expand the offerings available through Paytronix’s platform and help accelerate its growth, executives said.

By Jessica Loder • Nov. 4, 2024 -

5 payments predictions from research firm Forrester

Cash use worldwide will drop significantly next year, despite its U.S. persistence, the research firm Forrester predicts. Meanwhile, business-to-business acquisitions in the payments realm will pick up.

By Tatiana Walk-Morris and Lynne Marek • Nov. 1, 2024 -

AI increases fraud risk, fintechs say

Financial firms monitor for fraud by looking for unusual activity, but an artificial intelligence model can be trained to transact like a real person.

By Patrick Cooley • Oct. 31, 2024 -

Global Payments sells AdvancedMD for $1.1B

The payments processor divested the unit as part of a plan to streamline the company’s business, and it’s targeting more sales, CEO Cameron Bready said.

By Lynne Marek • Oct. 30, 2024 -

MoneyGram cites cash-to-digital conversion opportunity

A MoneyGram executive speaking at the Money 20/20 conference cooed about the trillion-dollar opportunity to lure cash users to digital options, but didn’t mention the company’s recent systemwide outage.

By Lynne Marek and Patrick Cooley • Oct. 30, 2024 -

Retrieved from Lynne Marek on March 04, 2022

Retrieved from Lynne Marek on March 04, 2022

MoneyGram replaces CEO, naming former Walmart executive to the role

The money transfer company named the new CEO just weeks after a cyberattack led to a systemwide shutdown of its services for several days.

By Lynne Marek • Oct. 29, 2024 -

Finix eyes competition with rivals like Stripe

The payment processor said Thursday that it raised $75 million and is seeking to grab a bigger slice of a payments market dominated by larger rivals.

By Patrick Cooley • Oct. 25, 2024 -

Payments trade groups caution World Bank on digital infrastructure

U.S. payments associations urged the World Bank this week to consider interoperability and private sector involvement in its development of a digital public infrastructure.

By Tatiana Walk-Morris • Oct. 24, 2024 -

California to begin oversight of EWA

The state instituted regulations Tuesday that will require earned wage access providers to register and be regulated as of next February.

By Lynne Marek • Oct. 23, 2024 -

Pipe pursues international expansion

The digital cash advance provider to small businesses deepened its ties to the British firm GoCardless this week as part of its quest to expand outside the U.S. market.

By Lynne Marek • Oct. 23, 2024 -

CFPB issues final rule on open banking

In a change from last year’s proposal, payment apps are included under the rule. Financial institutions with less than $850 million in assets are exempt.

By Dan Ennis • Oct. 22, 2024