Banking: Page 25

-

Visa to upgrade pay-by-bank service in UK next year

The card network plans to make the account-to-account service available to consumers for paying bills, like rent, but eventually for other uses too, such as digital streaming.

By Patrick Cooley , Lynne Marek • Sept. 6, 2024 -

Ex-Discover exec alleges age, gender bias in lawsuit

Diane Offereins is suing the card network over roughly $7 million in clawed-back equity, claiming she was a “convenient scapegoat” for Discover’s card misclassification issue.

By Caitlin Mullen • Sept. 5, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Opinion

CFPB’s EWA rule may undo progress

“The CFPB’s plan to reclassify EWA as a loan could accidentally backfire on the agency by driving people right back to the payday lending industry,” writes one tech trade group professional.

By Adam Kovacevich • Sept. 5, 2024 -

CFPB slammed with EWA commentary

The Consumer Financial Protection Bureau asked for public feedback on its earned wage access rule proposal and it got an earful.

By Lynne Marek • Sept. 4, 2024 -

Viral JPMorgan Chase glitch is ‘fraud, plain and simple,’ bank says

Some customers deposited bad checks and immediately withdrew funds before the checks bounced in a glitch that went viral on TikTok. Now, some users have holds on their accounts.

By Gabrielle Saulsbery • Sept. 4, 2024 -

Paysafe taps FIS alum for CFO amid growth pivot

The iGaming payments platform is looking to expand on its “robust” performance in the first half of the year with the appointment of new financial leadership.

By Grace Noto • Sept. 4, 2024 -

U.S. Bank works to simplify SMB banking, payments

A recent survey by the bank is leading it to bring its payments and banking tools together to work for small and mid-size business clients in a more simplified way.

By Caitlin Mullen • Sept. 3, 2024 -

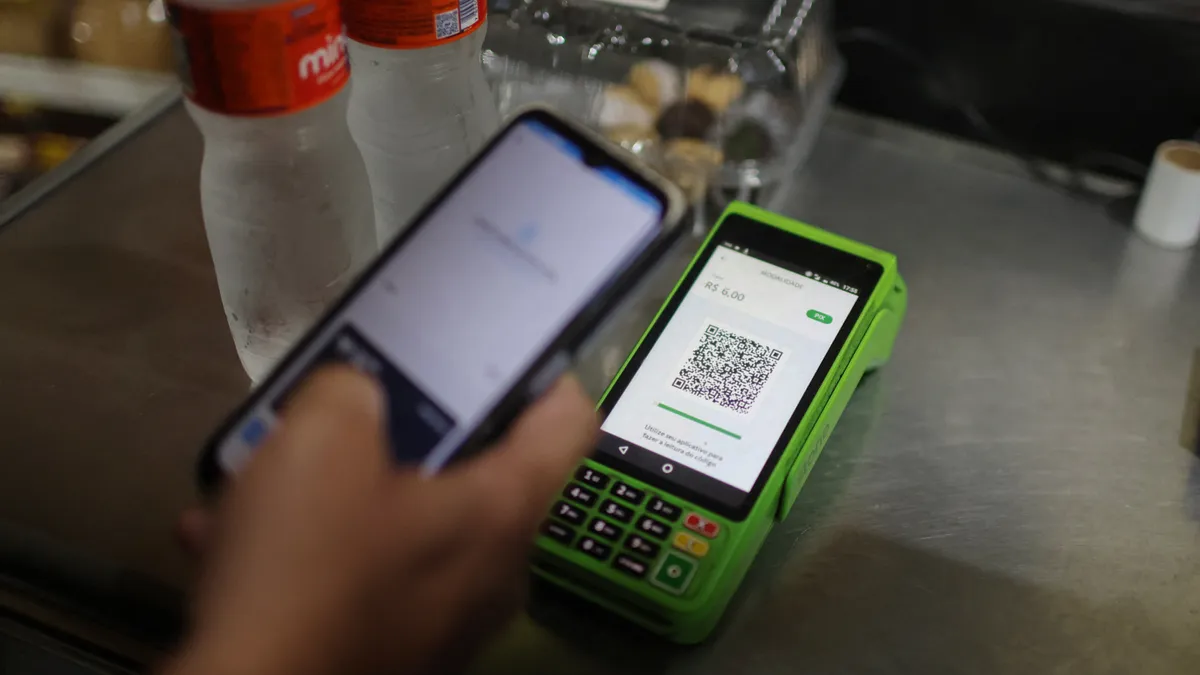

PayPal joins group investing $15M in Brazilian startup

The digital payments pioneer expects the fintech to capitalize on the rise of buy now, pay later services in Brazil.

By Tatiana Walk-Morris • Aug. 30, 2024 -

Tracker

Earned wage access: Following states that have passed laws, or have legislation pending

States began passing laws friendly to the industry in 2023 and have continued to pursue them this year, even after the federal government weighed in with a stricter standard.

By Lynne Marek • Aug. 30, 2024 -

Fed official questions faster cross-border payments ties

Federal Reserve Governor Christopher Waller suspects there could be more fraud and money-laundering if countries move too quickly to link their faster payments systems, he said at a conference.

By Lynne Marek • Aug. 29, 2024 -

MoneyGram, Adyen add chief technology officers

The payments companies are bolstering their tech leadership as big changes roil the industry and stoke competition.

By Lynne Marek • Aug. 28, 2024 -

CFPB chides retailers on fees for cash back

The federal agency surveyed major retailers and was concerned to find three retailers impose $90 million in fees annually when consumers ask for cash back with a debit or prepaid card purchase.

By Lynne Marek • Aug. 27, 2024 -

Aeropay targets pay-by-bank evolution in US

The Chicago fintech has moved from servicing small merchants to handling cannabis payments, and now it’s catering to gaming clients.

