Risk: Page 20

-

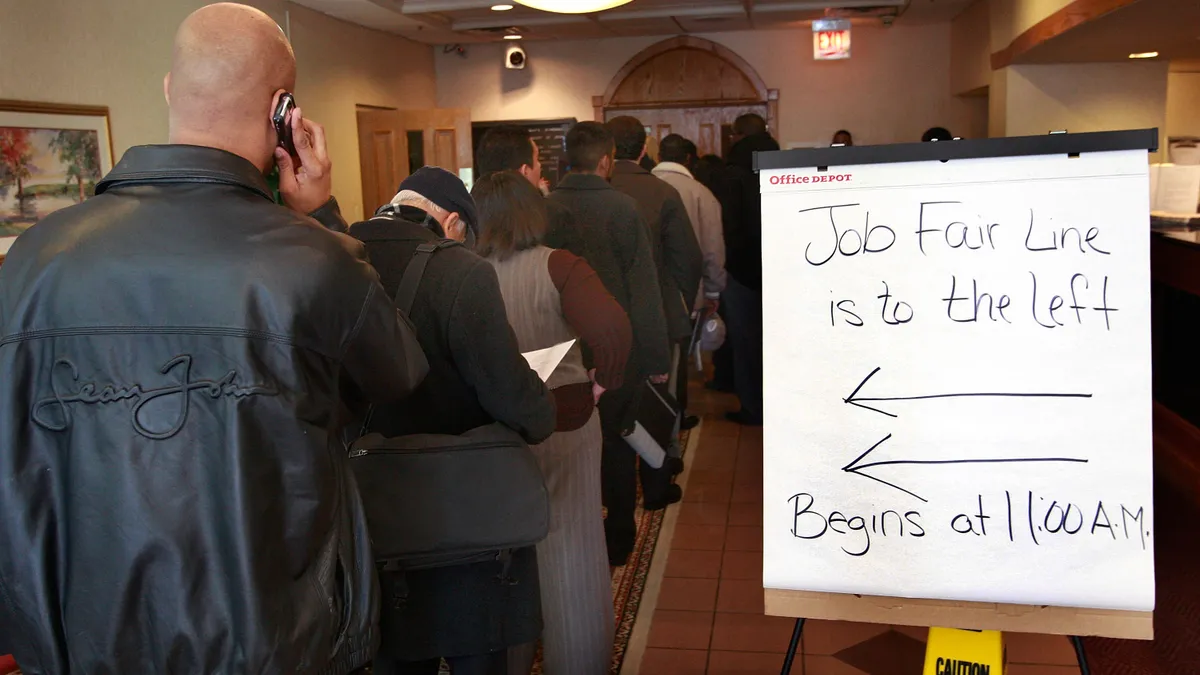

Job cuts piled up in payments this year

Payments companies chopped jobs as they confronted challenges posed by inflation and stagnating e-commerce growth.

By Caitlin Mullen • Dec. 21, 2022 -

Consumer credit metrics slip further

Discover Financial Services and Synchrony Financial this week each reported increases in delinquencies and charge-offs.

By Caitlin Mullen • Dec. 16, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

BofA analysts downgrade Affirm, Discover, Synchrony

Exposure to consumer credit risk and lower-income spending is significant for those three payments companies, analysts warned Tuesday.

By Caitlin Mullen • Dec. 14, 2022 -

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Discover pulls back on debit product

The card company has suspended applications for its checking and cashback debit product due to instances of fraud, its CEO said this week.

By Caitlin Mullen • Dec. 8, 2022 -

PayPal CEO gives gloomy forecast

PayPal CEO Dan Schulman said he doesn’t expect the global economy or retail activity to improve in 2023, especially with the war in Ukraine dogging Europe.

By Lynne Marek • Dec. 8, 2022 -

FTX fallout spurs regulatory fears

Payments industry professionals, including at the software security firm Fireblocks, worry that the crypto exchange’s downfall could trigger a regulatory backlash against digital assets.

By Caitlin Mullen • Dec. 6, 2022 -

Harvard researchers flag BNPL risks

The working paper shines a spotlight on BNPL risks just as the payment method lures more consumers amid high inflation.

By Caitlin Mullen • Dec. 1, 2022 -

Banks discuss refund rule for customers defrauded on Zelle: report

Under measures being discussed, banks would share liability inside Zelle’s system and guarantee to reimburse one another, sources told The Wall Street Journal.

