Banking: Page 32

-

Accounts receivable automator Versapay taps new CFO

Ed Neumann is joining the AR platform provider as it looks to grow by targeting companies seeking to digitize their older manual systems.

By Maura Webber Sadovi • April 19, 2024 -

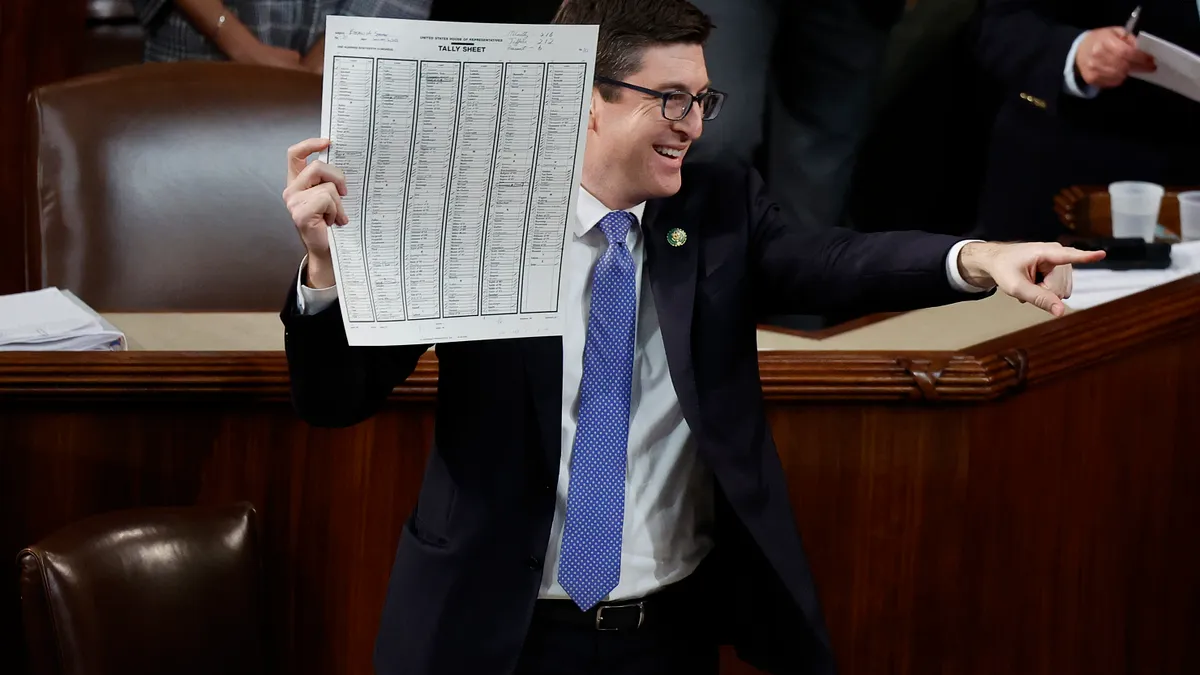

House committee advances EWA bill

The Republican-backed and industry-friendly bill was passed by the House Financial Services Committee despite pushback from Democratic lawmakers.

By James Pothen • April 18, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Klarna overhauls credit card features

The Swedish buy now, pay later pioneer revised its approach to credit cards in the U.S. market, ditching a more expensive version it touted two years ago.

By Lynne Marek • April 18, 2024 -

Discover adds $799M to bolster reserves

The card network opted to increase the card misclassification remediation reserve, based in part on discussions with regulators, executives said Thursday.

By Caitlin Mullen • April 18, 2024 -

Fed keeps up CBDC research

Despite political opposition to a potential U.S. central bank digital currency, research staff at the central bank continue to study the possibility.

By Lynne Marek • April 17, 2024 -

CFPB $8 late fee cap edges toward reality

Despite an industry-backed lawsuit seeking to stop the Consumer Financial Protection Bureau’s new $8 late fee rule, bank card issuers are bracing for potential implementation.

By Lynne Marek • April 17, 2024 -

Opinion

CFPB’s new late fee cap charts ‘a better way,’ says Sunbit CEO

“The credit card industry should take a page from innovators, instead of relying on yesterday’s fee models,” argues the CEO of the payment tools provider.

By Arad Levertov • April 16, 2024 -

FlexWage wins Vermont EWA carve-out

Earned wage access provider FlexWage has received leeway from the Vermont Department of Financial Regulation to operate in the state without a lender or money transmitter license.

By Lynne Marek • April 15, 2024 -

US, Europe lock arms on payments regulation

U.S. and European regulators have joined forces to monitor digital payment concerns, including those related to buy now, pay later financing and big tech market participation.

