Risk: Page 2

-

Consumers push back on swipe fees: survey

A third of merchants reported customers cancelling purchases when a credit card surcharge is included in their bill, analytics firm J.D. Power found.

By Patrick Cooley • Jan. 20, 2026 -

Afterpay tallies BNPL repayments

Most Afterpay customers have repaid their Black Friday and Cyber Monday purchases, the company said, pushing back on consumer “debt spiral” concerns.

By Tatiana Walk Morris • Jan. 20, 2026 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

FTC blasts payments processor Cliq

The Federal Trade Commission lashed out at the firm formerly known as CardFlex, saying this week it should pay $52.9 million to consumers.

By Lynne Marek • Jan. 16, 2026 -

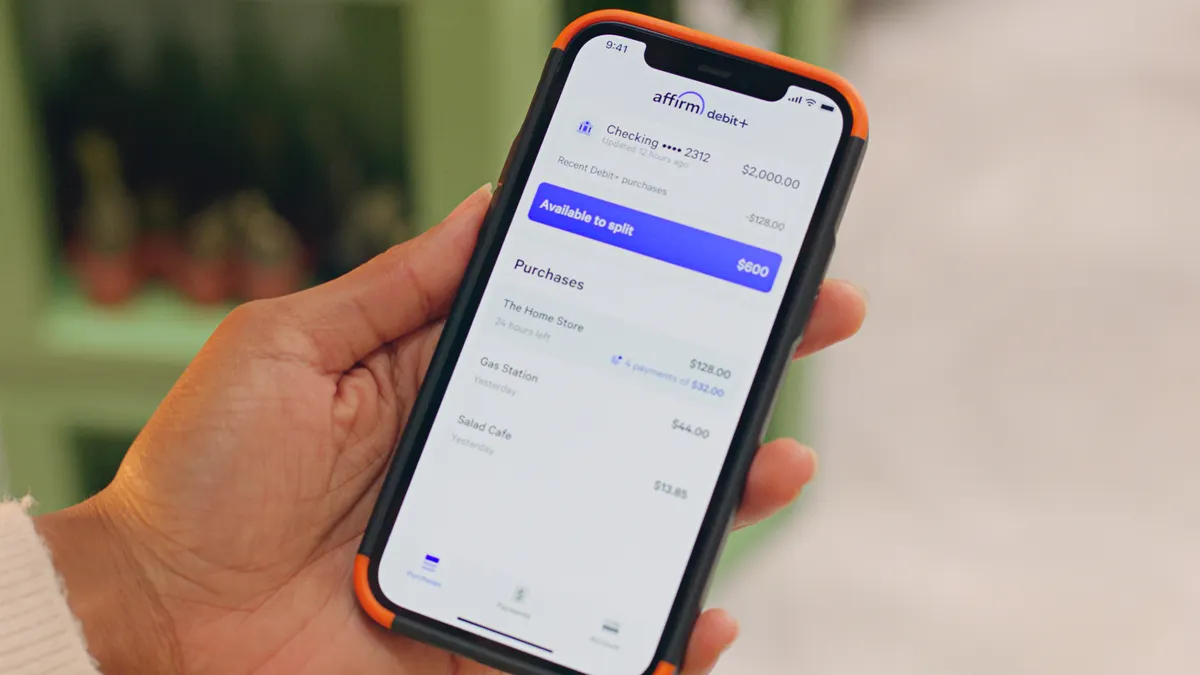

Affirm to offer BNPL for rent

The buy now, pay later player is one of the first to offer pay later installment financing for tenants paying their monthly rent.

By Patrick Cooley • Jan. 15, 2026 -

House Democrat joins EWA effort

Earned wage access providers support a forthcoming bipartisan House bill that would provide federal regulation, overriding state laws.

By Justin Bachman • Jan. 15, 2026 -

Checkout.com grabs special banking charter

The payments processor received conditional approval for Georgia’s merchant acquirer limited purpose bank charter.

