Regulations & Policy: Page 8

-

HUD studies BNPL housing risks

U.S. regulators want to learn more about how buy now, pay later loans may affect borrowers’ finances and housing market stability.

By Justin Bachman • July 11, 2025 -

Wise to reform AML oversight

The money transfer firm will pay $4.2 million and bolster anti-money laundering and other compliance in a consent settlement with six states.

By Justin Bachman • July 10, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Column

Will the X payments plan morph?

With the exit of CEO Linda Yaccarino, it’s a question mark as to when, and whether, the company’s plan for an “everything app” will materialize.

By Lynne Marek • July 10, 2025 -

Visa, Mastercard vie for Treasury role

The two biggest card networks bid for a piece of the Treasury Department’s program seeking to modernize the U.S. payments system.

By Lynne Marek • July 9, 2025 -

Court denies open banking briefs

A federal judge said “friend of the court” briefs wouldn't be helpful in litigation over the Consumer Financial Protection Bureau’s open banking rule.

By Justin Bachman • July 9, 2025 -

FICO reporting could stunt BNPL

If buy now, pay later firms know when consumers borrow heavily or fail to make repayments, providers may be reluctant to offer their payment services to so many consumers.

By Patrick Cooley • July 9, 2025 -

Warren demands Zelle scam update

In letters to Zelle’s bank owners, Sen. Elizabeth Warren and two other Democrats asked what the financial institutions are doing to protect customers using the digital payments service.

By Patrick Cooley • July 8, 2025 -

DailyPay lands novel funding

The on-demand pay company sourced $200 million from Barclays, Morgan Stanley and Citi through an asset-based securitization to accelerate growth.

By Tatiana Walk-Morris • July 7, 2025 -

Louisiana, Connecticut advance EWA bills

While Louisiana enacted a new earned wage access law this month, the controversy over state legislation rages on in Connecticut.

By Lynne Marek • July 7, 2025 -

Shift4 strategy segues with Global Blue

The deal is a departure from the company’s typical blueprint for acquisitions, according to analysts.

By Patrick Cooley • July 7, 2025 -

Balance, Alibaba team on BNPL for biz clients

Small and mid-sized businesses can now use Balance’s buy now, pay later financing on the global e-commerce marketplace.

By Tatiana Walk-Morris • July 2, 2025 -

Processors lean on AI to fight fraud

Payments players are urging Washington policymakers to leave artificial intelligence less regulated so they can use it to fight fraud.

By Lynne Marek • July 2, 2025 -

Early Warning pitches Zelle to Treasury

The company that owns the peer-to-peer service Zelle suggested the U.S. Treasury Department use that tool to replace checks with digital payments.

