Retail: Page 13

-

Card fraud losses will increase over next decade

Fraud losses in card payments will continue to rise worldwide, the research firm Nilson Report said this month, predicting $404 billion in global losses over the next ten years.

By Lynne Marek • Jan. 15, 2025 -

Q&A

How AI makes payments faster, cheaper

Artificial intelligence can simplify payment transactions for merchants, Davi Strazza, president of North America for Adyen, said in an interview.

By Patrick Cooley • Jan. 15, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Deep Dive

Payments plays gather momentum in 2025: 6 industry trends to watch

Deregulation, artificial intelligence and stablecoin use are among the industry forces that will drive more digital payments use and innovation this year.

By Lynne Marek and Patrick Cooley • Jan. 9, 2025 -

Sezzle challenges critical research from short-seller firm

The buy now, pay later firm argues that a recent Hindenburg Research report highlighting a decline in users and merchant partners overlooks important context and details.

By Patrick Cooley • Jan. 8, 2025 -

Column

Will Trump and Sanders lock arms to cap credit card interest rates?

The senator and incoming president partnering on a cap proposal may not be as far-fetched as the payments and banking industries would hope.

By Lynne Marek • Jan. 7, 2025 -

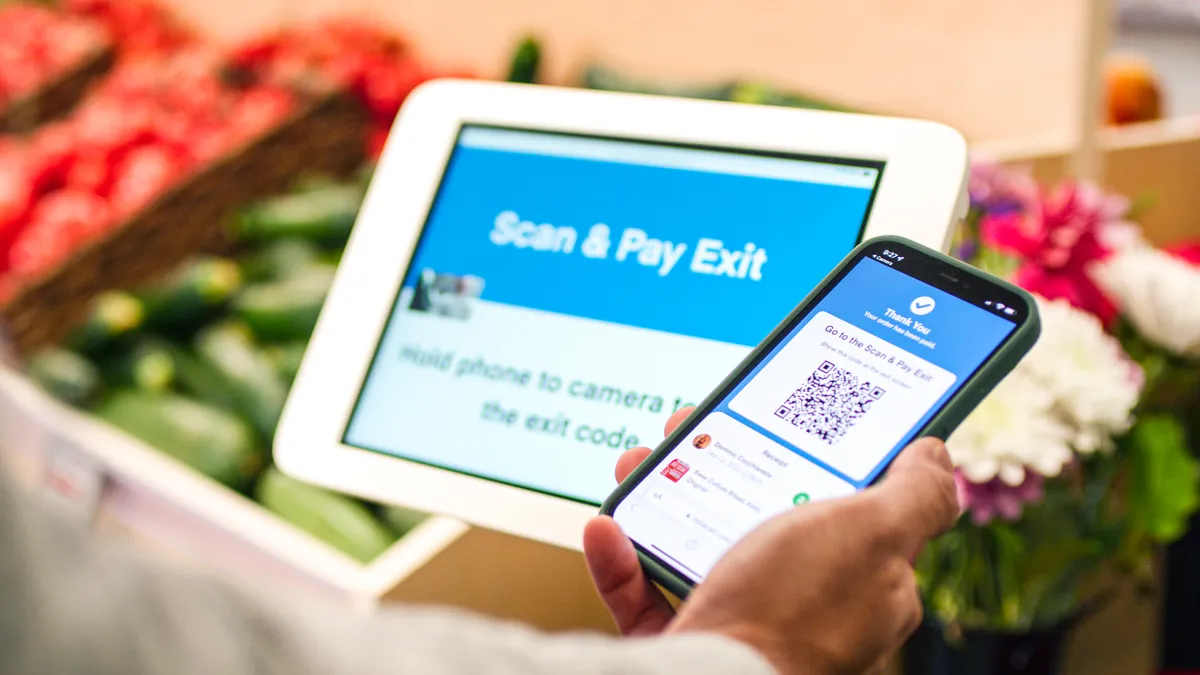

How ‘frictionless’ payments may benefit, hurt consumers

Such digital payments can slash transaction times, improve data security and provide valuable insights into consumer purchasing behavior and preferences.

By Michael Brady • Jan. 6, 2025 -

Debit card decline issue persists for Affirm

The buy now, pay later firm has a team working to correct a problem with some customers experiencing debit card declines, the company CFO said in December.

