Regulations & Policy: Page 36

-

PayPal considers Xoom sale: report

The digital payments company is considering a sale of its Xoom cross-border business, The Information reported, citing an unnamed source.

By Lynne Marek • May 17, 2023 -

Discover pursues ESG goals

The card company this week issued a new report on the environmental, social and corporate governance aspects of its business and its aspirations.

By Tatiana Walk-Morris • May 12, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Everee takes on EWA providers

The payroll provider is angling to disrupt the earned wage access companies that have been making it easier for employers to offer workers on-demand pay.

By Lynne Marek • May 11, 2023 -

Senators call out banks on card late fees

A group of lawmakers asked the CEOs of large credit card issuers to explain their late fee practices.

By Caitlin Mullen • May 9, 2023 -

Synchrony, Wells Fargo, Bread Financial lead medical credit card market: CFPB

The medical credit card industry has expanded in recent years as healthcare providers promoted the cards to patients, the agency said in a report.

By Tatiana Walk-Morris • May 8, 2023 -

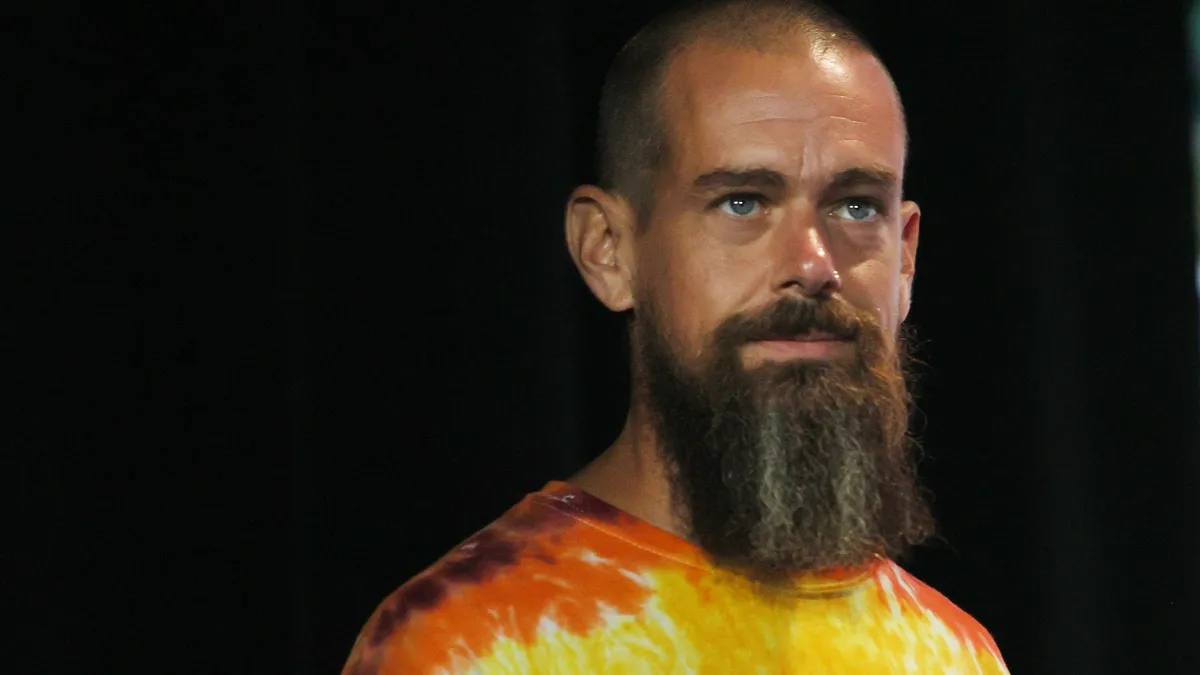

Block boosts compliance spending to $160M

Square parent Block is increasing compliance spending on personnel and software this year.

By Caitlin Mullen • May 5, 2023 -

Battle ensues over CFPB proposal to cap late fees

Supporters and opponents of the CFPB’s proposal to cap late fees at $8 clashed in comments to the agency in recent weeks.

