Risk: Page 18

-

Michigan State shooter tapped cash, debit card

A gunman who killed three Michigan State University students in February used more than one payment method to buy guns. This coverage is part of a Payments Dive series.

By Debbie Carlson • June 15, 2023 -

Banks too slow to address P2P payment scams, CFPB’s Chopra says

“They have been very slow to take action,” the bureau’s director said Tuesday, when asked if banks were creating frameworks to combat fraud and scams conducted on peer-to-peer payment platforms.

By Anna Hrushka • June 14, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Affirm CFO acknowledges ‘difficult environment’

Bank failures and macroeconomic challenges have made capital markets challenging to navigate, Affirm CFO Michael Linford said.

By Caitlin Mullen • June 9, 2023 -

Fed, FDIC, OCC update guidance on third-party risk management

The guidance is aimed at helping banks address the operational, compliance and strategic risks of third-party tie-ups, such as those with fintech firms.

By Anna Hrushka • June 8, 2023 -

Republicans draft crypto legislation

The discussion draft, which addresses how digital assets can be defined, represents the most comprehensive federal legislative development in the crypto sphere this year.

By Gabrielle Saulsbery • June 5, 2023 -

CBDCs offer benefits, risks

Central bank digital currencies, which are being tested around the world, could increase the efficiency of cross-border payments, but there are associated risks, according to a trade group report.

By Lynne Marek • June 5, 2023 -

Amex beats back gift card scams

The card company is “putting a lot of time and effort” into preventing customers from being victims of those scams, CEO Steve Squeri said.

By Caitlin Mullen • June 5, 2023 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB slaps warning on P2P

The federal agency told consumers that money sitting in uninsured accounts, such as some offered by PayPal, Venmo and Cash App, could be at risk.

By Lynne Marek • June 2, 2023 -

Deep Dive

Payments fraud climbs as banks reach for joint response

Financial institutions and payments players are seeking to coalesce around new efforts to battle skyrocketing payments fraud.

By Lynne Marek • May 25, 2023 -

Card debt weighs on consumers

First-quarter credit card balances jumped 17% over the same period last year, according to New York Fed data.

By Caitlin Mullen • May 16, 2023 -

Affirm, FICO to create BNPL credit-scoring model

The “first-of-its-kind” model will enable buy now, pay later loans to be factored into lending decisions, Affirm’s CEO said.

By Caitlin Mullen • May 10, 2023 -

Block boosts compliance spending to $160M

Square parent Block is increasing compliance spending on personnel and software this year.

By Caitlin Mullen • May 5, 2023 -

Finix takes aim at processor incumbents

Now certified as a processor, Finix seeks to take on legacy and fintech rivals.

By Caitlin Mullen • May 3, 2023 -

Mastercard ‘cannot afford to ignore’ AI, CEO says

The card network company is considering using artificial intelligence in more ways, including in customer service, CEO Michael Miebach said.

By Caitlin Mullen • April 28, 2023 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Payments increasingly in regulatory crosshairs, industry lawyers say

Attorneys and payments professionals called out recent areas of interest for regulators during the Electronic Transactions Association’s conference in Atlanta.

By Caitlin Mullen • April 27, 2023 -

Profits slip for Amex, Discover

In light of rising charge-offs, the card companies on Thursday each reported adding to credit loss provisions. That put a dent in their first-quarter profits.

By Caitlin Mullen • April 21, 2023 -

Synchrony signals openness to Walmart

Despite Synchrony Financial’s history with Walmart, the card issuer may be willing to work with the retailer again.

By Caitlin Mullen • April 20, 2023 -

NCR in recovery as ransomware disrupts widely used point-of-sale system

In-restaurant purchases are still being processed on NCR Aloha, but other capabilities and business processes remain down, the company said.

By Matt Kapko • Updated April 24, 2023 -

CFPB focuses on BNPL consumer disputes

A Consumer Financial Protection Bureau official pointed to how buy now, pay later providers handle consumer disputes as a major area of concern for the agency.

