Retail: Page 54

-

Mobile wallets gain traction in bill payments: survey

Consumers are increasingly interested in faster bill payment processing, a survey from payments firm ACI Worldwide revealed.

By Tatiana Walk-Morris • Aug. 1, 2022 -

Legislation aimed at Visa, Mastercard lands

A new bill to curb Visa and Mastercard’s dominance of credit payments is likely to rev up a long-time battle between merchants and card companies.

By Lynne Marek • July 29, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Card CEOs react to macroeconomic threats

Amid talk of a recession, executives with Visa, Mastercard, American Express and Discover are keeping a close eye on inflation, consumer demand and unemployment levels.

By Caitlin Mullen , Lynne Marek • July 29, 2022 -

Retrieved from Loves Furniture & Mattresses on January 11, 2021

Retrieved from Loves Furniture & Mattresses on January 11, 2021 Column

ColumnCEOs Sound Off: Payments execs navigate economic turmoil

CEOs of three payments companies share how macroeconomic headwinds are affecting their businesses and how they’re seeing their firms through the uncertainty.

By Jonathan Berr • July 29, 2022 -

Mastercard earnings get cross-border lift

“We will continue to watch the environment closely” and “be nimble in managing our expenses,” Mastercard CEO Michael Miebach said during a conference call with analysts.

By Caitlin Mullen • July 28, 2022 -

Durbin to lob bill at Visa, Mastercard

Sen. Dick Durbin is poised to make good on his long-time threat to further rein in the two big U.S. credit card companies Visa and Mastercard with legislation aimed at increasing competition.

By Lynne Marek • July 28, 2022 -

Visa's 3Q results defy recession talk

Visa’s fiscal third quarter results were buoyed by increased cross-border travel and consumer spending, with no signs of a recession in sight for the largest U.S. card company.

By Lynne Marek • July 27, 2022 -

Balance raises $56M for B2B payments

The B2B payments services provider has quickly attracted investors, including Forerunner and Salesforce Ventures, since its founding in 2020.

By Tatiana Walk-Morris • July 26, 2022 -

Amazon opens a new wallet for sellers

The e-commerce juggernaut said it’s offering a new digital wallet service to its sellers and planning to roll it out more broadly over the “next few months.”

