Banking: Page 74

-

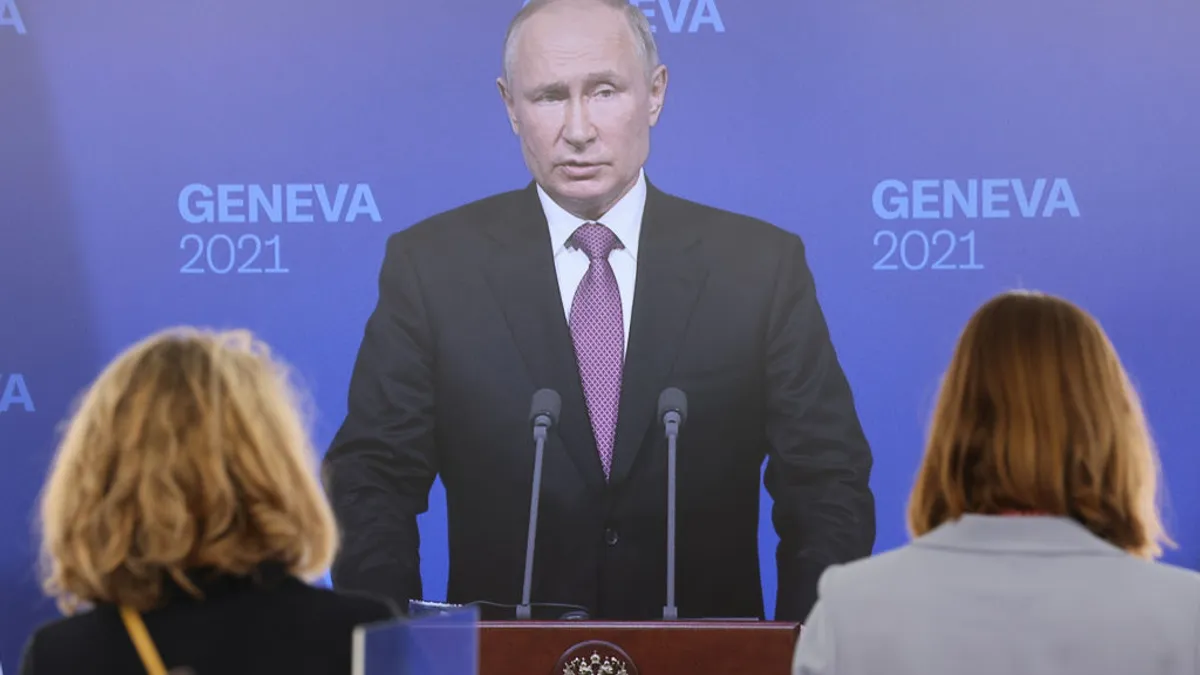

The potential payments peril of punishing Russia

The international community is weighing kicking Russia out of the Swift global payments network as a sanction for the country's aggression in Ukraine, but it could backfire.

By Jonathan Berr • Jan. 6, 2022 -

Payments deals pile up in 2021

More than $50 billion in acquisitions were announced last year by companies in the payments arena. That wasn't a record, but it still ranked among one of the industry's busiest years for deal-making.

By Lynne Marek • Jan. 5, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

stock.adobe.com./Antonioguillem

Opinion

OpinionPayments are becoming invisible. Here's why that's a good thing.

"The next great evolution will see payments fully disappear into simplified, holistic commerce platforms," according to a U.S. Bank payments executive. That new era "will be here faster than you think."

By Shailesh Kotwal • Jan. 4, 2022 -

7 payments trends for 2022 as innovation climbs

From cross-border services to BNPL to cybersecurity tools, there will be no shortage of innovation and competition in the payments industry as businesses and their regulators shape new digital tools in the wake of the COVID-19 pandemic.

By Jonathan Berr , Caitlin Mullen , Lynne Marek • Jan. 4, 2022 -

Payments firms raised record sums in 2021

It was a banner year for payments startups in 2021, as they raked in nearly $32 billion in investments, according to research firm CB Insights. This year could be even hotter.

