Regulations & Policy: Page 32

-

Opinion

Is FedNow pivotal for payments or overhyped?

FedNow won’t fill the gap between the U.S. and other countries in payments innovation, writes one fintech CEO.

By Eric Shoykhet • Sept. 26, 2023 -

Mastercard fires back at Durbin in letter

The CCCA would “remove consumer choice, erode security, eliminate rewards, and dramatically prevent small businesses from investing in their future,” Mastercard said in a letter.

By James Pothen • Sept. 25, 2023 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlinePayments industry seeks to keep pace with fraudsters

As losses from fraud in payments have climbed, companies are seeking new tools to combat illicit schemes.

By Payments Dive staff -

Congressional committee passes bill to thwart CBDC

The House Financial Services Committee advanced a bill last week that would block the creation of a central bank digital currency.

By Lynne Marek • Sept. 25, 2023 -

Biden administration seeks to erase medical debt from credit reports

In kicking off a medical debt rulemaking process, the CFPB aims to address the "tremendous burden" of medical debt, Vice President Kamala Harris said Thursday.

By Caitlin Mullen • Sept. 22, 2023 -

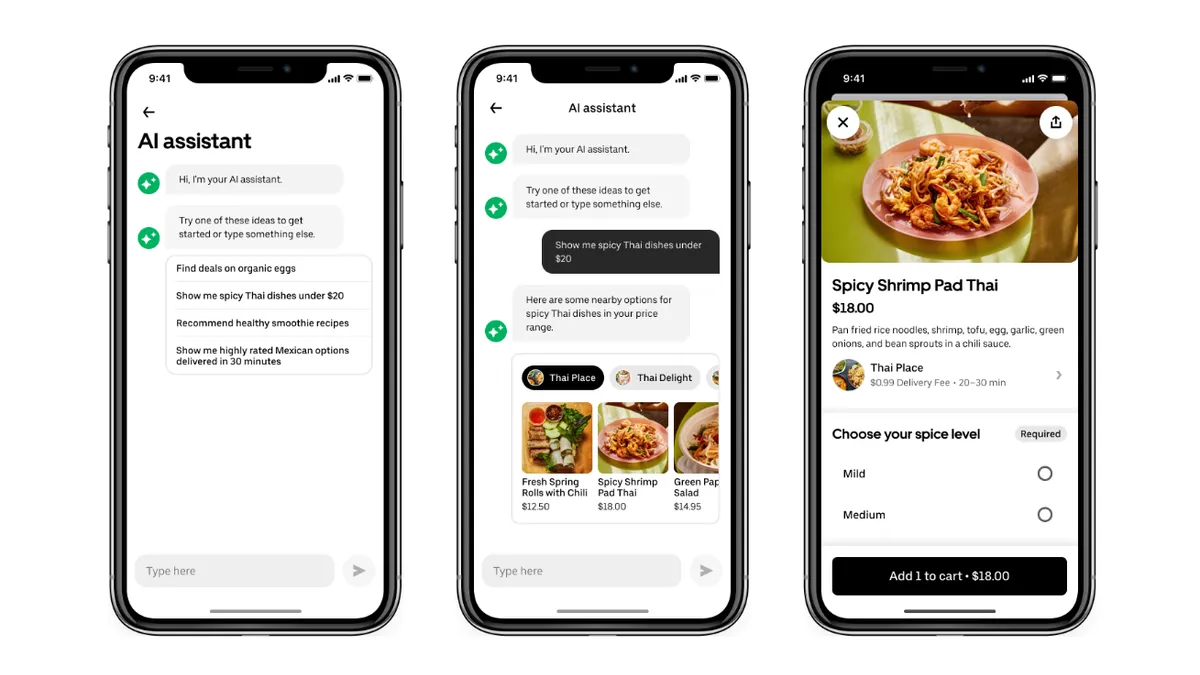

Uber to add more payments tools to its app

The planned updates to Uber Eats include the addition of SNAP and healthcare benefits payments starting next year.

By Catherine Douglas Moran • Sept. 21, 2023 -

Is X unfit to hold state money licenses?

Lawyers who sued the company on behalf of an imprisoned Saudi activist urged states to apply “heavy scrutiny” in reviewing the social media platform’s license requests.

By James Pothen • Sept. 21, 2023 -

Connecticut moves to regulate EWA

The state is instituting new lending regulations that are likely to apply to some earned wage access providers starting next month.