By Lynne Marek • May 5, 2023 -

Chargebacks911 appoints new CEO

The promotion for the company’s COO and founder comes as the returns management firm faces regulatory scrutiny over its business practices.

By Tatiana Walk-Morris and Lynne Marek • May 3, 2023 -

Andreessen Horowitz partners spy payments play

Gaming, cannabis and telehealth are some of the “high-risk” niches that would benefit from more vertical-specific payments software, two partners for the firm contend.

By Lynne Marek • May 3, 2023 -

FDIC proposes higher insurance coverage for payroll accounts

Under the agency’s targeted coverage scenario, accounts used for payment purposes — specifically, business payment accounts — would merit higher deposit insurance coverage.

By Anna Hrushka • May 2, 2023 -

Mastercard ‘cannot afford to ignore’ AI, CEO says

The card network company is considering using artificial intelligence in more ways, including in customer service, CEO Michael Miebach said.

By Caitlin Mullen • April 28, 2023 -

Justice debit probe draws in Mastercard

The Justice Department’s antitrust division issued a civil investigative demand to the card company as part of a debit card probe that has also entangled its larger rival Visa.

By Lynne Marek • April 28, 2023 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Payments increasingly in regulatory crosshairs, industry lawyers say

Attorneys and payments professionals called out recent areas of interest for regulators during the Electronic Transactions Association’s conference in Atlanta.

By Caitlin Mullen • April 27, 2023 -

Opinion

Swift executive calls for payments standardization

“As a standardized format, ISO 20022 creates a common language for international payments the world over,” writes an executive in support of industry collaboration.

By Stephen Lindsay • April 26, 2023 -

Fiserv lines up bank clients for FedNow

The mega processor has a handful of bank customers in the Federal Reserve’s real-time payments pilot, and a pack signed up for services after the system’s July launch. It’s part of the company’s growth strategy.

By Lynne Marek • April 26, 2023 -

Opinion

FedNow won’t bring ‘tidal wave’ of change

“Payments solutions reach scale when they provide better usability, affordability, and security,” write partners at a San Francisco venture capital firm.

By Kevin Jacques and Ben Malka • April 21, 2023 -

Fed to reduce cross-border payments program

The Federal Reserve plans to discontinue its cross-border ACH payments service to Europe and Canada later this year, Fed officials reiterated at a conference this week.

By Lynne Marek • April 20, 2023 -

Credit card processor Nexway to pay $650K fine for fraud

A court initially imposed a $49.5 million judgment against a group of Nexway companies over processing payments tied to tech support scams, but they’ll ultimately pay the smaller fine for defrauding consumers.

By Caitlin Mullen • April 19, 2023 -

CFPB focuses on BNPL consumer disputes

A Consumer Financial Protection Bureau official pointed to how buy now, pay later providers handle consumer disputes as a major area of concern for the agency.

By Lynne Marek • April 19, 2023 -

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

FedNow spurs industry intrigue

Financial institutions, payments players and other businesses are being drawn in by FedNow, according to survey results presented at the Nacha Smarter Faster Payments conference.

By Lynne Marek • April 17, 2023 -

Visa remains cryptic about new surcharge cap

The card giant is set to impose a new surcharge cap of 3% tomorrow, but many payments processing professionals are still searching for details about it.

By Lynne Marek • April 14, 2023 -

Opinion

Why card networks should embrace gun codes

Using the new merchant category code for gun and ammunition sales “could help identify dangerous patterns,” one advocacy group lawyer argues.

By Adam Skaggs • April 13, 2023 -

SBA to open flagship lending program to fintechs

A new rule, which takes effect May 11, ends a 40-year moratorium on admitting new nonbank lenders to the agency’s 7(a) loan program.

By Anna Hrushka • April 12, 2023 -

CFPB director wants some payments firms labeled systemically important

The bureau's chief, Rohit Chopra, urged users who maintain balances on their digital wallets and money-transfer apps to move that uninsured money to a bank account.

By Anna Hrushka • April 12, 2023 -

Visa rattles ISOs with surcharge plan

Payment processors and their merchant clients are bracing for Visa’s 3% surcharge cap. “Don’t fight Visa right now – you’re not going to win,” advises one consultant.

By Lynne Marek • April 12, 2023