By Lynne Marek • Aug. 26, 2024 -

Consumers tap credit cards, loans to manage inflation: Fed report

Gen Z and millennials were the age groups most likely to use loans and credit cards to respond to higher prices, a Federal Reserve research report said.

By Tatiana Walk-Morris • Aug. 26, 2024 -

Fed’s Waller eggs on payments research

Federal Reserve Governor Christopher Waller encouraged attendees at a summer research workshop to keep exploring payments systems, and innovations to overcome frictions in financial markets.

By Tatiana Walk-Morris and Lynne Marek • Aug. 23, 2024 -

Opinion

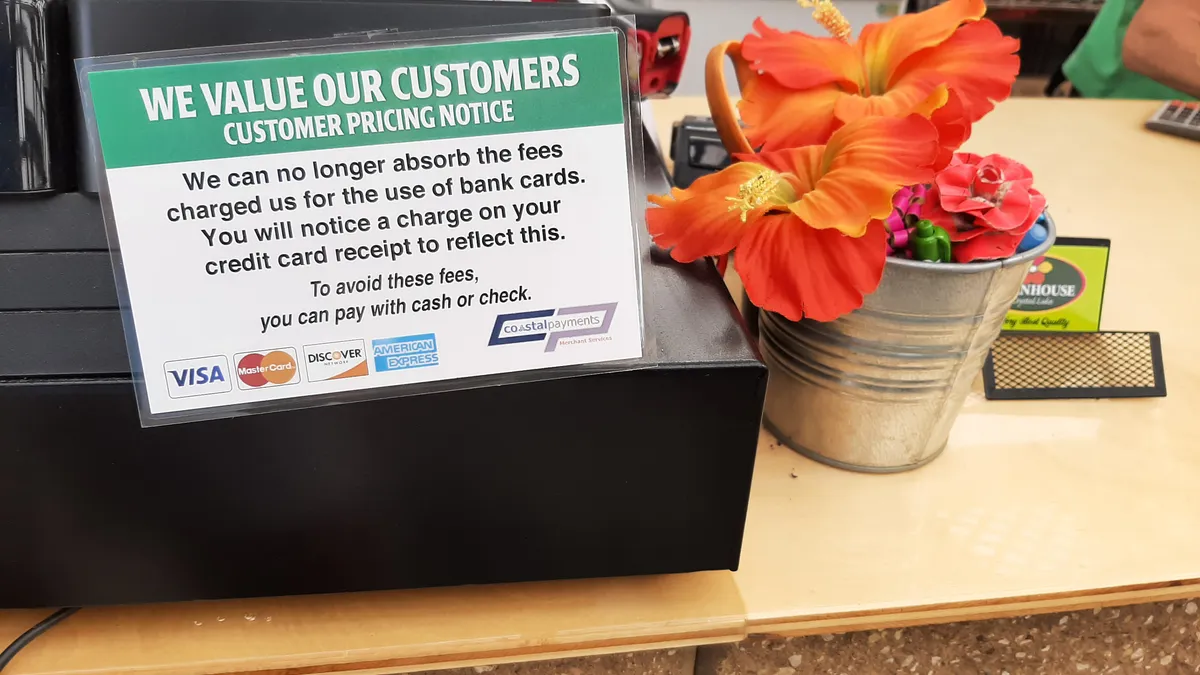

Surcharging doesn’t have to be a bad word

“The time has come to rethink surcharging not as a necessary evil but as a strategic advantage that can benefit both businesses and customers,” writes a Billtrust executive.

By Nick Izquierdo • Aug. 23, 2024 -

Amex, Flutterwave partner in Nigeria

The collaboration marks the latest move by American Express to expand its footprint in Africa, which is the world's second-largest continent by population.

By Patrick Cooley • Aug. 22, 2024 -

U.S. Bank buys healthcare payments firm

The bank’s acquisition of Tempe, Arizona-based Salucro Healthcare allows its Elavon unit to dig deeper into healthcare payments and billing services.

By Lynne Marek • Aug. 22, 2024 -

Q&A

Marqeta isn’t a ‘single-trick pony,’ CEO says

The embedded finance firm’s partnerships with Varo Bank, Affirm, Visa and Zoho and its new office launch in Warsaw, Poland, underscore the expansion of the payment platform's market presence.

By Rajashree Chakravarty • Aug. 22, 2024 -

EWA providers crusade against CFPB rule proposal

Earned wage access providers that backed state laws friendly to the industry are preparing for a fight over the Consumer Financial Protection Bureau’s plan to treat such payments like loans.

By Lynne Marek • Aug. 21, 2024 -

Capital One, Citi plan to join FedNow in ‘near future’

The two big banks say they’ll soon connect to the Federal Reserve’s new instant payment system, even as other major banks remain on the sidelines.

By Lynne Marek • Aug. 20, 2024 -

BNPL providers won’t face penalties during transition to new CFPB rule

CFPB Director Rohit Chopra said in a blog post that the agency will not fine companies making a good faith effort to follow regulations treating buy now, pay later loans like credit card transactions. His remarks follow significant industry pushback.

By Patrick Cooley • Aug. 20, 2024 -

Visa-Mastercard settlement claims deadline postponed

Merchants seeking a piece of the $5.5 billion settlement now have until February 2025 to file claims, a federal judge overseeing the class action said.

By Lyle Moran • Aug. 19, 2024 -

Mastercard to cut 1,000 employees in restructuring

The card network is shrinking its workforce as it restructures the company to focus more resources on some international markets.

By Lynne Marek • Aug. 19, 2024 -

UK fintech Revolut valued at $45B

The British fintech has completed a secondary share sale with new and existing investors to provide liquidity to employees.

By Gabrielle Saulsbery • Aug. 16, 2024