Regulations & Policy: Page 35

-

US servicemembers ensnared by digital payment app scams

Servicemember complaints about digital payment apps surged last year, according to a CFPB report, which also highlighted military families’ susceptibility to payments fraud.

By Lynne Marek • June 22, 2023 -

Congress members introduce bills to protect cash

The bills introduced last week aim to protect Americans’ right to use cash, and to address privacy concerns regarding a cashless economy.

By James Pothen • June 20, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Column

Will Nevada’s law prod the CFPB on EWA?

Nevada’s new law on earned wage access increases the importance of hearing more from the Consumer Financial Protection Bureau about its view of the growing on-demand pay trend.

By Lynne Marek • June 20, 2023 -

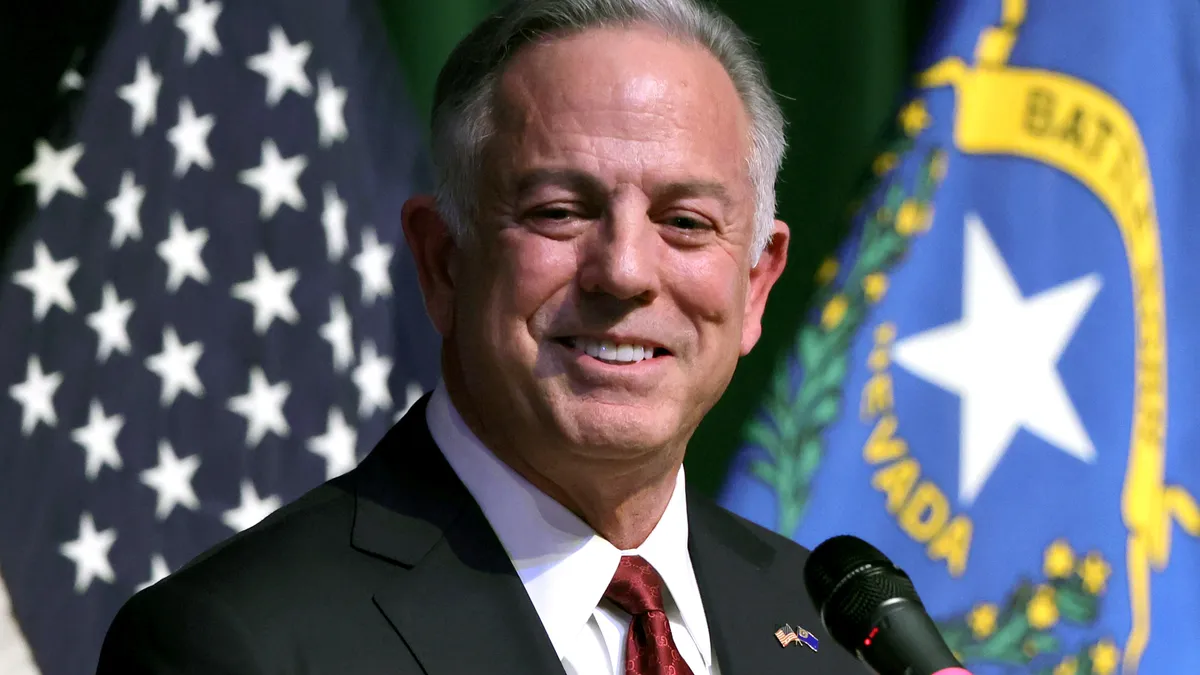

Nevada governor signs first state EWA law

Backers of the law establishing a licensing process for earned wage access providers operating in the state say it’s the first of its kind in the U.S.

By Lynne Marek • June 16, 2023 -

Michigan State shooter tapped cash, debit card

A gunman who killed three Michigan State University students in February used more than one payment method to buy guns. This coverage is part of a Payments Dive series.

By Debbie Carlson • June 15, 2023 -

Banks too slow to address P2P payment scams, CFPB’s Chopra says

“They have been very slow to take action,” the bureau’s director said Tuesday, when asked if banks were creating frameworks to combat fraud and scams conducted on peer-to-peer payment platforms.