By Lynne Marek • April 15, 2024 -

Q&A

Gen Z clings to new payment tools

Gen Zers will abandon a transaction in one out of two cases if their preferred payment method isn’t available, says an EY payments specialist, citing the firm’s survey results.

By Lynne Marek • April 12, 2024 -

Opinion

Digital wallets must take hold in B2B

“Digital wallets, once primarily associated with consumer transactions, have now firmly established their presence in the B2B realm,” writes an industry manager.

By Lakshmi Sushma Daggubati • April 12, 2024 -

EWA providers seek to steer state legislation

Payactiv, DailyPay and other earned wage access providers teamed up in calling on the governor of Kansas to pass legislation similar to laws recently enacted in three other states.

By Lynne Marek • April 11, 2024 -

Mastercard appoints three C-suite execs

As part of the leadership changes and a corporate realignment, a long-time executive is also leaving the card network company.

By Tatiana Walk-Morris • April 11, 2024 -

PayPal’s new CEO lands $42M pay package

The bulk of that compensation stems from a major stock grant handed to Alex Chriss when he took the digital payments company’s top post last year.

By Lynne Marek • April 10, 2024 -

Capital One’s Discover bid tops biggest Q1 tech-related deals

The proposed Capital One-Discover merger made the list because of fintech issues that are at stake in the $35.3 billion deal.

By Alexei Alexis • April 10, 2024 -

CFPB, DOJ boost teamwork on cases

The bureau will refer “potentially criminal conduct,” including “anti-competitive mischief,” to the DOJ for action, CFPB Director Rohit Chopra said Monday.

By James Pothen • April 9, 2024 -

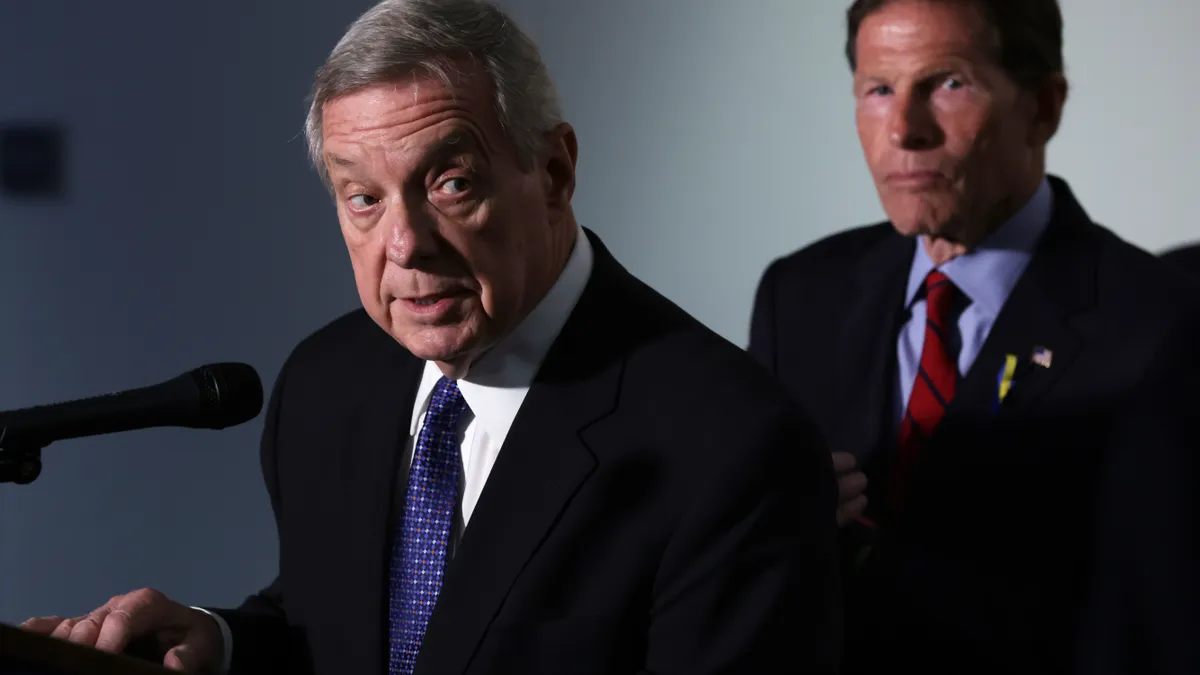

Visa, Mastercard CEOs throw hearing off track

Senate Judiciary Committee Chairman Dick Durbin postponed a plan to call credit card chieftains on the capitol carpet at a Tuesday hearing, but he’s still aiming to get them to Washington.

