Retail: Page 55

-

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Walmart lashes back at FTC over money-transfer lawsuit

In a fiery rebuttal to the Federal Trade Commission lawsuit last week, the nation’s biggest retailer is already doing battle in the court of public opinion.

By Lynne Marek • July 6, 2022 -

Retrieved from Lynne Marek on March 04, 2022

Retrieved from Lynne Marek on March 04, 2022

Wyre ties to new MoneyGram crypto-cash services

The crypto payment company that partners with digital wallet providers said it’s providing its 15 million end-users worldwide with the ability to load or cash out of digital currencies.

By Tatiana Walk-Morris • July 6, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

ABG settles lawsuit with Bolt

With the settlement, the brand licensing company has acquired a stake in the online checkout startup.

By Caitlin Mullen • July 6, 2022 -

Retrieved from Outside spokesperson Daniel Gerardi on March 29, 2022

Retrieved from Outside spokesperson Daniel Gerardi on March 29, 2022 Opinion

OpinionFrom a payments CEO: 5 discriminatory behaviors that need to go

“Until the industry addresses this blatant lack of advocacy for women in leadership, it will continue to foster a culture where women can’t thrive,” says Stax CEO Suneera Madhani.

By Suneera Madhani • June 30, 2022 -

Self-checkout terminal sales jump: report

Cashless systems are growing in popularity, with the sale of self-checkout terminals expected to surge 50% to 300,000 annually by 2027, according to an industry research firm.

By Tatiana Walk-Morris • June 29, 2022 -

FTC sues Walmart over money transfer services

The federal agency said Tuesday that the big retailer allowed money transfer fraud that “fleeced customers out of hundreds of millions of dollars.”

By Lynne Marek • June 29, 2022 -

There's cheaper gas if you pay with cash

About a third of convenience stores are now giving a discount to consumers who pay for gas with cash, according to the results of a retailer survey issued this week.

By Jonathan Berr • June 29, 2022 -

Fundbox nudges SMBs to shift strategies in face of inflation

The San Francisco-based provider of credit and payment solutions to small businesses recently announced partnerships with both card network Visa and payment processing platform Stripe.

By Grace Noto • June 28, 2022 -

Wagestream jumps into US on-demand pay fray

With $175 million in recently raised capital, the British new entrant in the U.S. earned wage access arena is setting lofty goals for expansion.

By Lynne Marek • June 28, 2022 -

PayPal launches small business credit card

The digital payments company is targeting small business owners as they seek credit financing and loans.

By Tatiana Walk-Morris • June 28, 2022 -

Bed Bath & Beyond adds BNPL option

The retailer said its buy now-pay later option, Welcome Pay, allows customers to pay for purchases in four payments.

By Caroline Jansen • June 27, 2022 -

BNPL faces tough economic challenges

Evidence suggests that BNPL borrowers are increasingly having trouble paying off their loans, based on a report from one analyst who follows the U.S. buy now-pay later provider Affirm.

By Jonathan Berr • June 27, 2022 -

PayPal changes up its pricing

In a move that could increase or decrease charges for merchants, the company said it aims to better distinguish between personal and commercial payments on its system.

By Lynne Marek • June 24, 2022 -

EVO Payments finds deals harder to come by, CEO says

EVO Payments has grown over the past decade through dozens of acquisitions, but it’s not so eager to buy now.

By Jonathan Berr • June 23, 2022 -

Alo Yoga accepts crypto payments, allows crypto paychecks

The direct-to-consumer lifestyle brand is betting big on Web3 technology, although U.S. data suggest minimal usage of crypto for purchasing goods.

By Dani James • June 22, 2022 -

Mastercard expands sonic branding with 'Priceless' album

The multi-artist album, a first-time marketing move by the card company, features original songs that incorporate Mastercard’s brand sound.

By Chris Kelly • June 22, 2022 -

Mastercard shareholders reject ghost guns proposal

A shareholder who is also a state official and candidate for Congress urged the card giant’s board to issue a report related to untraceable guns, but the proposal didn’t win enough support to pass at the company’s annual meeting.

By Caitlin Mullen • June 22, 2022 -

Opinion

Friendly fraud: How should fintechs view the risks?

With friendly fraud, fintechs don’t always consider the whole picture when it comes to fraudulent disputes.