By Patrick Cooley • Jan. 3, 2025 -

Walmart forced delivery workers to pay ‘junk fees,’ CFPB alleges

A Consumer Financial Protection Bureau lawsuit alleges the retailer and fintech Branch Messenger illegally opened accounts for drivers, and deposited their pay into accounts without their consent.

By Peyton Bigora • Jan. 3, 2025 -

Fiserv swallows gig rival Payfare

The mega payments processor bought a Canadian digital banking provider after the two jockeyed for business from the delivery company DoorDash.

By Patrick Cooley • Jan. 2, 2025 -

BNPL payments rise with young, repeat users

Buy now, pay later users in the U.S. tended to be returning customers under 35 years-old, according to a new analysis from LexisNexis Risk Solutions.

By Patrick Cooley • Dec. 20, 2024 -

CFPB sues Early Warning Services over Zelle

The federal agency sued the operator of the pay-by-bank service as well as three bank owners, alleging they let fraud "fester" on the digital system.

By Lynne Marek • Dec. 20, 2024 -

Visa spots tripling of fraud over holiday weekend

The card network attributed the spike in fraud partly to criminals adopting artificial intelligence to execute their schemes.

By Tatiana Walk-Morris • Dec. 19, 2024 -

CFPB swats at retail credit cards

The federal agency warned companies issuing credit cards about illegal tactics, specifically calling out promotions that turn into “bait-and-switch” offers.

By Lynne Marek • Dec. 18, 2024 -

Merchants maneuver as Visa enforces surcharge program

As the card network giant enforces its surcharge rules, merchants react to different experiences in the market and adjust.

By Shefali Kapadia • Dec. 17, 2024 -

What role do stablecoins play in the payments industry?

With the discussion of stablecoins intensifying after the election of Donald Trump, here’s a primer explaining what this cryptocurrency is and what its practical uses may be.

By Patrick Cooley • Dec. 17, 2024 -

Klarna, eBay for European expansion

The Swedish buy now, pay later provider is expanding with the global marketplace company as it contemplates a U.S. initial public offering.

By Tatiana Walk-Morris • Dec. 13, 2024 -

PayPal to boost prices for merchants

The digital payments pioneer plans to increase fees U.S. merchants pay for some of its services, including buy now, pay later options, starting next month.

By Lynne Marek • Dec. 12, 2024 -

Afterpay to drive Cash App growth, executive says

Once users have signed up for the Cash App card, Block can convince them to use other Block products, a company executive said.

By Patrick Cooley • Dec. 11, 2024 -

Q&A

Keeping cash may be critical for a resilient payment system

Climate change, wars and societal benefits should lead the U.S. to maintain greenbacks as an alternative to electronic money, one business professor argues, but he’s worried about preserving it.

By Lynne Marek • Dec. 9, 2024 -

Caitlin Mullen/Payments Dive, data from Fiserv

Caitlin Mullen/Payments Dive, data from Fiserv

Fiserv CEO tapped to lead Social Security Administration

President-elect Trump announced the nomination of Frank Bisignano late Wednesday, and the payments processor confirmed the appointment Thursday.

By Lynne Marek • Dec. 5, 2024 -

PayPal targets higher Braintree pricing

The digital payments pioneer is attempting to develop a more profitable unbranded business line, the company's CFO said at an investor conference this week.

By Suman Bhattacharyya • Dec. 5, 2024 -

CFPB proposes rule to rein in data brokers’ sale of consumer information

With the proposal, the federal agency aims to crack down on fraudsters and others seeking to use sensitive personal information for illicit activities.

By Lynne Marek • Dec. 3, 2024 -

Lightspeed discloses strategic reorganization

The Canadian payments software company said it expects the operational overhaul to impact 200 workers and result in savings that can be redirected to its priorities.

By Lynne Marek • Dec. 2, 2024 -

Musk calls for end to CFPB

The presumed Trump Cabinet appointee said there “are too many duplicative regulatory agencies,” calling out the consumer watchdog specifically Wednesday.

By Gabrielle Saulsbery • Dec. 2, 2024 -

Consumers grab credit cards for holiday shopping

Credit card debt will not slow shoppers down as they spend for the holidays, according to a new survey of U.S. consumers.

By Tatiana Walk-Morris • Dec. 2, 2024