By Patrick Cooley • Jan. 12, 2026 -

Stripe to enable crypto payments

A collaboration with Crypto.com announced Tuesday will allow consumers to make payments to merchants with digital currencies.

By Patrick Cooley • Jan. 9, 2026 -

Fiserv’s Clover adopts biometrics

Customers will be able to make payments by scanning their face or palm at merchants that use the subsidiary’s point-of-sale service.

By Patrick Cooley • Jan. 7, 2026 -

Klarna faces investor lawsuit

The buy now, pay later company understated the risks of its consumer loans, the legal action alleges.

By Patrick Cooley • Jan. 5, 2026 -

Klarna, Shift4 embrace stablecoins

Both companies announced stablecoin ventures in the past week.

By Patrick Cooley • Dec. 23, 2025 -

Fiserv, Visa unite on agentic tools

The payment processor plans to partner with card networks, also including Mastercard, to cater to merchants navigating agentic commerce.

By Patrick Cooley • Dec. 22, 2025 -

Q&A

Can transparency curb synthetic fraud?

Giving consumers a deeper look into their data will reduce payments fraud, the president of checkout software firm Bolt contends.

By Justin Bachman • Dec. 22, 2025 -

Cross-border payments goals remain elusive

G20 nations have inched ahead in making cross-border payments more efficient and affordable, but progress has been uneven, says a new BIS study.

By Tatiana Walk-Morris • Dec. 18, 2025 -

Mobile phone IDs may help fight fraud

Biometric features in Apple iPhones and Google’s Android-based devices can pair with digital identifications to combat fraud, two U.S. House members said.

By Justin Bachman • Dec. 18, 2025 -

BNPL connected to poor mental health: study

Johns Hopkins University researchers have spotted a link between people with mental health conditions and those that have used buy now, pay later loans.

By Patrick Cooley • Dec. 18, 2025 -

Amex CEO slams surcharges

Steve Squeri said higher surcharges would be a negative experience for the card network’s customers.

By Patrick Cooley • Dec. 16, 2025 -

BNPL loan values rise, CFPB says

The average size of buy now, pay later loans grew and use of the payment method inched up, a Consumer Financial Protection Bureau study said.

By Patrick Cooley • Dec. 15, 2025 -

Opinion

Stablecoins are inevitable in cross-border payments

The digital currency is already demonstrating its value across a variety of use cases in multiple markets, a cryptocurrency executive writes.

By Rocio Rodriguez Saa • Dec. 12, 2025 -

Stripe digs deeper into crypto

The digital payments player bought a crypto-focused digital wallet, and its Privy unit has joined with Klarna to develop a crypto wallet.

By Patrick Cooley • Dec. 11, 2025 -

Why Block created a credit score

The digital payments company has services like Cash App and Afterpay that are largely used by young customers who lack credit histories.

By Patrick Cooley • Dec. 10, 2025 -

Payments players cozy up to crypto

Banks, card networks and fintechs are issuing stablecoins, and embracing the digital currency infrastructure to usher clients into a new financial era.

By Patrick Cooley • Dec. 9, 2025 -

Visa’s new program vexes merchants

The card giant’s revamped system for assessing interchange fees on credit card transactions has socked some merchants with higher costs.

By Lynne Marek • Dec. 9, 2025 -

Fiserv faces security issue lawsuit

A civil complaint alleges the payment processor misled its customers about the use of two-factor authentication to access systems containing sensitive information.

By Patrick Cooley • Dec. 8, 2025 -

FinCen targets illegal remittances

The federal government’s financial security enforcement arm urged money transfer businesses to be on the lookout for illegal cross-border transfers.

By Lynne Marek • Dec. 5, 2025 -

Former PayPal execs invest in Sokin

The former C-suite executives pitched in to help the cross-border payments startup raise $50 million as it seeks to expand internationally.

By Tatiana Walk-Morris • Dec. 4, 2025