By Lynne Marek • July 26, 2022 -

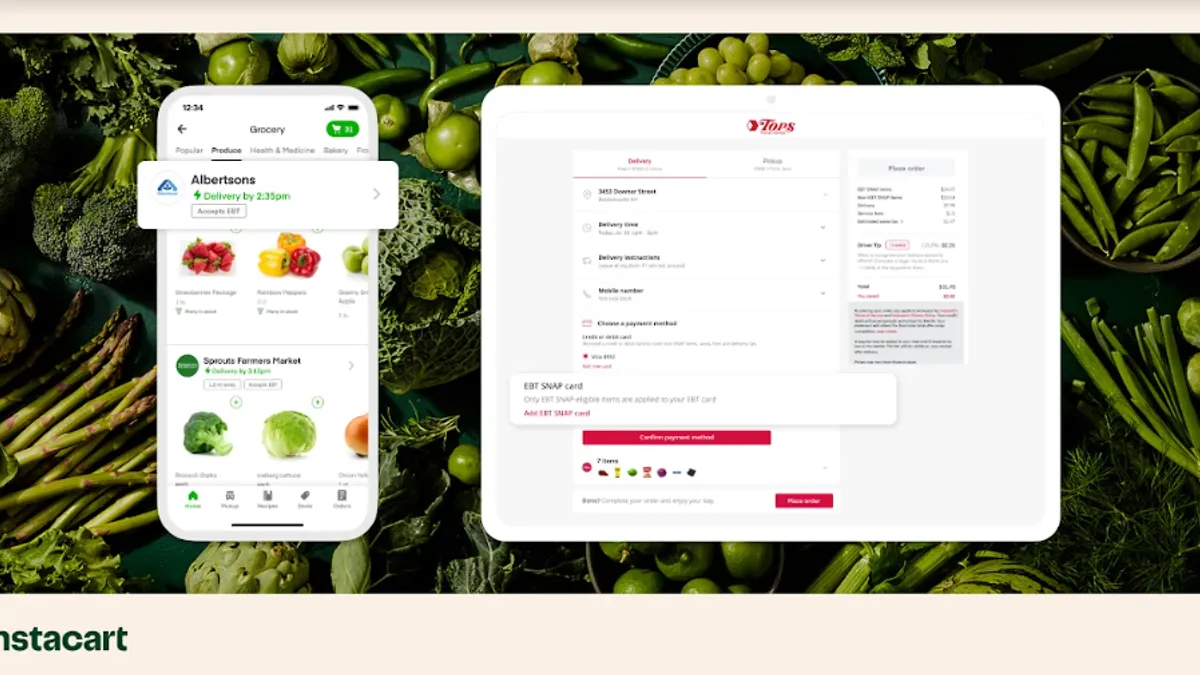

Grocery company Albertsons rolls out SNAP online payment

The company now offers the purchasing capability at five banners through its own platform as well as the Instacart app.

By Catherine Douglas Moran , Jeff Wells • July 25, 2022 -

Opinion

Blaming cards for high gas prices doesn't make sense, trade group argues

The leader of the Electronic Payments Coalition tells people looking to blame credit and debit card companies for higher gas prices to find a different scapegoat.

By Jeff Tassey • July 25, 2022 -

Amex raises growth projections

The spending behaviors of American Express customers don’t suggest an economic downturn is imminent, CEO Steve Squeri asserted during Friday’s second quarter earnings call.

By Caitlin Mullen • July 22, 2022 -

PayPal hands out stock to new workers

The digital payments pioneer is distributing shares of its beat-up stock to hundreds of new workers in a bid to hang onto employees after cutting others earlier this year. A spokesperson said the distribution was a “normal course” of action.

By Lynne Marek • July 22, 2022 -

Payments funding, deal-making declines in Q2

Payments startups are getting caught in the venture funding downdraft. Investment dollars and deal-making dropped in the second quarter, according to a CB Insights report.

By Lynne Marek • July 21, 2022 -

Opinion

BNPL will evolve as providers tweak the model

“Challengers frequently believe BNPL 1.0 is what it is, and will not evolve,” writes Brian Shniderman, CEO of Opy, a U.S. subsidiary of Australian payments fintech Openpay. “But it can, and very recently, it has proven that it will.”

By Brian Shniderman • July 20, 2022 -

Klarna to open Los Angeles pop-up shop

Located on Melrose Avenue, the buy now-pay later firm’s two-day shopping experience will showcase sustainable brands.

By Tatiana Walk-Morris • July 19, 2022 -

NBCU, Peacock create shoppable TV show using QR codes

Viewers of the show 'Love Island USA' will be able to shop featured products in every episode using scannable QR codes starting this week.

