Banking: Page 15

-

Discover CEO may reap $2.4M bonus

Michael Shepherd will remain as interim chief executive officer potentially through June, and receive a $2.4 million cash bonus if the sale to Capital One closes by then.

By Lynne Marek • March 31, 2025 -

CFPB plans to spike BNPL rule

The buy now, pay later industry sued to block the consumer-friendly rule, arguing that the services are not the same as those offered via credit cards.

By Justin Bachman • March 31, 2025 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineDigital wallets proliferate as features advance

As more companies aim to offer digital wallets the rise in competition is sharpening their features.

By Payments Dive staff -

Executive Shuffle: Bolt, MoneyGram and DailyPay

New C-suite appointments so far this year demonstrate the payments industry’s efforts to digitize their offerings and cater to small business clients.

By Lynne Marek • March 28, 2025 -

Mercury raises $300M

The payments startup, which has backing from Marathon Management Partners and Andreessen Horowitz, aims to use the funds to expand its clientele and increase its profitability.

By Tatiana Walk-Morris • March 28, 2025 -

Swipe fee foes find legislative support in almost a dozen states

The battle to curb interchange fees has migrated from Illinois across the nation, with bills in 11 states seeing robust lobbying.

By Justin Bachman • March 28, 2025 -

CFPB nixes filing in case tied to Electronic Funds Transfer Act

The bureau’s brief was withdrawn because it “advances an interpretation of the law that has never been embraced by any federal court prior.”

By Gabrielle Saulsbery • March 27, 2025 -

Utah governor signs EWA law

The state joins a pack of others that have passed industry-friendly laws seeking to oversee earned wage access providers and their services.

By Lynne Marek • March 27, 2025 -

CFPB predicts late fee lawsuit settlement

The agency’s new leadership believes it can settle a 2024 lawsuit banks and business groups filed over an $8 cap on credit card late fees.

By Justin Bachman • March 26, 2025 -

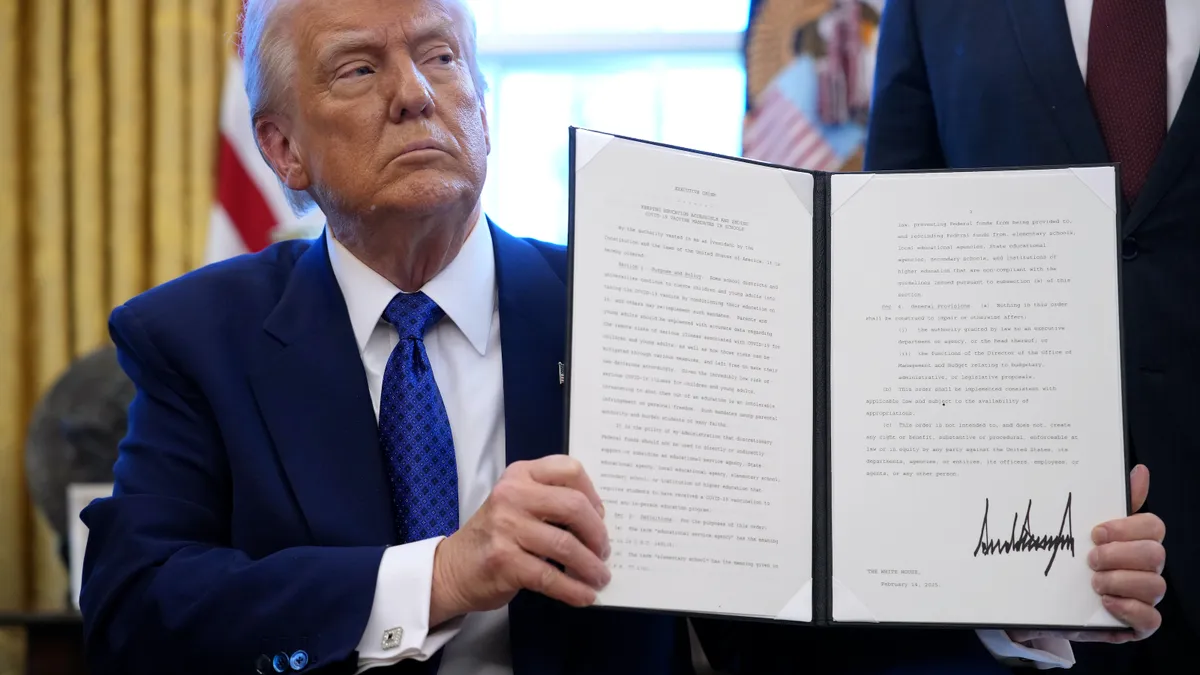

Trump calls on federal gov’t to banish paper checks

The White House issued an executive order calling on the federal government to cease using paper checks by September, except in certain circumstances.