By Patrick Cooley • July 1, 2025 -

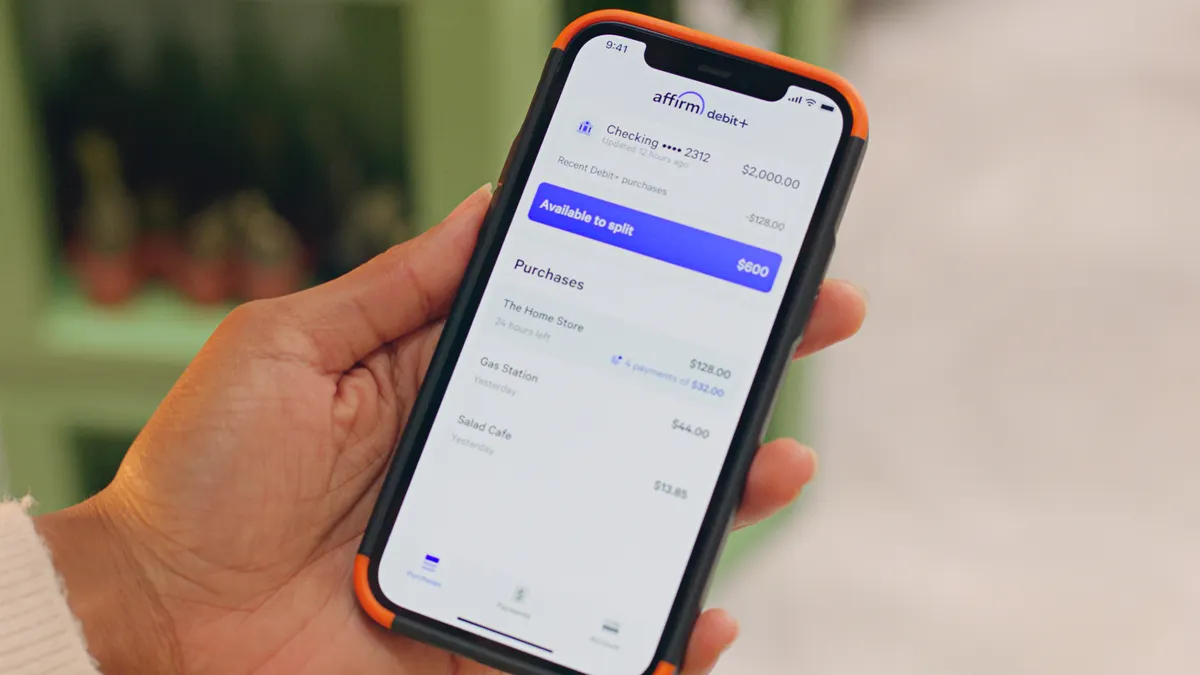

Affirm delves into in-game payments

The buy now, pay later player is for the first time partnering with a company that provides in-game payment services to video game developers.

By Patrick Cooley • June 30, 2025 -

Fintechs ask court to uphold open banking

Banks and the Consumer Financial Protection Bureau are misreading the law that enables open banking, the Financial Technology Association told a federal court.

By Justin Bachman • June 30, 2025 -

Visa, FIS boost value-added card services

The companies say they aim to strengthen tech tools available for smaller financial institutions in issuing cards.

By Tatiana Walk-Morris • June 30, 2025 -

NY crafts BNPL rules

New York’s regulation of buy now, pay later will be based on data and BNPL firms' input, DFS boss tells fintech conference amid industry disapproval.

By Justin Bachman • June 27, 2025 -

Stablecoins may act as finance bridge

Stablecoins are like “another payment rail,” said Vince Tejada, who heads treasury and strategic finance at stablecoin infrastructure provider Bastion.

By Grace Noto • June 26, 2025 -

Payments conferences yet to come in 2025

Artificial intelligence, FedNow and the ISO 20022 standards are expected to be hot topics at this year’s payments conferences.

By Shefali Kapadia • Updated June 26, 2025 -

FedNow delivers new risk management tools

Alongside those instant payment security features, the Federal Reserve increased the maximum payment that can be sent over the real-time system to $1 million.

By Tatiana Walk-Morris • June 26, 2025 -

Stablecoins may push aside payments

Digital assets have the power to “disintermediate” the financial system by bypassing traditional payment rails, according to a Deloitte report.

By Patrick Cooley • June 25, 2025 -

Court approves $197M ATM settlement

The class action agreement covers consumers and ATM operators who alleged that Visa and Mastercard restrained competition in the cash machine market.

By Justin Bachman • June 24, 2025 -

CFPB medical debt rule weighed

With additional briefs in hand, a federal judge will consider a Consumer Financial Protection Bureau rule that bars medical debt on consumer credit reports.

By Justin Bachman • June 23, 2025 -

Senate official blocks CFPB defunding in Trump’s megabill

Measures to defund the Consumer Financial Protection Bureau and to reduce salaries at the Federal Reserve are outside the limits of Senate reconciliation procedures, the chamber’s parliamentarian ruled Thursday.

By Gabrielle Saulsbery • June 23, 2025 -

Walmart settles FTC money transfer fraud case

The $10M deal resolves US allegations that the retail giant turned a blind eye to scams and fraud that cost consumers hundreds of millions of dollars.

By Daphne Howland • June 23, 2025