By Jessica Hammers • July 19, 2022 -

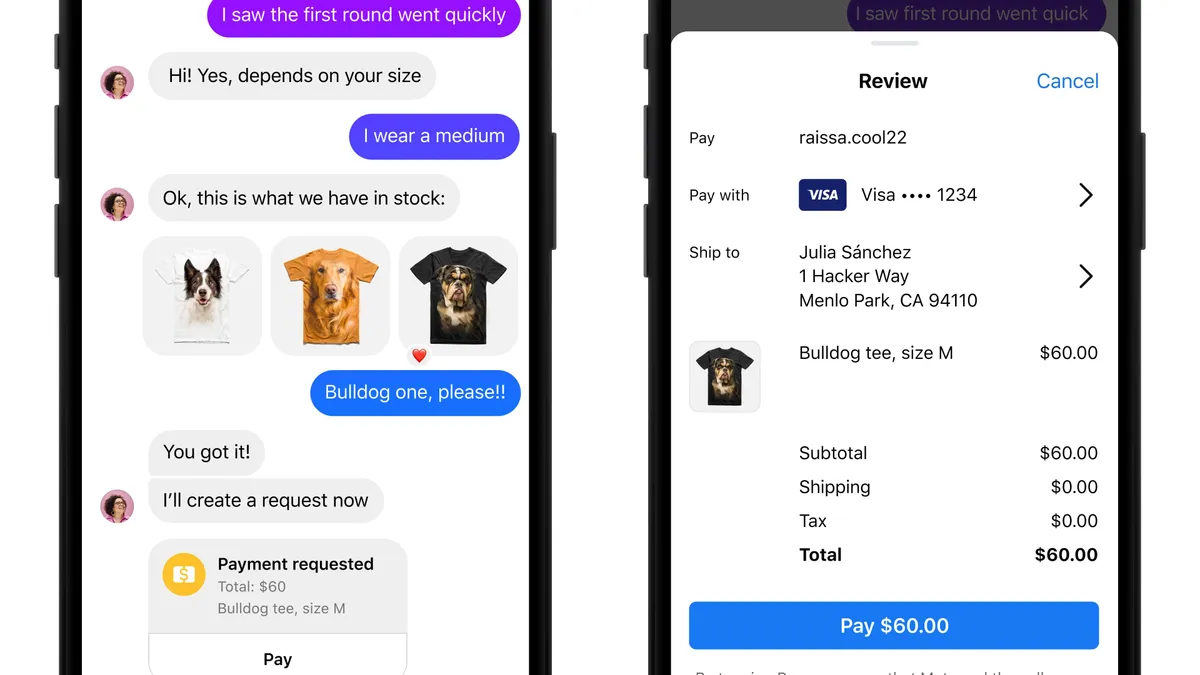

Instagram enables payments in chat

Meta-owned Instagram will allow users to make purchases from small businesses directly within messages sent in the app.

By Caitlin Mullen • July 18, 2022 -

Sponsored by Cybersource

5 essential features to look for in an omnichannel commerce partner

An experienced commerce partner can help provide the technology needed to help merchants keep up.

July 18, 2022 -

Stripe's valuation slashed as fintech rout continues

The company told employees Friday that its internal share price had fallen 27% to $29 from $40, The Wall Street Journal reported, citing unnamed sources.

By Jonathan Berr • July 15, 2022 -

SeatGeek taps Affirm for event BNPL

As inflation threatens consumers’ discretionary spending, event ticketing companies like SeatGeek could view the buy now-pay later option as an attractive way to bolster sales.

By Caitlin Mullen • July 15, 2022 -

Retrieved from Kaitlyn Fitzgerald, a spokesperson for Charlie Youakim on January 24, 2022

Retrieved from Kaitlyn Fitzgerald, a spokesperson for Charlie Youakim on January 24, 2022

Zip ditches Sezzle BNPL buyout

The Australian company will pay $11 million to Sezzle after it dropped a plan to purchase the Minneapolis-based company in the face of “macroeconomic and market conditions.”

By Lynne Marek • July 12, 2022 -

Mastercard reports consumer spending increase despite inflation

In-store spending in June rose 11.7% over last year while e-commerce sales grew at a slower 1.1% pace, excluding auto and gas expenditures, according to Mastercard.

By Jonathan Berr • July 11, 2022 -

Bolt CEO says no need to raise more capital this year

After cutting about 30% of its workforce earlier this year, digital checkout startup Bolt is on a path to profitability within the next three years, said CEO Maju Kuruvilla.

By Caitlin Mullen • July 11, 2022 -

How retailers are approaching cryptocurrency payments

Retailers Pacsun and American Eagle Outfitters have similar target audiences but are approaching the rising popularity of digital currency differently.

By Dani James • July 8, 2022