Banking: Page 26

-

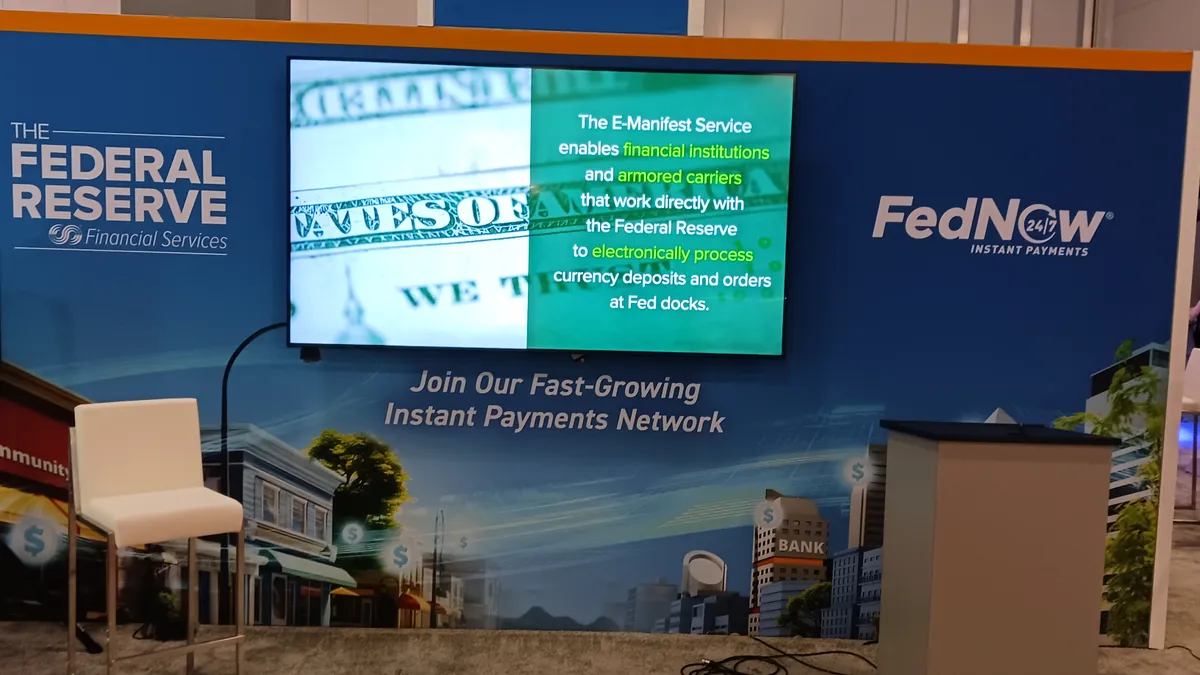

FedNow to add more fraud tools, Fed official says

The Federal Reserve is still seeking to allay financial institutions' concerns that faster payments allowed by the new instant payments system could lead to faster fraud.

By Lynne Marek • Aug. 16, 2024 -

Klarna jumps into banking business

The Swedish buy now, pay later company will let consumers use savings accounts to make payments, receive refunds and earn cash rewards from some retailers.

By Lynne Marek • Aug. 15, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Fintechs ramp up lobbying over earned wage access, crypto

Chime, PayPal and Block, for example, spent more on lobbying in the first half of 2024 than for the same span last year, OpenSecrets reported.

By Suman Bhattacharyya • Aug. 15, 2024 -

Senators ask Dimon to justify new checking account fees

“JPMorgan Chase is the industry leader when it comes to usurious overdraft fees,” Sens. Elizabeth Warren, D-MA, and Chris Van Hollen, D-MD, wrote in a letter sent Friday.

By Rajashree Chakravarty • Aug. 15, 2024 -

Capital One insists Discover deal won’t increase card fees

The bank and credit card issuer told regulators in a letter that competition will require it to keep its products fairly priced.

By Patrick Cooley • Aug. 14, 2024 -

How embedded payments are changing the way we pay

As payments technology advances, more companies are embedding the payments process in websites and apps. Here’s a primer on how this trend is advancing and changing the payments arena.

By Patrick Cooley • Aug. 13, 2024 -

Finance professionals grapple with payments fraud

About a fifth of finance professionals in a recent survey said their organization has already been targeted by AI-driven deepfake or executive impersonation attacks.