By Caitlin Mullen • Dec. 28, 2021 -

Community banks group launches lower-cost P2P option

Unlike other platforms, the new alternative to Zelle lets consumers send money over the platform of their choice.

By Jonathan Berr • Dec. 22, 2021 -

Community banks form payments network to compete with Zelle: report

Community bank innovation consortium Alloy Labs Alliance will manage the network in partnership with Payrailz, a digital payments company, Forbes reported.

By Anna Hrushka • Dec. 20, 2021 -

Bankers group presses CFPB to expand tech probe

Independent Community Bankers of America is urging the Consumer Financial Protection Bureau to sweep data aggregators into its inquiry into the practices of payment tech companies.

By Jonathan Berr • Dec. 20, 2021 -

Payhawk plans 2022 New York office opening

The Sofia-based company raised more than $130 million this year, arming it to take on U.S. rivals in providing business clients with payments management tools.

By Ted Jackson • Dec. 17, 2021 -

Klarna extends BNPL to all online retailers

After acquiring the Dutch marketing software company Piggy, the Swedish buy now-pay later company is folding automatic couponing and price drop notifications into its offering and expanding the reach of its services.

By Tatiana Walk-Morris • Dec. 15, 2021 -

Gen Zers relied on buy now-pay later for holiday shopping. It's time to pay up.

Look up #Klarna, #Afterpay or #Affirm on the social media site TikTok. Beneath some of those BNPL provider hashtags are videos of teens dancing and lip syncing to viral sounds, with the balances they owe in the background.

By Maria Monteros • Dec. 15, 2021 -

Sponsored by Justt

Moving toward a services-oriented future in acquiring

The future growth of the acquiring business is in providing value-added services to small and medium enterprises.

Dec. 13, 2021 -

Crypto execs urge regulation tailored to risks

They told lawmakers at a Wednesday hearing on Capitol Hill that nothing short of U.S. leadership in the field of digital assets is at stake.

By Dan Ennis • Dec. 10, 2021 -

Microsoft shoppers get another BNPL option

Microsoft tapped Citizens Bank to offer its customers more options for spreading out their purchases as the buy now-pay later space becomes crowded.

By Caitlin Mullen • Dec. 10, 2021 -

Discover mulls more BNPL services

Discover Financial is brainstorming how to extend its buy now-pay later services beyond a partnership with Sezzle, CEO Roger Hochschild said at an investors' conference this week.

By Lynne Marek • Dec. 9, 2021 -

Bank groups spell out payments industry concerns

"Consumers can make better-informed choices if they more fully understand a big tech’s ability to collect and use a consumer’s financial transaction data, or directly and regularly access their bank account using their sign in and password," the trade groups say.

By Jonathan Berr • Dec. 8, 2021 -

New York Fed, BIS partner on fintech research center

The innovation hub is meant to support the U.S. central bank's analysis of digital currencies, including CBDCs, and to help make cross-border payments faster and less expensive, Fed Chair Jerome Powell said.

By Robin Bradley • Dec. 7, 2021 -

Diem co-creator Marcus to leave Facebook parent Meta

David Marcus, who has spent the past three years working on the social media giant’s stalled cryptocurrency project, Diem, said he is leaving the company at the end of the year to pursue other projects.