By Anna Hrushka • June 14, 2023 -

Opinion

Get ready for FedNow

“In the U.S., we never kill payment systems,” writes Modern Treasury cofounder Sam Aarons. “People still write paper checks. But the future of money, especially inside larger enterprises, is instant payments.”

By Sam Aarons • June 13, 2023 -

Visa, Mastercard split on open banking

The two big U.S. card companies have diverging views on prospects for open banking. Will it make a difference in their rivalry?

By Lynne Marek • June 8, 2023 -

Fed, FDIC, OCC update guidance on third-party risk management

The guidance is aimed at helping banks address the operational, compliance and strategic risks of third-party tie-ups, such as those with fintech firms.

By Anna Hrushka • June 8, 2023 -

Republicans take lead on card bill

Republicans planned to host a press conference for a revived Credit Card Competition Act bill. The legislation’s champion, Sen. Dick Durbin, didn't plan to attend.

By Lynne Marek • June 7, 2023 -

Opinion

BNPL regulation requires balancing act

“As the CFPB prepares to release new regulatory guidance on BNPL providers, it is important that any new regulations do not stifle the industry's growth and limit its availability,” writes one checkout services CEO.

By Jordan Gal • June 7, 2023 -

Opponents of CCCA brace for reintroduction

Detractors of the Credit Card Competition Act proposal that failed last year are preparing for a reintroduction of similar legislation in Congress, as soon as this week.

By Lynne Marek • June 6, 2023 -

Nevada passes EWA legislation

Nevada this past weekend became one of the few states to pass legislation directed at policing the expanding earned wage access industry.

By Lynne Marek • June 5, 2023 -

SEC charges Binance, CEO Zhao with 13 violations

The regulator alleged high-value U.S. customers were secretly allowed to trade on Binance platforms after the company said otherwise, and that controls allowed customers’ funds to commingle.

By Dan Ennis • June 5, 2023 -

Republicans draft crypto legislation

The discussion draft, which addresses how digital assets can be defined, represents the most comprehensive federal legislative development in the crypto sphere this year.

By Gabrielle Saulsbery • June 5, 2023 -

CBDCs offer benefits, risks

Central bank digital currencies, which are being tested around the world, could increase the efficiency of cross-border payments, but there are associated risks, according to a trade group report.

By Lynne Marek • June 5, 2023 -

Consumers, businesses gravitate to faster, mobile payments

As electronic payment options become available, consumers and businesses in the U.S. are using them more often, but keeping a wary eye on fraud.

By Lynne Marek • May 26, 2023 -

Debit network players gear up for July

Card network operators Visa, Mastercard and Fiserv are bracing for change in light of the Federal Reserve’s debit routing rule clarification.

By Caitlin Mullen • May 26, 2023 -

Deep Dive

Payments fraud climbs as banks reach for joint response

Financial institutions and payments players are seeking to coalesce around new efforts to battle skyrocketing payments fraud.

By Lynne Marek • May 25, 2023 -

Citizens Bank to pay $9M to settle disputed-charge suit

The CFPB said the bank, in 2015, improperly denied customer reports of fraud and unauthorized use and, in some cases, failed to fully reimburse users.

By Dan Ennis • May 24, 2023 -

Opinion

Give EWA a chance

“It is unclear why critics want to place EWA in the credit silo and call for heavy-handed regulations to restrict access to EWA products,” argues the CEO of the Innovative Payments Association.

By Brian Tate • May 24, 2023 -

Legislators spar over stablecoin proposals

Lawmakers agree stablecoin legislation is needed to ensure the U.S. establishes itself as a leader in the space.

By Caitlin Mullen • May 22, 2023 -

NY Fed teams with Singapore on CBDC study

The two central banks tested digital ledger technology for payments across multiple currencies in less than 30 seconds.

By Lynne Marek • May 22, 2023 -

Bill Holdings discloses ‘material weakness’

Despite that finding, the company noted an independent auditor’s evaluation of the company’s 2022 financial statements “remains unchanged.”

By Caitlin Mullen • May 19, 2023 -

Fed official stresses importance of dollar’s standing

“For the dollar to maintain its status, it is important for U.S. elected officials and other policymakers to make decisions that instill confidence in our economy and institutions,” a New York Fed official said Thursday.

By Tatiana Walk-Morris • May 19, 2023