Regulations & Policy: Page 33

-

Q&A

Processor trade group weighs in on FedNow, surcharges

The American Transaction Processors Coalition, which includes payments players from Visa to Fiserv, strives to strike a balance in representing their interests at the federal and state levels.

By Lynne Marek • Aug. 28, 2023 -

Column

Incoming payments CEOs usher industry into new era

A spate of CEO appointments this year reflects an era of change and competition that’s likely to keep driving turmoil and advances in the industry.

By Lynne Marek • Aug. 28, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

X adds state money licenses in pursuit of payments

The social media company, formerly known as Twitter, advanced its payments strategy by collecting two more state money transmitter licenses.

By James Pothen • Aug. 28, 2023 -

Opinion

Why the CCCA is ‘ill-informed’

A payments processing consultant argues that the Credit Card Competition Act isn’t the way to spur more competition in the industry.

By James Shepherd • Aug. 24, 2023 -

Swift makes progress on some G20 cross-border payments goals

The international cooperative reports improvements in meeting some G20 cross-border payments goals, but says the industry is falling short on others.

By Debbie Carlson • Aug. 24, 2023 -

New Jersey enacts law capping surcharges

New Jersey’s governor signed a new law capping credit card surcharges, limiting the amount merchants can charge for processing a transaction.

By Lynne Marek • Aug. 23, 2023 -

Q&A

BNPL risks raise questions for Consumer Reports

BNPL’s ubiquity and growing use for everyday purchases should grab regulators’ attention, said Consumer Reports’s senior policy counsel.

By Caitlin Mullen • Aug. 21, 2023 -

ClassWallet draws $95M in funding

The company raised the money after government agencies and school districts lined up for its digital payments and fund management services.

By Tatiana Walk-Morris • Aug. 21, 2023 -

EWA advocates push back on Maryland guidance

At least one earned wage access advocate is pushing back on Maryland’s recent guidance that labels some on-demand wage offerings as loans.

By Lynne Marek • Aug. 17, 2023 -

Retrieved from Daniel Oberhaus/Wikimedia Commons on April 18, 2022

Retrieved from Daniel Oberhaus/Wikimedia Commons on April 18, 2022

Sociable: Behind Musk’s X app payments vision

Elon Musk wants you to use his X app for all types of banking and payments. That will require a leap of faith from consumers.

By Andrew Hutchinson • Aug. 17, 2023 -

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Retrieved from Discover Spokesman Robert Weiss on December 14, 2021

Discover ‘acting with urgency’ on Hochschild replacement

Interim CEO John Owen also said the company has hired about 200 compliance officers in recent months as Discover bolsters regulatory and risk management efforts.

By Caitlin Mullen • Aug. 17, 2023 -

Opinion

Why the ‘click-to-cancel’ amendment makes sense

“This proposal reflects the growing consumer demand for an easier subscription cancellation process,” writes a payments industry CEO. “However, this isn’t only in the interests of consumers.”

By Monica Eaton • Aug. 11, 2023 -

T-Mobile, AT&T follow Verizon on discouraging credit cards for bill-pay

The telecom carriers are incentivizing customers to use their debit cards or bank accounts, as opposed to credit cards, in automatic bill-pay programs.

By Debbie Carlson • Aug. 10, 2023 -

New Fed unit to supervise crypto, nonbank partnerships

The central bank clarified that any state bank it supervises must get the regulator’s green light before issuing, holding or transacting in dollar tokens, such as stablecoins, to facilitate payments.

By Anna Hrushka • Aug. 9, 2023 -

Column

What a shooter’s payment choice reveals — or doesn’t

Whether or not the payment type behind an active shooter’s purchase of a gun means anything may be revealed in patterns.

By Lynne Marek • Aug. 8, 2023 -

PayPal launches stablecoin

PayPal is planting a flag in the stablecoin space despite the slow uptake of digital assets in consumer payments and the lingering crypto chill.

By Caitlin Mullen • Aug. 8, 2023 -

EWA study by Harvard spotlights worker input

Earned wage access provides financial assistance to users while trapping them in “short-term liquidity crunches,” according to a new report by Harvard University researchers.

By Tatiana Walk-Morris • Aug. 4, 2023 -

GameStop ditches its crypto wallets due to ‘regulatory uncertainty’

The retailer, which is pulling support on Nov. 1, had sought to tap into gaming culture to make crypto a larger part of the company’s future.