By Anna Hrushka • Dec. 2, 2021 -

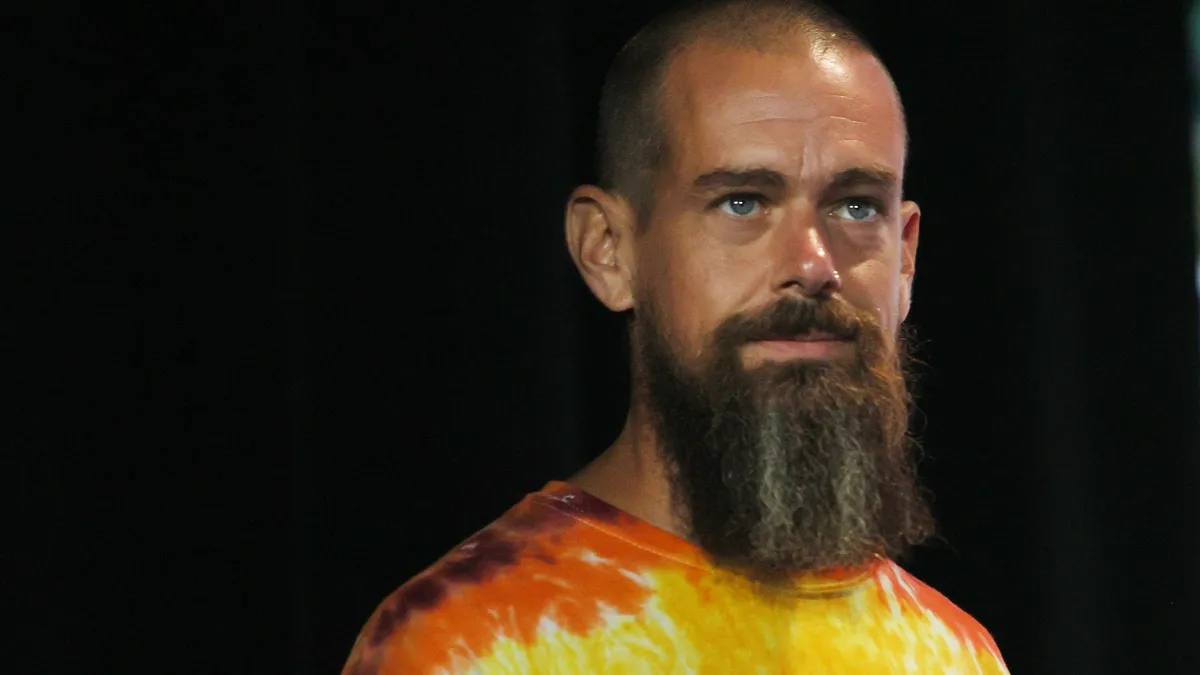

Square takes a new moniker: Block

No sooner does Jack Dorsey arrive full-time at Square than the company decides it needs a new name. The corporate parent will become Block, but keep the Square brand for its digital payments business.

By Lynne Marek • Dec. 1, 2021 -

Wise gears up for U.S. expansion

Wise plans to expand in North America next year, increasing its U.S. workforce by 150 employees, or more than 40 percent, including at a new office in Austin, the company said.

By Jonathan Berr • Dec. 1, 2021 -

Will the Amazon-Visa dispute spill over to other credit card companies?

While Visa's rivals are dependent on interchange fees like those at the center of the Amazon-Visa fight, they also might benefit if Amazon tosses some business in new directions.

By Jonathan Berr • Nov. 30, 2021 -

FIS may sell unit to Symphony Tech for $2B: Report

Mega payments processor FIS is in discussions about the possibility of selling part of its capital markets unit to investment firm Symphony Technology Group, according to a report from Bloomberg. The transaction could be valued at about $2 billion, the outlet reported, citing unnamed sources.

By Lynne Marek • Nov. 28, 2021 -

Mastercard buys payments processor Arcus FI, expanding in Latin America

Mastercard said the acquisition will allow it to "help support the delivery of bill pay solutions and other real-time payment applications across Latin America."

By Jonathan Berr • Nov. 24, 2021 -

KeyBank buys XUP to bolster merchant payments services

The acquisition will help the bank address challenges regarding its legacy infrastructure, and create a streamlined experience for its merchant clients, KeyBank’s head of commercial product and innovation said.

By Anna Hrushka • Nov. 24, 2021 -

Citi names crypto team chief, plans hiring for digital asset effort

Puneet Singhvi will become the head of digital assets for Citi's institutional clients group Dec. 1, according to an internal memo.

By Robin Bradley • Nov. 24, 2021