By Lynne Marek • Sept. 19, 2023 -

Digital dollar bill resurfaces in Congress

The proposed digital dollar would create an electronic version of the U.S. currency, but it wouldn’t be the same as a central bank digital currency.

By Lynne Marek • Sept. 18, 2023 -

Battle over credit card bill escalates

The fight over the Credit Card Competition Act is intensifying on Capitol Hill, with Senate floor diatribes and doughnut truck freebies.

By Lynne Marek • Sept. 15, 2023 -

The image by Ted Eytan is licensed under CC BY-SA 2.0

The image by Ted Eytan is licensed under CC BY-SA 2.0

CFPB flags risks of tuition payment plans

In a new report, the federal watchdog highlighted the pitfalls of school-based tuition payment plans, including confusing repayment terms and a high cost for credit.

By Caitlin Mullen • Sept. 15, 2023 -

CEO out at embattled Binance.US

Brian Shroder joined the U.S. arm of the world's largest crypto exchange in 2021. Now, he's gone, as are one-third of the company's employees — who, unlike Shroder, were laid off this week.

By Gabrielle Saulsbery • Sept. 14, 2023 -

Fed officials tout FedNow, seek adoption

Fed officials are on a campaign to increase adoption of the new instant payments system, noting it may have implications for other Fed services.

By Lynne Marek • Sept. 13, 2023 -

Discover shares pricing error findings with regulators

Discover executives met with regulators on the issue Monday, and the company expects further discussion, CFO John Greene said.

By Caitlin Mullen • Sept. 13, 2023 -

CCCA backers target vote this year

Supporters of the proposed Credit Card Competition Act say Republican Sen. Roger Marshall foresees a Senate vote on the legislation this year.

By Lynne Marek • Sept. 12, 2023 -

5 takeaways from Michael Barr’s views on CBDCs, stablecoins and more

The Federal Reserve’s vice chair for supervision spoke about “responsible innovation” Friday at a Philadelphia Fed fintech conference.

By Suman Bhattacharyya • Sept. 11, 2023 -

PayPal CEO stresses stablecoin potential

The digital payments pioneer has set its expectations high for growth in stablecoins, as regulators circle the space.

By Lynne Marek • Sept. 11, 2023 -

Affirm extends bridge to regulators

“I think a fair amount of our competitors believe that they’ll either talk their way out of [regulatory attention] or hide,” Affirm CEO Max Levchin said.

By Caitlin Mullen • Sept. 11, 2023 -

Medical credit cards ‘exploit loopholes’ in healthcare debt protection, report finds

The credit cards, which can promise patients deceptive no- or low-interest rates, are increasingly being offered in hospitals and physician offices, a PIRG report said.

By Sydney Halleman • Sept. 11, 2023 -

Q&A

Turmoil at Discover may make it an acquisition target

Discover, hunting for a new CEO while it addresses compliance issues, might catch the eye of a large regional bank, an industry attorney said.

By Caitlin Mullen • Sept. 8, 2023 -

CFPB takes aim at Apple, Google tap-to-pay tech

“Regulations imposed by Big Tech firms have a big impact on whether consumers and businesses can make payments using third-party apps,” CFPB Director Rohit Chopra said in a Thursday press release.

By James Pothen • Sept. 8, 2023 -

X nabs Rhode Island, Mississippi money licenses

The new licenses are aimed at advancing Elon Musk's campaign to expand the social media company formerly known as Twitter into the payments business.

By James Pothen • Sept. 7, 2023 -

Mastercard CEO counters WSJ fee increase story

In a Tuesday presentation, Mastercard’s CEO rebutted Wall Street Journal reporting last week about prospective credit card fee increases for merchants.

By Lynne Marek • Sept. 6, 2023 -

Discover expands board with former regulator

The card issuer added a former FDIC regional director to its board as it grapples with regulatory scrutiny.

By Caitlin Mullen • Sept. 6, 2023 -

Visa leans into stablecoin efforts

Visa has tapped new partners, including Worldpay and Solana, to build on a digital currency experiment it began in 2021 with Ethereum and Crypto.com.

By Lynne Marek • Sept. 5, 2023 -

Durbin, Marshall lambaste card fee increases

Sens. Dick Durbin and Roger Marshall railed against expected credit card fee increases following a report that hikes are planned for October and April.

By Lynne Marek • Sept. 1, 2023