Banking: Page 33

-

Nuvei goes private in stock sale to Advent

The sale of the Canadian payments processor’s stock to the private equity firm will hand some investors a $560 million windfall.

By Lynne Marek • April 2, 2024 -

How Amex is entangled in the Visa-Mastercard settlement

The settlement gives merchants the ability to surcharge for nearly all Visa and Mastercard credit card transactions, and puts pressure on American Express to allow the same.

By Lynne Marek • April 1, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

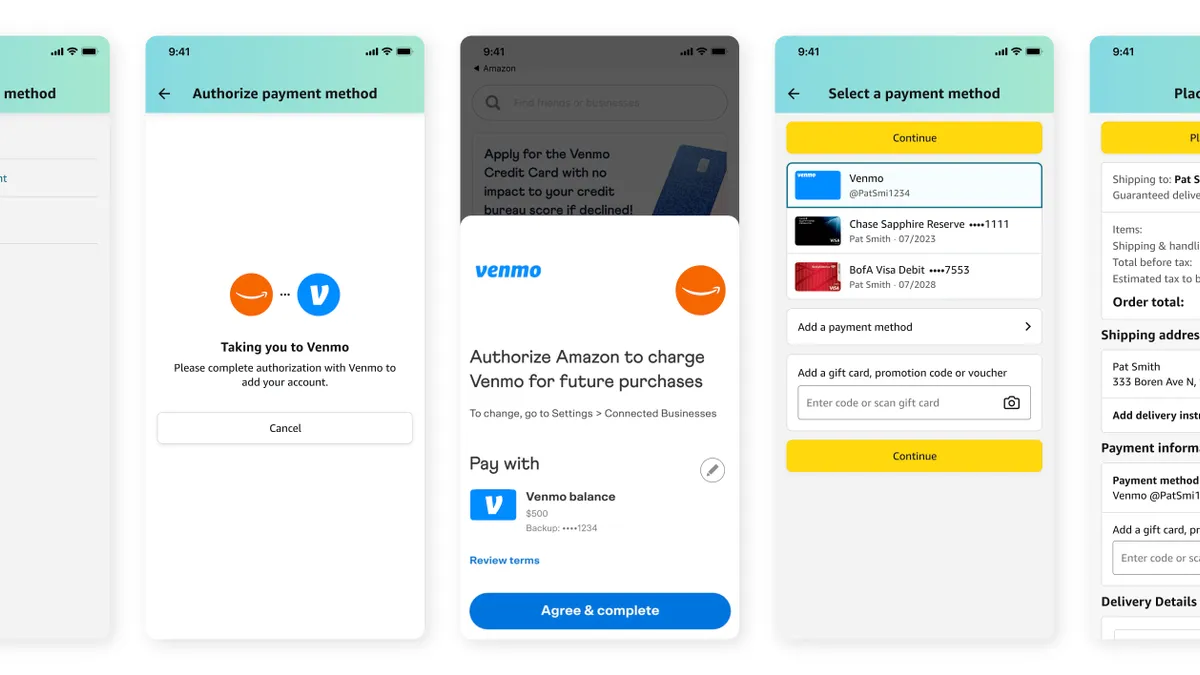

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Sponsored by U.S. Bank

Stay competitive: Enhance your payment experience with U.S. Bank Card as a Service (CaaS)

For many companies, CaaS not only improves the customer experience but also yields expected—and sometimes unexpected—benefits for the business.

April 1, 2024 -

CFPB targets ‘bait-and-switch’ card reward programs

Major credit card providers saddle rewards programs with fees and interest, burdening consumers who carry balances, CFPB Director Rohit Chopra said.

By James Pothen • March 27, 2024 -

Discover CEO to exit for Ally

Michael G. Rhodes, who took the top post at Discover this year, is leaving to become the next CEO of the bank Ally.

By Caitlin Mullen • March 27, 2024 -

Walmart can end Capital One card tie early, judge says

It won’t be easy for Walmart to find a new partner to replace Capital One, though, said Brian Riley, co-head of payments at Javelin Strategy & Research.

By Caitlin Mullen • March 27, 2024 -

NY Assembly bill counters governor on BNPL

A New York assemblymember has introduced a buy now, pay later bill, countering one introduced in the governor’s budget bill.