By Anna Hrushka • Nov. 28, 2022 -

Demand for credit cards climbed this year

Consumer demand for credit cards rose this year over prior years, and card issuers increasingly approved their applications despite the worsening economic climate.

By Lynne Marek • Nov. 22, 2022 -

Card debt mounts for younger, less affluent borrowers

Debt burdens and delinquencies are rising more rapidly for younger and less wealthy borrowers, the New York Federal Reserve Bank researchers said.

By Caitlin Mullen • Nov. 18, 2022 -

Column

Can Congress come together on crypto?

Perhaps even a divided Congress can make bipartisan headway in crafting a regulatory framework for crypto following the FTX failure.

By Lynne Marek • Nov. 17, 2022 -

Q&A

CEOs Sound Off: Payments forecasts for 2023

The CEOs of Brex, Splitit and Paystand weigh in on what’s to come in the year ahead, commenting on the trends, challenges, regulation and M&A.

By Caitlin Mullen , Lynne Marek • Nov. 16, 2022 -

Discover concludes student loan probe

While the card company said it has finished its own investigation into its student loan servicing practices, it may still be subject to regulatory probes.

By Caitlin Mullen • Nov. 16, 2022 -

FTX files for bankruptcy, CEO steps down

FTX.com’s assets were frozen in the Bahamas, where the company is headquartered. Crypto lender BlockFi also paused withdrawals because of its exposure to FTX.

By Gabrielle Saulsbery • Nov. 11, 2022 -

FIS targets $500M in cost cuts

The digital payments company is aiming to cut costs by streamlining operations, reducing capital expenditures and pulling back on vendor contracts.

By Jonathan Berr • Nov. 9, 2022 -

Tracker

How active shooters pay for guns

Payment methods used by active shooters to acquire guns are becoming part of the U.S. dialogue about such incidents. A Payments Dive series tracking those details seeks to inform the discussion.

By Payments Dive staff • Updated Dec. 13, 2022 -

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Retrieved from Global Payments Spokesperson Matt Cochran on September 10, 2021

Global Payments leans into fintechs

As it pursues more fintech clients, the payments processor sees B2B and commercial cards as areas ripe for expansion.

By Jonathan Berr • Nov. 3, 2022 -

6 payments takeaways from big consulting firms

Recent reports from Ernst & Young, Forrester Research and McKinsey examined forces at play in the payments industry, from “swipe” fee frustration to open banking and cross-border payments trends.

By Caitlin Mullen , Lynne Marek , Jonathan Berr • Nov. 2, 2022 -

Sponsored by Banked

Mitigating fraud in the payments industry

Cybercrime countermeasures are essential to protecting private banking data. Here’s how fintech innovators can protect customer data.

Oct. 31, 2022 -

Visa eyes 2023 growth, sidesteps threats for now

“Should there be a recession, or a geopolitical shock that impacts our business...we will, of course, adjust our spending plans,” Visa’s CFO said.

By Lynne Marek • Oct. 27, 2022 -

Ukraine raises fraud concerns, Stripe exec says

The war in Ukraine raised the stakes for payment fraud detection, as bad actors devise more complex ways of evading oversight.

By Suman Bhattacharyya • Oct. 26, 2022 -

Synchrony delivers mixed results

While the financial services company’s third-quarter income rose over the year-earlier period, net earnings sagged. Synchrony also increased credit loss provisions.

By Jonathan Berr • Oct. 26, 2022 -

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Discover tightens underwriting

Count the card company among those that added to credit loss provisions in the third quarter as economic conditions soured.

By Caitlin Mullen • Oct. 26, 2022 -

Column

Fintechs party like it’s 2021 at Money 20/20

Thousands of payments and fintech professionals at the Money 20/20 conference in Las Vegas this week are racing ahead with high-growth businesses, even as a drop-off in capital threatens to ruin the celebration.

By Lynne Marek • Oct. 25, 2022 -

Fiserv divestiture hints at strategy shift

As payments companies face economic headwinds, Fiserv and its peers “may try to focus on their strongest market positions versus more ancillary opportunities,” said Oppenheimer & Co. analyst Dominick Gabriele.

By Caitlin Mullen • Oct. 24, 2022