By Nate Delesline III • Aug. 2, 2023 -

Senate ‘making good progress’ on pot banking bill, Schumer says

There may be bipartisan agreement on SAFE Banking’s goal to help the cannabis industry enter the banking fold, but lawmakers are reportedly haggling over some of the bill’s details.

By Anna Hrushka • Aug. 2, 2023 -

Q&A

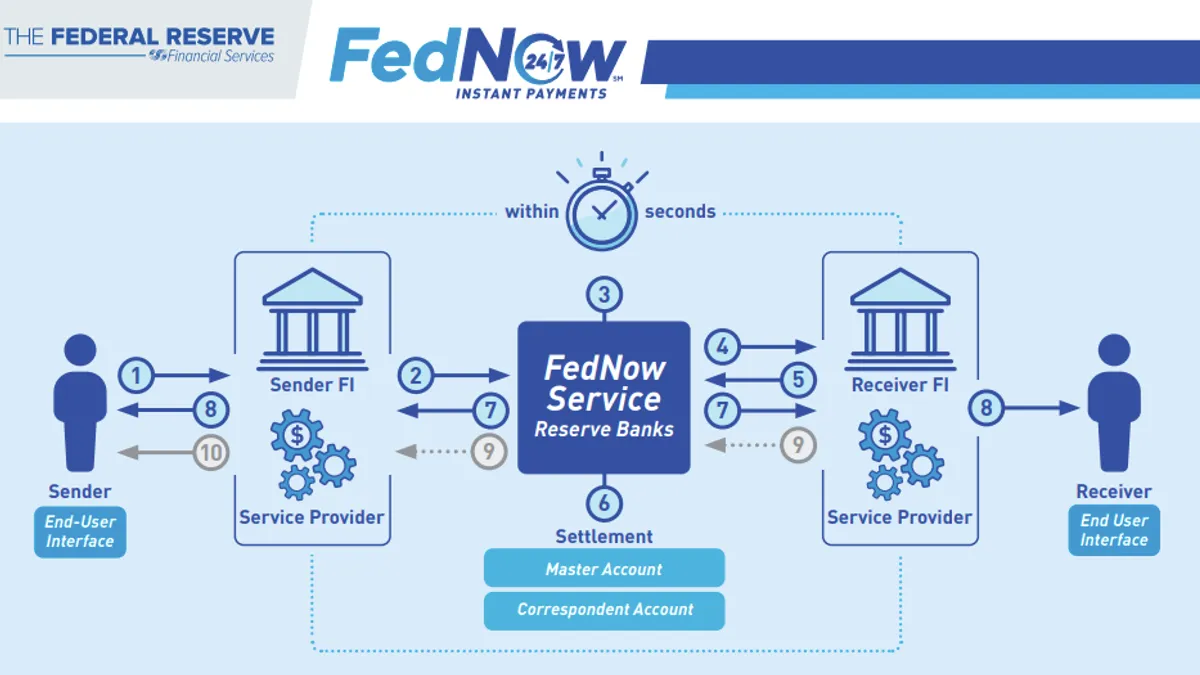

ACI eyes FedNow for cross-border uses

In the future, FedNow will be part of the race to develop cross-border instant payment systems and use cases, said ACI Worldwide CEO Tom Warsop.

By Lynne Marek • Aug. 1, 2023 -

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

Federal Reserve. "FedNow Instant Payments". Retrieved from FRB Services.

RTP takes on FedNow

As the only two real-time payments rails in the U.S., the rivalry between RTP and FedNow could get intense, but maybe not.

By Lynne Marek • July 31, 2023 -

Opinion

It’s time for a new payday approach

“It's time to question whether this traditional approach to paying employees is still the most efficient and equitable,” writes one earned wage access CEO.

By Kevin Coop • July 28, 2023 -

Amex pays $15M OCC penalty

The card issuer paid the fine for failing to properly monitor a third-party affiliate and in connection with its courting of small business clients, the agency said.

By Lynne Marek • July 25, 2023 -

How FedNow may affect businesses

The launch of the instant payments system FedNow last week has the potential to change how businesses manage cash flow and corporate processes. Here are six ways that could play out.

By Suman Bhattacharyya • July 25, 2023 -

Opinion

FedNow’s launch ‘is just the start’

Direct access to the Fed’s payments system for nonbanks — specifically payments companies — will push the U.S. more fully into payments modernization, writes an executive from cross-border payments company Wise.

By Brigit Carroll • July 21, 2023