By Lynne Marek • March 27, 2024 -

Capital One pledges to give Discover’s network a boost

Dominated by Visa and Mastercard, card network markets “sorely need an injection of competitive rivalry,” Capital One argued in its application to regulators to purchase Discover.

By Caitlin Mullen • March 26, 2024 -

DOJ calls Apple card fees ‘significant expense’ for banks

The tech giant’s fees for credit card transactions “cut into funding for features and benefits that banks might otherwise offer smartphone users,” the Department of Justice said in suing the company earlier this month.

By James Pothen • March 26, 2024 -

Visa, Mastercard reach landmark credit card settlement

The two biggest U.S. card networks agreed to cap interchange fees for five years, among other terms, to settle merchant litigation that has lasted nearly two decades.

By Lynne Marek • March 26, 2024 -

JPMorgan seeks embedded payments niches

The biggest U.S. bank aims to offer embedded payments software solutions in more industries for its corporate clients.

By Lynne Marek • March 25, 2024 -

How Visa handled ‘BidenCash’ card fraud incident

The card network giant identified 556,000 card accounts that were put at risk as a result of the cybercrime ring BidenCash’s release of data online in December.

By Tatiana Walk-Morris and Lynne Marek • March 25, 2024 -

Advocates urge transparency in Capital One-Discover review

More than 30 organizations demanded the deal not be subject to expedited federal review and that public hearings be held in the largest lending markets for both Capital One and Discover.

By Caitlin Mullen • March 22, 2024 -

Wisconsin passes EWA law as states’ paths diverge

Wisconsin became the third state to pass a law requiring that earned wage access providers be licensed, and leaving the payments unregulated under lending laws.

By Lynne Marek • March 22, 2024 -

Column

PayPal’s new CEO takes the Venmo challenge

PayPal has been striving for more than a decade to better connect Venmo to merchants and make it pay off. Now, a new CEO has inherited the challenge.

By Lynne Marek • March 21, 2024 -

ABA, U.S. Postal Services jointly combat check fraud

American Bankers Association and the U.S. Postal Inspection Service are working together to educate postal and banking employees as well as consumers on the rising form of fraud.

By Tatiana Walk-Morris • March 21, 2024 -

Fed banks analyze consumer use of card promos

New research from the Philadelphia and Boston Feds finds that consumers are cycling through low APR credit card offers.

By Tatiana Walk-Morris • March 20, 2024 -

Clearing House’s ACH growth rate outstrips Fed

Automated payments volume processed by The Clearing House grew at a faster rate than at the Federal Reserve last year.

By Lynne Marek • March 19, 2024 -

Mastercard extends tie to Alipay

The card giant said the expanded partnership will let the Chinese digital wallet company’s 1 billion users send payments to 180 markets.

By Lynne Marek • March 19, 2024 -

Ballooning credit card balances loom over retail sales

The level of debt may surpass the all-time record this year, even when adjusted for inflation, some analysts say.

By Daphne Howland • March 19, 2024 -

New Nacha rules strike at push-payment fraud

“With respect to transaction monitoring for fraud, it would no longer be acceptable to do nothing,” Nacha Executive Vice President Michael Herd said.

By James Pothen • March 19, 2024 -

Nuvei forms committee to evaluate ‘strategic alternatives’

The Canadian payments company confirmed it’s in talks about a potential transaction with a third party, noting the committee will explore possibilities.

By Lynne Marek • March 18, 2024 -

Marqeta CFO touts EWA expansion

The card-issuing fintech has seen adoption of its debit card-linked EWA product increase as hourly workers at Walmart and Uber have been added, CFO Mike Milotich said.

By James Pothen • March 18, 2024 -

CFPB warns of ‘dangers’ on standards for open banking

“We know dangers exist when more powerful players weaponize industry standards,” Consumer Financial Protection Bureau Director Rohit Chopra said in advance of finalizing an open banking rule later this year.

By Lynne Marek • March 15, 2024 -

Retrieved from Business Wire on March 14, 2024

Retrieved from Business Wire on March 14, 2024

Fiserv searches for ‘tuck-in type’ deals

Despite a focus on smaller acquisition options, the processor doesn’t feel confined to a particular price range, CFO Bob Hau suggested Thursday.

By Caitlin Mullen • March 15, 2024