By Sarah Mirsky-Terranova • June 21, 2022 -

Discover eyes benefits of downturn

As smaller fintechs grapple with restructuring challenges, the card company expects there will be more opportunities for it in hiring talent and acquiring businesses.

By Caitlin Mullen • June 21, 2022 -

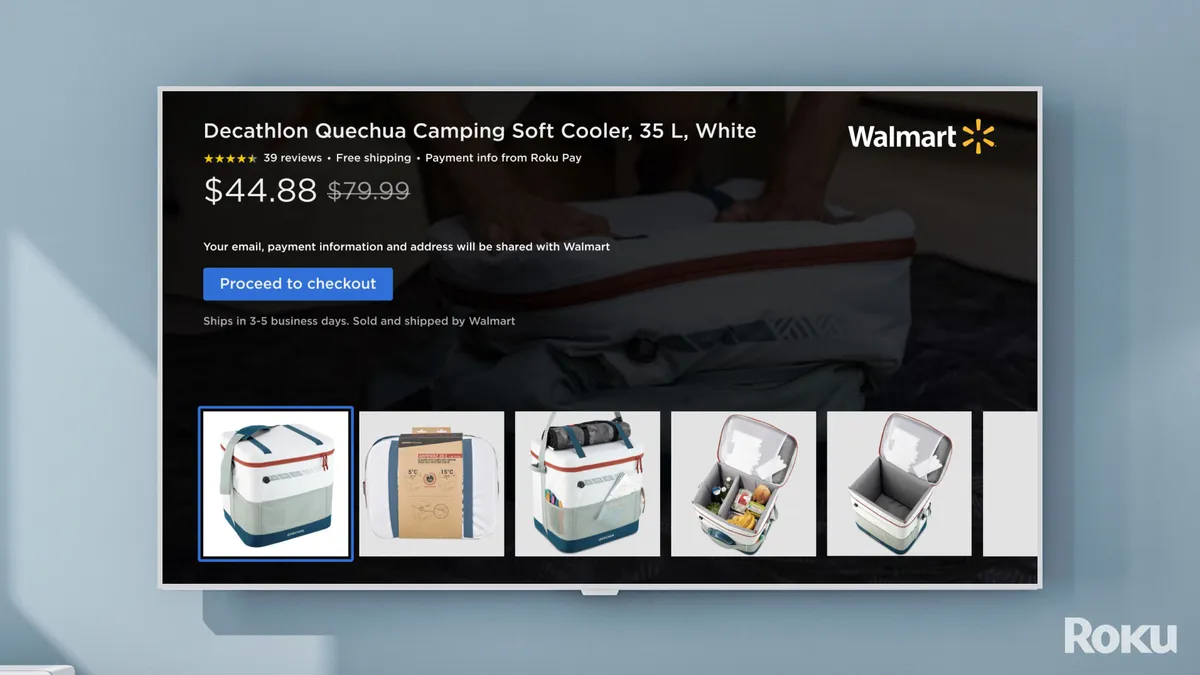

Walmart, Roku partner to evolve shoppable streaming ads 'beyond the QR code'

The mega-retailer is the exclusive partner on a new Roku feature that allows people to purchase products by clicking on ads with their remote.

By Peter Adams • June 17, 2022 -

Opinion

Card fees: the price hike nobody is talking about

"The Visa-Mastercard duopoly controls about 80% of the market share, allowing them to raise fees indiscriminately and with no formidable opposition," contends Doug Kantor, general counsel for the National Association of Convenience Stores.

By Doug Kantor • June 17, 2022 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB urges standardization in BNPL credit reporting

The agency isn’t pleased about the three big credit reporting bureaus taking different approaches to tracking consumer data for buy now-pay later financing.

By Lynne Marek • Updated June 17, 2022 -

Samsung debuts a new digital wallet with crypto

The new wallet will store IDs, cards and crypto, giving the South Korean company more leverage to compete with digital payment apps from tech giants Apple and Google.

By Tatiana Walk-Morris • June 16, 2022 -

Startup Metropolis snags $167M to scale

Metropolis Technologies, which uses computer vision and machine learning for parking payments, plans to use the funding to scale, aiming to hire 500 workers by the end of the year.

By Caitlin Mullen • June 15, 2022 -

Grubhub adds instant pay option for delivery drivers

Food delivery company GrubHub will make an instant payout option available to its couriers, with an assist from PayPal and Visa, so drivers can deposit earnings to a debit card.

By Alicia Kelso • June 15, 2022