By Lynne Marek • April 19, 2023 -

Visa remains cryptic about new surcharge cap

The card giant is set to impose a new surcharge cap of 3% tomorrow, but many payments processing professionals are still searching for details about it.

By Lynne Marek • April 14, 2023 -

CFPB director wants some payments firms labeled systemically important

The bureau's chief, Rohit Chopra, urged users who maintain balances on their digital wallets and money-transfer apps to move that uninsured money to a bank account.

By Anna Hrushka • April 12, 2023 -

North American Bancard taps Virtualitics’ AI tech

The artificial intelligence and data analytics company aims to help North American Bancard protect its merchants from payment processing fraud, Virtualitics CEO Michael Amori said.

By Tatiana Walk-Morris • April 7, 2023 -

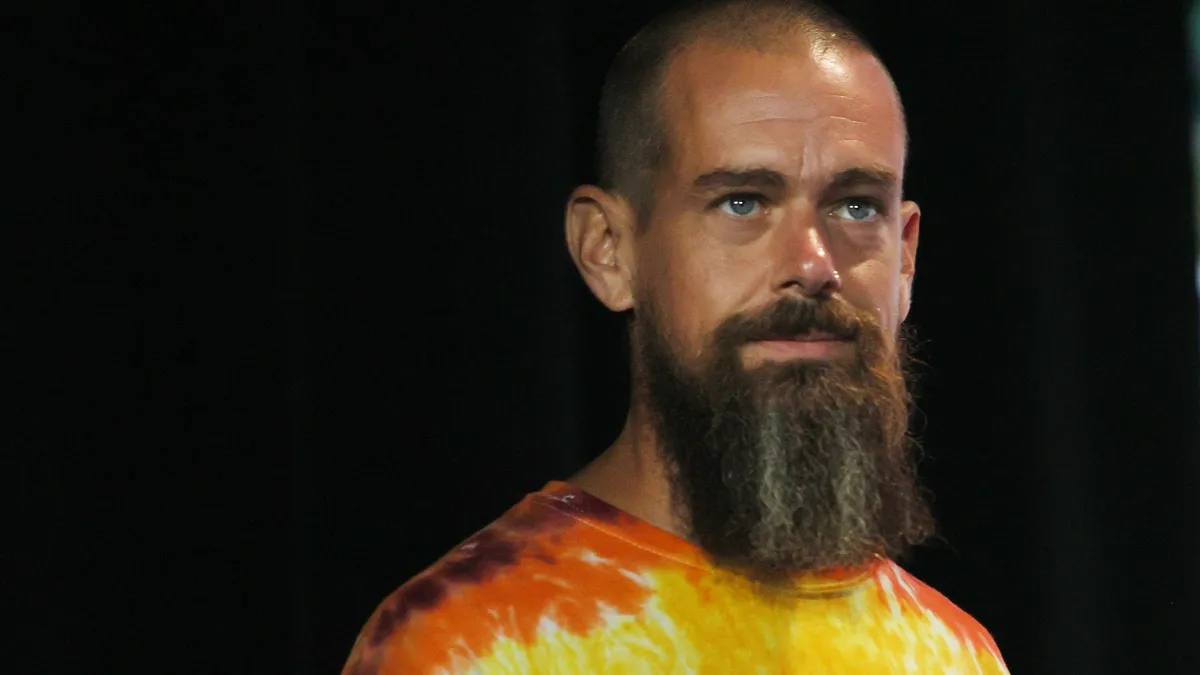

Block defends against short seller allegations

The Jack Dorsey-led digital payments company pushed back by underscoring fraud mitigation tactics and account metrics for its Cash App business.

By Caitlin Mullen • March 30, 2023 -

Analysts call on Block to share anti-fraud details

Following a controversial short seller’s report, analysts advised digital payments company Block to share more information related to active user numbers and know-your-customer practices.

By Caitlin Mullen • March 29, 2023 -

BNPL remains mainly absent from consumer credit histories

The lack of BNPL data being furnished to credit bureaus more than a year after inclusion efforts were announced points to the complexity involved with fitting the burgeoning payment method into the traditional credit scoring framework.

By Caitlin Mullen • March 27, 2023