By Lynne Marek • April 9, 2024 -

Fiserv CEO compensation rose last year to $28M

Compensation for Fiserv CEO Frank Bisignano climbed 57% over 2022, as the value of stock awarded to him surged and he received a $3 million cash bonus.

By Lynne Marek • April 8, 2024 -

Tension brews over healthcare payments: JPMorgan

Healthcare consumers are often confused about the bill payment process, while providers grapple with delays and high collection costs, according to a survey by the bank.

By Tatiana Walk-Morris • April 8, 2024 -

Virtual marketplaces risk real losses: CFPB

Virtual worlds “can become a haven for scams, fraud, financial losses, and unanticipated purchases that can deplete a family’s real-world financial assets,” CFPB Director Rohit Chopra said.

By James Pothen • April 5, 2024 -

Opinion

EWA shouldn’t be regulated like loans

“Attempts to regulate EWA as credit threaten worker access to this innovative and consumer-friendly financial tool,” writes one earned wage access industry CEO.

By Darcy Tuer • April 5, 2024 -

Photo by Bia Santana from Pexels.

Fiserv to let Brazilians use Pix in US

The payments processing giant is providing support to extend the Brazilian instant payments system to merchants and consumers around the world.

By Lynne Marek • April 4, 2024 -

NY Fed enters cross-border tokenization effort

The central bank will join six other central banks in exploring blockchain technology to speed up international payments.

By James Pothen • April 4, 2024 -

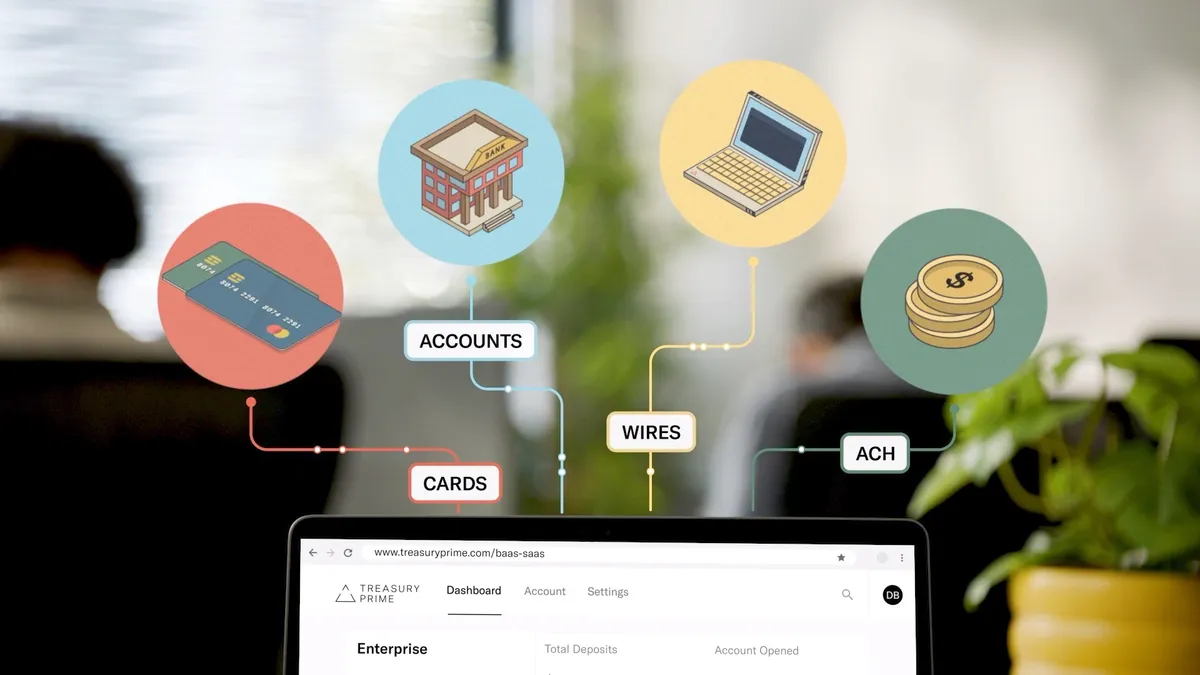

Treasury Prime, Narmi partner to offer FedNow service

The partnership aims to simplify and accelerate the adoption of FedNow by small and medium-sized financial institutions in Treasury Prime’s network.

By Rajashree Chakravarty • April 3, 2024 -

Credit card complaints jumped 38% last year: CFPB

The Consumer Financial Protection Bureau received 70,000 card-related complaints from consumers last year, according to a report last week.

By James Pothen • April 3, 2024