By David McCann • Aug. 13, 2024 -

Capital One-Discover antitrust concerns may be overblown

Capital One’s proposed acquisition of the smaller Discover seems “too small to be a core antitrust concern,” said Barry Barnett, an antitrust lawyer.

By Caitlin Mullen • Aug. 9, 2024 -

Flywire acquires Invoiced for $55M

By way of the latest deal, the software company seeks to further expand its international payments services for its business-to-business clientele.

By Tatiana Walk-Morris • Aug. 9, 2024 -

US credit card balances climb to $1.14 trillion

Consumer credit card debt delinquencies are also on the rise, particularly among younger consumers, according to a New York Federal Reserve report.

By Tatiana Walk-Morris • Aug. 8, 2024 -

JPMorgan fires up biometric payments processing

The biggest U.S. bank is piloting payments processing for biometric transactions, with plans to use it at the hamburger chain Whataburger, which lets customers pay with a face scan.

By Lynne Marek • Aug. 7, 2024 -

FIS starts to get its payments mojo back

Fidelity National Information Services is starting to recharge its card payments business in the wake of selling Worldpay, the company’s CEO said.

By Lynne Marek • Aug. 6, 2024 -

Q&A

Credit card delinquencies rise even as credit limits are extended

The two developments stem from greater use of credit cards, and could have implications for some businesses, says a Bain & Company analyst.

By Patrick Cooley • Aug. 6, 2024 -

FedNow ‘could lower fees’ in future, analyst reports

The Federal Reserve instant payments system may cut fees after it attracts more financial institutions, or in the face of competition, a Wolfe Research analyst said, citing a FedNow official.

By Lynne Marek • Aug. 5, 2024 -

JPMorgan threatens to sue CFPB over Zelle

The bank flagged government inquiries over its handling of P2P disputes in May, and said Friday it would consider litigation if the agency issues an enforcement action.

By Dan Ennis • Aug. 5, 2024 -

Opinion

Credit Card Competition proposal should become law

“In the aftermath of the CrowdStrike outage, Congress and state lawmakers should look for opportunities to build backups and redundancies into critical online systems,” writes a payments consultant.

By Dan Swanson • Aug. 2, 2024 -

Outdated tech could slow instant payment adoption: survey

Financial institutions expect business clients to be a driver of instant payment revenue, but adopting the technology comes with hurdles, the results of a recent survey showed.

By Tatiana Walk-Morris • Aug. 2, 2024 -

Stripe, Fifth Third Bank to team on embedded services

The global digital payments company will team with the bank to offer embedded finance services to its clients.

By Patrick Cooley • Aug. 1, 2024 -

Column

Is Visa readying for an expiration of cards?

Slowing card volume growth in the network giant’s earnings report this month revived questions about the longevity of its core business.

By Lynne Marek • July 31, 2024 -

Q&A

5 questions for Brex’s new compliance chief

When it comes to innovation, “if it's moving too quickly for customer protection to keep pace, it’s not happening,” said Sibongile Ngako, who recently joined the fintech as chief compliance officer.

By Caitlin Mullen • July 31, 2024 -

PayPal CEO leans on big-name clients for growth

Alex Chriss, appointed to lead the digital payments business last year, noted the company is benefiting from ties to companies like Facebook parent Meta.

By Lynne Marek • July 30, 2024 -

Milberg roils Visa-Mastercard settlement claims process

The law firm falsely suggested it represented well-known businesses in the claims filing process and blamed an outside party for the snafu that prompted a call for sanctions.

By Lyle Moran • July 29, 2024 -

Affirm says CFPB’s proposed BNPL rules will confuse customers

In commenting on the proposal, the BNPL provider said consumers would be better served by rules specific to BNPL transactions, as opposed to credit card regulations.

By Patrick Cooley • July 29, 2024 -

Capital One racks up Walmart, Discover costs

The card company set aside more than $800 million to brace for credit card losses tied to its break-up with retail behemoth Walmart.

By Caitlin Mullen • July 29, 2024 -

PayPal changes chairman, reduces board size

PayPal’s chairman of nine years left that post this week, and was replaced by one of the board’s newer members.

By Lynne Marek • July 26, 2024