By Lynne Marek • March 26, 2025 -

Revolut US CFO aims for growth, maturity ahead of U.S. entry

Balancing agility and compliance is crucial for the digital banking platform as it seeks to expand into markets like the U.S., Revolut Chief Financial Officer Max Lapin said.

By Grace Noto • March 26, 2025 -

Fiserv CEO vows to keep Social Security Administration intact

Senate Democrats questioned Frank Bisignano on privatization of the federal agency’s function during a confirmation hearing Tuesday.

By Patrick Cooley • March 26, 2025 -

Q&A

Fintechs egg on ‘willingness to challenge norms,’ Bolt president says

Justin Grooms expects fintechs to keep pushing the payments industry forward with more competition for legacy players.

By Lynne Marek • March 25, 2025 -

Banks bash Illinois trend-setting law on card swipe fees

Banks and credit unions are trying to kill a new Illinois law banning interchange fees, with a court filing, as multiple states seek to emulate the legislation.

By Justin Bachman • March 25, 2025 -

Caitlin Mullen/Payments Dive, data from Fiserv

Caitlin Mullen/Payments Dive, data from Fiserv

Fiserv CEO faces fire for Social Security cuts

Two Senate Democrats are calling on Frank Bisignano to oppose any cuts to Social Security ahead of hearings on his nomination to lead the agency.

By Patrick Cooley • March 25, 2025 -

Arkansas, Utah move ahead with EWA laws

The two states are the latest to pass legislation addressing workers’ growing practice of using earned wage access to tap their income before a regularly scheduled payday.

By Lynne Marek • March 24, 2025 -

Bank transfer fraud losses outpace crypto

The value of fraud losses last year was highest for bank transfers and payments, followed by cryptocurrency transactions, according to a report from the Federal Trade Commission released last week.

By Lynne Marek • March 21, 2025 -

Mastercard courts community banks

The card network has initiated a new partnership with the Independent Community Bankers of America that will extend its services to that group’s financial institution members.

By Lynne Marek • March 20, 2025 -

Corpay CAO steps up as CFO exits for nonprofit

Alissa Vickery is taking over as interim CFO as Tom Panther has left the company to become CFO of the National Christian Foundation.

By Maura Webber Sadovi • March 19, 2025 -

Fiserv acquires Dutch payment company CCV

The processor will use CCV to expand the presence of its Clover point-of-sale system across Europe, the company said. The price paid was about $220 million, according to a regulatory disclosure.

By Patrick Cooley • March 19, 2025 -

Klarna seeks to flex advertising muscle

Buy now, pay later provider Klarna has become an advertising juggernaut, and the new tie to Walmart will give it access to troves of additional customer data.

By Patrick Cooley • March 19, 2025 -

Affirm executive joins crypto firm Gemini as CFO

Dan Chen was formerly the vice president of capital markets and bank partnerships for the buy now, pay later company.

By Grace Noto • March 19, 2025 -

Brex strives for predictability after operational overhaul

After the company laid off 20% of its employees last January and changed the way it puts out products, Brex COO Camilla Matias has high hopes for what’s coming.

By Gabrielle Saulsbery • March 18, 2025 -

Trump Organization lawsuit raises questions about Capital One-Discover deal

Capital One needs three U.S. approvals to proceed with its $35 billion purchase of Discover. Could a Trump Organization lawsuit against the bank spell trouble?

By Justin Bachman • March 18, 2025 -

Northern Trust exec: Crypto rule changes may ease tokenization

Biden-era anti-crypto regulations didn’t just affect volatile digital assets. They also affected firms offering traditional assets, like bonds, on the blockchain.

By Gabrielle Saulsbery • March 18, 2025 -

Klarna to displace Affirm as Walmart BNPL provider

The Swedish buy now, pay later business partnered with a Walmart-backed fintech to offer loans at the retail giant via a digital payments app.

By Patrick Cooley • March 17, 2025